How Financial Advisors Can Revolutionize Their Approach to Balancing Technology and Personal Relationships

Are you struggling to balance tech in financial advising while maintaining personal client relationships and trust? The integration of digital financial planning tools presents both opportunities and challenges.

As a life coach, I’ve helped many professionals navigate these challenges in personalized wealth management. In my experience, finding the right balance between financial technology integration and the human touch in fintech is crucial for long-term success and client trust.

In this article, we’ll explore actionable client communication strategies to integrate AI in financial planning while maintaining personal touchpoints. You’ll discover how to use technology effectively in hybrid advisory services while ensuring empathetic client interactions and building trust in financial advising.

Let’s dive into balancing tech in financial advising to provide customized financial solutions.

The Challenge of Balancing Tech and Personal Relationships

As technology becomes more integrated into financial advising, the risk of losing the personal touch increases. Clients value the human connection and trust that come from face-to-face interactions in personalized wealth management.

Many clients initially struggle with the impersonal nature of AI in financial planning. They miss the nuanced understanding that a human advisor provides when balancing tech in financial advising.

In my experience, relying too heavily on digital financial planning tools can erode client trust. I’ve seen advisors who focus on financial technology integration often miss out on building deep client relationships.

Balancing tech in financial advising with personal relationships is crucial. It ensures clients feel valued and understood through effective client communication strategies.

Technology is a tool, not a replacement for human empathy and connection in hybrid advisory services.

Strategies to Balance Technology and Personal Relationships in Financial Advising

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in balancing tech in financial advising:

- Integrate AI Tools for Personalized Advice: Utilize AI in financial planning to analyze data and provide tailored recommendations for customized financial solutions.

- Establish Regular Face-to-Face Client Meetings: Schedule consistent in-person or virtual meetings with clients to enhance client communication strategies.

- Use Tech for Analysis, Human Touch for Empathy: Combine AI-driven insights with personal, empathetic discussions to maintain the human touch in fintech.

- Offer Hybrid Robo-Advisor and Human Services: Blend automated services with personalized wealth management advice through hybrid advisory services.

- Educate Clients on Tech Benefits and Limitations: Inform clients about digital financial planning tools’ advantages and constraints through workshops, building trust in financial advising.

Let’s dive in!

1: Integrate AI tools for personalized advice

Integrating AI tools for personalized advice can enhance the precision and relevance of financial recommendations, showcasing the importance of balancing tech in financial advising.

Actionable Steps:

- Implement AI tools to analyze client data and tailor investment advice, enhancing personalized wealth management.

- Use AI-powered chatbots to provide 24/7 client support and quick responses, improving client communication strategies.

- Utilize AI-driven risk assessment tools to understand and align with client risk tolerance, supporting data-driven financial advice.

Explanation:

These steps are vital as they allow you to provide precise, data-driven advice while maintaining accessibility and relevance in financial technology integration.

For instance, using AI tools can streamline client data analysis, leading to more personalized recommendations. According to recent research, AI-driven systems significantly enhance client interactions and satisfaction, demonstrating the benefits of balancing tech in financial advising.

Key benefits of AI integration in financial advising:

- Enhanced data analysis for more accurate recommendations, supporting customized financial solutions

- Improved client response times through 24/7 support, a crucial aspect of digital financial planning tools

- Better risk assessment and portfolio alignment, contributing to effective hybrid advisory services

This balanced approach ensures you leverage technology without losing the personal touch, essential for building trust in financial advising.

2: Establish regular face-to-face client meetings

Regular face-to-face client meetings are essential for maintaining strong personal relationships and trust while balancing tech in financial advising.

Actionable Steps:

- Schedule quarterly in-person or virtual meetings with each client, balancing digital financial planning tools with human interaction.

- Measure: Track meeting attendance and client engagement levels in hybrid advisory services.

- Create personalized meeting agendas based on AI-driven insights for customized financial solutions.

