How Entrepreneurs Can Make Smart Financial Decisions for Long-Term Wealth: The Ultimate Guide

Are you an entrepreneur finding it tricky to make smart financial decisions for long-term wealth? Financial planning for entrepreneurs can be a challenging but crucial aspect of business success.

As a life coach, I’ve helped many professionals navigate these challenges. From my experience, financial planning for entrepreneurs can be daunting but immensely rewarding, especially when it comes to business investment decisions and wealth preservation techniques.

In this article, we’ll explore specific strategies to enhance your financial planning. You’ll learn how to:

- Diversify investments for business growth

- Create a budget for effective cash flow management for startups

- Educate yourself on finance trends and risk assessment in entrepreneurship

- Build an emergency fund as part of your long-term wealth strategies

Let’s dive into these financial planning for entrepreneurs tips.

Understanding the Financial Hurdles Entrepreneurs Face

Entrepreneurs, especially Empty Nesters, often grapple with unique financial challenges. Many clients initially struggle with balancing business expenses and personal savings, highlighting the importance of financial planning for entrepreneurs.

Poor financial decisions can significantly impact long-term wealth strategies and stability for business owners.

In my experience, it’s common for entrepreneurs to overlook the importance of financial literacy and proper cash flow management for startups. This neglect can lead to costly mistakes in business investment decisions.

Unfortunately, many entrepreneurs don’t realize the gravity of these issues until it’s too late, emphasizing the need for risk assessment in entrepreneurship.

Further complicating matters, statistics reveal that only 43% of US respondents could correctly answer basic financial literacy questions (source).

This lack of knowledge underscores the urgency for better financial planning for entrepreneurs, including retirement planning and tax optimization for small businesses.

Strategic Steps for Smart Financial Decisions

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective financial planning for entrepreneurs to make progress.

- Diversify investments for long-term stability: Spread risk by investing in various assets, a crucial aspect of business investment decisions and long-term wealth strategies.

- Create and stick to a comprehensive budget: Track income and expenses to manage finances effectively, essential for cash flow management for startups.

- Continuously educate yourself on finance trends: Stay updated on financial knowledge and trends, including tax optimization for small businesses and wealth preservation techniques.

- Build an emergency fund for financial security: Save for unexpected expenses to ensure stability, a key component of risk assessment in entrepreneurship.

Let’s dive into these financial planning strategies for entrepreneurs!

1: Diversify investments for long-term stability

Diversifying your investments is crucial for spreading risk and ensuring long-term financial stability, especially in financial planning for entrepreneurs.

Actionable Steps:

- Research and invest in a balanced mix of stocks, bonds, and real estate to minimize risk and support business investment decisions.

- Regularly review and adjust your investment portfolio based on performance and market trends, a key aspect of financial planning for entrepreneurs.

- Explore alternative investments like peer-to-peer lending or cryptocurrencies to broaden your portfolio and enhance diversification for business owners.

Explanation: Diversifying your investments helps protect your wealth against market volatility and ensures steady growth, which is essential in long-term wealth strategies for entrepreneurs.

Regularly reviewing your portfolio can help you stay aligned with your financial goals and optimize asset allocation for business growth.

For more insights on long-term financial planning, check out this useful guide on small business financial goals.

Key benefits of investment diversification:

- Reduces overall portfolio risk, crucial for risk assessment in entrepreneurship

- Provides potential for higher returns, supporting cash flow management for startups

- Offers protection against market fluctuations, aiding in wealth preservation techniques

Taking these steps can significantly improve your financial stability and help you achieve long-term wealth, a primary goal in financial planning for entrepreneurs.

Now, let’s move on to the next strategy.

2: Create and stick to a comprehensive budget

Creating and sticking to a comprehensive budget is vital for managing your finances effectively and ensuring long-term wealth, especially in financial planning for entrepreneurs.

Actionable Steps:

- Download a budgeting app to track your income and expenses in real-time, which is crucial for cash flow management for startups.

- Set realistic financial goals and allocate funds for savings and emergencies, considering risk assessment in entrepreneurship.

- Review and adjust your budget monthly to reflect any changes in your financial situation, a key aspect of financial planning for entrepreneurs.

Explanation: A comprehensive budget helps you manage your finances efficiently and achieve your financial goals, including business investment decisions and asset allocation for business growth.

Regularly adjusting your budget ensures it remains relevant and effective. For more insights, check out this useful guide on personal finance.

These steps will help you maintain financial discipline and improve your financial stability. Now, let’s move on to the next strategy.

3: Continuously educate yourself on finance trends

Staying informed on finance trends is essential for making smart financial decisions and achieving long-term wealth, especially when it comes to financial planning for entrepreneurs.

