7 Essential Techniques for Financial Advisors to Communicate Sensitively About Money

Are you struggling to communicate sensitive financial matters without causing discomfort or misunderstanding? Effective financial communication strategies for advisors are essential in today’s wealth management landscape.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, learning to communicate constructively and avoid damaging language is crucial for financial advisors. Mastering client money discussions requires a blend of empathy and expertise.

In this article, you’ll discover strategies like:

- Active listening

- Clear communication

- Cultural sensitivity

These methods can help build stronger client relationships and enhance trust. Implementing these financial communication strategies can lead to more effective advisor-client conversations and improve your approach to sensitive wealth management.

Let’s dive into these personal finance sensitivity techniques and money talk best practices.

![]()

Understanding the Struggles of Sensitive Financial Communication

When discussing sensitive financial matters, stress and pressure can mount quickly. Many financial advisors face pitfalls like using jargon or being culturally insensitive when engaging in client money discussions.

These missteps can lead to misunderstandings and frustration in effective advisor-client conversations.

I often see clients struggle with poor financial communication strategies, which erodes trust and satisfaction. Imagine a client feeling lost in a sea of technical terms or disrespected due to a lack of cultural awareness in sensitive wealth management.

It’s painful to watch relationships crumble over these issues in personal finance sensitivity.

Effective communication is crucial for financial communication strategies advisors. Miscommunication can result in lost clients and damaged reputations.

To avoid this, you need to hone your empathetic financial counseling skills and money talk best practices.

![]()

Overcoming Communication Challenges in Financial Advising

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with financial communication strategies advisors can implement.

- Practice active listening with clients: Engage fully and show understanding in effective advisor-client conversations.

- Use jargon-free explanations of financial concepts: Make information clear and accessible for client money discussions.

- Develop cultural sensitivity for diverse clients: Respect and understand different backgrounds in sensitive wealth management.

- Employ empathy in discussing financial challenges: Show genuine care for client concerns through empathetic financial counseling.

- Create a safe, non-judgmental environment: Foster open and honest communication, building trust with clients.

- Use relatable analogies to explain complex ideas: Simplify and clarify concepts for tactful financial guidance.

- Ask open-ended questions to encourage sharing: Promote deeper conversations and insights, applying emotional intelligence in finance.

Let’s dive into these financial communication strategies advisors can use for money talk best practices!

1: Practice active listening with clients

Practicing active listening with clients is key to building trust and understanding their unique needs. This is one of the essential financial communication strategies advisors can employ for effective advisor-client conversations.

Actionable Steps:

- Attend a workshop on active listening techniques: Look for local or online workshops tailored for financial professionals to improve client money discussions.

- Implement active listening exercises during client meetings: Use techniques like paraphrasing and summarizing to show you understand, enhancing empathetic financial counseling.

- Seek feedback from clients about their experience: Create a short survey to gather client feedback on your listening skills, which is crucial for sensitive wealth management.

Explanation:

These steps matter because active listening helps you understand your clients better, leading to stronger relationships and increased trust. It’s a cornerstone of personal finance sensitivity.

According to Shore Beauty School, effective listening is crucial during consultations to set clear expectations and tailor services.

By actively listening, you ensure clients feel heard and valued, which is essential for long-term success and aligns with money talk best practices.

Key benefits of active listening include:

- Enhanced client satisfaction

- Improved problem-solving abilities

- Increased client retention rates

Implementing these practices can significantly enhance your client interactions and demonstrate emotional intelligence in finance, which are crucial financial communication strategies advisors should master.

2: Use jargon-free explanations of financial concepts

Using jargon-free explanations of financial concepts is essential to ensure clients fully understand their financial situation. This is a key financial communication strategy advisors should employ for effective advisor-client conversations.

Actionable Steps:

- Create a glossary of common financial terms in plain language: Regularly update it based on client questions and feedback, enhancing client money discussions.

- Practice explaining complex concepts to a non-expert friend or family member: Record the explanations and review them for clarity, improving your empathetic financial counseling skills.

- Develop client-friendly handouts and visual aids: Use infographics and simple charts to illustrate key points, supporting sensitive wealth management practices.

Explanation:

These steps matter because clear communication helps clients feel more secure and confident about their financial decisions, which is crucial for building trust with clients.

According to Interview Ace, jargon-free explanations build trust and client satisfaction, aligning with money talk best practices.

