7 Steps to Calculate a Fair Hourly Rate for Freelance Success

Are you struggling to set an hourly rate that truly reflects your worth and covers all your expenses? Freelancer hourly rate calculation can be a daunting task for many self-employed professionals.

As a life coach, I’ve helped many freelancers navigate the complex world of rate setting and freelance pricing strategies. In my experience, this is a common but crucial challenge when determining freelance service value.

In this article, you’ll learn actionable strategies to calculate a fair hourly rate for your freelance work. We’ll cover everything from estimating expenses to factoring in non-billable time, ensuring you set competitive hourly rates for freelancers in your field.

Let’s dive into the factors affecting freelance pricing and explore effective methods for freelance income estimation.

The Common Struggles Freelancers Face with Rate Setting

Getting your freelancer hourly rate calculation right is tough. Many freelancers undercharge at the start to attract clients, neglecting proper freelance pricing strategies.

This often leads to financial strain and burnout, impacting freelance income estimation.

In my experience, people often miscalculate expenses when determining freelance service value. They forget overhead costs, taxes, and non-billable hours, which are crucial factors affecting freelance pricing.

This mistake can be costly. It impacts both personal and business finances, making it hard to achieve financial goals and maintain competitive hourly rates for freelancers.

Freelancers need to be realistic. Accurate rate setting and self-employed rate calculation are crucial for sustainability and growth.

It’s not just about covering costs, but about thriving in your freelance career by understanding profit margins in freelance work and making cost of living adjustments for freelancers.

Steps to Determine Your Fair Hourly Rate

Overcoming this challenge of freelancer hourly rate calculation requires a few key steps. Here are the main areas to focus on to make progress in determining freelance service value.

- Calculate annual expenses and income needs: List all expenses and desired income for a clear financial picture, essential for freelance income estimation.

- Determine your billable hours realistically: Calculate available working days and realistic daily hours, crucial for accurate billing and time tracking.

- Factor in non-billable time and tasks: Subtract time spent on non-billable activities from your total hours, a key aspect of freelance pricing strategies.

- Add profit margin to cover business growth: Include a reasonable profit margin in your rate calculation, considering profit margins in freelance work.

- Research industry rates for your experience level: Conduct market research for freelance rates to find standard rates for similar skills.

- Account for taxes and self-employed costs: Calculate and set aside income for taxes, an important factor in self-employed rate calculation.

- Adjust rates based on project complexity: Develop a pricing tier system for different project complexities, addressing factors affecting freelance pricing.

Let’s dive into these steps for freelancer hourly rate calculation!

1: Calculate annual expenses and income needs

Setting your hourly rate begins with understanding your financial needs, a crucial step in freelancer hourly rate calculation.

Actionable Steps:

- List all annual personal and business expenses. Include rent, utilities, software subscriptions, and equipment costs.

- Determine your desired annual income by considering your lifestyle and financial goals.

- Use a spreadsheet to organize and total these amounts for a clear picture of your financial needs.

Explanation: These steps matter because they provide a realistic view of your financial requirements, ensuring you set a rate that covers both personal and business expenses, which is essential in self-employed rate calculation.

For further guidance, you can refer to Coursera’s guide on freelance digital marketing to understand better how to manage your finances.

Key factors to consider when calculating expenses:

- Regular monthly bills (rent, utilities, subscriptions)

- Annual or one-time expenses (insurance, equipment upgrades)

- Emergency fund contributions

Identifying your expenses and income needs sets a strong foundation for accurate rate setting and determining freelance service value.

2: Determine your billable hours realistically

Accurately determining your billable hours is essential for setting a fair hourly rate and is a crucial step in freelancer hourly rate calculation.

Actionable Steps:

- Calculate total working days: Subtract weekends and holidays from the total days in a year to find your available working days, a key factor affecting freelance pricing.

- Estimate daily working hours: Identify the number of hours you can realistically work each day, accounting for breaks and other commitments, to aid in self-employed rate calculation.

- Track actual billable hours: Use time tracking for accurate billing and monitor your billable hours over a few weeks to validate your estimates and improve freelance income estimation.

Explanation: Knowing your billable hours ensures you set a rate that reflects actual working time, avoiding undercharging and helping in determining freelance service value.

