5 Smart Strategies for Newlyweds: How to Invest $20,000 Savings Short-Term

Are you and your partner feeling overwhelmed about how to invest your $20,000 savings for the short term? As newlyweds exploring short-term investments, it’s natural to have questions.

As a life coach, I’ve guided many newlyweds through the maze of financial decisions and short-term investment strategies for couples. I understand the challenges you face during wedding planning and the uncertainty around whether to open new accounts or invest in low-risk investment options for newlyweds.

In this article, you’ll find practical strategies to help you make informed investment choices for short-term investments as newlyweds. We’ll explore high-yield savings accounts for married couples, CDs, and more liquid investments for young married couples.

Let’s dive into short-term investments for newlyweds.

Common Financial Dilemmas for Newlyweds

When newlyweds come to me, they often express uncertainty about how to manage their $20,000 wedding savings. Balancing between opening new accounts or investing in short-term investments for newlyweds can be overwhelming.

Many clients initially struggle with deciding whether to prioritize liquidity or potential returns. This decision is crucial because the right choice can ensure financial stability during the early years of marriage. Short-term investment strategies for couples can play a significant role in newlywed financial planning.

For instance, some couples worry about locking their savings in investment vehicles and losing quick access to funds. Others fear that not investing could mean missing out on valuable growth opportunities. High-yield savings accounts for married couples and low-risk investment options for newlyweds are often considerations in this dilemma.

It’s a dilemma that requires careful thought and planning. Making informed decisions about short-term investments for newlyweds can ease these concerns and help you achieve your financial goals. Options like emergency fund allocation for new marriages and joint investment accounts for couples are worth exploring.

Five Key Steps for Investing Your Wedding Savings

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for short-term investments for newlyweds to make progress.

- Open a high-yield savings account (HYSA): Find a reputable bank with competitive interest rates for married couples.

- Invest in short-term CD ladders: Allocate funds across CDs with staggered maturity dates, an effective strategy for couples.

- Explore money market accounts at credit unions: Compare fees, rates, and requirements for newlywed financial planning.

- Consider liquid funds for short-term goals: Consult a financial advisor for suitable options, including short-term bonds for married couples.

- Diversify with low-risk ETFs or index funds: Research and allocate a portion of savings as part of joint investment accounts for couples.

Let’s dive in!

1: Open a high-yield savings account (HYSA)

Opening a high-yield savings account (HYSA) is a smart move for short-term investments for newlyweds due to its competitive interest rates.

Actionable Steps:

- Research and compare interest rates: Look for reputable banks offering the best rates and terms for newlywed financial planning.

- Open an HYSA: Choose a bank with strong reviews and customer service for your joint investment accounts as a couple.

- Set up automatic transfers: Schedule regular deposits to consistently build your savings and emergency fund allocation for new marriages.

Explanation: These steps ensure you maximize returns while keeping your funds accessible, making HYSAs ideal low-risk investment options for newlyweds.

According to Bankrate, HYSAs offer higher interest rates compared to traditional savings accounts, making them ideal for short-term goals and short-term investment strategies for couples.

Key benefits of HYSAs include:

- Higher interest rates than traditional savings accounts, perfect for liquid investments for young married couples

- Easy access to funds for emergencies

- FDIC insurance protection

This approach provides a solid foundation for your short-term investments for newlyweds.

Next, let’s explore investing in short-term CD ladders as another option for short-term investments for newlyweds.

2: Invest in short-term CD ladders

Investing in short-term CD ladders is a highly effective strategy for maximizing returns while maintaining liquidity, making it an excellent short-term investment for newlyweds.

Actionable Steps:

- Identify the best interest rates: Compare short-term CDs (3-12 months) from various banks to find the highest rates available for your newlywed financial planning.

- Allocate funds across CDs: Distribute your $20,000 among multiple CDs with staggered maturity dates to ensure continuous access to funds, an ideal approach for low-risk investment options for newlyweds.

- Reinvest matured CDs: When a CD matures, reinvest the principal and interest into new CDs or other short-term investment strategies for couples.

Explanation: These steps help ensure your savings grow while providing regular access to your funds, supporting emergency fund allocation for new marriages.

According to Bankrate, CD ladders offer a balance of higher interest rates and liquidity, making them ideal for short-term investments for newlyweds.

This strategy also minimizes the risk of locking all your funds in a single CD, offering liquid investments for young married couples.

