5 Proven Ways Financial Professionals Can Manage Stress During Market Volatility

Are you feeling overwhelmed by the constant market fluctuations and mounting client expectations during volatile times? Managing stress for financial advisors has become increasingly crucial in today’s unpredictable economic landscape.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, financial advisors often struggle to maintain composure when markets are unpredictable. Stress management for financial advisors is key to coping with market uncertainty and preventing financial professional burnout.

In this article, you’ll discover effective strategies to manage stress, enhance client communication, and stay resilient. From personalized stress management routines to ongoing behavioral finance education, we’ll cover practical steps to help you thrive. We’ll explore mindfulness techniques for traders, work-life balance in finance careers, and emotional resilience in volatile markets.

Let’s dive in to uncover self-care strategies for investment professionals and stress reduction techniques for wealth managers that can make a significant difference in managing client anxiety during market downturns.

The Impact of Market Volatility on Financial Advisors’ Stress

Managing stress for financial advisors is crucial when navigating market volatility. Many clients initially struggle with the unpredictability of the market, which translates to increased pressure on you.

This pressure often comes from managing client expectations and staying up-to-date with rapid market changes, contributing to the need for effective stress management for financial advisors.

Unmanaged stress can significantly affect your well-being and professional performance. Stressors such as tight deadlines, economic uncertainty, and client anxieties can lead to burnout, highlighting the importance of financial professional burnout prevention.

In my experience, people often find it challenging to balance personal life and professional demands during these turbulent times, emphasizing the need for work-life balance in finance careers.

It’s crucial to recognize these stressors and address them proactively. Your ability to maintain composure and provide clear guidance during market downturns is essential for client trust and retention, showcasing the need for emotional resilience in volatile markets.

Implementing effective stress management strategies can make a significant difference in managing stress for financial advisors.

Key Steps to Managing Stress During Market Volatility

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for managing stress for financial advisors and making progress:

- Develop a personalized stress management routine: Identify stress triggers, incorporate mindfulness techniques for traders, and set boundaries to balance work and life in finance careers.

- Practice active listening with concerned clients: Empathize, validate emotions, and provide clear and calm guidance for managing client anxiety during market downturns.

- Implement regular portfolio rebalancing: Schedule reviews, diversify investments, and monitor market trends to cope with market uncertainty.

- Engage in ongoing behavioral finance education: Attend workshops on stress management for financial advisors, read relevant literature, and apply learnings to enhance emotional resilience in volatile markets.

- Cultivate a supportive professional network: Join associations, find a mentor, and create peer support groups to prevent financial professional burnout.

Let’s dive in!

1: Develop a personalized stress management routine

Creating a personalized stress management routine is vital for managing stress for financial advisors during market volatility.

Actionable Steps:

- Identify Stress Triggers: Keep a stress diary to note situations that cause stress. Analyze patterns to understand what needs to be managed, particularly when coping with market uncertainty.

- Incorporate Relaxation Techniques: Practice daily meditation or deep breathing exercises as mindfulness techniques for traders. Schedule regular physical activity to release tension and boost mood, aiding in financial professional burnout prevention.

- Set Boundaries: Allocate specific times for work and personal life to ensure a healthy work-life balance in finance careers. Use technology, like calendar apps, to enforce these boundaries.

Explanation: These steps matter because identifying and managing stress triggers help you maintain focus and productivity, essential for managing stress for financial advisors.

According to research, relaxation techniques and boundary setting can significantly reduce stress and improve overall well-being, enhancing emotional resilience in volatile markets. For more strategies on managing stress, refer to this study on coping strategies.

By following these steps, you’ll build resilience and enhance your ability to support clients effectively, crucial for managing client anxiety during market downturns.

2: Practice active listening with concerned clients

Understanding and addressing client concerns during volatile times is crucial for managing stress for financial advisors and maintaining trust and composure.

Actionable Steps:

- Encourage Open Communication: Ask clients about their specific worries and listen without interrupting. Show genuine interest in their concerns, which aids in coping with market uncertainty.