This approach aligns with industry recommendations, such as those found in Toggl’s guide to calculating billable hourly rates.

Using these steps, you can achieve a more sustainable and profitable freelance career while establishing competitive hourly rates for freelancers.

This foundation will help you move on to factoring in non-billable time and tasks, which are important considerations in freelance pricing strategies.

3: Factor in non-billable time and tasks

Incorporating non-billable time and tasks is essential for setting a fair hourly rate in freelancer hourly rate calculation.

Actionable Steps:

- List all non-billable tasks: Identify activities like administrative work, marketing, and client communication that affect freelance pricing strategies.

- Estimate time spent on these tasks: Calculate the hours dedicated to non-billable activities and subtract them from your total working hours for accurate self-employed rate calculation.

- Adjust your billable hours: Modify your billable hours to account for the time spent on non-billable tasks, impacting your freelance income estimation.

Explanation: These steps help ensure your hourly rate reflects actual working time, avoiding undercharging and determining freelance service value.

This approach aligns with industry recommendations, such as those found in Toggl’s guide to calculating billable hourly rates.

Using these steps, you can achieve a more sustainable and profitable freelance career, considering factors affecting freelance pricing.

Factoring in non-billable time sets a realistic foundation for your freelancer hourly rate calculation.

4: Add profit margin to cover business growth

Including a profit margin is essential to ensure your freelance business can grow and thrive, and it’s a crucial factor in your freelancer hourly rate calculation.

Actionable Steps:

- Decide on a profit margin percentage: Choose a reasonable percentage that aligns with your business growth goals and factors affecting freelance pricing.

- Include this margin in your rate calculation: Ensure your rate covers expenses and supports business growth, considering competitive hourly rates for freelancers.

- Reevaluate your profit margin annually: Adjust your profit margin to reflect changes in your business needs and goals, including cost of living adjustments for freelancers.

Explanation: These steps matter because they help you plan for future growth and sustainability in your self-employed rate calculation.

Including a profit margin ensures you’re not just covering costs but also investing in your business, which is key to determining freelance service value.

For more insights, refer to Coursera’s guide on freelance digital marketing which discusses setting rates and managing finances.

Adding a profit margin prepares you for long-term success and stability in your freelance income estimation.

5: Research industry rates for your experience level

Understanding industry rates for your experience level is crucial for setting competitive and fair prices when calculating your freelancer hourly rate.

Actionable Steps:

- Conduct market research: Explore online platforms and industry reports to find out standard rates for freelancers with similar skills and determine freelance service value.

- Join freelancer forums: Engage in discussions on professional networks to gather insights and benchmarks from peers about freelance pricing strategies.

- Adjust your rates: Use the information to ensure your rates are competitive and reflect your unique value proposition in self-employed rate calculation.

Explanation: These steps help you stay informed about market trends and maintain competitiveness in determining competitive hourly rates for freelancers.

For instance, you can refer to HeyOrca’s guide on social media agency pricing to understand better how rates vary with experience. This knowledge ensures you charge rates that match your expertise and market demand when performing freelancer hourly rate calculation.

Effective ways to research industry rates:

- Analyze job postings for similar roles to understand factors affecting freelance pricing

- Network with peers at industry events to discuss freelance income estimation

- Consult professional associations’ salary guides for market research on freelance rates

Researching industry rates keeps your pricing strategy aligned with current market standards and helps in accurate freelancer hourly rate calculation.

6: Account for taxes and self-employment costs

Understanding and accounting for taxes and self-employment costs are crucial for setting a sustainable hourly rate, which is a key aspect of freelancer hourly rate calculation.

Actionable Steps:

- Calculate self-employment taxes: Determine the amount you need to pay, including Social Security and Medicare, using tools or expert advice for accurate self-employed rate calculation.

- Set aside income for taxes: Allocate a percentage of your earnings regularly to avoid surprises during tax season, an essential part of freelance income estimation.

- Consult with an accountant: Seek professional advice or use tax software to ensure you meet all tax obligations accurately, which is vital for determining freelance service value.

Explanation: These steps matter because they help you avoid financial pitfalls and stay compliant with tax laws, crucial factors affecting freelance pricing.

For instance, the Golden Apple Agency guide provides detailed insights into self-employment taxes.