Transitioning to our next strategy, let’s explore money market accounts at credit unions as another option for short-term investments for newlyweds.

3: Explore money market accounts at credit unions

Exploring money market accounts at credit unions is a smart strategy for maximizing your short-term investments for newlyweds.

Actionable Steps:

- Visit local credit unions: Inquire about their money market accounts for newlyweds, including interest rates and terms.

- Compare fees and requirements: Evaluate various credit unions to find the most favorable terms and lowest fees for short-term investment strategies for couples.

- Open an account: Choose the best option and start depositing your savings regularly as part of your newlywed financial planning.

Explanation: These steps ensure you benefit from higher interest rates and member-focused service provided by credit unions, making them ideal for short-term investments for newlyweds.

According to Austin Telco FCU, credit unions often offer competitive rates and lower fees compared to traditional banks, making them a great choice for short-term savings and low-risk investment options for newlyweds.

This approach helps balance liquidity and returns, supporting your financial goals as a newly married couple.

Next, let’s consider investing in liquid funds for short-term goals.

4: Consider liquid funds for short-term goals

Considering liquid funds for short-term investments for newlyweds is essential for balancing flexibility and returns in your investment strategy.

Actionable Steps:

- Consult a financial advisor: Seek professional advice to identify suitable liquid investments for young married couples aligned with your risk tolerance and goals.

- Invest a portion of the $20,000: Allocate a specific amount into selected liquid funds to maintain liquidity while earning better returns, an important aspect of newlywed financial planning.

- Regularly review the performance: Monitor your short-term investments for newlyweds and adjust as needed to stay on track with your financial objectives.

Explanation: These steps help ensure your savings grow while remaining accessible.

According to Gurus Rediff, liquid funds are ideal for short-term goals due to their flexibility and potential for higher returns compared to traditional savings accounts.

This strategy supports your need for both accessibility and growth.

Advantages of liquid funds for short-term goals:

- Higher potential returns than high-yield savings accounts for married couples

- Easy access to funds when needed, making them suitable low-risk investment options for newlyweds

- Lower risk compared to equity investments, aligning with short-term investment strategies for couples

This approach complements the other strategies discussed, providing a well-rounded plan for your short-term savings.

5: Diversify with low-risk ETFs or index funds

Diversifying with low-risk ETFs or index funds is crucial for balancing growth and stability in your short-term investment strategy for newlyweds.

Actionable Steps:

- Research low-risk ETFs or index funds: Identify options with strong historical performance and low expense ratios for short-term investments for newlyweds.

- Allocate a portion of the savings: Invest a specific amount into these funds to spread risk and enhance potential returns in your joint investment accounts for couples.

- Monitor and rebalance the portfolio: Regularly review your investments and adjust allocations to stay aligned with your newlywed financial planning goals.

Explanation: These steps help ensure your savings grow steadily while minimizing risk in your short-term investments for newlyweds.

According to SmartAsset, ETFs and index funds offer diversification and stability, making them ideal for short-term investment strategies for couples.

This strategy complements your overall financial plan, providing a balanced approach to savings and growth for newlyweds.

Key factors to consider when choosing ETFs or index funds for short-term investments for newlyweds:

- Low expense ratios to maximize returns

- Broad market exposure for diversification

- Historical performance and volatility

This approach rounds out your investment strategy, ensuring a well-diversified portfolio for your short-term savings as a newly married couple.

Partner with Alleo on Your Investment Journey

We’ve explored the best short-term investments for newlyweds to invest $20,000 in savings. Did you know you can work directly with Alleo to make this process easier and faster for your newlywed financial planning?

Setting up an account with Alleo is simple. First, create your personalized investment plan for short-term investment strategies as a couple.

Alleo’s AI coach will guide you through each step of managing your joint investment accounts. You’ll receive tailored advice on low-risk investment options for newlyweds, automated reminders, and expert insights to keep your investments on track.

Alleo helps you monitor progress and make adjustments as needed for your emergency fund allocation and liquid investments as young married couples.