- Measure: Monitor meeting outcomes and client satisfaction with personalized wealth management.

- Follow up with personalized thank-you notes or summary emails as part of client communication strategies.

- Measure: Assess client retention rates and feedback on human touch in fintech.

Explanation:

These steps matter because they keep the human touch in your practice, which clients greatly value when balancing tech in financial advising. For example, personalized meeting agendas show clients that you understand their unique needs while leveraging financial technology integration.

According to Investopedia, staying in touch and being transparent are key to maintaining client relationships, especially during tough market conditions. This applies to both traditional and data-driven financial advice.

Regular face-to-face meetings ensure clients feel valued and understood, fostering long-term trust and satisfaction in the realm of AI in financial planning and personalized wealth management.

3: Use tech for analysis, human touch for empathy

Balancing tech in financial advising is vital for building strong client relationships while integrating technology for analysis and maintaining human empathy.

Actionable Steps:

- Leverage AI in financial planning for portfolio analysis and optimization.

- Measure: Evaluate portfolio performance and client trust levels.

- Conduct empathetic, face-to-face discussions about clients’ financial goals and concerns, focusing on personalized wealth management.

- Measure: Track client satisfaction and emotional engagement.

- Use digital financial planning tools to prepare detailed reports, then discuss them in person.

- Measure: Monitor client understanding and trust in recommendations.

Explanation:

These steps matter because they ensure a balanced approach to financial technology integration, combining data-driven insights with personal interactions. For instance, using AI for portfolio analysis enhances precision, while face-to-face discussions build trust in financial advising.

According to FPA research, clients appreciate the blend of tech efficiency and human empathy in financial advising.

Effective ways to combine tech and human touch in hybrid advisory services:

- Use AI for data crunching, humans for interpretation

- Automate routine tasks, personalize complex decisions

- Leverage tech for preparation, humans for presentation

This approach to balancing tech in financial advising helps you maintain a personal connection with clients, fostering trust and satisfaction while providing customized financial solutions.

4: Offer hybrid robo-advisor and human services

Offering hybrid robo-advisor and human services is essential to leverage technology while maintaining the personal touch clients value when balancing tech in financial advising.

Actionable Steps:

- Combine robo-advisor services with personalized wealth management advice.

- Measure: Track client usage of both services and satisfaction levels.

- Educate clients on the benefits of hybrid advisory services.

- Measure: Monitor client understanding and adoption rates.

- Provide personalized financial plans that integrate digital financial planning tools with human expertise.

- Measure: Evaluate plan effectiveness and client feedback.

Explanation:

These steps are crucial because they balance tech in financial advising with human empathy. For instance, combining robo-advisors with personal advice ensures clients get the best of both worlds in financial technology integration.

According to FPA research, clients appreciate the blend of automated and personalized services, leading to higher satisfaction and trust in financial advising.

This approach helps you stay competitive while fostering strong client communication strategies and relationships.

5: Educate clients on tech benefits and limitations

Educating clients on the benefits and limitations of technology is crucial for managing expectations and building trust in financial advising, especially when balancing tech in financial advising.

Actionable Steps:

- Host educational workshops or webinars to inform clients about the role of technology in financial advising and digital financial planning tools.

- Measure: Track attendance and participant feedback.

- Share case studies and success stories highlighting the positive impact of tech-enhanced advising and personalized wealth management.

- Measure: Assess client trust and willingness to adopt new technologies.

- Provide clear, transparent information about the limitations of AI tools during client meetings, emphasizing the importance of human touch in fintech.

- Measure: Monitor client understanding and manage expectations.

Explanation:

These steps matter because they help clients understand how technology can benefit their financial planning while also being aware of its limitations. For instance, hosting educational workshops can demystify AI in financial planning and build client confidence in hybrid advisory services.

According to FPA research, clients appreciate transparency about tech, which enhances trust and satisfaction in financial advising.