By accounting for these costs, you ensure your rate covers all necessary expenses, leading to a more stable freelance career and competitive hourly rates for freelancers.

Taking these steps will help you build a strong financial foundation and avoid unexpected tax liabilities, which is essential for maintaining healthy profit margins in freelance work.

7: Adjust rates based on project complexity

Adjusting rates based on project complexity ensures you are fairly compensated for your time and expertise when calculating your freelancer hourly rate.

Actionable Steps:

- Develop a pricing tier system: Create tiers for different project types based on complexity and time requirements, a key aspect of freelance pricing strategies.

- Offer customized quotes: Provide tailored quotes for unique projects that demand specialized skills or more time, helping in determining freelance service value.

- Review and adjust rates regularly: Regularly assess and update your rates to reflect your growing experience and project complexity, ensuring competitive hourly rates for freelancers.

Explanation: These steps help you maintain fair compensation and stay competitive in the market. By offering customized quotes and having a tiered system, you can better match your rates to the project’s demands, which is crucial for self-employed rate calculation.

For more insights, check out Shillington’s guide on pricing freelance projects. This approach ensures your rates evolve with your skills and market trends, aiding in freelance income estimation.

Factors to consider when adjusting rates:

- Project timeline and urgency

- Required technical expertise

- Potential for long-term client relationship

Adjusting rates based on project complexity keeps your pricing fair and competitive, considering factors affecting freelance pricing.

Partner with Alleo on Your Freelance Rate-Setting Journey

We’ve explored the challenges of setting fair hourly rates and how to overcome them. But did you know you can work directly with Alleo to make this process of freelancer hourly rate calculation easier?

Setting up an account with Alleo is simple. Create a personalized plan that meets your unique needs for determining freelance service value and competitive hourly rates for freelancers.

Alleo’s AI coach offers tailored coaching support, just like a human coach. You’ll get full sessions on freelance pricing strategies and a free 14-day trial with no credit card required.

The coach will follow up on your progress and handle changes in factors affecting freelance pricing. You’ll stay accountable through text and push notifications, helping you with time tracking for accurate billing.

Ready to get started for free and improve your freelance income estimation? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey with Alleo’s AI coach and start setting fair freelance rates, Log in to your account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent practices that will help you manage your time more effectively, leading to more accurate rate-setting and improved productivity in your freelance career.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in the AI coach to receive tailored guidance on setting fair hourly rates, managing freelance income, and achieving financial stability in your freelance career.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized plan to tackle your freelance rate-setting challenges and guide you towards achieving fair compensation for your work.