- Validate Their Emotions: Acknowledge clients’ fears and frustrations. Provide reassurance by showing empathy and understanding, enhancing emotional resilience in volatile markets.

- Offer Clear Guidance: Explain market conditions and impacts using simple language. Provide actionable advice tailored to their financial situations, helping in managing client anxiety during market downturns.

Key benefits of active listening include:

- Strengthening client relationships

- Reducing misunderstandings

- Identifying underlying concerns

Explanation: These steps matter because active listening helps build stronger client relationships and trust, contributing to stress management for financial advisors.

According to Investopedia, empathetic communication can alleviate client fears and enhance your professional credibility.

Implementing these practices ensures clients feel heard and supported, even during stressful market conditions, which is essential for managing stress for financial advisors.

3: Implement regular portfolio rebalancing

Regular portfolio rebalancing is essential for managing stress for financial advisors and maintaining stability during market volatility.

Actionable Steps:

- Schedule Quarterly Reviews: Set quarterly portfolio reviews to assess and adjust asset allocations based on current market conditions and client goals, helping financial advisors cope with market uncertainty.

- Diversify Investments: Spread investments across different asset classes, industries, and regions to mitigate risk and reduce potential losses, enhancing emotional resilience in volatile markets.

- Monitor and Adapt: Use financial industry stress management tools to track portfolio performance and make timely adjustments as needed, aiding in stress reduction techniques for wealth managers.

Explanation: These steps matter because regular rebalancing helps maintain a balanced portfolio, reducing the impact of market volatility and managing stress for financial advisors.

Diversification and ongoing monitoring are crucial for managing risk and ensuring financial stability. According to the Corporate Finance Institute, these practices are fundamental for effective market risk management and financial professional burnout prevention.

By following these steps, you’ll be better equipped to handle market fluctuations and support your clients effectively, improving work-life balance in finance careers.

4: Engage in ongoing behavioral finance education

Engaging in ongoing behavioral finance education is crucial for managing stress for financial advisors and effectively managing client relationships during volatile markets.

Actionable Steps:

- Attend Workshops and Seminars: Participate in industry conferences and webinars focusing on behavioral finance and stress management for financial advisors. Enroll in online courses to deepen your understanding of cognitive biases and investor behavior.

- Read Relevant Literature: Subscribe to journals and magazines that cover the latest research in behavioral finance and coping with market uncertainty. Join book clubs or discussion groups to explore these topics further.

- Implement Learnings: Apply insights from behavioral finance to client interactions and portfolio management. Develop strategies that address common psychological pitfalls in investing and promote emotional resilience in volatile markets.

Top resources for behavioral finance education and managing stress for financial advisors:

- Journal of Behavioral Finance

- Behavioral Finance: Understanding the Social, Cognitive, and Economic Debates by Edwin Burton and Sunit Shah

- CFA Institute’s Behavioral Finance Program

Explanation: These steps matter because continuous learning helps you stay updated with the latest industry insights, enhancing your ability to support clients effectively while managing stress for financial advisors.

According to a study on coping strategies, ongoing education is vital for adapting to changing market conditions and client needs, which can aid in financial professional burnout prevention.

By staying informed, you can better manage stress and maintain a high level of professionalism, incorporating mindfulness techniques for traders and work-life balance in finance careers.

Implementing these educational steps ensures you remain a valuable resource for your clients, even during turbulent times, while developing self-care strategies for investment professionals.

5: Cultivate a supportive professional network

Building a supportive professional network is essential for managing stress for financial advisors during market volatility.

Actionable Steps:

- Join Professional Associations: Become a member of financial advisor networks and associations. Attend local chapter meetings and events to build connections and learn stress management for financial advisors.

- Find a Mentor: Seek guidance from experienced advisors who can offer advice and support for coping with market uncertainty. Regularly meet with your mentor to discuss challenges and solutions.

