How Financial Advisors Can Master LinkedIn for Personal Branding and Client Acquisition: A Comprehensive Guide

Are you uncertain about how to use LinkedIn for financial advisors effectively for personal branding and client acquisition? Many finance professionals struggle with LinkedIn marketing for financial advisors.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience helping clients stand out in competitive industries, I often encounter similar concerns about social media networking for financial services.

In this article, you’ll discover proven strategies to optimize your LinkedIn profile, create valuable content, and engage with your target audience. By following these steps, you’ll build a strong personal brand and attract more clients through LinkedIn lead generation for financial planners.

Let’s dive into personal branding strategies for finance professionals and content marketing for financial advisors on LinkedIn.

Understanding the Challenges Financial Advisors Face on LinkedIn

Navigating LinkedIn for financial advisors can be daunting when it comes to personal branding. Many struggle to stand out in a crowded space, unsure how to effectively showcase their expertise and implement LinkedIn marketing for financial advisors.

It’s not uncommon to see profiles that lack polish or fail to capture the advisor’s unique value proposition, missing opportunities for LinkedIn profile optimization for advisors.

Personal branding strategies for finance professionals are crucial for client acquisition, yet the uncertainty around LinkedIn’s efficacy can be paralyzing. I frequently encounter clients who feel overwhelmed by the platform’s potential but unsure where to start with content marketing for financial advisors on LinkedIn.

LinkedIn boasts over 65 million decision-makers, making it a goldmine for networking and LinkedIn lead generation for financial planners. However, without a strategic approach to social media networking for financial services, advisors often miss out on these opportunities.

This can lead to frustration and missed business growth, particularly when it comes to engaging with potential clients on LinkedIn.

Let’s tackle this challenge head-on and explore how financial advisors can leverage LinkedIn for building credibility as a financial expert online.

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective LinkedIn marketing for financial advisors:

- Optimize LinkedIn profile for advisor branding: Enhance your profile’s professionalism and appeal, focusing on personal branding strategies for finance professionals.

- Create and share valuable financial content: Offer insights and tips to engage your audience, implementing content marketing for financial advisors on LinkedIn.

- Engage with target audience’s posts and comments: Build relationships through meaningful interactions, utilizing social media networking for financial services.

- Join and participate in relevant LinkedIn groups: Expand your reach and influence through LinkedIn groups for financial industry networking.

- Leverage LinkedIn’s networking tools strategically: Identify and connect with potential clients, employing client acquisition techniques on LinkedIn.

- Use LinkedIn analytics to refine content strategy: Monitor and adjust your approach for better results in LinkedIn lead generation for financial planners.

- Showcase client testimonials and success stories: Highlight your proven track record, building credibility as a financial expert online.

Let’s dive into these LinkedIn for financial advisors strategies!

1: Optimize LinkedIn profile for advisor branding

Optimizing your LinkedIn profile is crucial for establishing a strong personal brand and attracting potential clients as a financial advisor. LinkedIn for financial advisors can be a powerful tool for client acquisition and networking.

Actionable Steps:

- Update your profile picture and background image to reflect professionalism.

- Schedule a professional photoshoot.

- Measure: Increase in profile views.

- Craft a compelling headline and summary that highlights your unique expertise in financial advising.

- Use specific keywords related to financial advising and wealth management.

- Measure: Engagement rate on profile.

- List relevant skills and obtain endorsements to build credibility as a financial expert online.

- Request endorsements from clients and colleagues in the financial services industry.

- Measure: Number of endorsements received.

Key elements of a strong LinkedIn profile for financial advisors:

- Professional, high-quality profile photo

- Compelling headline that showcases your expertise in financial planning

- Detailed summary highlighting your unique value proposition in financial services

Explanation:

These steps matter because a polished LinkedIn profile makes a strong first impression and builds credibility, essential for LinkedIn marketing for financial advisors.

According to LinkedIn personal branding experts, optimizing your profile can significantly boost your visibility and engagement, crucial for social media networking in financial services.

Next, let’s explore how to create and share valuable financial content as part of your content marketing strategy on LinkedIn.

2: Create and share valuable financial content

Creating and sharing valuable financial content is essential for engaging your audience and building credibility on LinkedIn for financial advisors.

Actionable Steps:

- Develop a content calendar with regular posts about financial tips and market insights.

- Plan content using a scheduling tool for LinkedIn marketing for financial advisors.

- Measure: Consistency in posting.

- Write and publish articles on LinkedIn Publishing as part of your content marketing for financial advisors on LinkedIn.

- Aim for one article per month.

- Measure: Article views and comments.

- Share educational resources and financial news to enhance your personal branding strategies for finance professionals.

- Use curated content from reputable sources.

- Measure: Number of shares and reactions.