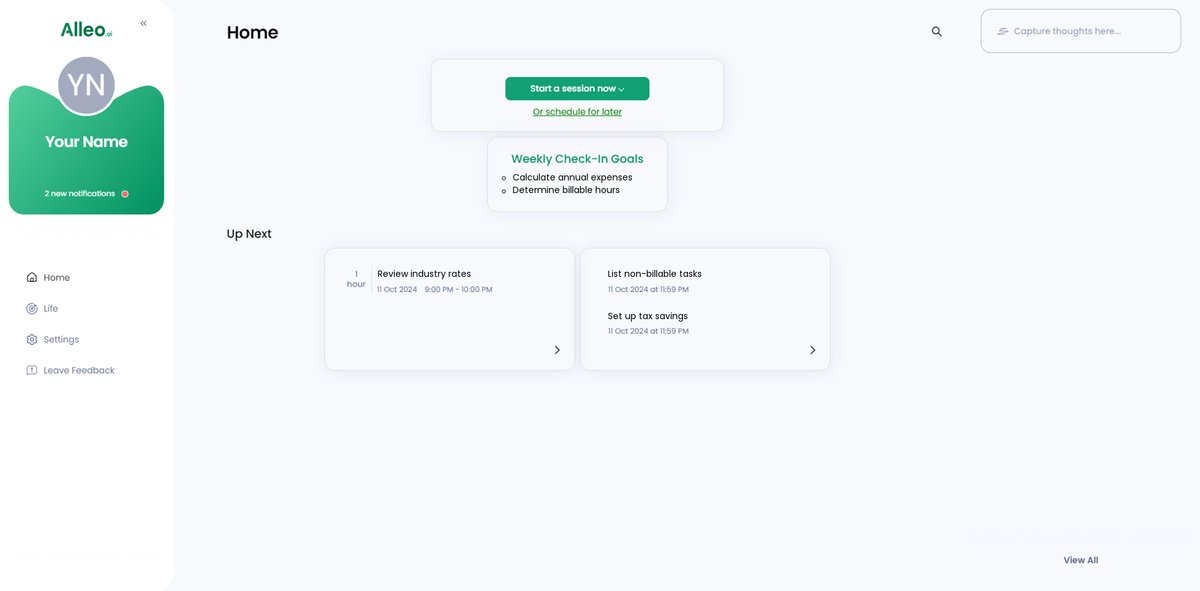

Step 5: Viewing and managing goals after the session

After your coaching session on setting fair hourly rates, check the Alleo app’s home page to review and manage the goals you discussed, ensuring you stay on track with implementing your new pricing strategy.

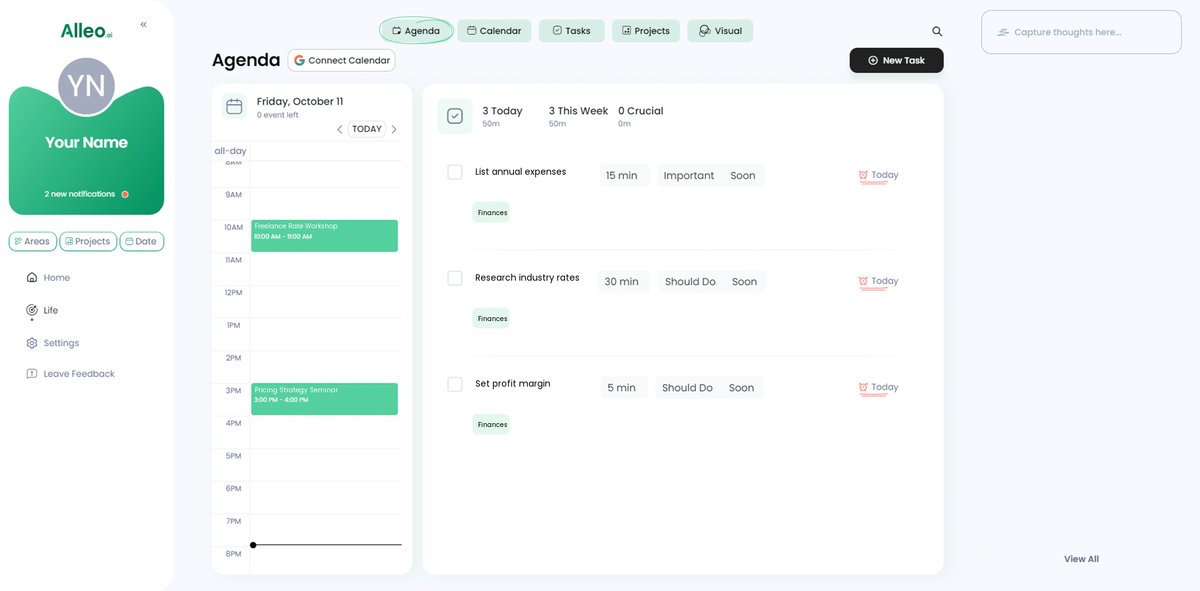

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to add important events related to your rate-setting process, allowing you to easily track your progress and stay on top of deadlines as you work towards establishing fair and competitive freelance rates.

Bringing It All Together: Your Path to Fair Rates

As we wrap up, remember that setting a fair hourly rate is crucial for your success as a freelancer.

Empathizing with the challenges you face, it’s clear that accurate freelancer hourly rate calculation is not just about numbers but about determining freelance service value.

You’ve learned how to calculate expenses, track billable hours for accurate billing, and factor in non-billable tasks.

You’ve also explored the importance of profit margins in freelance work and industry research to stay competitive and develop effective freelance pricing strategies.

Now, it’s time to put these strategies into practice. Taking these steps will help you achieve financial stability and growth through proper self-employed rate calculation.

Don’t forget, Alleo is here to support you. Our AI coach can provide personalized advice and reminders to keep you on track with your freelance income estimation.

Ready to elevate your freelance career? Start your free trial with Alleo today and join a community of freelancers dedicated to sustainable success and mastering competitive hourly rates for freelancers.