How Financial Advisors Can Help Clients Navigate Economic Uncertainty in Michigan: The Ultimate Guide

What if you could guide your clients through navigating Michigan’s economic uncertainty with confidence and clarity?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience assisting clients amidst financial turbulence in Michigan, I often encounter similar obstacles related to economic uncertainty in Michigan.

In this article, you’ll discover strategies like personalized risk assessments, diversified portfolios for uncertain times, and behavioral coaching. These approaches can help you better support your clients during economic uncertainty, including retirement strategies in unstable markets and risk management for Michigan residents.

Let’s dive in.

The Economic Landscape and Its Challenges

Navigating Michigan’s economic uncertainty is no small feat. Many clients initially struggle with the complex interplay of local economic indicators in Michigan’s uncertain economic landscape.

Unemployment rates and consumer sentiment fluctuate, creating financial instability. This economic uncertainty in Michigan can disrupt business operations and individual financial plans, including retirement strategies in unstable markets.

For instance, several clients report anxiety over potential job losses. This anxiety often leads to hasty financial decisions, highlighting the need for risk management for Michigan residents.

Economic turbulence requires adaptive risk management to maintain financial stability. Understanding the local economic landscape is key to supporting your clients effectively, especially when considering Michigan investment opportunities and diversification tactics for uncertain times.

By staying informed and proactive, you can help clients weather these economic storms while navigating Michigan’s economic uncertainty.

Strategic Approaches for Financial Advisors in Michigan

Navigating Michigan’s economic uncertainty requires a few key steps. Here are the main areas to focus on to make progress in financial planning during recession.

- Conduct personalized risk assessments: Regularly review financial goals and risk tolerance with clients, focusing on risk management for Michigan residents.

- Develop diversified, Michigan-focused portfolios: Invest in local Michigan investment opportunities and diverse asset classes, implementing diversification tactics for uncertain times.

- Provide behavioral coaching during volatility: Offer workshops and check-ins to maintain financial discipline, addressing retirement strategies in unstable markets.

Let’s dive in to explore these strategies for navigating Michigan’s economic uncertainty!

1: Conduct personalized risk assessments

Conducting personalized risk assessments is crucial in helping clients navigate Michigan’s economic uncertainty.

Actionable Steps:

- Schedule regular one-on-one meetings with clients to review their financial goals and risk tolerance in light of economic uncertainty in Michigan.

- Utilize advanced analytics to evaluate clients’ current financial positions and potential risks, considering Michigan-specific financial regulations.

- Develop customized risk management strategies for Michigan residents based on individual client assessments.

Key benefits of personalized risk assessments:

- Tailored strategies for each client’s unique situation, including retirement strategies in unstable markets

- Improved client confidence in financial decisions while navigating Michigan’s economic uncertainty

- Enhanced ability to adapt to changing economic conditions through diversification tactics for uncertain times

Explanation: Personalized risk assessments help tailor financial strategies to individual needs, fostering confidence and stability when navigating Michigan’s economic uncertainty.

For more insights on effective risk management, you can explore the CohnReznick article on building resilient businesses. This tailored approach ensures clients remain on track despite economic fluctuations in Michigan.

By implementing these steps, you can provide clients with the clarity and confidence they need to face economic challenges and explore Michigan investment opportunities.

Now, let’s explore developing diversified, Michigan-focused portfolios.

2: Develop diversified, Michigan-focused portfolios

Developing diversified, Michigan-focused portfolios is crucial for navigating Michigan’s economic uncertainty effectively.

Actionable Steps:

- Research and identify local investment opportunities in Michigan’s key industries like automotive, technology, and healthcare to mitigate economic uncertainty in Michigan.

- Encourage clients to invest in a mix of asset classes, including stocks, bonds, real estate, and alternative investments as diversification tactics for uncertain times.

- Stay updated on Michigan’s economic policies and trends by subscribing to local economic reports and attending relevant seminars to better understand Michigan-specific financial regulations.

Explanation: Diversified portfolios help mitigate risk and capitalize on Michigan’s unique economic landscape, ensuring stability and supporting retirement strategies in unstable markets.

For more insights on effective investment strategies, consider exploring the Forbes article discussing top RIA firms.