- Create Peer Support Groups: Form or join small groups of peers for regular check-ins and mutual support. Share experiences, strategies, and resources to manage stress together and prevent financial professional burnout.

Explanation: These steps matter because having a strong support network can provide valuable insights, emotional support, and practical advice for managing stress for financial advisors.

According to a study on work environments, promoting work-life balance in finance careers and seeking support can enhance overall well-being and reduce stress.

By cultivating a network, you’ll find it easier to navigate market challenges and maintain your professional composure while developing emotional resilience in volatile markets.

Benefits of a strong professional network:

- Access to diverse perspectives and experiences

- Emotional support during challenging times

- Opportunities for collaborative problem-solving and sharing stress reduction techniques for wealth managers

Building a robust network is not just about professional growth; it’s about creating a safety net that helps you thrive and manage stress for financial advisors effectively.

Partner with Alleo on Your Stress Management Journey

We’ve explored the challenges of managing stress for financial advisors during market volatility and the steps to overcome them. But did you know you can work directly with Alleo to make this stress management journey easier for financial professionals?

Set up an account with Alleo, create a personalized plan for coping with market uncertainty, and work with our AI coach. Our coach will help you manage stress, provide actionable advice on stress reduction techniques for wealth managers, and keep you accountable in maintaining work-life balance in finance careers.

Alleo offers full coaching sessions just like a human coach, with text and push notifications to support your emotional resilience in volatile markets.

Ready to get started for free and learn mindfulness techniques for traders?

Let me show you how to prevent financial professional burnout!

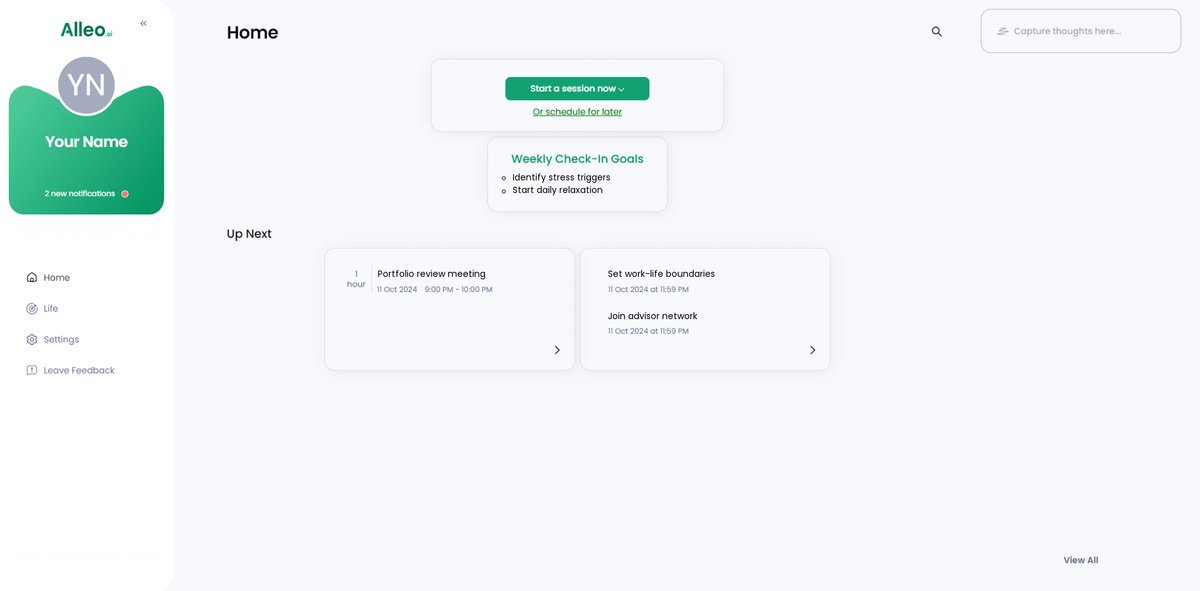

Step 1: Log In or Create Your Account

To begin managing your stress with our AI coach, log in to your existing account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop a personalized stress management routine that will help you maintain composure and effectively guide clients during market volatility.