Actionable Steps:

- Subscribe to financial newsletters and read books on personal finance and investments, focusing on business investment decisions and cash flow management for startups.

- Dedicate 30 minutes daily to read an article or a book chapter on finance.

- Attend financial workshops and webinars to stay updated on the latest trends in financial planning for entrepreneurs.

- Sign up for webinars on topics like the impact of inflation on investments and risk assessment in entrepreneurship.

- Network with other entrepreneurs and financial experts to exchange knowledge and experiences on diversification for business owners.

- Join a business networking group and attend monthly meetings.

Top resources for financial education:

- Online courses from reputable universities on financial planning for entrepreneurs

- Finance podcasts and YouTube channels covering long-term wealth strategies

- Industry-specific financial publications on tax optimization for small businesses

Explanation: Keeping up with finance trends allows you to make better decisions and adapt to market changes, which is crucial for asset allocation for business growth.

Regularly attending workshops and networking helps you stay ahead in financial planning for entrepreneurs. For further information, consider exploring this comprehensive guide on financial education.

These steps will help you stay informed and make smarter financial decisions, including retirement planning for entrepreneurs and wealth preservation techniques. Now, let’s move on to the next strategy.

4: Build an emergency fund for financial security

Building an emergency fund is essential for ensuring financial security and managing unexpected expenses, especially in financial planning for entrepreneurs.

Actionable Steps:

- Open a dedicated savings account specifically for your emergency fund.

- Set up automatic monthly transfers to this account to build your fund consistently, a crucial aspect of cash flow management for startups.

- Aim to save at least three to six months’ worth of living expenses.

- Calculate your monthly expenses and set a clear timeline to reach this goal, aligning with long-term wealth strategies.

- Avoid using your emergency fund for non-emergencies and replenish it promptly if used.

- Establish clear criteria for what constitutes an emergency, considering risk assessment in entrepreneurship.

Explanation:

These steps create a safety net, providing peace of mind and financial stability. Regularly saving and avoiding unnecessary withdrawals ensure your fund is available when truly needed, which is crucial in financial planning for entrepreneurs.

For more tips on effective financial planning, check out this detailed guide on financial security.

Common financial emergencies to prepare for:

- Unexpected medical expenses

- Sudden job loss or income reduction

- Major home or car repairs

By following these steps, you’ll be better prepared for unexpected financial challenges, an important aspect of wealth preservation techniques.

Now, let’s explore how Alleo can assist in implementing these strategies.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of making smart financial decisions for long-term wealth strategies, especially in financial planning for entrepreneurs. But did you know you can work directly with Alleo to make this journey easier and faster?

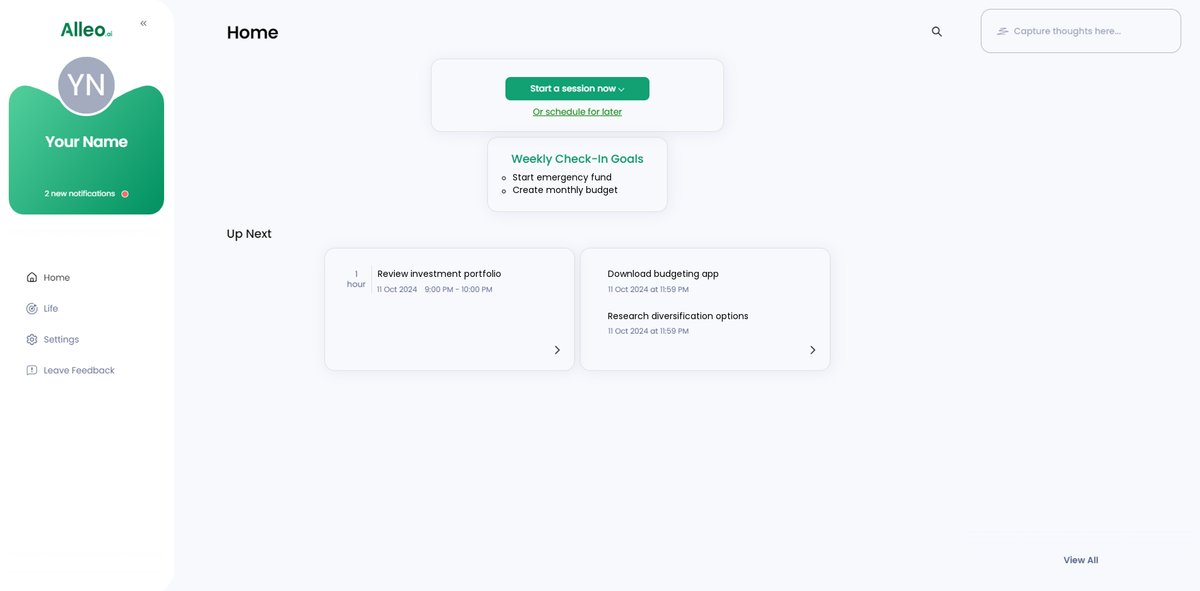

Setting up an account with Alleo is simple. Create a personalized plan with the AI coach to address your financial challenges, including cash flow management for startups and business investment decisions.

