How Finance Professionals Can Build Confidence in Answering Financial Management Questions: A Comprehensive Guide

Are you often overwhelmed by financial management questions, unsure how to respond confidently? Building financial management confidence is crucial for effective communication in finance.

As a life coach, I’ve helped many small business owners overcome similar challenges. I understand the importance of confidence in financial management and developing financial literacy skills.

In this article, you’ll discover actionable strategies for financial problem-solving and building financial management confidence. We’ll cover practical steps like regular practice, peer learning, and staying current with financial regulations and industry trends.

Ready to transform your financial management skills and enhance your professional development as a finance expert? Let’s dive into confidence-building exercises for finance professionals.

Understanding the Core Challenges in Financial Management

When managing finances, small business owners often feel overwhelmed. Many struggle with building financial management confidence and answering financial questions confidently.

This lack of confidence can stem from limited practical experience or the fear of making mistakes. Improving financial literacy skills is crucial for overcoming these challenges.

In my experience, people often find the complexity of financial management daunting. They worry about handling complex financial scenarios, which can halt business growth.

For instance, several clients report feeling anxious during critical financial meetings, highlighting the need for effective communication in finance.

These challenges can lead to missed opportunities and financial missteps. As a result, improving your confidence in financial management is crucial for professional development for finance experts.

With the right approach, including strategies for financial problem-solving and continuous learning in financial management, you can overcome these hurdles and thrive.

A Strategic Roadmap to Building Financial Confidence

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in building financial management confidence.

- Regularly practice financial case studies: Dedicate time daily to solve relevant financial scenarios and improve your financial literacy skills.

- Join a finance professional peer learning group: Engage with peers to share insights and challenges, fostering professional development for finance experts.

- Create a personal financial knowledge database: Organize and update key financial resources regularly to enhance your strategies for financial problem-solving.

- Engage in mock financial Q&A sessions: Practice with colleagues or mentors to refine your skills in handling complex financial scenarios.

- Stay updated on industry trends and news: Read finance newsletters and blogs daily to stay current with financial regulations.

- Develop storytelling skills for financial data: Use simple narratives to explain complex data, improving your effective communication in finance.

- Seek mentorship from experienced professionals: Gain insights and advice from seasoned experts to boost your confidence in financial management.

Let’s dive in to explore these confidence-building exercises for finance professionals!

1: Regularly practice financial case studies

Practicing financial case studies regularly is crucial for building financial management confidence and enhancing your financial literacy skills.

Actionable Steps:

- Dedicate 30 minutes daily to solve a financial case study relevant to your business, focusing on strategies for financial problem-solving.

- Use online resources to find case studies that cover various financial scenarios and support continuous learning in financial management.

- Track your progress and identify areas for improvement in your financial analysis techniques.

Explanation: Regular practice helps you become familiar with different financial scenarios, enhancing your problem-solving skills and building financial management confidence. By dedicating time daily, you can gradually improve your ability in handling complex financial scenarios.

For instance, using resources like Interview Ace can provide diverse case studies to practice and improve your skills in effective communication in finance.

Key benefits of regular practice include:

- Improved analytical thinking for financial management

- Enhanced decision-making skills in finance

- Increased familiarity with financial concepts and regulations

Practicing consistently can transform your approach to financial management, making you more confident in handling complex questions and supporting your professional development as a finance expert.

2: Join a finance professional peer learning group

Joining a finance professional peer learning group can significantly boost your confidence in building financial management skills by offering a supportive environment for sharing knowledge and experiences.

Actionable Steps:

- Research and join local or online finance professional groups: Look for groups that align with your interests and goals in financial literacy skills.

- Participate actively in discussions: Share your challenges and insights to benefit from collective wisdom and enhance your strategies for financial problem-solving.

- Attend monthly meetups or webinars: Stay engaged and learn from peers’ experiences to improve your effective communication in finance.

Explanation: Engaging with a peer learning group provides you with diverse perspectives and practical advice for continuous learning in financial management.

This collaborative approach helps you stay updated and confident in financial management, including financial analysis techniques. For more insights on the benefits of peer learning, check out Propel Nonprofits.

Connecting with like-minded professionals can be a game-changer in your financial journey, helping you build confidence in handling complex financial scenarios.

