5 Essential Ways to Budget for Unexpected Rental Property Expenses as a Landlord

Imagine a scenario where an unexpected repair in your rental property drains your savings, leaving you scrambling for funds. This highlights the importance of rental property expense budgeting.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, budgeting for unexpected rental property expenses is crucial, especially when it comes to emergency property repairs and tenant damage costs.

In this article, you’ll learn strategies for creating an emergency fund, implementing proactive maintenance, using property management software, and more. We’ll cover topics like rental property insurance, property tax increases, and establishing a maintenance fund for landlords.

Let’s dive into effective rental property expense budgeting techniques.

Navigating Financial Uncertainties as a Landlord

Owning rental properties comes with a unique set of financial challenges. Many freelance landlords struggle with irregular income and expenses, making rental property expense budgeting crucial.

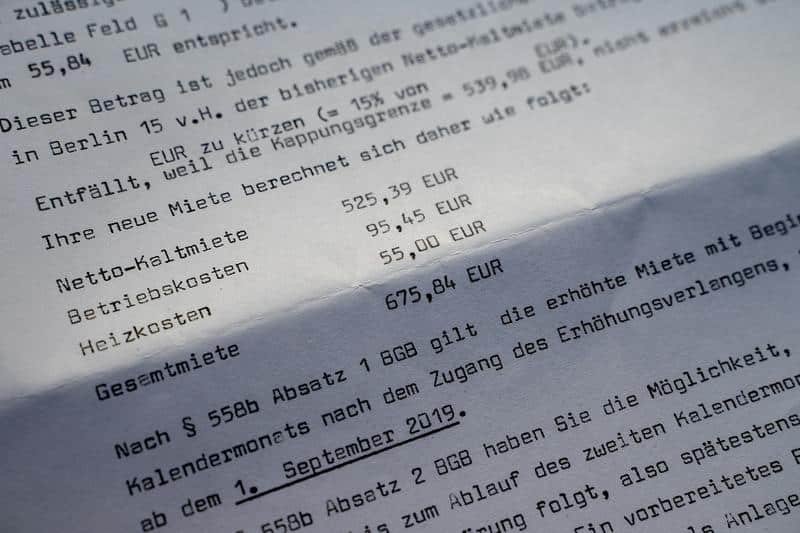

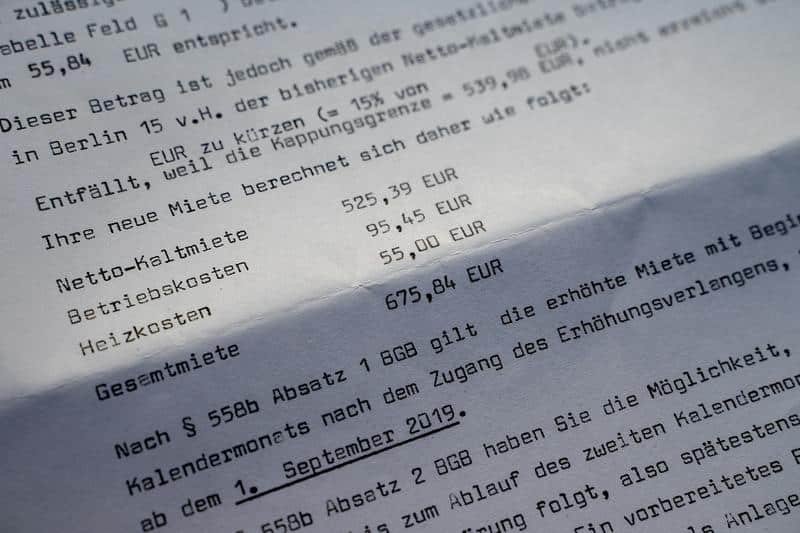

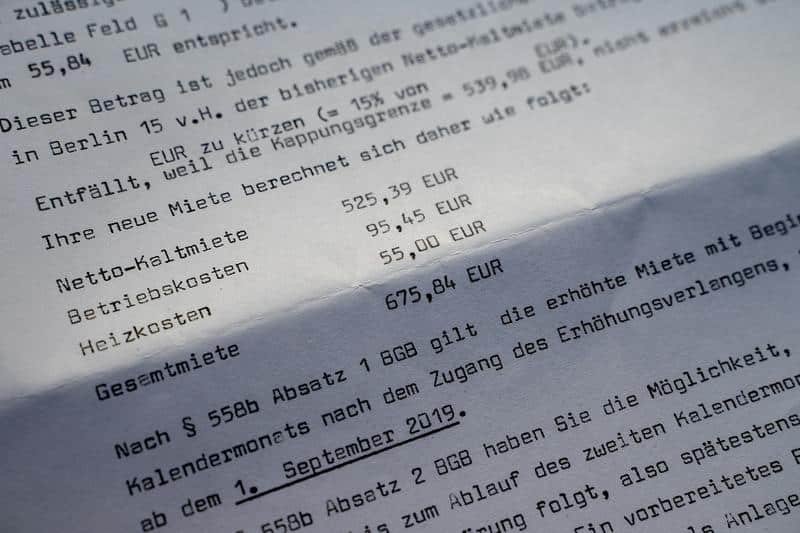

This unpredictability makes it difficult to accurately forecast and budget for significant, irregular costs such as emergency property repairs or tenant damage costs.

Unexpected expenses, like major repairs or tenant turnover, can be financially draining. In my experience, these unplanned financial burdens create stress and uncertainty, emphasizing the importance of maintaining rental property cash reserves.

Several clients initially find themselves overwhelmed by the sporadic nature of these costs, including property tax increases and vacancy expenses.

Without proper rental property expense budgeting, these surprises can quickly deplete your savings. This is why it’s crucial to adopt strategies that can help mitigate these financial shocks, such as establishing a maintenance fund for landlords.

Key Steps to Budget for Unexpected Rental Property Expenses

Overcoming this challenge in rental property expense budgeting requires a few key steps. Here are the main areas to focus on to make progress:

