Newlyweds’ Guide: Merging Finances While Maintaining Independence

Imagine starting your married life with financial harmony, where both partners feel secure and independent when merging finances after marriage.

As a life coach, I’ve helped many couples navigate these challenges. Merging finances after marriage while maintaining financial independence can indeed be tricky, especially when considering joint bank accounts vs. separate accounts.

In this article, you’ll discover practical strategies for combining assets after marriage and keeping some aspects separate. You’ll also learn how to set long-term financial goals for newlyweds and maintain open communication about money in relationships.

Let’s dive into financial planning for couples and budgeting tips for newlyweds.

The Financial Dilemmas Newlyweds Face

Navigating financial decisions as newlyweds is no small feat. Merging finances after marriage can create stress and resentment, disrupting the harmony in your relationship. Financial planning for couples is crucial to avoid these pitfalls.

Many clients struggle with setting clear boundaries for shared versus individual expenses. The decision between joint bank accounts vs. separate accounts often poses a challenge for newlyweds.

In my experience, differing spending habits often lead to tension. Financial infidelity, where one partner hides purchases or debts, can further erode trust. Effective communication about money in relationships is key to preventing such issues.

Financial issues are a leading cause of divorce, underscoring the importance of clarity and communication when merging finances after marriage. Prenuptial agreements and financial protection may be worth considering for some couples.

You need practical strategies to balance joint and individual financial responsibilities. This balance fosters both independence and mutual support. Budgeting tips for newlyweds and managing shared expenses can help achieve this equilibrium while working towards long-term financial goals for newlyweds.

Merging finances after marriage can be a challenging process, but overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in financial planning for couples.

- Create a Joint Account for Shared Expenses: Set up a joint account for household expenses and managing shared expenses.

- Establish Individual “Fun Money” Accounts: Each partner should have an individual account for personal spending, helping maintain financial independence in marriage.

- Set Financial Goals as a Couple: Discuss and prioritize your long-term financial goals together, focusing on combining assets after marriage.

- Develop a System for Regular Money Discussions: Schedule monthly meetings to review finances and adjust plans, improving communication about money in relationships.

Let’s dive into these strategies for merging finances after marriage!

1: Create a joint account for shared expenses

Combining finances after marriage through a joint account simplifies managing shared household expenses, a key aspect of merging finances after marriage.

Actionable Steps:

- Identify shared expenses: List out all common costs like rent, utilities, and groceries. Decide which expenses will come from the joint account, an essential step in financial planning for couples.

- Choose a bank and set up the account: Select a bank offering joint accounts with benefits. Both partners should agree on a percentage of income to contribute, considering joint bank accounts vs. separate accounts.

- Automate transfers and payments: Set up automatic transfers from your individual accounts to the joint account. Ensure shared bills are paid from this account, aiding in managing shared expenses.

Explanation:

These steps help streamline financial management, reduce stress, and avoid late payments when merging finances after marriage.

According to Investopedia, joint accounts can simplify money management but require clear agreements.

Benefits of a joint account include:

- Simplified bill payments

- Increased financial transparency

- Shared responsibility for expenses

Starting with a joint account sets a strong foundation for financial harmony when combining assets after marriage.

2: Establish individual “fun money” accounts

When merging finances after marriage, creating individual “fun money” accounts allows each partner to spend freely without consulting the other, maintaining personal independence.

Actionable Steps:

- Define your “fun money” limits: Agree on a monthly allowance for each partner to spend on personal hobbies and non-essential purchases, an important aspect of financial planning for couples.

- Open separate accounts: Each partner should have an individual account for their “fun money.” Set up automatic transfers from the joint bank account to these personal accounts.

Explanation:

These steps help ensure both partners have financial autonomy while maintaining a shared budget for essential expenses when combining assets after marriage.

According to FBFS, keeping some finances separate can help avoid arguments and provide personal control, which is crucial for maintaining financial independence in marriage.

Regular reviews of “fun money” allocations can also keep things fair and facilitate communication about money in relationships.

This approach balances shared financial goals with individual freedom when merging finances after marriage.

3: Set financial goals as a couple

Setting financial goals as a couple is key to achieving long-term success and harmony in your marriage when merging finances after marriage.

Actionable Steps:

- Discuss your financial dreams: Have an open conversation about your future plans like buying a house, starting a family, or traveling, focusing on long-term financial goals for newlyweds.

