How Freelancers Can Calculate Self-Employment Taxes for Accurate Pricing: The Ultimate Guide

Are you struggling to set your rates as a freelancer due to the complexity of freelancer self-employment tax calculation?

As a life coach, I’ve guided many freelancers through the challenges of accurately calculating taxes to ensure profitability. I understand how overwhelming it can be to navigate self-employment tax calculation, especially when it can consume up to 30-35% of your earnings. This is particularly important for those dealing with 1099 income tax planning.

In this article, you’ll learn how to calculate self-employment taxes, set aside the right amount of revenue, and adjust your freelancer pricing strategies accordingly. By following these steps, you’ll avoid financial stress and ensure your freelance business remains profitable. We’ll touch on important aspects like Schedule C deductions for freelancers and quarterly estimated tax payments.

Let’s dive in.

Understanding the Tax Burden for Freelancers

Calculating self-employment taxes can be a daunting task for freelancers. Many find themselves overwhelmed by the 15.3% self-employment tax rate, which includes both Social Security and Medicare. Understanding freelancer self-employment tax calculation is crucial for effective 1099 income tax planning.

In addition to self-employment tax calculation, you have to account for income taxes, making the total tax burden even heavier. This often leads to unexpected financial strain, especially if you’re unprepared for the total amount owed when dealing with quarterly estimated tax payments.

Several clients initially struggle with setting aside enough revenue for taxes. They often underestimate the impact of these taxes on their net income, leading to cash flow issues. Proper business expense tracking for freelancers can help mitigate some of these challenges.

It’s crucial to take a systematic approach to manage these tax obligations effectively. By understanding and planning for these taxes, including exploring Schedule C deductions for freelancers, you can avoid these common pitfalls and keep your freelance business profitable. Implementing sound freelancer pricing strategies can also help offset the tax burden.

Key Steps for Calculating Self-Employment Taxes to Set Accurate Rates

To tackle this challenge of freelancer self-employment tax calculation, focus on the following key actions:

- Calculate Gross Income from All Freelance Work: Gather and update all 1099 income tax planning sources regularly.

- Determine Self-Employment Tax Rate (15.3%): Understand and calculate your self-employment tax calculation.

- Estimate Income Tax Based on Tax Brackets: Identify your tax bracket and calculate estimated taxes for quarterly estimated tax payments.

- Set Aside 30% of Revenue for Taxes: Create and monitor a tax savings plan, considering healthcare costs for freelancers.

- Use Schedule C to Track Business Expenses: Categorize and record expenses, maximizing Schedule C deductions for freelancers.

- Adjust Pricing to Cover Taxes and Expenses: Analyze and implement new freelancer pricing strategies.

Let’s dive into these steps for effective freelancer self-employment tax calculation!

1: Calculate gross income from all freelance work

Accurately calculating your gross income is crucial for freelancer self-employment tax calculation, as it forms the basis for all your tax calculations.

Actionable Steps:

- Collect all income documentation: Gather all 1099 forms and other income records for 1099 income tax planning. Use a spreadsheet or financial software to compile your total earnings.

- Regularly update income records: Set a schedule, such as weekly or monthly, to update your income records. Automate income tracking using financial management tools for efficient business expense tracking for freelancers.

Key benefits of accurate income tracking:

- Ensures precise self-employment tax calculation

- Facilitates effective financial planning

- Helps avoid surprises at tax time

Explanation:

Consistently tracking your income helps ensure you have a clear picture of your earnings, which is essential for accurate freelancer self-employment tax calculation.

This proactive approach prevents surprises at tax time and supports effective financial planning, including considerations for self-employed retirement plans and healthcare costs for freelancers.

For more detailed guidance, check out the Money with Katie blog on tax implications for the self-employed.

Next, we’ll dive into determining your self-employment tax rate.

2: Determine self-employment tax rate (15.3%)

Knowing your self-employment tax rate is vital for accurate freelancer self-employment tax calculations and financial planning.

Actionable Steps:

- Understand the components of self-employment tax: Learn about the 12.4% Social Security and 2.9% Medicare taxes. This gives you a clear picture of what you’re paying as part of your self-employment tax calculation.