- Create an emergency fund for rental properties: Save 3-6 months of operating expenses to cover emergency property repairs and vacancy expenses.

- Implement a proactive maintenance schedule: Regularly inspect and maintain your properties to manage seasonal property upkeep.

- Use property management software for tracking: Track expenses and manage finances efficiently, including rental property depreciation.

- Set aside 1-4% of property value annually: Budget for annual maintenance based on property value to build a maintenance fund for landlords.

- Diversify income sources to cover expenses: Explore additional rental income opportunities to offset potential property tax increases and legal fees for landlords.

Let’s dive in to explore these rental property expense budgeting strategies!

1: Create an emergency fund for rental properties

Establishing an emergency fund is crucial for landlords to manage unexpected expenses and is a key aspect of rental property expense budgeting.

Actionable Steps:

- Calculate the ideal emergency fund amount: Determine 3-6 months of operating expenses to be saved based on your property’s value, including potential emergency property repairs and vacancy expenses.

- Automate monthly savings: Set up an automatic transfer of a fixed percentage of your rental income to a dedicated savings account for maintenance fund for landlords.

- Review and adjust annually: Conduct an annual review to ensure the emergency fund meets current needs, adjusting for inflation, property tax increases, and changes in property expenses.

Explanation: Creating an emergency fund helps you handle unexpected repairs, tenant damage costs, and other financial surprises without stress.

By saving consistently, you build rental property cash reserves that protect your cash flow and cover seasonal property upkeep.

According to Bay Management Group, setting aside funds for unexpected costs is essential for maintaining financial stability.

Taking these steps ensures you’re prepared for any unforeseen expenses, including legal fees for landlords, making property management less stressful and more predictable.

2: Implement a proactive maintenance schedule

A proactive maintenance schedule is essential to prevent unexpected property expenses and is a key component of rental property expense budgeting.