- Create a joint savings plan: Decide on a monthly savings target and automate contributions from your joint bank account to a savings account, addressing the aspect of combining assets after marriage.

- Track your progress: Use a budgeting app or spreadsheet to monitor your savings and celebrate milestones together, implementing effective budgeting tips for newlyweds.

Explanation:

These steps ensure both partners are aligned on financial priorities and can work together towards common objectives when merging finances after marriage.

According to NPR, open discussions about financial goals help couples stay motivated and maintain transparency in financial planning for couples.

Key benefits of setting financial goals together:

- Improved financial alignment

- Enhanced motivation to save

- Stronger sense of partnership in managing shared expenses

Setting financial goals as a couple fosters teamwork and mutual support, enhancing your financial journey when merging finances after marriage.

4: Develop a system for regular money discussions

Establishing a routine for financial discussions helps maintain transparency and alignment when merging finances after marriage.

Actionable Steps:

- Schedule monthly meetings: Set a recurring date each month to review your finances together. Discuss any changes in income, expenses, or long-term financial goals for newlyweds.

- Use a budgeting tool: Utilize a budgeting app to track your spending and savings. Share access so both partners can stay informed about managing shared expenses.

- Seek professional advice: Consider speaking with a financial advisor for unbiased guidance on financial planning for couples. Attend workshops or webinars on combining assets after marriage.

Explanation:

These steps keep both partners informed and engaged in financial decisions, reducing misunderstandings when merging finances after marriage.

According to ChooseFI, regular financial discussions foster trust and transparency. This approach ensures that both partners are aligned and proactive in managing their finances.

Topics to cover in your financial discussions:

- Recent spending patterns

- Progress towards savings goals

- Upcoming major expenses

Consistent communication about money strengthens your relationship and financial stability when merging finances after marriage.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of merging finances after marriage while maintaining financial independence. But did you know you can work directly with Alleo to make this journey easier for couples?

Alleo, your AI life coach, offers tailored financial planning for newlyweds. Set up an account and create a personalized plan for managing shared expenses and combining assets after marriage.

Alleo will follow up on your progress and keep you accountable via text and push notifications, helping you stay on track with your long-term financial goals as newlyweds.

Ready to get started for free? Let me show you how to begin your journey of merging finances after marriage!

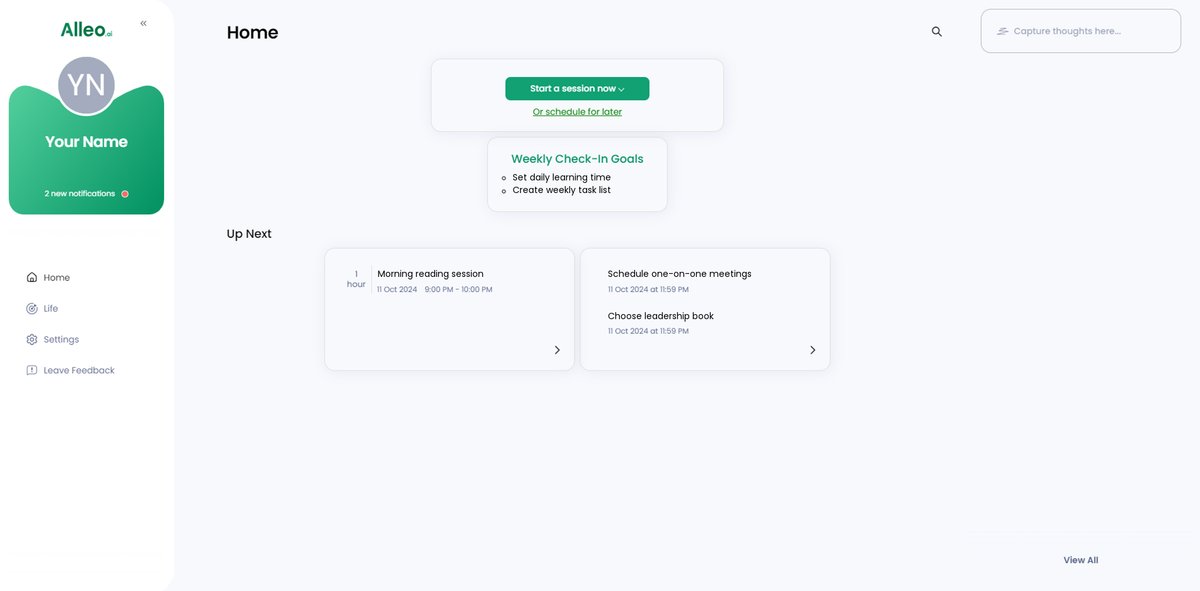

Step 1: Log In or Create Your Account

To start your journey towards financial harmony with your partner, log in to your existing Alleo account or create a new one to access personalized financial coaching for newlyweds.