- Calculate your self-employment tax accurately: Use a trusted online tax calculator or software for freelancer self-employment tax calculation. This ensures your calculations are precise and up-to-date, helping with 1099 income tax planning.

- Research additional Medicare tax if applicable: Check if you owe the additional Medicare tax, which applies to higher income levels. This is crucial for comprehensive freelancer self-employment tax calculation.

Explanation:

Taking these steps ensures you accurately calculate your self-employment taxes, which helps you plan better and avoid surprises. This is essential for effective freelancer pricing strategies.

For more detailed guidance, visit the TurboTax guide on self-employment taxes.

This proactive approach supports effective financial planning and helps with quarterly estimated tax payments.

Next, we’ll estimate your income tax based on tax brackets.

3: Estimate income tax based on tax brackets

Accurately estimating your income tax based on tax brackets is crucial for effective financial planning, especially for freelancers dealing with self-employment tax calculation.

Actionable Steps:

- Identify your tax bracket: Review IRS tax brackets based on your income level. This helps you predict your tax liability and is essential for freelancer self-employment tax calculation.

- Use tax preparation software: Simulate your tax liabilities using reliable tax software. This ensures accurate estimations and aids in 1099 income tax planning.

- Consult a tax advisor: Get professional advice to verify your calculations and understand any nuances in tax laws, including Schedule C deductions for freelancers.

Explanation:

These steps help you accurately estimate your income tax, preventing surprises at tax time. This approach supports your financial stability and ensures you set aside the right amount for taxes, including quarterly estimated tax payments.

For more information, check out the IRS guide on estimated taxes.

Next, let’s look at setting aside 30% of your revenue for taxes.

4: Set aside 30% of revenue for taxes

Setting aside 30% of your revenue for taxes is a crucial step in ensuring you’re prepared for tax season and avoid any financial surprises when calculating your freelancer self-employment tax.

Actionable Steps:

- Open a dedicated tax savings account: Allocate a separate savings account specifically for your tax obligations to avoid spending the funds elsewhere, which is essential for effective 1099 income tax planning.

- Automate transfers: Set up automatic transfers from your primary business account to your tax savings account. This ensures you consistently set aside the necessary funds for quarterly estimated tax payments without having to remember to do it manually.

- Review and adjust quarterly: Regularly review your tax savings each quarter to ensure you’re on track with your estimated tax liabilities. Adjust the amounts set aside if your income changes significantly, considering factors like home office tax deductions and healthcare costs for freelancers.

Explanation:

These steps help you systematically save for taxes, preventing financial strain when tax payments are due and supporting accurate freelancer self-employment tax calculation.

By automating the process and regularly reviewing your savings, you stay proactive in managing your finances and ensuring proper freelance income reporting.

This approach is recommended by experts, as seen in the Golden Apple Agency’s guide on quarterly tax calculations.

Next, we’ll explore how to use Schedule C to track your business expenses and maximize Schedule C deductions for freelancers.

5: Use Schedule C to track business expenses

Tracking business expenses is essential for maximizing deductions and ensuring accurate freelancer self-employment tax calculations.

Actionable Steps:

- Categorize and record expenses: Use accounting software to categorize expenses such as office supplies and travel. Keep digital copies of receipts and invoices for Schedule C deductions for freelancers.

- Regularly update expense records: Set a schedule, such as weekly or monthly, to update your expense records. This helps maintain accurate and up-to-date information for self-employment tax calculation.

- Maximize deductions: Research allowable deductions for freelancers. Join a local business group or meetup to learn about best practices from other professionals for 1099 income tax planning.

Common deductible expenses for freelancers:

- Home office tax deductions

- Professional development costs

- Marketing and advertising fees

Explanation:

These steps help you manage and track your business expenses efficiently, which is crucial for accurate tax reporting and freelancer self-employment tax calculation.

By categorizing and recording expenses, you can easily identify areas for potential deductions. This proactive approach supports effective financial planning and helps you stay compliant with IRS regulations for self-employment tax calculation.

For more detailed guidance, refer to the BlueNotary guide on Schedule C tax forms.

Next, we’ll explore how to adjust your pricing to cover taxes and expenses.