By simplifying complex concepts, you make financial advice more accessible and relatable, demonstrating emotional intelligence in finance.

Implementing these practices will enhance your client interactions and improve your financial communication strategies.

3: Develop cultural sensitivity for diverse clients

Developing cultural sensitivity for diverse clients is essential to building trust and delivering personalized financial advice. This is a crucial aspect of financial communication strategies advisors should implement.

Actionable Steps:

- Take a cultural sensitivity training course: Enroll in an online course that offers certification to enhance your understanding of different cultures and improve your financial communication strategies.

- Learn about the specific cultural backgrounds of your clients: Conduct research or ask clients directly about their cultural preferences to tailor your approach, enhancing client money discussions.

- Apply culturally sensitive practices in your interactions: Use culturally appropriate greetings and be mindful of cultural taboos to show respect, fostering empathetic financial counseling.

Explanation:

These steps matter because being culturally sensitive helps you connect better with clients, fostering trust and satisfaction. It’s a key component of sensitive wealth management practices.

According to Money with Katie, understanding cultural nuances is crucial for effective advisor-client conversations and successful financial advising.

By respecting clients’ cultural backgrounds, you demonstrate empathy and professionalism, essential for long-term success in personal finance sensitivity.

Implementing these practices can significantly enhance your client relationships and improve your money talk best practices, contributing to more effective financial communication strategies advisors can employ.

![]()

4: Employ empathy in discussing financial challenges

Empathy is crucial when discussing financial challenges with clients to foster trust and understanding. Financial communication strategies advisors use should prioritize this approach for effective advisor-client conversations.

Actionable Steps:

- Participate in role-playing exercises: Pair up with a colleague and take turns playing the roles of advisor and client. This helps you practice empathetic responses and improve client money discussions.

- Read books or articles on empathy in financial advising: Compile a reading list and set a goal to read one book or article per month. This broadens your understanding of empathetic financial counseling.

- Reflect on your own financial challenges: Keep a journal of your reflections and insights. This enhances your ability to relate to clients and provide sensitive wealth management.

Explanation:

These financial communication strategies advisors can implement matter because empathy builds stronger client relationships and trust.

According to Dr. Megan McCoy, combining financial planning with therapeutic approaches can significantly improve client satisfaction.

By practicing empathy, you demonstrate genuine care, which is essential for long-term success in personal finance sensitivity.

Implementing these practices will enhance your ability to connect with clients on a deeper level, fostering loyalty and trust through tactful financial guidance and emotional intelligence in finance.

![]()

5: Create a safe, non-judgmental environment

Creating a safe, non-judgmental environment is vital for open and honest financial discussions with clients, forming a crucial part of effective financial communication strategies advisors employ.

Actionable Steps:

- Design your office space to be welcoming and comfortable: Include elements like comfortable seating, neutral colors, and privacy screens to make clients feel at ease during sensitive wealth management conversations.

- Set the tone for open communication at the beginning of each meeting: Use a script to reassure clients that all discussions are confidential and judgment-free, fostering effective advisor-client conversations.

- Encourage clients to share their concerns without fear of judgment: Use open body language and verbal affirmations to show support and understanding, demonstrating emotional intelligence in finance.

Explanation:

These steps matter because a comfortable and secure environment fosters trust and openness. According to Shore Beauty School, effective consultations require a safe space for clients to express their needs.

By creating a non-judgmental atmosphere, you ensure clients feel respected and valued, which is essential for long-term success in client money discussions and personal finance sensitivity.

Elements of a safe, non-judgmental environment:

- Confidentiality assurance

- Empathetic responses for empathetic financial counseling

- Comfortable physical space for tactful financial guidance

Implementing these financial communication strategies and money talk best practices will strengthen your client relationships and aid in building trust with clients.

![]()

6: Use relatable analogies to explain complex ideas

Using relatable analogies simplifies complex financial concepts for clients, making it a key financial communication strategy advisors can employ.

Actionable Steps:

- Develop a list of common analogies: Test different analogies with clients and note which ones resonate the most in effective advisor-client conversations.

- Incorporate analogies into presentations: Create a presentation template that includes spaces for relevant analogies to enhance client money discussions.

- Continuously refine analogies based on feedback: Ask clients for their input and adjust your analogies accordingly to improve personal finance sensitivity.

Explanation:

These steps matter because analogies make financial advice more accessible and relatable, supporting empathetic financial counseling.