Explanation:

These steps matter because consistent, high-quality content positions you as an expert in your field, supporting your LinkedIn profile optimization for advisors.

According to LinkedIn personal branding experts, sharing valuable content can significantly boost your visibility and engagement, aiding in client acquisition techniques on LinkedIn.

Regular sharing of insights helps build trust with your audience, making you their go-to advisor and facilitating LinkedIn lead generation for financial planners.

Next, let’s explore how to engage with your target audience’s posts and comments, a key aspect of social media networking for financial services.

3: Engage with target audience’s posts and comments

Engaging with your target audience’s posts and comments is crucial for building relationships and enhancing visibility on LinkedIn for financial advisors.

Actionable Steps:

- Comment on posts from potential clients and industry leaders.

- Set a daily goal for meaningful comments.

- Measure: Engagement rate on comments.

- Like and share posts that align with your brand, enhancing your LinkedIn marketing for financial advisors.

- Identify key influencers to follow.

- Measure: Increase in followers.

- Start conversations by asking questions in comments, a key client acquisition technique on LinkedIn.

- Ask thought-provoking questions relevant to financial advising.

- Measure: Number of replies and interactions.

Explanation:

These steps matter because they foster interaction and build trust with your audience. Engaging with others’ content increases your visibility and positions you as an approachable expert, which is essential for personal branding strategies for finance professionals.

According to organic social media strategies, meaningful interactions can significantly boost your credibility and client base.

Taking these actions can open new opportunities for collaboration and client acquisition, making LinkedIn an effective platform for financial advisors seeking to expand their network.

4: Join and participate in relevant LinkedIn groups

Joining and participating in LinkedIn groups is crucial for expanding your network and establishing your expertise as a financial advisor using LinkedIn.

Actionable Steps:

- Identify and join groups related to financial advising and your target markets.

- Join at least five relevant groups for LinkedIn marketing for financial advisors.

- Measure: Active group membership.

- Contribute to group discussions with valuable insights.

- Post at least one discussion topic per week to boost your personal branding strategies for finance professionals.

- Measure: Engagement in group posts.

- Network with group members by sending personalized messages.

- Initiate conversations based on group interactions as part of your client acquisition techniques on LinkedIn.

- Measure: Number of meaningful connections made.

Benefits of active group participation:

- Expanded professional network through social media networking for financial services

- Increased visibility within your industry

- Access to potential clients and collaborators

Explanation:

These steps matter because active participation in groups can significantly enhance your visibility and credibility as a financial advisor on LinkedIn.

According to branding experts, engaging in relevant groups helps you connect with potential clients and industry peers. By sharing your expertise, you position yourself as a trusted advisor, building credibility as a financial expert online.

Next, let’s explore leveraging LinkedIn’s networking tools strategically for LinkedIn lead generation for financial planners.

5: Leverage LinkedIn’s networking tools strategically

Leveraging LinkedIn’s networking tools is crucial for financial advisors identifying potential clients and expanding their professional network on LinkedIn.

Actionable Steps:

- Use LinkedIn’s advanced search to find potential clients.

- Perform weekly searches for new connections.

- Measure: Number of new connections made.

- Send personalized connection requests as part of your LinkedIn marketing for financial advisors strategy.

- Mention common interests or groups.

- Measure: Connection acceptance rate.

- Utilize LinkedIn’s messaging features for follow-up and client acquisition techniques on LinkedIn.

- Schedule regular follow-up messages.

- Measure: Response rate to messages.

Explanation:

These steps matter because strategic networking can significantly increase your connection base and potential client leads, which is essential for LinkedIn for financial advisors.

According to LinkedIn lead generation strategies, personalized and consistent outreach is key to building meaningful relationships and enhancing social media networking for financial services.

Effective use of LinkedIn’s tools ensures you stay top-of-mind with potential clients and supports your personal branding strategies for finance professionals.

Next, let’s explore how to use LinkedIn analytics to refine your content marketing for financial advisors on LinkedIn strategy.

6: Use LinkedIn analytics to refine content strategy

Using LinkedIn analytics to refine your content strategy is crucial for maximizing engagement and effectiveness for financial advisors on LinkedIn.

Actionable Steps:

- Monitor content performance using LinkedIn Analytics for financial advisors.

- Review analytics weekly to identify high-performing posts in LinkedIn marketing for financial advisors.

- Measure: Engagement metrics such as likes, shares, and comments.

- Adjust content strategy based on analytics insights.

- Focus on content types that perform well for client acquisition on LinkedIn.

- Measure: Improvement in engagement rates.

- Track profile views and connection growth.

- Set monthly growth targets for profile views and connections as part of personal branding strategies for finance professionals.

- Measure: Increase in profile views and connections.