6: Adjust pricing to cover taxes and expenses

Ensuring your rates account for taxes and expenses is essential for maintaining profitability as a freelancer. This includes considering freelancer self-employment tax calculation in your pricing strategy.

Actionable Steps:

- Analyze your current pricing strategy: Compare your rates with industry standards. Calculate the true cost of your services, including self-employment tax calculation and Schedule C deductions for freelancers.

- Test new rates with select clients: Gather feedback and make adjustments as needed. This approach helps you find the ideal pricing for your 1099 income tax planning.

Key factors to consider when adjusting your rates:

- Market demand for your services

- Your level of expertise and experience

- Cost of living in your area, including healthcare costs for freelancers

Explanation:

These steps ensure you cover all costs and maintain profitability. By testing and adjusting your rates, you align your pricing with industry standards and your financial needs, including quarterly estimated tax payments and business expense tracking for freelancers.

For more detailed guidance, check out the TurboTax guide on self-employment taxes. Adjusting your pricing strategy is crucial for long-term success, including considerations for home office tax deductions and self-employed retirement plans.

Next, let’s explore how Alleo can help you set and track financial goals.

Work with Alleo to Master Your Freelance Finances

We’ve explored the challenges of calculating self-employment taxes and setting accurate rates for freelancers. But did you know you can work directly with Alleo to make freelancer self-employment tax calculation easier and faster?

Setting up an account with Alleo is simple and straightforward. First, sign up for a free 14-day trial, no credit card required. This trial can help you start managing your 1099 income tax planning effectively.

Then, create a personalized financial plan tailored to your freelance business needs, including strategies for self-employment tax calculation and Schedule C deductions for freelancers.

Alleo’s AI coach will help you track income, estimate taxes, and set aside funds for quarterly estimated tax payments. The coach will follow up on your progress, handle any changes, and keep you accountable with your freelancer pricing strategies.

You’ll receive reminders and tips via text and push notifications, including advice on business expense tracking for freelancers and home office tax deductions.

Ready to get started for free? Let me show you how to simplify your freelancer self-employment tax calculation!

