How Financial Advisors Can Confidently Evaluate Tesla Trade-In Offers: 4 Fundamental Principles

Ever faced the conundrum of advising clients on evaluating Tesla trade-in offers during uncertain economic times? Let’s dive into how you can navigate this with confidence, considering Tesla trade-in value assessment and electric vehicle market trends.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, addressing specific financial uncertainties is crucial, especially when it comes to Tesla resale value factors.

In this article, you’ll discover strategies to evaluate Tesla trade-in offers confidently, even in unpredictable economic climates. We’ll explore trade-in trends, compare financing options, and assess client goals, including Tesla trade-in vs. private sale considerations.

Let’s dive in.

Understanding the Challenges in Evaluating Tesla Trade-In Offers

Navigating Tesla trade-in offers can be overwhelming for financial advisors. Many clients struggle with the unpredictability of the 0% financing option for a 2022 Tesla Model Y, highlighting the complexity of Tesla model comparison for trade-ins.

The economic uncertainty adds to the complexity of evaluating Tesla trade-in offers. I often see clients unsure about the best course of action when analyzing Tesla depreciation rates and resale value factors.

Advisors face the challenge of ensuring clients make informed decisions when evaluating Tesla trade-in offers. The fluctuating trade-in values and complex financing options require a robust approach to Tesla trade-in value assessment.

Without a clear strategy for negotiating Tesla trade-in deals, clients may feel lost. This can result in less-than-optimal financial decisions when considering Tesla trade-in vs. private sale options.

It’s crucial to address these challenges head-on. Understanding the intricacies of electric vehicle market trends can help advisors provide the best guidance in maximizing client returns on Tesla trades.

A Roadmap to Confidently Evaluating Tesla Trade-In Offers

Overcoming this challenge requires a few key steps. Here are the main areas to focus on when evaluating Tesla trade-in offers to make progress.

- Analyze Trade-In Value Trends for Tesla Models: Use historical data to identify trends and compare with electric vehicle market trends, focusing on Tesla trade-in value assessment.

- Compare Tesla Financing with Other EV Options: Create a comparative analysis and consult experts with financial advisor automotive expertise to understand the pros and cons of Tesla model comparison for trade-ins.

- Assess Client’s Financial Goals and Risk Tolerance: Conduct personalized assessments and develop customized financial plans for EV purchases, considering Tesla resale value factors.

- Review Tesla’s Trade-In Process and Policies: Examine Tesla’s policies and monitor client feedback to navigate potential issues when negotiating Tesla trade-in deals.

Let’s dive in!

1: Analyze trade-in value trends for Tesla models

Understanding trade-in value trends is crucial for evaluating Tesla trade-in offers and making informed financial decisions.

Actionable Steps:

- Research historical data: Review Tesla’s trade-in values from the past five years to identify patterns and analyze Tesla depreciation rates.

- Monitor market indicators: Compare these trends with economic indicators to gauge electric vehicle market trends and conditions.

- Attend industry events: Participate in webinars and conferences to stay updated on the latest trends in Tesla trade-in value assessment.

Key factors influencing Tesla trade-in values and resale value factors:

- Model popularity and availability for Tesla model comparison for trade-ins

- Battery technology advancements

- Competition from other EV manufacturers

Explanation: These steps help you understand how trade-in values fluctuate, allowing you to advise clients accurately when evaluating Tesla trade-in offers.

Staying informed through reliable sources like industry reports ensures you provide the best guidance for financial planning for EV purchases.

By following these steps, you can better navigate the complexities of Tesla trade-in evaluations and maximize client returns on Tesla trades.

2: Compare Tesla financing with other EV options

Understanding how Tesla’s financing stacks up against other EV brands is key to providing the best advice for your clients, especially when evaluating Tesla trade-in offers.

Actionable Steps:

- Create a comparative analysis chart: Gather data on financing options from Tesla and other leading EV brands. Compare interest rates, loan terms, and down payment requirements. Include Tesla trade-in value assessment in your analysis.

- Consult with industry experts: Speak with professionals who specialize in EV financing to gain insights into the benefits and drawbacks of each option, including Tesla model comparison for trade-ins.

- Use financial modeling tools: Project long-term costs and benefits of different financing options to help clients make informed decisions, factoring in Tesla resale value factors and analyzing Tesla depreciation rates.

Explanation: These steps ensure you have a comprehensive understanding of the various financing options available, allowing you to provide well-rounded advice on evaluating Tesla trade-in offers.