Actionable Steps:

- Create a detailed annual maintenance plan: List all routine maintenance tasks and schedule them throughout the year, including seasonal property upkeep.

- Conduct regular property inspections: Schedule quarterly inspections to identify and address minor issues before they become major problems, potentially reducing emergency property repairs.

- Use preventive maintenance strategies: Invest in high-quality materials and services to extend the lifespan of property elements, reducing future repair costs and building a maintenance fund for landlords.

Explanation: Proactive maintenance helps avoid costly emergency repairs and extends the life of your property. By addressing small issues early, you prevent them from becoming major problems and minimize tenant damage costs.

According to RentCheck, regular maintenance can significantly reduce long-term expenses. This strategy makes property management more predictable and less stressful.

Key benefits of proactive maintenance include:

- Reduced emergency repair costs and better rental property expense budgeting

- Improved tenant satisfaction and retention, potentially lowering vacancy expenses

- Extended lifespan of property components, positively impacting rental property depreciation

Following a proactive maintenance schedule ensures your properties remain in good condition, keeping tenants satisfied and protecting your investment while managing rental property cash reserves effectively.

3: Use property management software for tracking

Using property management software can streamline your rental property expense budgeting and help you stay organized.

Actionable Steps:

- Choose a comprehensive property management software: Research and select software that offers features like expense tracking, tenant management, and maintenance scheduling for your rental property.

- Input all financial data into the software: Regularly update the software with income, expenses, and maintenance records, including costs for emergency property repairs and rental property insurance.

- Utilize reporting features to monitor financial health: Generate monthly reports to track expenses, identify trends, and make informed budgeting decisions for your rental property.

Explanation: By using property management software, you can efficiently manage your finances and ensure all expenses are accurately tracked, including tenant damage costs and property tax increases.

This approach helps in maintaining clear records and aids in making informed financial decisions for your rental property expense budgeting.

According to Landlord Studio, property management software can significantly streamline expense tracking and reporting, making financial planning more efficient for landlords managing rental properties.

Incorporating these steps will help you stay organized and better prepared for any financial surprises, including vacancy expenses and seasonal property upkeep costs.

4: Set aside 1-4% of property value annually

Setting aside 1-4% of your property’s value annually is crucial for effective rental property expense budgeting and managing unexpected maintenance costs.

Actionable Steps:

- Calculate the annual maintenance budget: Use the 1-4% rule to determine the exact amount to set aside each year for your rental property cash reserves.

- Allocate funds monthly: Divide the annual maintenance budget by 12 and set aside this amount each month for expenses like emergency property repairs.

- Adjust the percentage regularly: Reassess the percentage based on property-specific factors like age, condition, and location to ensure adequate budgeting for seasonal property upkeep.

Explanation: Setting aside a portion of your property value annually helps you prepare for unforeseen repairs and tenant damage costs, ensuring financial stability.

This approach aligns with industry standards, as suggested by Hemlane, and protects your investment by maintaining the property’s condition over time.

Factors influencing the maintenance fund for landlords:

- Property age and condition

- Local climate and environmental factors

- Property type (e.g., single-family, multi-unit)

Following these steps ensures you have a steady financial plan to cover unexpected expenses, including property tax increases and legal fees for landlords, making rental property expense budgeting more predictable and less stressful.

5: Diversify income sources to cover expenses

Diversifying your income sources can provide a financial cushion, helping you manage unexpected property expenses and improve your rental property expense budgeting more effectively.

Actionable Steps:

- Explore additional rental income opportunities: Consider short-term rentals or shared spaces to increase rental income and build cash reserves for rental property maintenance.

- Invest in complementary income sources: Diversify investments into other real estate projects or financial instruments for additional revenue streams to offset potential vacancy expenses.

- Establish a side business related to property management: Offer property management services to other landlords to generate extra income and build a maintenance fund for landlords.