According to Interview Ace, using relatable examples helps build trust and client satisfaction, which is crucial in sensitive wealth management.

By simplifying complex ideas, you enhance client understanding and confidence, improving money talk best practices.

Implementing these practices will improve your client interactions and build stronger relationships, demonstrating emotional intelligence in finance and providing tactful financial guidance.

7: Ask open-ended questions to encourage sharing

Asking open-ended questions is essential for fostering deeper conversations and gaining valuable insights from your clients. This is a key financial communication strategy advisors can use to improve client money discussions.

Actionable Steps:

- Prepare a list of open-ended questions: Keep a list handy during client meetings to encourage detailed responses and facilitate effective advisor-client conversations.

- Practice using open-ended questions in daily interactions: Engage with friends or family and focus on asking open-ended questions to improve your skills in sensitive wealth management discussions.

- Evaluate the effectiveness of your questions: Reflect on client interactions and adjust your questions based on their responses and feedback to enhance your empathetic financial counseling approach.

Explanation:

These steps matter because open-ended questions help clients feel heard and valued, promoting trust and satisfaction. This is crucial for building trust with clients in financial advisory relationships.

According to Shore Beauty School, effective communication is crucial for client engagement.

By encouraging clients to share more, you gain deeper insights into their needs and build stronger relationships. This approach is essential for personal finance sensitivity and tactful financial guidance.

Examples of effective open-ended questions for financial communication strategies advisors can use:

- “What are your long-term financial goals?”

- “How do you feel about your current financial situation?”

- “What concerns you most about your financial future?”

Implementing these practices will enhance your client interactions and foster open communication, demonstrating emotional intelligence in finance and adhering to money talk best practices.

![]()

Partner with Alleo to Enhance Your Financial Communication Strategies

We’ve explored the challenges of sensitive financial communication and how solving them can benefit your client relationships. But did you know you can work directly with Alleo to make this journey easier and faster for financial communication strategies advisors?

Setting up an Alleo account is simple and quick. You’ll start by creating a personalized plan tailored to your communication needs, focusing on effective advisor-client conversations and money talk best practices.

Alleo’s AI coach will help you master active listening, empathy, and cultural sensitivity for empathetic financial counseling. The coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, ensuring you develop emotional intelligence in finance.

Ready to get started for free? Let me show you how to improve your financial communication strategies!

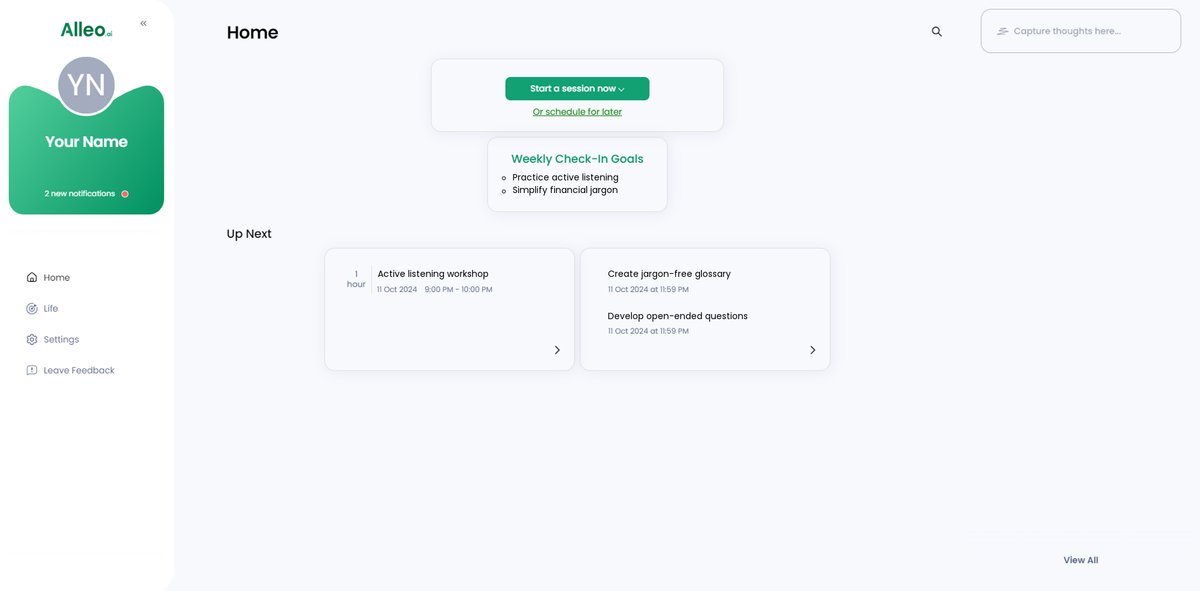

Step 1: Log In or Create Your Account

To begin improving your financial communication skills with Alleo, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop consistent communication practices that will enhance your client interactions and build trust. This goal directly addresses the challenges of sensitive financial communication discussed in the article, helping you create a structured approach to improving your skills.