Staying informed about industry trends through reliable sources, like the insights from the Center for Strategic and International Studies, helps you stay ahead of electric vehicle market trends.

By comparing financing options and considering Tesla trade-in vs. private sale, you can help clients navigate their choices confidently and maximize client returns on Tesla trades.

3: Assess client’s financial goals and risk tolerance

Understanding your client’s financial goals and risk tolerance is essential to providing tailored advice when evaluating Tesla trade-in offers.

Actionable Steps:

- Conduct personalized financial assessments: Use detailed questionnaires and interviews to gather information about each client’s financial objectives, risk tolerance, and considerations for Tesla trade-in value assessment.

- Develop customized financial plans: Align these plans with clients’ long-term goals, current economic conditions, and electric vehicle market trends to ensure they are realistic and achievable.

- Offer one-on-one coaching sessions: Address any concerns and provide tailored advice to help clients feel confident in their decisions, including strategies for negotiating Tesla trade-in deals.

Important aspects to consider in financial assessments:

- Current income and expenses

- Future financial goals, including financial planning for EV purchases

- Investment experience and preferences, including analyzing Tesla depreciation rates

Explanation: These steps ensure that you understand your client’s unique needs and can provide advice that’s tailored to their situation when evaluating Tesla trade-in offers.

This approach helps you stay aligned with industry trends and best practices, as noted in this study on financial reasoning.

By assessing financial goals and risk tolerance, you can guide clients effectively through the complexities of Tesla trade-in offers and help them understand Tesla resale value factors.

These strategies can help you provide the best possible advice as you navigate this process with your clients, including comparing Tesla trade-in vs. private sale options to maximize client returns on Tesla trades.

4: Review Tesla’s trade-in process and policies

Understanding Tesla’s trade-in process and policies is crucial for providing accurate advice when evaluating Tesla trade-in offers.

Actionable Steps:

- Thoroughly review Tesla’s trade-in policies: Examine the details of Tesla’s trade-in process on their website to identify potential pitfalls and benefits, focusing on Tesla trade-in value assessment.

- Monitor client feedback: Track and analyze client experiences and reviews to identify common issues and areas for improvement in Tesla trade-in deals.

- Collaborate with other financial advisors: Share insights and strategies with peers to navigate Tesla’s trade-in process more effectively and enhance financial advisor automotive expertise.

Key elements of Tesla’s trade-in process:

- Online valuation tool

- Vehicle condition assessment

- Trade-in credit application

Explanation: These steps help ensure you are well-informed about Tesla’s trade-in policies, which is essential for advising clients accurately on evaluating Tesla trade-in offers.

By staying updated on client experiences and collaborating with peers, you can provide better guidance on Tesla model comparison for trade-ins and analyzing Tesla depreciation rates.

For more insights on industry trends, refer to Chevy House.

By following these steps, you can help clients navigate Tesla’s trade-in process confidently and maximize client returns on Tesla trades.

Partner with Alleo to Navigate Tesla Trade-In Decisions

We’ve explored the challenges of evaluating Tesla trade-in offers. But did you know you can work with Alleo to make this process smoother? Our expertise in Tesla trade-in value assessment can help you navigate the electric vehicle market trends.

Setting up an account is easy. Create a personalized plan with Alleo’s AI coach, tailored to your needs, including Tesla model comparison for trade-ins.

The coach will follow up on your progress. It will handle changes and keep you accountable via text and notifications, helping you in analyzing Tesla depreciation rates and understanding Tesla resale value factors.

Alleo provides affordable, tailored coaching support. Full coaching sessions are like working with a human coach, offering financial advisor automotive expertise to assist in negotiating Tesla trade-in deals.

Enjoy a free 14-day trial with no credit card required. This trial can help you explore financial planning for EV purchases and compare Tesla trade-in vs. private sale options.

Ready to get started for free? Let me show you how to maximize client returns on Tesla trades!

Step 1: Logging in or Creating an Account

To start navigating Tesla trade-in decisions with confidence, log in to your existing Alleo account or create a new one to access our AI coach and personalized guidance.