Explanation: Diversifying your income sources helps ensure a steady cash flow, reducing the financial strain of unexpected expenses such as emergency property repairs or tenant damage costs.

According to Bay Management Group, having multiple income streams can safeguard against financial instability. By broadening your income base, you create resilience against unplanned costs, making your property management less stressful and more predictable, even in the face of property tax increases or legal fees for landlords.

Benefits of income diversification for landlords:

- Increased financial stability to handle rental property expense budgeting

- Reduced dependence on a single property, mitigating risks of vacancy expenses

- Opportunities for business growth and better management of seasonal property upkeep costs

This approach not only protects your investment but also enhances your financial security, helping you manage rental property depreciation and maintain adequate rental property insurance coverage.

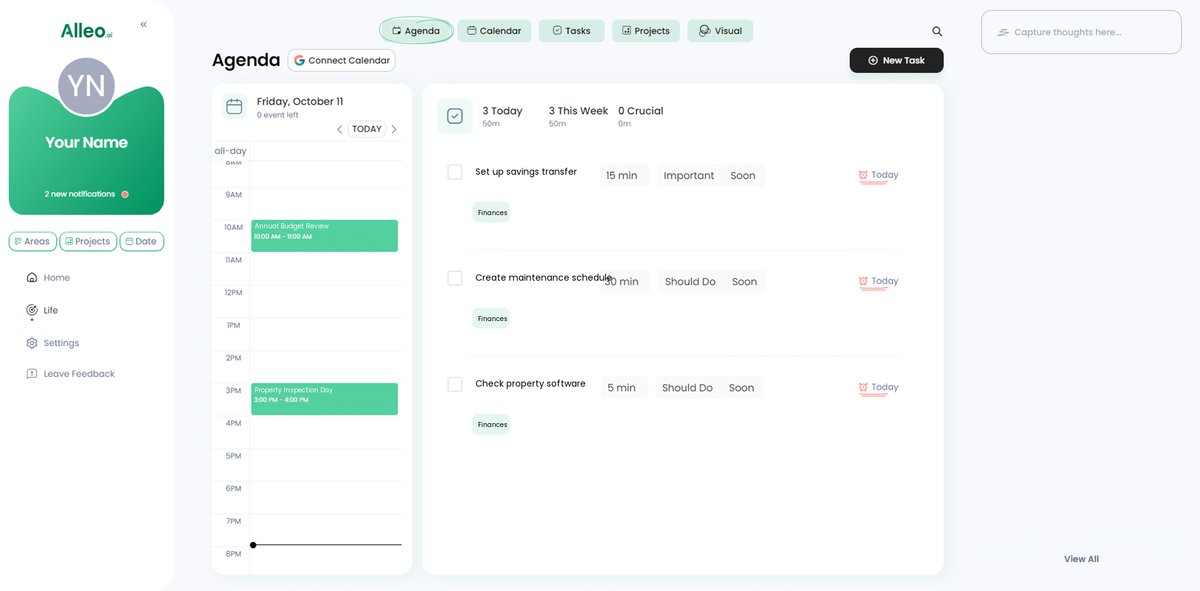

Streamline Your Rental Property Budget with Alleo

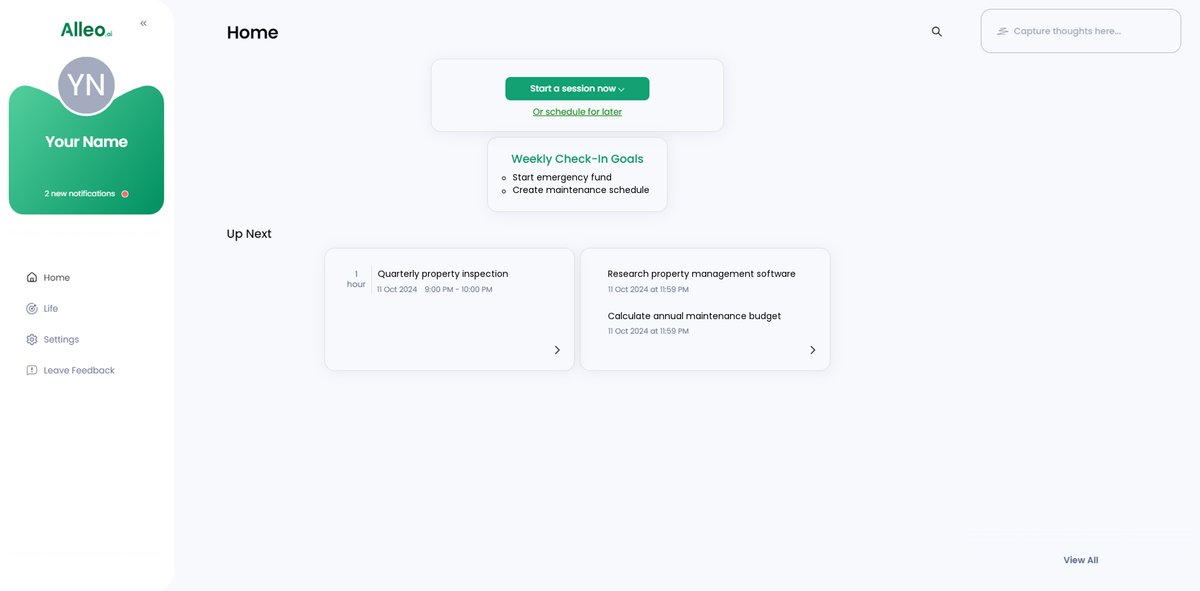

We’ve explored how to budget for unexpected rental property expenses effectively. But did you know you can work directly with Alleo to make this process of rental property expense budgeting easier?

Setting up an account with Alleo is simple. Create a personalized plan that addresses your unique financial challenges, including emergency property repairs and tenant damage costs.

Alleo’s AI coach will help you set up and manage an emergency fund, create maintenance schedules for seasonal property upkeep, and track expenses like rental property insurance and property tax increases.

The coach provides tailored coaching support for your needs. It follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping you manage vacancy expenses and maintain rental property cash reserves.

With Alleo, you get full coaching sessions just like a human coach, covering topics from legal fees for landlords to rental property depreciation.

Ready to get started for free and improve your rental property expense budgeting? Let me show you how!