Step 2: Choose Your Financial Focus

Click on “Building better habits and routines” to start developing consistent financial practices that will help you and your partner achieve harmony in your shared finances while maintaining individual independence.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on merging accounts, setting shared goals, and maintaining financial independence as newlyweds.

Step 4: Starting a coaching session

Begin your financial journey as newlyweds with an intake session, where Alleo will help you set up a personalized plan to merge finances while maintaining independence.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your discussed financial goals conveniently displayed on the home page, allowing you to easily track and manage your progress as a couple.

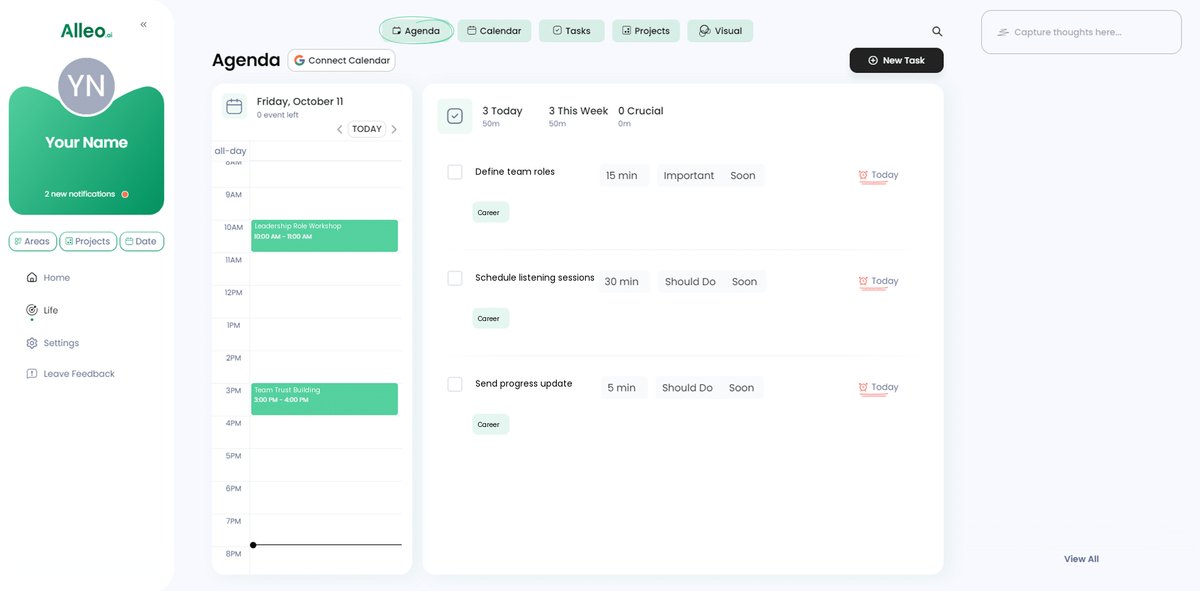

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your monthly financial discussions, ensuring you stay on top of your shared financial goals and maintain open communication with your partner.

Achieving Financial Harmony Together

So far, we’ve explored practical steps to merge finances after marriage and maintain independence.

Combining assets after marriage doesn’t have to be daunting. By setting up joint bank accounts and individual “fun money” accounts, you can balance shared responsibilities and personal financial independence in marriage.

Discussing and setting long-term financial goals for newlyweds ensures you’re both on the same path. Regular money discussions keep communication about money in relationships open and prevent misunderstandings.

Remember, it’s all about finding a system that works for both of you when merging finances after marriage. Communication and respect are key.

Ready to take the next step in financial planning for couples? Try Alleo for personalized financial coaching and embark on your journey towards financial harmony today.