Step 2: Choose Your Focus Area

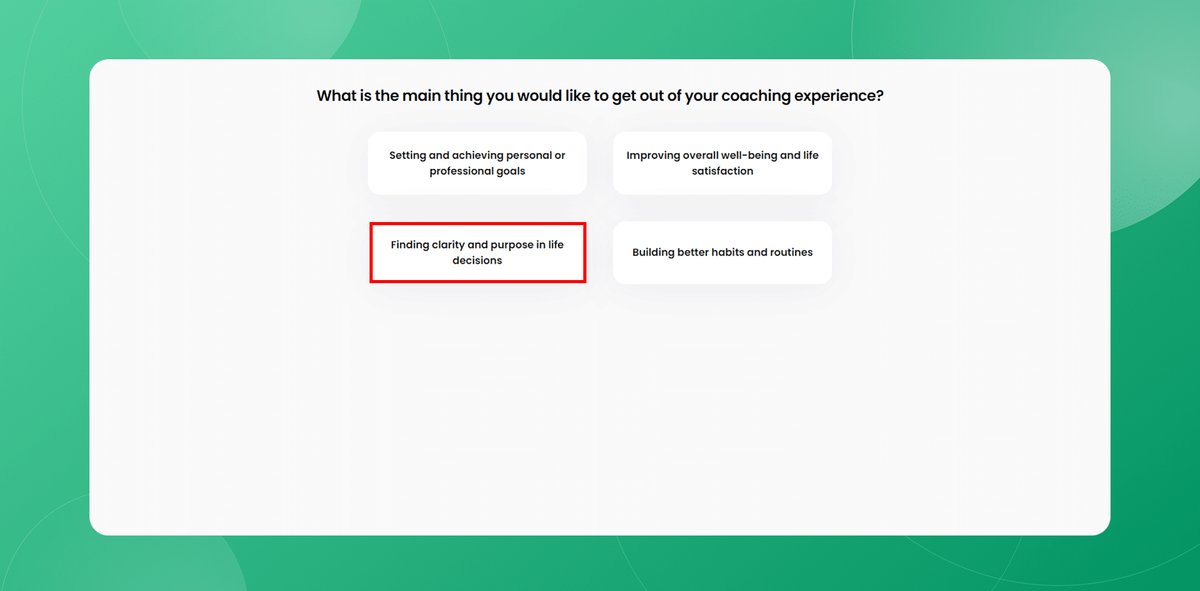

Select “Finding clarity and purpose in life decisions” as your goal to gain insight on evaluating Tesla trade-in offers and aligning them with your financial objectives. This focus will help you navigate the complexities of car financing decisions with confidence.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to get tailored guidance on evaluating Tesla trade-in offers, comparing financing options, and aligning decisions with your financial goals and risk tolerance.

Step 4: Starting a coaching session

Begin your AI coaching journey with an intake session to establish your personalized plan for navigating Tesla trade-in decisions and financial advising challenges.

