5 Proven Methods to Manage Cash Flow as a Self-Employed Professional with Irregular Income

Imagine the freedom of being your own boss, coupled with the anxiety of unpredictable income. Managing freelance cash flow can be a challenging aspect of self-employment.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, managing cash flow is a common struggle for freelancers, especially when it comes to irregular income management strategies.

In this article, you’ll discover proven strategies to handle inconsistent income and expenses. We’ll cover practical tips like setting up a dedicated business account and building an emergency fund for self-employed professionals. You’ll also learn about cash flow forecasting for freelancers and effective invoice management for steady cash flow.

Let’s dive in to explore these essential self-employed budgeting tips.

Understanding the Cash Flow Struggle

Freelancers often face unique challenges with managing freelance cash flow and irregular income. Many clients initially struggle with unpredictable cash flow, impacting their ability to manage both personal and business finances.

Poor cash flow management can lead to missed bills, stress, and difficulty planning for the future. Imagine trying to save for taxes or invest in your business without knowing when your next payment will arrive. This is where self-employed budgeting tips and irregular income management strategies become crucial.

In my experience, freelancers who don’t manage their cash flow effectively often find themselves in financial trouble. This lack of stability can even affect your mental health and productivity. Implementing cash flow forecasting for freelancers can help mitigate these issues.

Understanding these challenges is the first step towards overcoming them. Let’s explore actionable strategies to help you gain control over your finances and effectively manage freelance cash flow.

Key Steps to Manage Cash Flow for Freelancers

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in managing freelance cash flow.

- Create a Separate Business Bank Account: Open a dedicated business bank account to separate personal and business finances, essential for effective cash flow forecasting for freelancers.

- Set Up an Effective Budgeting System: Track monthly income and expenses to create a reliable budget, incorporating self-employed budgeting tips.

- Implement Milestone Payments for Projects: Break down projects into smaller tasks with corresponding payment schedules, aiding in irregular income management strategies.

- Use Accounting Software for Income Tracking: Invest in software like QuickBooks or FreshBooks to automate financial management and improve invoice management for steady cash flow.

- Build an Emergency Fund for Lean Periods: Save a portion of your income each month to prepare for unexpected expenses, crucial for saving money with inconsistent earnings.

Let’s dive in!

1: Create a separate business bank account

Creating a separate business bank account is essential to manage your finances effectively and is a crucial step in managing freelance cash flow.

Actionable Steps:

- Open a dedicated business bank account at your local bank or a digital banking platform for better expense tracking for variable income.

- Deposit all business earnings into this account to keep personal and business finances distinct, aiding in self-employed budgeting tips.

- Use this account exclusively for business expenses to simplify tax planning for independent contractors and track spending easily.

Explanation:

Having a separate business bank account helps you maintain clear financial records, making tax time less stressful. It also allows you to see your business’s financial health at a glance, supporting irregular income management strategies.

According to Montreal Financial, separating finances is crucial for accurate financial management.

Key benefits of a separate business account include:

- Improved financial organization for managing freelance cash flow

- Easier tax preparation

- Enhanced professionalism with clients

This step is foundational before moving on to budgeting and cash flow forecasting for freelancers.

2: Set up an effective budgeting system

Setting up an effective budgeting system is crucial for managing freelance cash flow and maintaining financial stability when dealing with irregular income.

Actionable Steps:

- Track your monthly income and expenses over the past year to establish an average baseline for cash flow forecasting for freelancers.

- Categorize your expenses into fixed and variable costs, prioritizing essential outlays as part of self-employed budgeting tips.

- Allocate a portion of your income to savings and taxes each month to avoid year-end surprises and improve tax planning for independent contractors.

Explanation:

Creating and sticking to a budget helps you understand your financial health and plan for the future, which is essential for irregular income management strategies.

By tracking your income and categorizing expenses, you can allocate funds efficiently and avoid financial pitfalls, supporting saving money with inconsistent earnings.

According to Everlance, budgeting apps can simplify this process, offering insights into your cash flow.

This step lays the groundwork for more advanced financial strategies in managing freelance cash flow.

3: Implement milestone payments for projects

Implementing milestone payments for projects is crucial for managing freelance cash flow and maintaining steady income.

Actionable Steps:

- Break down larger projects into smaller milestones with clear deliverables and corresponding payment schedules, aiding in cash flow forecasting for freelancers.

- Negotiate upfront deposits and interim payments to ensure steady cash flow throughout the project duration, essential for self-employed budgeting.

- Set clear timelines and expectations for each milestone to align payments with project progress, supporting invoice management for steady cash flow.