Step 1: Log In or Create Your Account

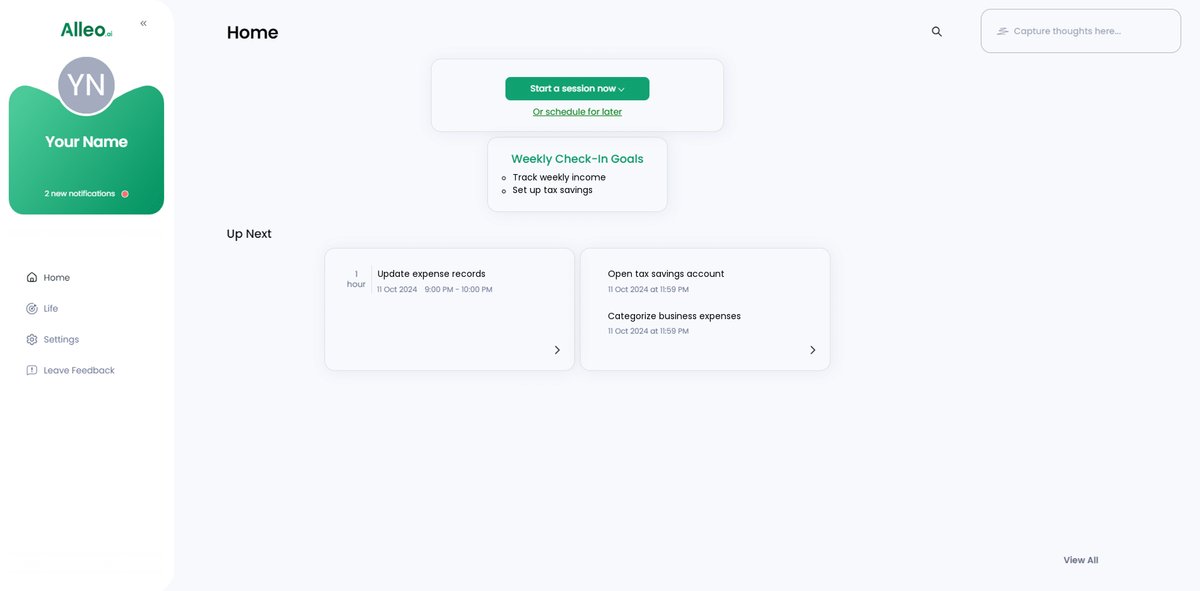

To get started with Alleo’s AI coach for managing your freelance finances, log in to your account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a structured approach for managing your freelance finances, including regularly tracking income, setting aside taxes, and adjusting pricing – key habits that will help you maintain financial stability and avoid tax-related stress.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to address your freelance tax challenges and improve your overall financial health. This selection allows Alleo’s AI coach to provide targeted advice on calculating self-employment taxes, setting accurate rates, and managing your freelance income effectively.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll work with your AI coach to set up a personalized financial plan tailored to your freelance business needs and tax-saving goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the financial goals you discussed, making it easy to track your progress and stay accountable as you navigate self-employment taxes and pricing strategies.

Step 6: Adding events to your calendar or app

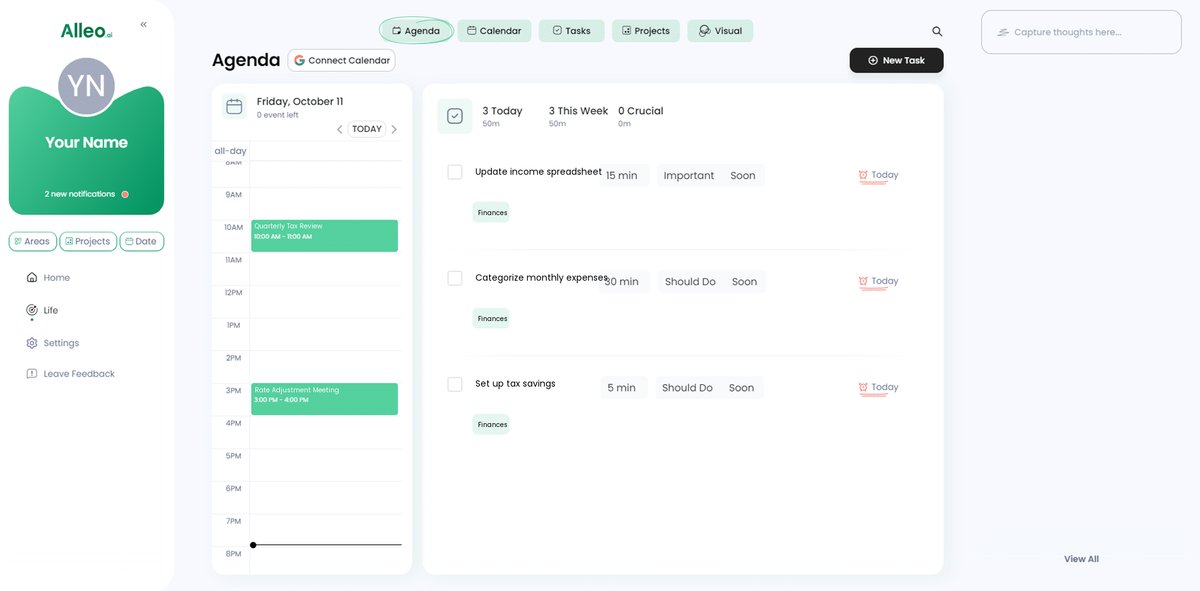

Use Alleo’s calendar and task features to track your progress on calculating taxes and adjusting rates, setting reminders for key deadlines like quarterly estimated tax payments and annual financial reviews to stay on top of your freelance finances.

Wrapping Up: Your Path to Financial Stability

We’ve covered the essential steps to calculate self-employment taxes and set accurate rates for freelancers. I know it can be overwhelming, but you’re not alone in navigating freelancer self-employment tax calculation.

By following these actionable steps, you’ll avoid financial stress and keep your freelance business profitable. Remember to consistently track your income, save for quarterly estimated tax payments, and adjust your pricing strategies.

You’re capable of managing your finances effectively, including Schedule C deductions for freelancers.

Take control of your freelance business with confidence, mastering self-employment tax calculation.

To make this journey easier, try Alleo for personalized financial guidance on 1099 income tax planning.

Sign up today for a free 14-day trial and experience the difference in managing your freelance income reporting.