Key metrics to monitor in LinkedIn Analytics for financial advisors:

- Post engagement rates

- Follower growth

- Profile visit frequency

Explanation:

These steps matter because they allow you to understand what resonates with your audience in social media networking for financial services.

By leveraging LinkedIn Analytics, you can tailor your content to meet your audience’s preferences, thereby increasing engagement and building credibility as a financial expert online.

According to LinkedIn marketing experts, analytics insights are invaluable for fine-tuning your strategy for LinkedIn lead generation for financial planners.

Next, let’s explore showcasing client testimonials and success stories as part of content marketing for financial advisors on LinkedIn.

7: Showcase client testimonials and success stories

Showcasing client testimonials and success stories is crucial for building credibility and trust with potential clients, especially when using LinkedIn for financial advisors.

Actionable Steps:

- Request and publish testimonials from satisfied clients on your LinkedIn profile.

- Reach out to top clients for testimonials, highlighting your LinkedIn marketing for financial advisors.

- Measure: Number of testimonials received.

- Share success stories highlighting client achievements as part of your content marketing for financial advisors on LinkedIn.

- Write and post case studies to enhance your personal branding strategies for finance professionals.

- Measure: Engagement on success posts.

- Create video testimonials to add a personal touch and boost your LinkedIn profile optimization for advisors.

- Schedule video calls with clients to record their experiences, aiding in client acquisition techniques on LinkedIn.

- Measure: Video views and shares.

Explanation:

These steps matter because testimonials and success stories offer social proof, enhancing your credibility. They demonstrate your expertise and the value you provide to clients, which is essential for building credibility as a financial expert online.

According to branding experts, sharing client success stories can significantly boost your visibility and attract new clients, making it an effective LinkedIn lead generation for financial planners strategy.

Highlighting client achievements can be the key to inspiring trust and showing your potential clients the tangible results they can expect, which is crucial when engaging with potential clients on LinkedIn.

Partner with Alleo on Your LinkedIn Journey

We’ve explored the challenges of leveraging LinkedIn for financial advisors in personal branding and client acquisition. Did you know you can work directly with Alleo to make this LinkedIn marketing for financial advisors journey easier and faster?

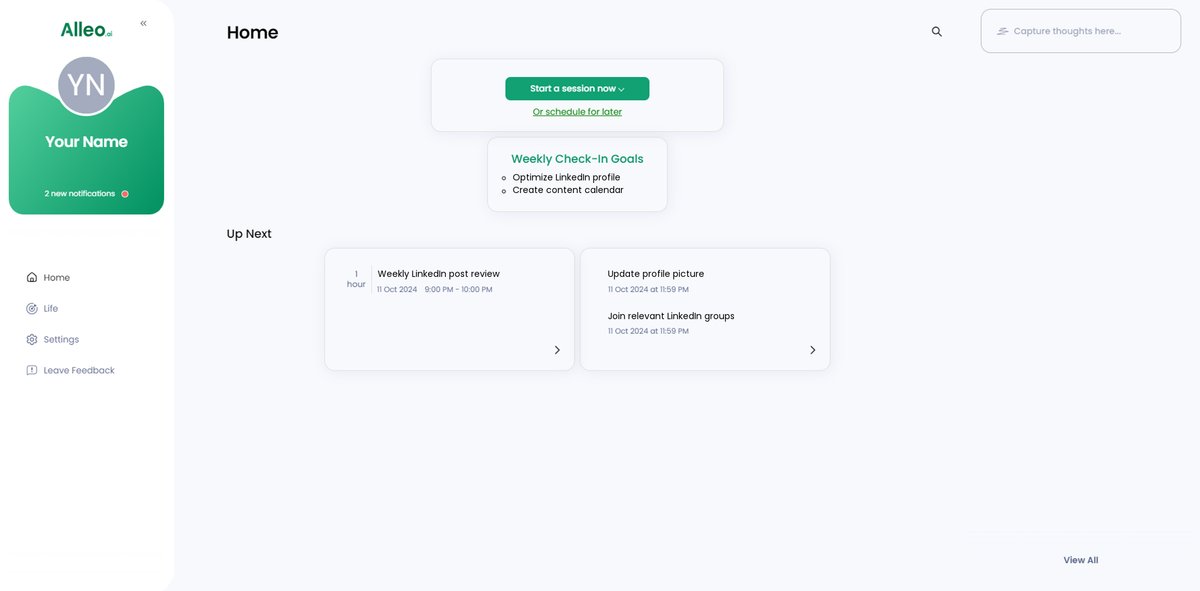

With Alleo, setting up your account is simple. Create a personalized plan to overcome LinkedIn challenges and optimize your LinkedIn profile as an advisor.

Our AI coach offers affordable, tailored coaching sessions for content marketing and social media networking for financial services, just like a human coach.