Explanation:

By breaking down projects into smaller, manageable tasks with corresponding payments, you can ensure a steady flow of income. This approach helps avoid financial strain caused by delayed payments and supports managing freelance cash flow effectively.

According to Architecture Courses, milestone payments are essential for maintaining stable cash flow, especially in freelance work.

Consider these factors when implementing milestone payments:

- Project complexity and duration

- Client’s payment preferences

- Your cash flow needs and irregular income management strategies

This method can significantly reduce financial stress and improve your budgeting accuracy, crucial for financial planning for gig workers.

4: Use accounting software for income tracking

Using accounting software for income tracking simplifies financial management and ensures you stay on top of your freelance cash flow.

Actionable Steps:

- Invest in reliable accounting software such as QuickBooks or FreshBooks to automate invoicing and expense tracking for managing freelance cash flow.

- Regularly update the software with all your income and expenses to maintain accurate financial records and assist with self-employed budgeting.

- Generate financial reports periodically to review cash flow trends and make informed decisions about irregular income management strategies.

Explanation:

Automating your income tracking with accounting software saves time and reduces errors. It helps you maintain accurate records, which are essential for tax planning for independent contractors and financial planning for gig workers.

As recommended by Architecture Courses, using tools like QuickBooks or FreshBooks can streamline your financial management process and assist with cash flow forecasting for freelancers.

This approach ensures you have a clear view of your finances, allowing you to make proactive adjustments, maintain an emergency fund for self-employed professionals, and stay financially healthy while managing freelance cash flow.

5: Build an emergency fund for lean periods

Building an emergency fund is essential to protect yourself from financial instability during periods of low income, a crucial aspect of managing freelance cash flow.

Actionable Steps:

- Save a portion of your income each month to build a cushion for unexpected expenses or lean periods, a key strategy in self-employed budgeting.

- Aim to save at least three to six months’ worth of living expenses to ensure you can cover your basic needs during tough times, which is vital for irregular income management.

Explanation:

Having an emergency fund provides a safety net, allowing you to handle financial challenges without stress. This proactive approach helps maintain stability and peace of mind, essential for managing freelance cash flow.

According to AFCPE, saving for emergencies is crucial for managing the uncertainties of freelance work.

Key reasons to prioritize an emergency fund:

- Financial security during slow periods

- Reduced stress when facing unexpected expenses

- Ability to focus on work without financial distractions

Building this financial buffer will give you confidence and resilience to face any unexpected downturns, a vital component of financial planning for gig workers.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of managing freelance cash flow as a self-employed professional. Imagine tackling these challenges with Alleo, your AI coach for irregular income management strategies.

Alleo offers affordable, tailored support to help you achieve financial stability and master self-employed budgeting tips. With a free 14-day trial, no credit card required, you can get started easily on your journey to managing freelance cash flow.

Set up your account in minutes. Create a personalized plan and work with Alleo’s coach to overcome specific challenges, including cash flow forecasting for freelancers and saving money with inconsistent earnings.

The coach follows up on progress, handles changes, and keeps you accountable via text and push notifications, helping you with expense tracking for variable income and invoice management for steady cash flow.

Ready to get started for free and improve your financial planning for gig work?

Let me show you how!

Step 1: Log In or Create Your Account

To start managing your freelance finances with Alleo, simply log in to your account or create a new one in just a few clicks, setting you on the path to better cash flow management and financial stability.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will help stabilize your income and expenses as a freelancer, addressing the cash flow challenges discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to address your cash flow challenges head-on and receive tailored guidance for managing irregular income, budgeting effectively, and building financial stability as a freelancer.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll collaborate with your AI coach to create a personalized financial plan tailored to your freelance income challenges.