These steps enable you to support clients in achieving long-term financial success despite economic fluctuations, helping them navigate Michigan’s economic uncertainty.

Now, let’s explore providing behavioral coaching during volatility.

3: Provide behavioral coaching during volatility

Guiding clients through market fluctuations is essential for long-term financial success, especially when navigating Michigan’s economic uncertainty.

Actionable Steps:

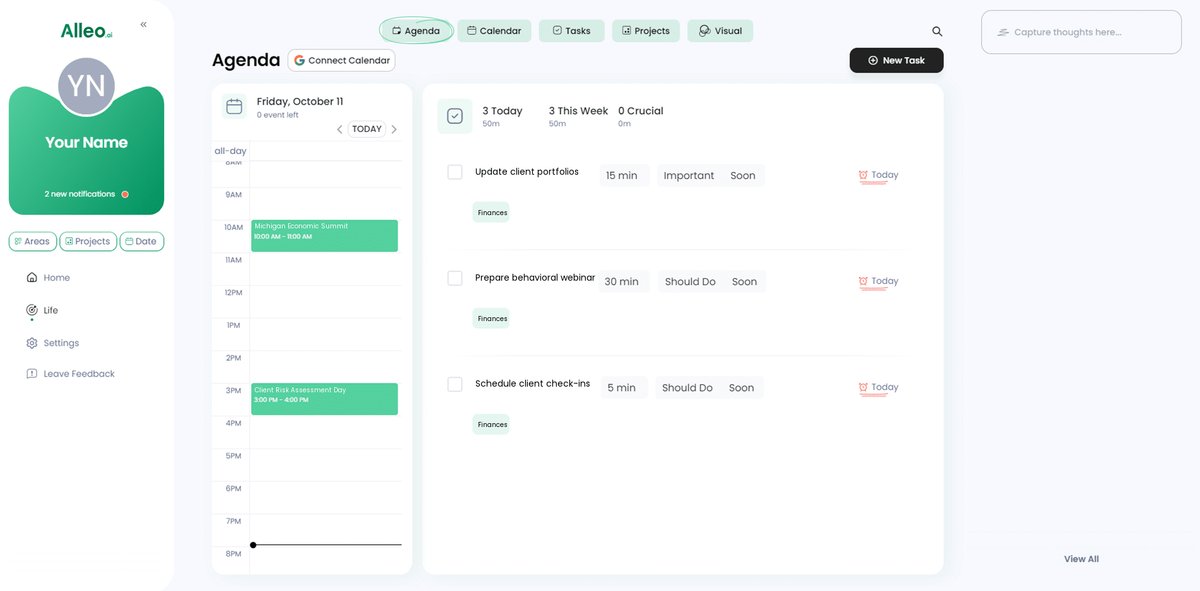

- Host monthly webinars on maintaining financial discipline during market changes and economic uncertainty in Michigan.

- Schedule bi-weekly check-ins to address emotional responses to market volatility and discuss retirement strategies in unstable markets.

- Use Alleo to help clients set and track financial goals, including Michigan investment opportunities and risk management for Michigan residents.

Effective behavioral coaching techniques:

- Active listening to understand client concerns about economic uncertainty in Michigan

- Reframing market events to maintain perspective on diversification tactics for uncertain times

- Providing historical context to illustrate long-term market trends and Michigan-specific financial regulations

Explanation: Behavioral coaching helps clients stay calm and make rational decisions during market turmoil. This approach ensures they stay committed to their long-term plans while navigating Michigan’s economic uncertainty.

For further insights, consider exploring the MICPA course on investing in uncertain times, which provides additional strategies for managing client behavior and tax planning during economic downturns.

Let’s now explore how Alleo can further support these strategies for navigating Michigan’s economic uncertainty.

Partner with Alleo on Your Financial Advising Journey

We’ve explored strategies for navigating Michigan’s economic uncertainty. But did you know you can work with Alleo to make this easier and faster when dealing with economic uncertainty in Michigan?

Alleo provides affordable, tailored coaching support for financial planning during recession. It offers full coaching sessions just like a human coach, helping with retirement strategies in unstable markets.

Plus, there’s a free 14-day trial with no credit card required to explore Michigan investment opportunities.