3: Create a personal financial knowledge database

Creating a personal financial knowledge database is essential for building financial management confidence and enhancing financial literacy skills.

Actionable Steps:

- Collect and organize key financial documents, articles, and resources: Start by gathering relevant materials that can help you understand financial concepts better and improve your strategies for financial problem-solving.

- Regularly update the database with new learnings and insights: Keep your database current by adding new information and insights you acquire, focusing on continuous learning in financial management.

- Review your database weekly to reinforce your knowledge: Schedule time each week to go through your database and refresh your memory, enhancing your financial analysis techniques.

Explanation: A well-maintained financial knowledge database helps you stay informed and confident. Regularly updating and reviewing this resource ensures you are always prepared for financial management questions and handling complex financial scenarios.

According to Ellevest, financial planners emphasize the importance of organized, up-to-date knowledge for effective financial decision-making and staying current with financial regulations.

Building and maintaining a personal financial knowledge database can transform your approach to financial management, boosting your confidence in handling financial matters.

4: Engage in mock financial Q&A sessions

Engaging in mock financial Q&A sessions is vital for building financial management confidence and enhancing financial literacy skills.

Actionable Steps:

- Partner with a colleague or mentor: Schedule regular mock Q&A sessions to simulate real-life scenarios and practice effective communication in finance.

- Record and review sessions: Analyze your performance to identify strengths and areas for improvement in financial analysis techniques.

- Gradually increase question complexity: As your confidence grows, tackle more challenging questions to enhance strategies for financial problem-solving.

Explanation: Mock Q&A sessions provide a safe environment to practice and refine your responses, supporting professional development for finance experts.

This method helps you identify gaps in your knowledge and improve your communication skills, crucial for handling complex financial scenarios.

According to Ellevest, regular practice and feedback are crucial for effective financial decision-making and confidence building.

These sessions will significantly enhance your ability to handle financial questions with ease, contributing to your continuous learning in financial management.

5: Stay updated on industry trends and news

Staying updated on industry trends and news is crucial for building financial management confidence and enhancing financial literacy skills.

Actionable Steps:

- Subscribe to reputable finance newsletters and blogs: Dedicate 15 minutes each morning to read the latest industry news and improve your financial analysis techniques.

- Join online forums or social media groups focused on financial management: Participate in discussions to stay informed about current trends and insights, fostering continuous learning in financial management.

- Set up Google Alerts for key financial topics: This ensures you receive timely updates on relevant industry changes and financial regulations.

Explanation: Keeping up with industry trends helps you stay informed and confident in your financial decisions, enhancing your strategies for financial problem-solving.

By regularly consuming reliable information, you’ll be better prepared for financial management questions and handling complex financial scenarios.

For example, subscribing to Ellevest can provide valuable insights and updates for professional development for finance experts.

Staying informed is key to building financial management confidence and improving your effective communication in finance.

6: Develop storytelling skills for financial data

Developing storytelling skills for financial data is crucial for effectively communicating complex financial information to stakeholders and building financial management confidence.

Actionable Steps:

- Take a course on storytelling and data visualization: Enroll in online courses to learn how to present financial data compellingly, enhancing your financial literacy skills.

- Practice explaining financial data using simple narratives: Regularly explain financial insights to non-financial stakeholders in easy-to-understand terms, improving your effective communication in finance.

- Create engaging presentations: Use visuals and narratives to highlight key financial insights in your presentations, developing essential presentation skills for financial data.

Explanation: These steps matter because storytelling makes financial data more accessible and engaging for diverse audiences, which is vital for building financial management confidence.

According to Poised, tailoring communication to your audience’s understanding is crucial. By mastering storytelling, you can make complex financial information more relatable and memorable, a key aspect of professional development for finance experts.

Key elements of effective financial storytelling:

- Clear narrative structure

- Relevant analogies and metaphors

- Compelling visual aids

This skill will significantly enhance your ability to convey financial insights effectively, contributing to your confidence in handling complex financial scenarios.

7: Seek mentorship from experienced professionals

Seeking mentorship from experienced professionals is crucial for building confidence in financial management and enhancing your financial literacy skills.

Actionable Steps:

- Identify and reach out to experienced finance professionals: Use platforms like LinkedIn to find mentors who align with your goals in building financial management confidence.