Step 1: Log In or Create Your Account

To start budgeting for your rental property expenses with Alleo, simply log in to your existing account or create a new one to access personalized AI coaching support.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop consistent practices for managing your rental property finances, such as regular savings for your emergency fund and implementing proactive maintenance schedules.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to get personalized guidance on budgeting for unexpected rental property expenses, creating emergency funds, and managing your property finances more effectively.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your rental property budget challenges and set up a personalized plan to tackle unexpected expenses effectively.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the rental property budgeting goals you discussed, allowing you to track your progress and make adjustments as needed.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in budgeting for unexpected rental property expenses, allowing you to set reminders for regular maintenance checks, emergency fund contributions, and financial review sessions.

Wrapping Up: Your Path to Financial Stability

We’ve covered essential strategies for rental property expense budgeting. These steps help you manage finances effectively and reduce stress, including planning for emergency property repairs and tenant damage costs.

Remember, creating an emergency fund, implementing proactive maintenance, and using property management software are key. Setting aside a percentage of your property’s value for maintenance funds and diversifying income sources to cover vacancy expenses also play crucial roles in rental property expense budgeting.

I understand the challenges of managing rental properties, including dealing with property tax increases and legal fees for landlords. You don’t have to do it alone.

Alleo can simplify this process for you. Our AI coach offers personalized support and ensures you stay on track with your rental property cash reserves and seasonal property upkeep.

Try Alleo for free today. Take control of your rental property budget now!