Step 3: Select “Finances” as Your Focus Area

Choose the “Finances” life area to improve your communication skills for sensitive financial discussions, aligning perfectly with your goals as a financial advisor to build stronger client relationships and trust.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your financial communication goals and create a personalized plan to enhance your skills in active listening, empathy, and cultural sensitivity.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, allowing you to easily track and manage your progress in improving your financial communication skills.

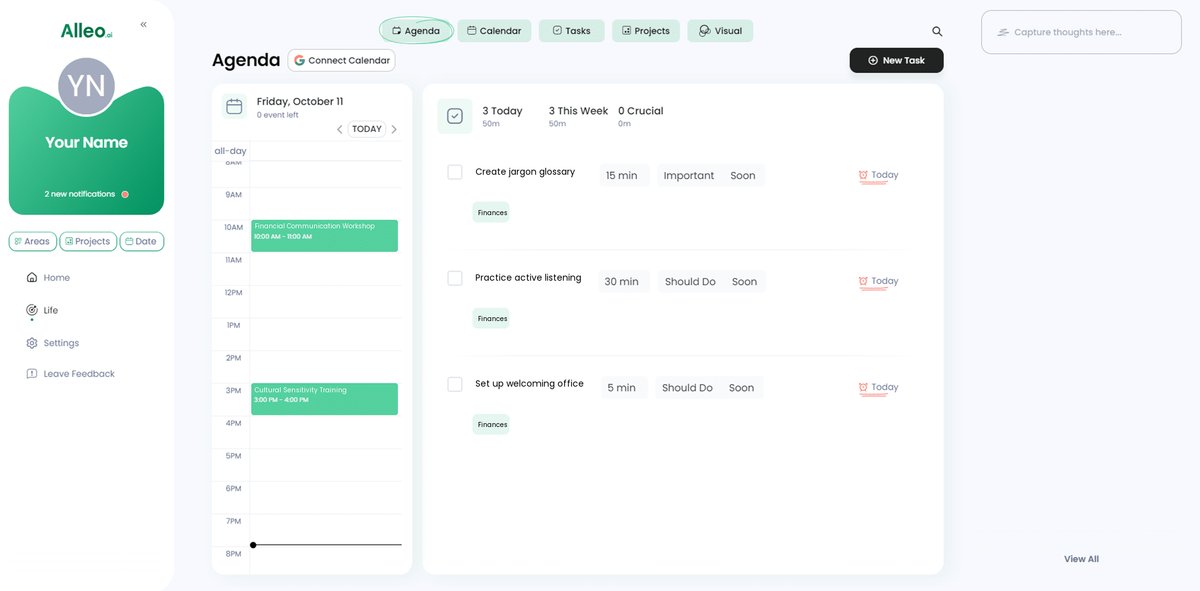

Step 6: Adding events to your calendar or app

Track your progress in improving financial communication by adding key milestones and practice sessions to your calendar using Alleo’s integrated task and event features, helping you stay accountable and measure your growth over time.

Bringing It All Together

Communicating sensitive financial matters can be challenging, but it’s essential for building trust with clients. By practicing active listening, using clear language, and showing empathy, financial communication strategies advisors use can significantly improve client relationships. Effective advisor-client conversations are key to success.

Remember, it’s not just about the numbers; it’s about understanding your clients’ unique needs and concerns. Creating a safe, judgment-free environment fosters open communication and trust. Empathetic financial counseling and sensitive wealth management approaches are crucial for tactful financial guidance.

You don’t have to navigate this alone. Alleo’s AI coach can guide you every step of the way, helping you master these financial communication strategies for advisors, including client money discussions and personal finance sensitivity.

Ready to enhance your communication and build stronger client relationships? Start your journey with Alleo for free today and improve your money talk best practices and emotional intelligence in finance.