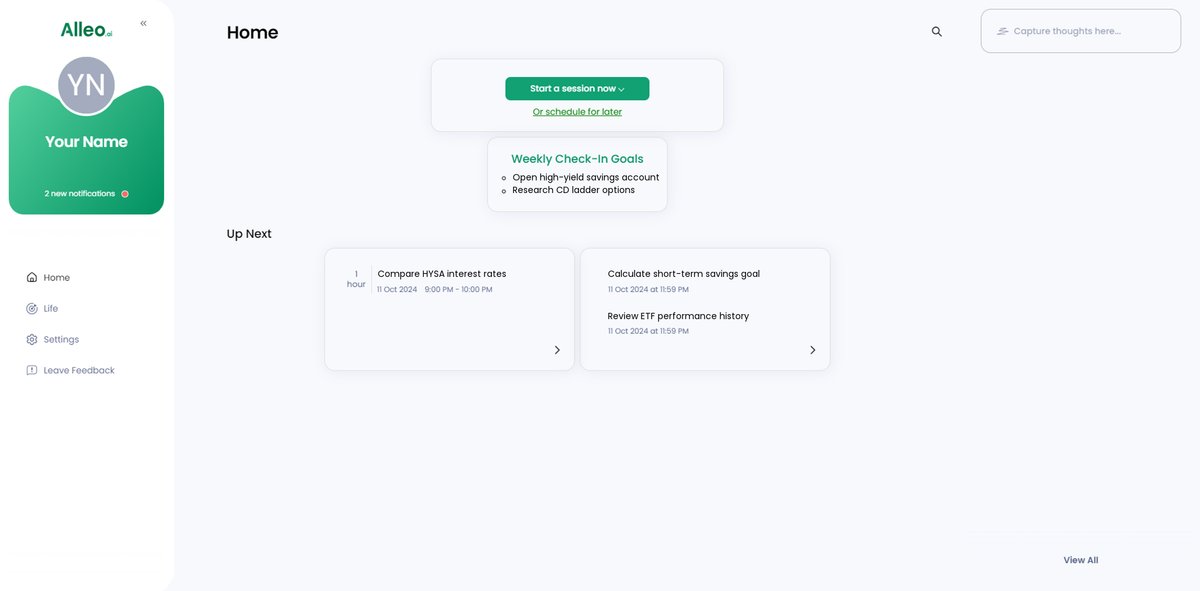

Ready to get started for free? Let me show you how to begin your short-term investments for newlyweds!

Step 1: Log In or Create Your Account

To begin your investment journey with Alleo, simply log in to your existing account or create a new one if you’re a first-time user.

Step 2: Choose Your Financial Focus

Select “Finding clarity and purpose in life decisions” to align your investment strategy with your long-term goals as newlyweds, ensuring your $20,000 savings work towards your shared future.