Key points to cover in client education:

- AI capabilities in financial analysis and prediction for data-driven financial advice

- Human advisor’s role in interpreting AI insights and providing customized financial solutions

- Limitations of AI in understanding complex personal situations, emphasizing the need for balancing tech in financial advising

By educating clients, you can foster a more informed and trusting relationship while effectively integrating financial technology.

In the next section, we’ll explore how to use Alleo to help streamline these educational efforts and maintain a balanced approach to client communication strategies.

![]()

Partner with Alleo to Balance Tech and Personal Relationships

We’ve explored the challenges of balancing tech in financial advising with personal relationships. Did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. You can create a personalized wealth management plan to tackle your specific challenges in financial technology integration.

Alleo’s AI coach offers affordable, tailored support, just like a human coach. Our coach will follow up on your progress, handle changes, and keep you accountable via text and push notifications, enhancing client communication strategies.

Ready to get started for free with our hybrid advisory services? Let me show you how!

Step 1: Logging in or Creating an Account

To start balancing technology and personal relationships in your financial advising practice, Log in to your account or create a new one to access Alleo’s AI coach and personalized guidance.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop a consistent approach that balances technology use with personal client interactions, helping you create a sustainable practice that leverages AI tools while maintaining strong relationships.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area to address the challenge of balancing technology and personal relationships in financial advising, allowing Alleo’s AI coach to provide tailored strategies for enhancing your professional practice and client interactions.

Step 4: Starting a coaching session

Begin your AI coaching journey with an intake session to establish your personalized plan for balancing technology and personal relationships in financial advising, setting clear goals and strategies for your practice moving forward.

Step 5: Viewing and Managing Goals After the Session

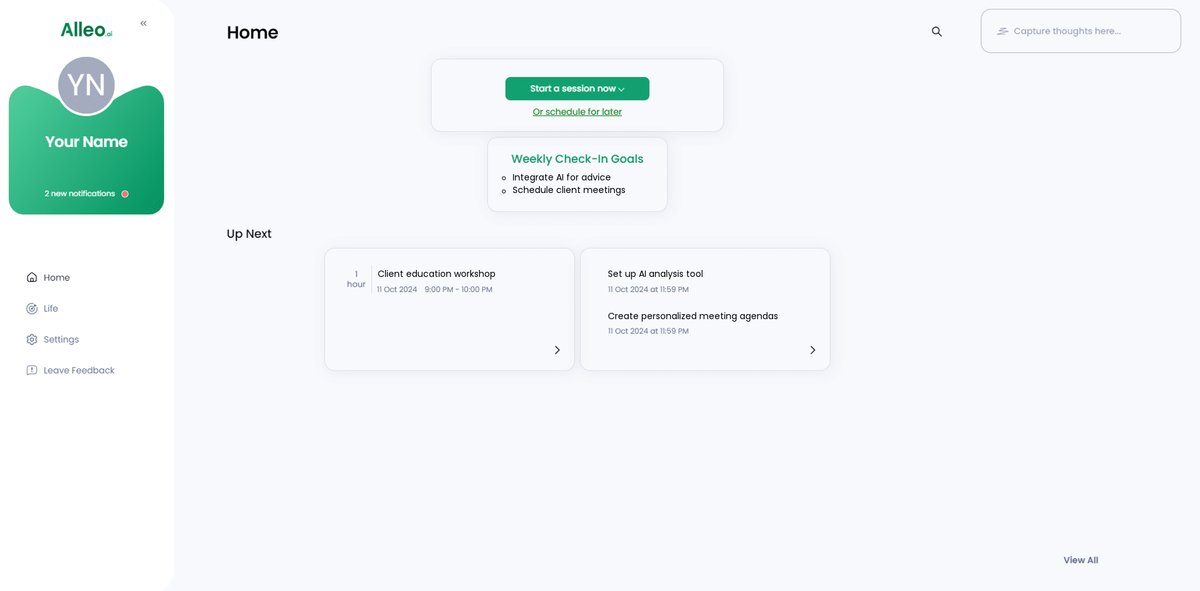

After your coaching session on balancing technology and personal relationships in financial advising, check the Alleo app’s home page to view and manage the goals you discussed, allowing you to track your progress in implementing strategies like integrating AI tools and maintaining regular client meetings.