Step 5: Viewing and Managing Goals After the Session

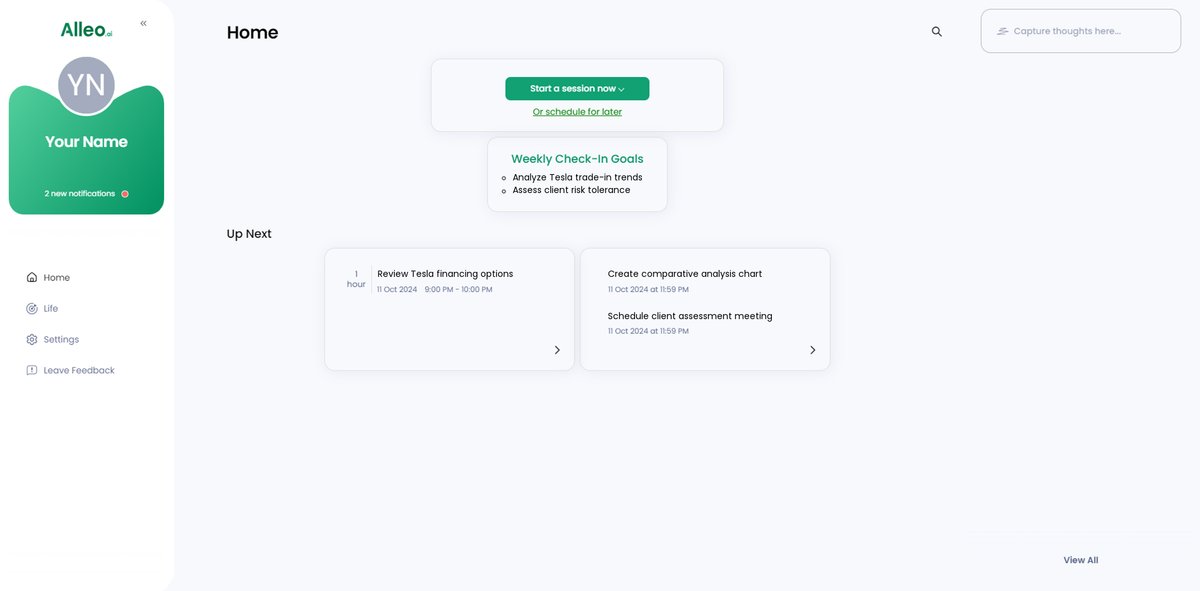

After your coaching session on Tesla trade-in evaluations, check the Alleo app’s home page to view and manage the goals you discussed, allowing you to track your progress and stay accountable in providing confident financial advice to your clients.

Step 6: Adding events to your calendar or app

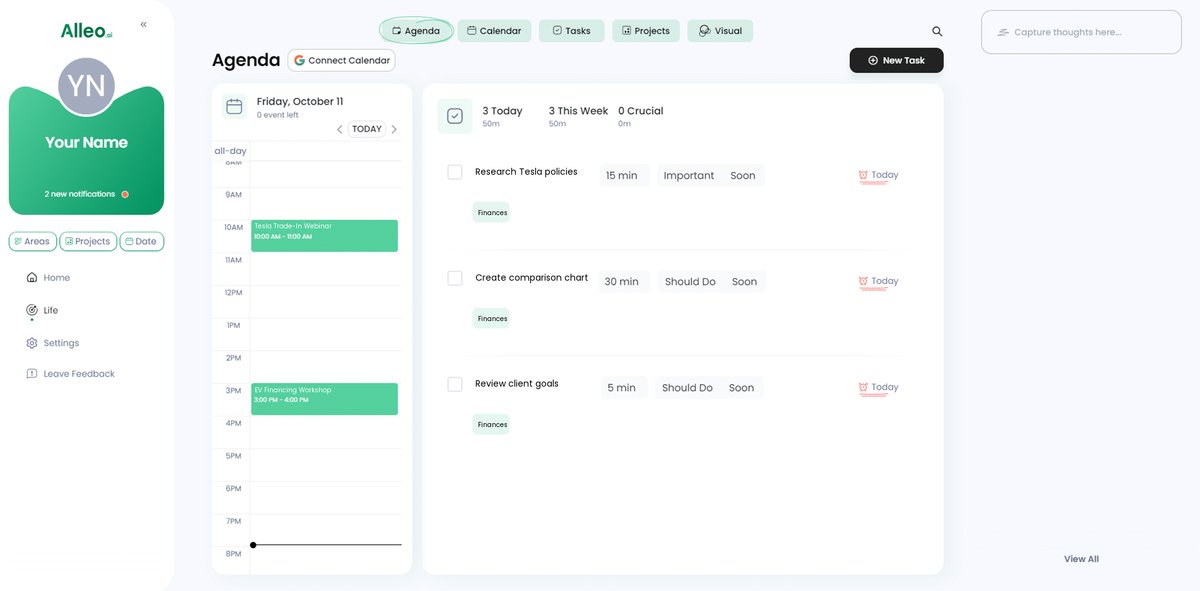

Use the calendar and task features in the Alleo app to schedule and track your progress on Tesla trade-in evaluations, allowing you to stay organized and accountable as you work through the decision-making process with your clients.

Putting It All Together: Your Path to Confident Tesla Trade-In Decisions

Navigating Tesla trade-ins can be daunting. You now have a roadmap to guide your clients confidently when evaluating Tesla trade-in offers.

Analyzing Tesla trade-in value assessment trends, comparing financing options, assessing client goals, and understanding Tesla’s policies for trade-in deals are key.

These steps provide a comprehensive strategy for evaluating Tesla trade-in offers. You can now better assist your clients in making informed decisions about their electric vehicle transactions.

Remember, you’re not alone in analyzing Tesla depreciation rates and resale value factors. Alleo is here to support you.

With Alleo’s AI coach, you can navigate these challenges seamlessly, including Tesla model comparisons for trade-ins. Try it for free and see the difference in your financial planning for EV purchases.

Let’s make confident decisions together when evaluating Tesla trade-in offers. Sign up for Alleo today and enhance your advisory process for maximizing client returns on Tesla trades.