Step 3: Selecting the life area you want to focus on

Choose “Career” as your focus area to address the stress management challenges specific to financial advising during market volatility, allowing you to develop targeted strategies for maintaining composure and enhancing client relationships in your professional life.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your stress management goals and create a personalized plan to navigate market volatility more effectively.

Step 5: Viewing and managing goals after the session

After your coaching session on stress management, check the Alleo app’s home page to review and track the personalized goals you discussed, helping you stay focused on improving your resilience during market volatility.

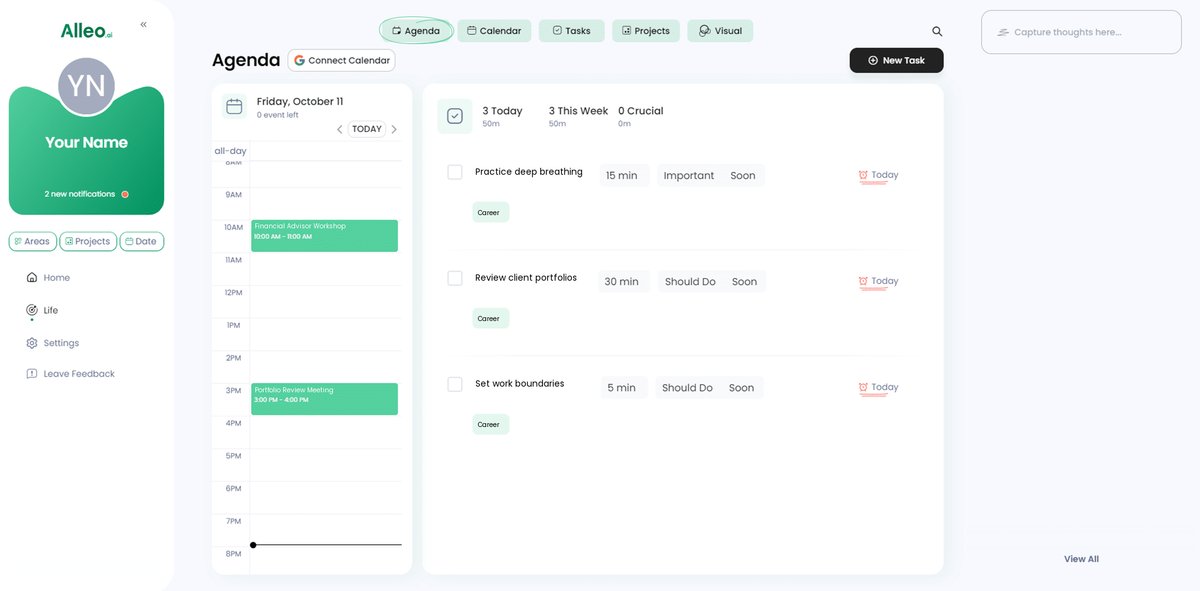

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track stress management activities, such as portfolio reviews, client meetings, and relaxation exercises, ensuring you stay on top of your professional commitments while maintaining a healthy work-life balance.

Embrace Stress Management for a Thriving Career

As we wrap up, it’s clear that managing stress for financial advisors during market volatility is vital for your success and well-being. Implementing these stress management strategies can make a profound difference in your finance career.

Remember, developing a personalized stress management routine for financial advisors, practicing active listening, and engaging in ongoing education are key steps in coping with market uncertainty. Cultivating a supportive network will also provide valuable support for financial professional burnout prevention.

Don’t let stress undermine your professionalism. You can thrive even in challenging markets by developing emotional resilience in volatile markets.

Consider using Alleo to guide you on this journey of managing stress for financial advisors. Set your stress management goals, track your progress, and stay accountable with financial industry stress management tools.

You can do this! Start today and see the difference in your work-life balance in finance careers.