Setting up an account is simple. Create a personalized plan, and Alleo’s coach will help you overcome specific challenges, including risk management for Michigan residents.

The coach follows up on your progress and handles changes. You’ll stay accountable via text and push notifications, assisting with diversification tactics for uncertain times.

Ready to get started for free and navigate Michigan’s economic uncertainty? Let me show you how!

Step 1: Log In or Create Your Account

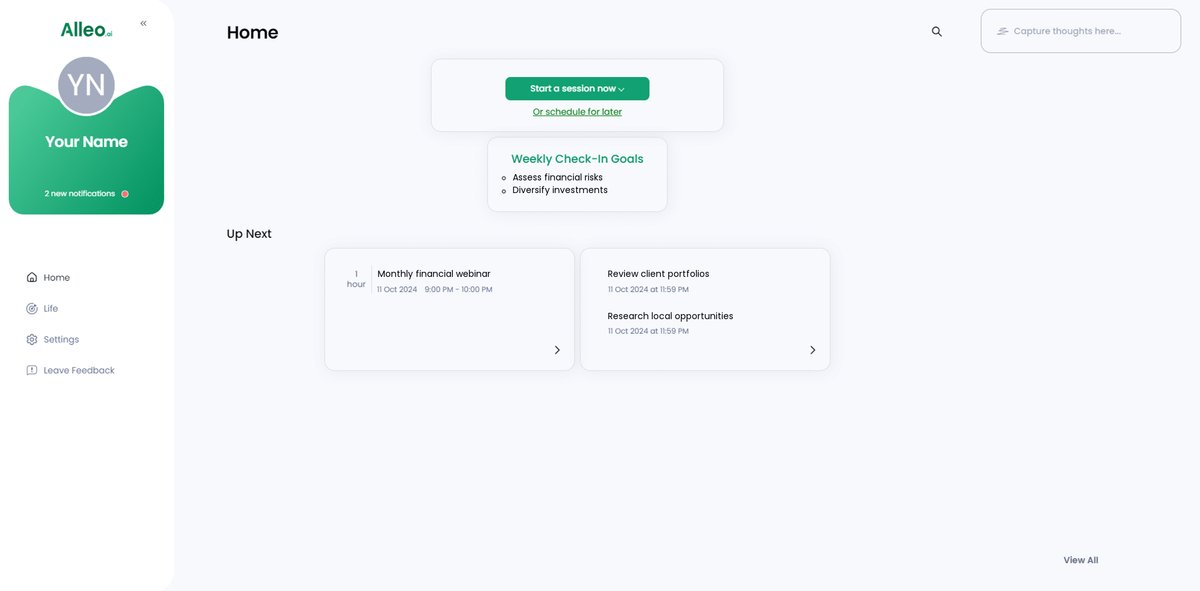

To begin navigating Michigan’s economic uncertainty with AI-powered guidance, Log in to your account or create a new one to access Alleo’s personalized coaching support.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your financial advisory practice with the strategies outlined for navigating economic uncertainty, helping you better support your clients through Michigan’s challenging economic landscape.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to tackle economic uncertainty head-on, aligning with the strategies discussed for managing financial challenges in Michigan’s fluctuating economy.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your financial advising goals and create a personalized plan to navigate Michigan’s economic uncertainty with confidence.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable in navigating Michigan’s economic uncertainty.

Step 6: Adding events to your calendar or app

Use Alleo’s built-in calendar and task features to add important financial events, client meetings, and goal checkpoints, allowing you to easily track your progress in helping clients navigate Michigan’s economic uncertainty.

Bringing It All Together

Navigating Michigan’s economic uncertainty is challenging, but you’re not alone. As financial advisors in Michigan, you have the tools to guide your clients confidently through economic uncertainty in Michigan.

Personalized risk assessments, diversified Michigan-focused portfolios, and behavioral coaching are your keys to success. These strategies help clients stay resilient and focused during turbulent times, especially when navigating Michigan’s economic uncertainty.

Remember, Alleo is here to support you. It offers tailored coaching to keep you and your clients on track with retirement strategies in unstable markets.

So, why wait? Let’s work together to navigate Michigan’s economic uncertainty and explore Michigan investment opportunities.

Try Alleo today and see the difference it can make in navigating Michigan’s economic uncertainty.