Alleo’s coach will follow up on your progress and handle changes. You’ll stay accountable via text and push notifications, enhancing your personal branding strategies for finance professionals.

Ready to get started for free and boost your LinkedIn lead generation for financial planners?

Let me show you how to excel at engaging with potential clients on LinkedIn!

Step 1: Log in or Create Your Account

To begin your LinkedIn optimization journey with Alleo, log in to your existing account or create a new one to access personalized AI coaching tailored to your financial advisory needs.

Step 2: Choose Your LinkedIn Branding Goal

Select “Setting and achieving personal or professional goals” to focus your efforts on enhancing your LinkedIn presence as a financial advisor. This goal aligns with the strategies outlined in the article, helping you overcome challenges in personal branding and client acquisition on the platform.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area to align with your LinkedIn branding goals and receive tailored guidance on optimizing your professional profile, creating impactful content, and expanding your network to attract more clients as a financial advisor.

Step 4: Starting a coaching session

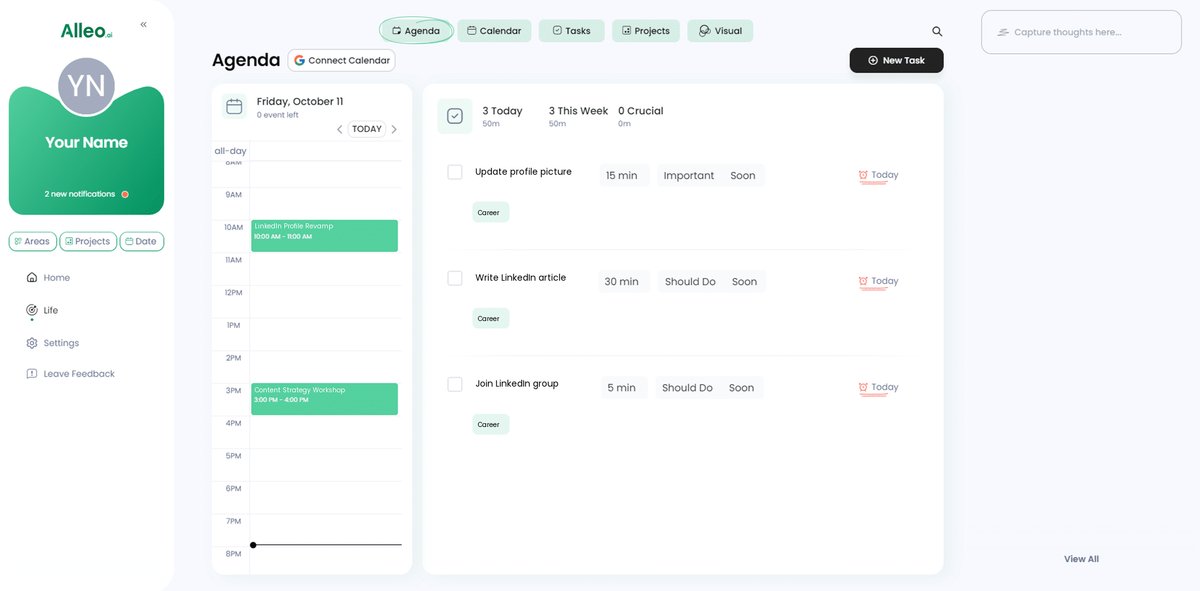

Begin your LinkedIn optimization journey with an intake session, where you’ll work with Alleo’s AI coach to set up a personalized plan for enhancing your profile and improving your client acquisition strategy.

Step 5: Viewing and managing goals after the session

After your LinkedIn strategy coaching session, easily track your progress by checking the goals discussed, which will appear on the home page of the Alleo app, allowing you to stay focused on optimizing your profile and engaging with your target audience.

Step 6: Adding events to your calendar or app

To keep track of your LinkedIn strategy progress, use Alleo’s calendar and task features to add important events like content posting schedules, networking sessions, or analytics review dates, ensuring you stay on top of your personal branding and client acquisition efforts.

Wrapping Up and Taking Action

We’ve covered a lot, haven’t we? By now, you should feel more confident about leveraging LinkedIn for financial advisors and personal branding strategies for finance professionals.

Remember, optimizing your LinkedIn profile, creating valuable content, engaging with your audience, and using LinkedIn’s tools strategically are key steps for financial advisors. Each action you take builds your credibility and visibility as a financial expert online.

You might still feel hesitant, and that’s okay.

Start small.

Implement one step at a time.

You’ll see progress.

Alleo is here to help you every step of the way. Our AI coach offers personalized support, simplifying your LinkedIn marketing for financial advisors journey.

Ready to boost your LinkedIn game and enhance your client acquisition techniques on LinkedIn?

Give Alleo a try for free today and start mastering social media networking for financial services!