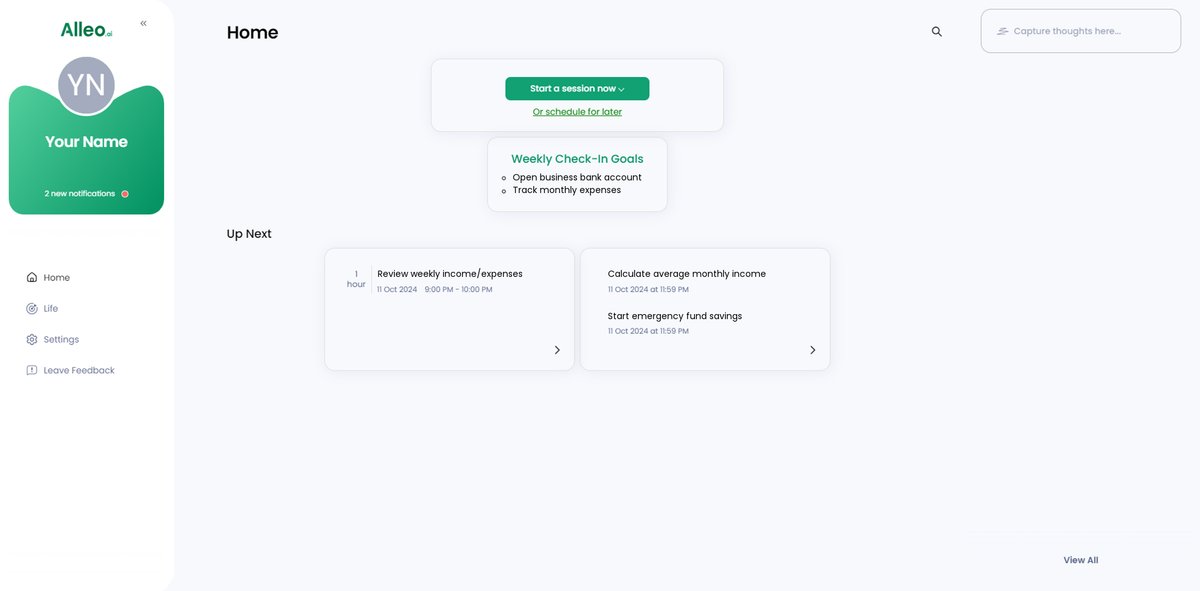

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to review and manage the financial goals you discussed, helping you stay on track with your freelance cash flow management strategies.

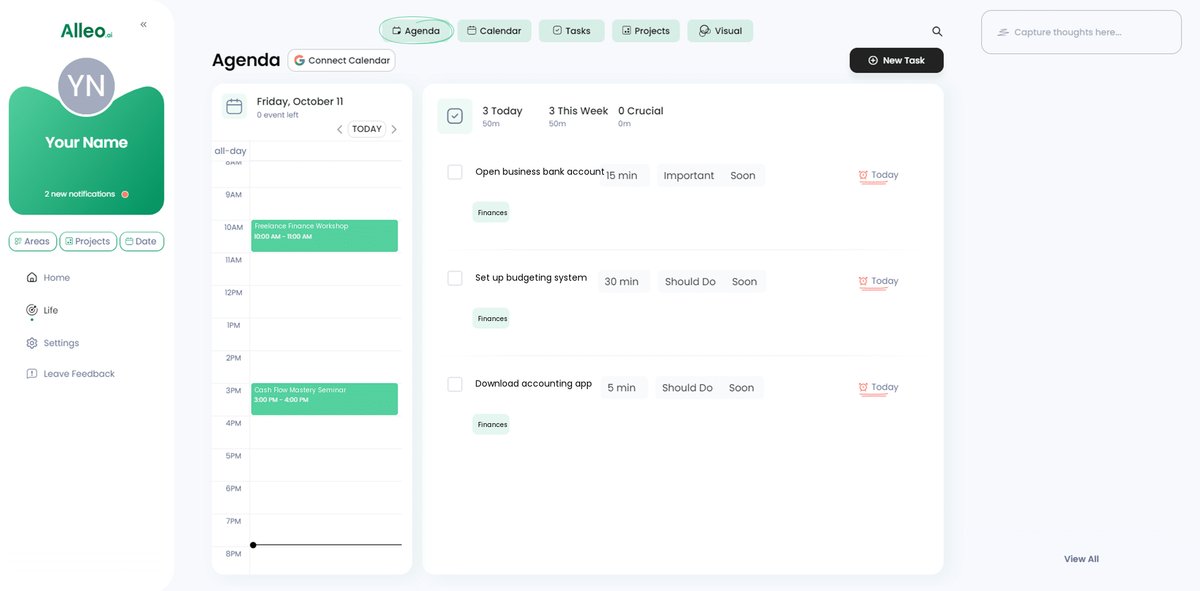

6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in solving cash flow challenges by adding key financial events, such as milestone payment dates or budget review sessions, ensuring you stay on top of your financial goals and deadlines.

Your Path to Financial Stability as a Freelancer

You’re now equipped with the tools to manage your freelance cash flow effectively. Remember, it’s all about taking small, consistent steps in managing irregular income.

You can overcome the challenges of inconsistent earnings by following these self-employed budgeting tips. Separate your finances, budget wisely, and build an emergency fund for self-employed professionals.

Using accounting software can simplify your financial management and assist with cash flow forecasting for freelancers. Implementing milestone payments ensures steady cash flow and helps with invoice management.

These steps will help you achieve financial stability and peace of mind while managing freelance cash flow.

Don’t forget, Alleo is here to support you on this journey of financial planning for gig workers. Try our free 14-day trial and see the difference it can make in expense tracking for variable income.

Take control of your financial future today!