- Schedule regular mentoring sessions: Meet bi-weekly to discuss challenges and seek advice on specific financial questions, focusing on strategies for financial problem-solving.

- Set specific goals with your mentor: Track your progress and adjust your learning objectives as needed, incorporating continuous learning in financial management.

Explanation: Mentorship provides personalized guidance and support, boosting your confidence in financial management. Regular interactions with experienced professionals help you gain insights and practical knowledge, including financial analysis techniques and effective communication in finance.

According to Propel Nonprofits, mentorship can significantly enhance your financial leadership skills.

Benefits of financial mentorship:

- Personalized career guidance for professional development in finance

- Access to industry insights, including staying current with financial regulations

- Expanded professional network for handling complex financial scenarios

Connecting with the right mentor can transform your approach to financial management and help in building confidence-building exercises for finance professionals.

Partner with Alleo on Your Financial Confidence Journey

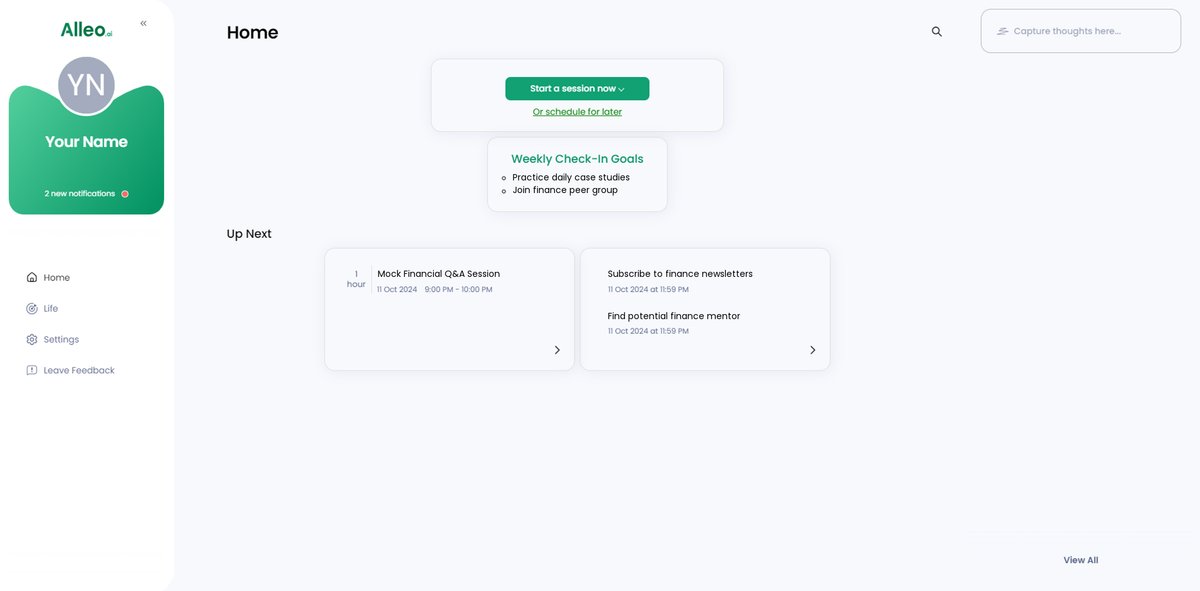

We’ve explored the challenges of building financial management confidence and how solving them can benefit your business. Did you know you can work directly with Alleo to make this journey easier and faster?

Alleo offers AI-driven practice sessions for financial case studies, helping you develop financial literacy skills and enhance your strategies for financial problem-solving. Connect with finance professionals through Alleo’s networking features to boost your professional development as a finance expert.

Organize and update your financial knowledge database with Alleo’s tools, aiding in continuous learning in financial management. Schedule mock Q&A sessions and review performance with Alleo’s analytics to improve your confidence in handling complex financial scenarios.

Stay informed with curated news updates and industry insights delivered by Alleo, ensuring you’re staying current with financial regulations. Receive storytelling and presentation coaching through Alleo’s personalized tips to enhance your presentation skills for financial data.

Find and communicate with mentors using Alleo’s mentorship matching feature, further building your financial management confidence.