Step 6: Adding events to your calendar or app

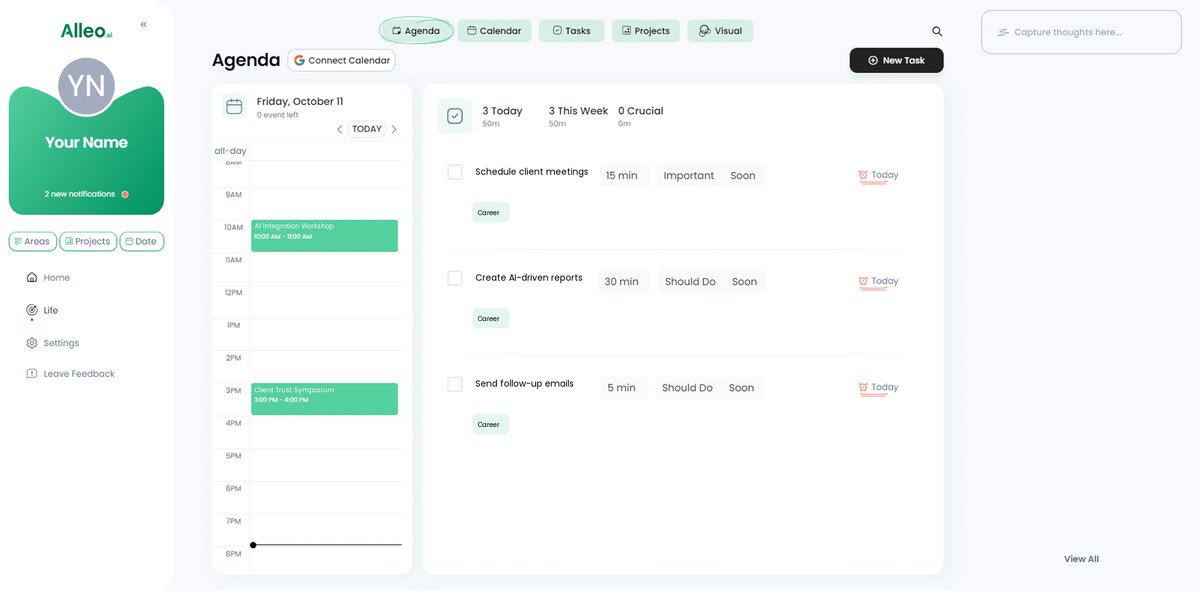

Use Alleo’s calendar and task features to schedule and track your progress on balancing technology with personal client relationships, adding key events like educational workshops or face-to-face meetings to stay organized and accountable.

Bringing It All Together: Balancing Tech and Personal Touch

We’ve examined how to balance technology with personal relationships in financial advising. Now, it’s time to take action.

Remember, technology is a tool to enhance—not replace—human connections in balancing tech in financial advising.

By integrating AI in financial planning for personalized advice, you can provide relevant recommendations while maintaining accessibility. Regular face-to-face meetings keep the human touch in fintech alive.

Using digital financial planning tools for analysis and empathy ensures you build strong client relationships.

Offering hybrid advisory services and educating clients on financial technology integration benefits and limitations fosters trust in financial advising.

With Alleo, you’re not alone in this journey of balancing tech in financial advising. Our AI coach can help you seamlessly blend technology with personal service for customized financial solutions.

Start now. Try Alleo for free and achieve a harmonious blend of data-driven financial advice and personalized wealth management in your advisory practice.