Step 3: Select “Finances” as Your Focus Area

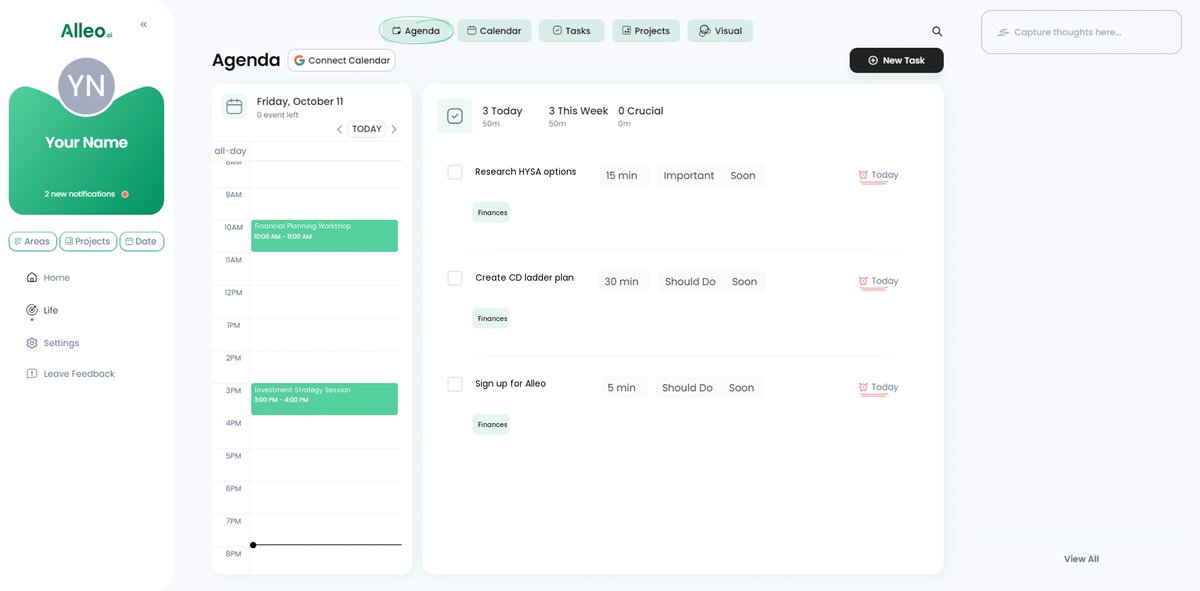

Choose “Finances” as your primary life area in Alleo to receive tailored guidance on managing your $20,000 wedding savings, exploring investment options like high-yield savings accounts and CD ladders, and creating a solid financial foundation for your new life together.

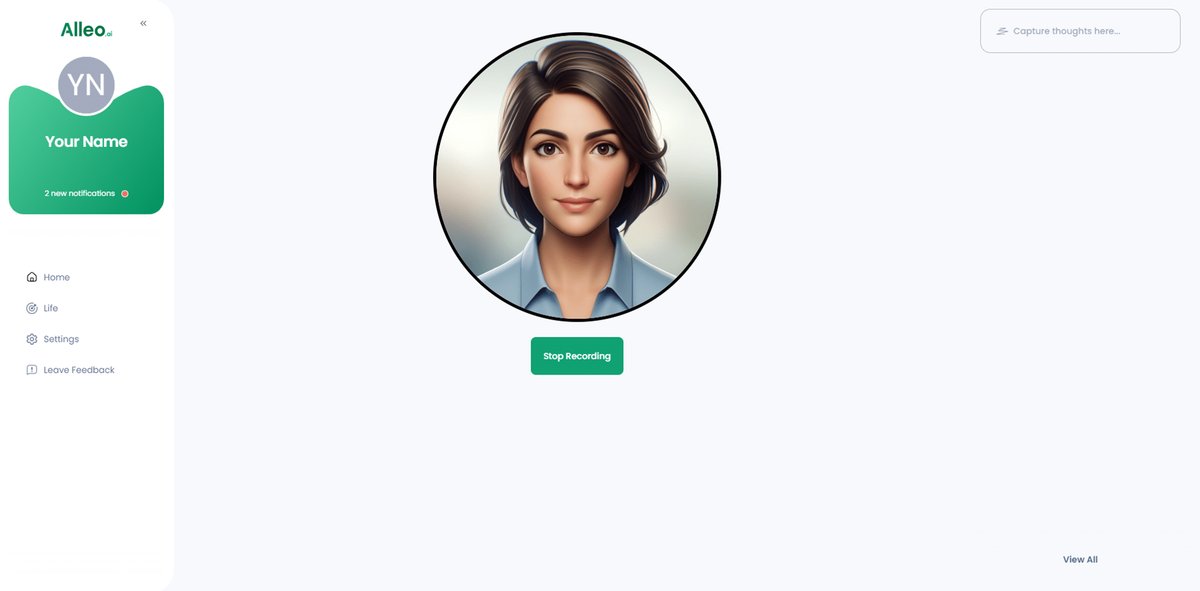

Step 4: Starting a coaching session

Begin your investment journey with Alleo by scheduling an intake session, where our AI coach will help you create a personalized plan for managing your $20,000 savings and guide you through setting financial goals as newlyweds.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, easily track your progress by checking the goals you discussed, which will be displayed on the home page of the Alleo app for convenient viewing and management.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in implementing your investment strategy, allowing you to schedule important dates like CD maturity or portfolio review sessions and set reminders for regular savings transfers.

Secure Your Financial Future Together

As we’ve explored, investing your $20,000 savings as newlyweds can be a daunting task, especially when considering short-term investments for newlyweds.

It’s crucial to make informed decisions that balance liquidity and growth. By opening a high-yield savings account for married couples, investing in CD ladders, exploring money market accounts for newlyweds, considering liquid investments for young married couples, and diversifying with ETFs, you can achieve financial stability and implement effective short-term investment strategies for couples.

Remember, you’re not alone in this journey of newlywed financial planning.

Alleo is here to help guide you with personalized financial advice and support for low-risk investment options for newlyweds.

Take the first step towards securing your financial future today through smart short-term investments for newlyweds.

Try Alleo for free and see the difference it can make in your joint investment accounts for couples.