Ready to get started for free? Try Alleo today to start building your confidence in answering financial management questions and improving your financial analysis techniques.

Step 1: Logging in or Creating an Account

To begin your journey towards financial confidence, log in to your Alleo account or create a new one if you haven’t already.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent financial practices, which will boost your confidence in managing money and answering financial questions effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to align with your goal of building confidence in financial management. This selection will tailor Alleo’s AI coaching to provide targeted strategies, resources, and practice exercises specifically designed to enhance your financial skills and decision-making abilities.

Step 4: Starting a Coaching Session

Begin your financial confidence journey with Alleo by scheduling an initial intake session, where you’ll discuss your goals and create a personalized plan to improve your financial management skills through regular practice sessions and mentorship opportunities.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app and check your home page to view and manage the financial management goals you discussed, allowing you to track your progress and stay accountable.

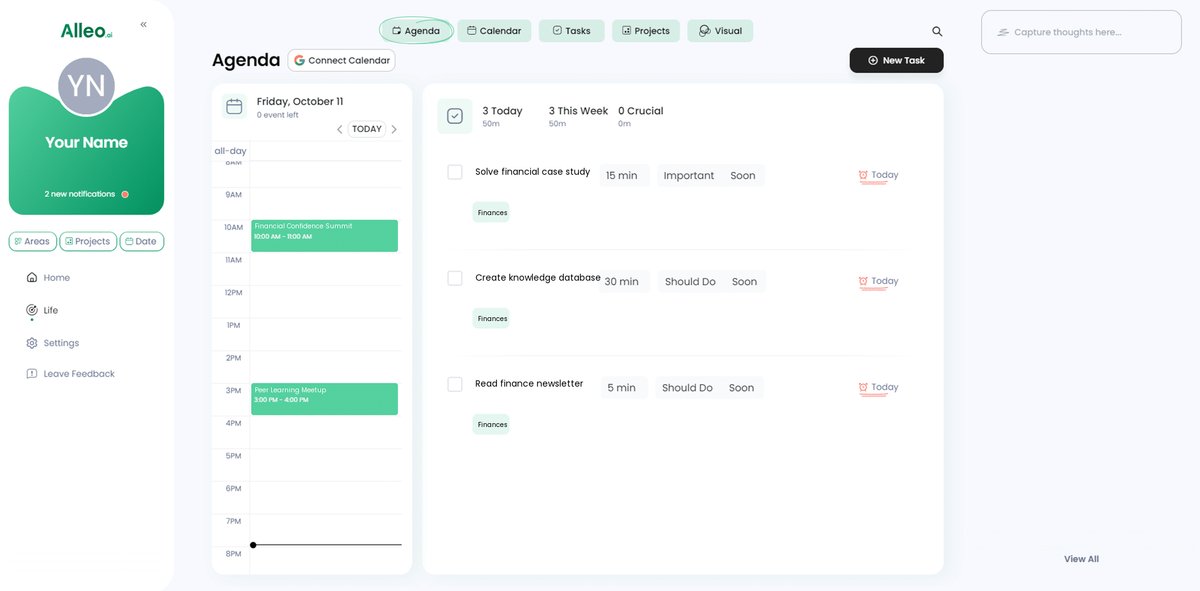

Step 6: Adding events to your calendar or app

Use the calendar and task features in Alleo to schedule and track your progress on financial case studies, peer learning sessions, and mock Q&A practices, helping you stay organized and motivated in building your financial management confidence.

Bringing It All Together: Your Path to Financial Confidence

As we’ve seen, building confidence in financial management is essential for small business success. By practicing regularly, engaging with peers, and staying informed about financial analysis techniques, you can transform your approach to finances and enhance your financial literacy skills.

Remember, it’s all about consistent effort and learning. Seek mentorship and practice storytelling to refine your skills, which are crucial for effective communication in finance. Building financial management confidence involves continuous learning and professional development for finance experts.

I understand the challenges you face in handling complex financial scenarios, and Alleo is here to help. Alleo’s tools and resources make this journey smoother and more efficient, supporting your strategies for financial problem-solving.

Start today and take control of your financial management. Try Alleo for free and see the difference it can make in building financial management confidence and improving your presentation skills for financial data.