Alleo offers affordable, tailored coaching support, just like a human coach. You’ll get full coaching sessions and a free 14-day trial, requiring no credit card. This is particularly beneficial for entrepreneurs seeking financial planning guidance.

The AI coach will follow up on your progress. It will help handle changes and keep you accountable via text and push notifications, assisting with risk assessment in entrepreneurship and diversification for business owners.

Ready to get started for free? Let me show you how Alleo can support your financial planning for entrepreneurs journey!

Step 1: Log In or Create Your Account

To begin your journey towards smarter financial decisions, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will support your long-term wealth goals and help you overcome the challenges of making smart financial decisions.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to address the challenges of making smart financial decisions for long-term wealth, aligning with the strategies discussed in the article such as diversifying investments, budgeting, and building an emergency fund.

Step 4: Starting a coaching session

Begin your financial journey with Alleo by scheduling an intake session, where you’ll discuss your goals and create a personalized plan to make smarter financial decisions for long-term wealth.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app and check your home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your long-term wealth strategies.

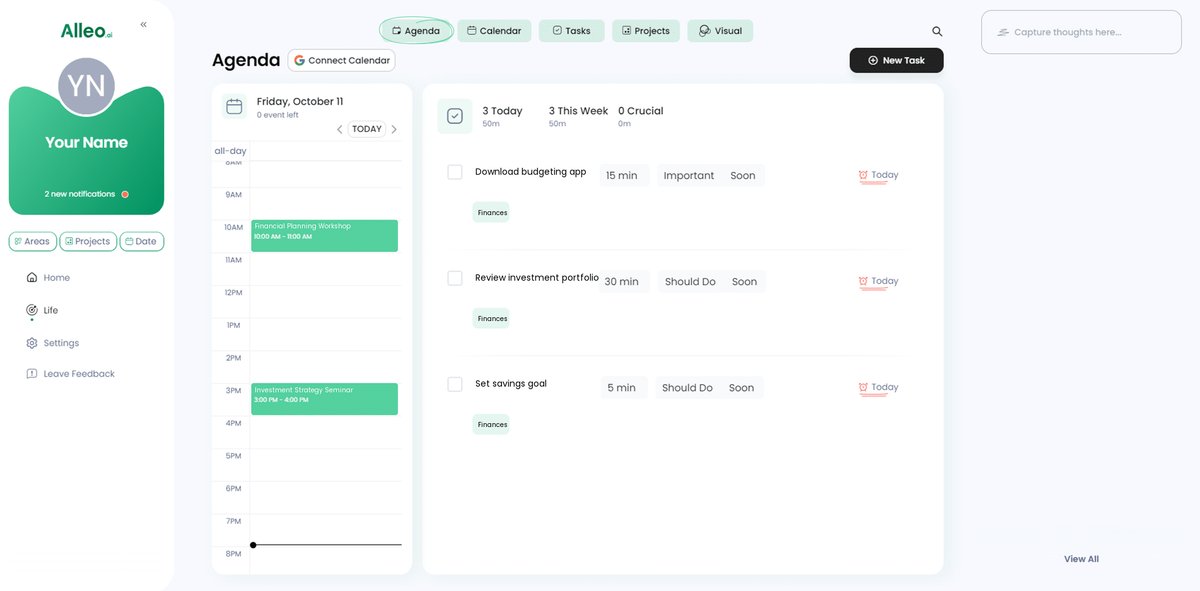

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your financial planning activities, such as budget reviews, investment diversification checks, and emergency fund contributions, helping you stay accountable and measure your progress towards long-term wealth goals.

Wrapping Up Your Financial Journey

By now, we’ve explored how to make smart financial decisions for long-term wealth, essential for financial planning for entrepreneurs.

Remember, diversifying investments, creating a budget, staying informed, and building an emergency fund are key strategies. These steps can help you achieve financial stability and peace of mind, crucial for entrepreneurs managing cash flow and assessing risks.

You can do this.

Don’t hesitate to start implementing these strategies today to optimize your business investment decisions.

Alleo can make this process easier by providing personalized guidance and support for your financial planning as an entrepreneur.

Take control of your financial future now, including retirement planning and tax optimization for your small business.

Let’s embark on this journey together—try Alleo for free and see the difference it makes in your long-term wealth strategies and asset allocation for business growth.