How Financial Advisors Can Guide Clients Through Economic Uncertainty: The Ultimate Roadmap

Are you struggling to guide your clients through economic uncertainty?

In times of market volatility, financial advisors play a critical role in providing stability and reassurance. Guiding clients through economic uncertainty requires a blend of expertise and empathy.

As a life coach, I’ve helped many professionals navigate these challenges. I’ve seen firsthand the importance of expert guidance during uncertain times, especially when it comes to risk management and long-term wealth preservation.

In this article, you’ll discover strategies to help clients manage their finances, understand market trends, and maintain a long-term perspective. We’ll explore economic volatility strategies and recession-proof investment advice to support your client communication in turbulent markets.

Ready to dive into effective methods for guiding clients through economic uncertainty?

Understanding Client Concerns During Economic Instability

During periods of economic instability, financial advisors face unique challenges in guiding clients through economic uncertainty. Clients often worry about their retirement plans, the safety of their investments, and ever-changing market trends, requiring advisors to implement effective economic volatility strategies.

In my experience, people frequently feel overwhelmed by the emotional and psychological impact of economic uncertainty. This stress can lead to impulsive decisions that may jeopardize their long-term financial goals, highlighting the importance of market downturn planning.

Many clients initially struggle with the fear of losing their hard-earned savings. They may find it difficult to stay focused on their long-term objectives amidst short-term market fluctuations, emphasizing the need for recession-proof investment advice and risk management for uncertain times.

You need to address these concerns effectively to maintain trust and provide the necessary reassurance. This involves not only managing the financial aspects but also offering emotional support, which is crucial when guiding clients through economic uncertainty.

Understanding these challenges is crucial for guiding clients through turbulent times. It sets the foundation for a structured approach to help them navigate uncertainty with confidence, incorporating strategies like diversification during economic instability and long-term wealth preservation.

Roadmap to Guiding Clients Through Economic Uncertainty

Overcoming this challenge of guiding clients through economic uncertainty requires a few key steps. Here are the main areas to focus on to make progress:

- Implement goals-based planning for clients: Regularly reassess financial goals and develop personalized financial roadmaps to navigate economic volatility.

- Educate clients on inflation and diversification: Provide workshops, one-on-one coaching, and informative content on recession-proof investment advice and risk management for uncertain times.

- Use visual tools to explain market trends: Utilize visual aids and interactive presentations to simplify complex information about long-term wealth preservation and asset allocation during economic shifts.

Let’s dive in to explore strategies for guiding clients through economic uncertainty!

1: Implement goals-based planning for clients

Implementing goals-based planning is crucial for guiding clients through economic uncertainty and market volatility.

Actionable Steps:

- Hold regular client meetings to reassess financial goals during economic shifts.

- Schedule quarterly or bi-annual check-ins to discuss progress and make necessary adjustments for long-term wealth preservation.

- Develop personalized financial roadmaps for each client to navigate economic uncertainty.

- Outline steps to achieve both short-term and long-term goals, including contingency plans for recession-proof investment advice.

- Encourage clients to maintain a long-term perspective in turbulent markets.

- Share historical data on market recoveries and long-term investment benefits during economic instability.

Key benefits of goals-based planning for guiding clients through economic uncertainty include:

- Increased client confidence in uncertain times

- Better alignment with personal objectives during market downturns

- Improved financial decision-making for risk management

Explanation:

These steps matter because they help clients stay focused on their long-term objectives despite market volatility and economic uncertainty.

Regular check-ins and personalized plans ensure clients feel supported and informed during financial crises.

By maintaining a long-term perspective, clients are less likely to make impulsive decisions in turbulent markets.

According to Nationwide, financial professionals emphasize the importance of a steady, long-term perspective during uncertain times.

This structured approach will assist your clients in navigating economic uncertainty with confidence, including strategies for diversification and asset allocation.

2: Educate clients on inflation and diversification

Educating clients on inflation and diversification is critical for guiding clients through economic uncertainty and helping them understand how to protect their investments during economic volatility.

Actionable Steps:

- Host educational workshops or webinars on inflation and economic volatility strategies.

- Cover topics like the impact of inflation on savings and how to diversify portfolios effectively during economic instability.

- Offer one-on-one coaching sessions to discuss individual concerns and market downturn planning.

- Tailor recession-proof investment advice to each client’s unique financial situation and risk tolerance.

- Create informative content like newsletters or blog posts on risk management for uncertain times.

- Share insights on current economic trends and practical advice on managing finances during economic shifts.

Explanation:

These steps matter because they empower clients with the knowledge to make informed decisions when guiding clients through economic uncertainty. According to Enrich.org, understanding inflation’s impact helps clients adjust their portfolios and manage long-term effects.

By offering workshops, personalized coaching, and informative content on financial crisis preparation, you can build trust and enhance your clients’ financial literacy.

Essential topics to cover in client education for long-term wealth preservation:

- Inflation’s effect on purchasing power

- Strategies for portfolio diversification during economic instability

- Risk management techniques for guiding clients through economic uncertainty

This approach will help your clients stay resilient and confident during economic uncertainty, focusing on asset allocation during economic shifts and retirement planning amid uncertainty.

3: Use visual tools to explain market trends

Leveraging visual tools is vital for guiding clients through economic uncertainty and helping them grasp complex market trends during turbulent times.

Actionable Steps:

- Use charts and graphs in client meetings for effective market downturn planning.

- Employ tools like the Morningstar Andex Chart to visually explain market cycles and economic volatility strategies.

- Create interactive presentations for client education on recession-proof investment advice.

- Develop engaging presentations with quizzes to help clients understand different scenarios and risk management for uncertain times.

- Share visual summaries of market updates for long-term wealth preservation.

- Provide clients with easy-to-understand infographics of current market conditions and diversification during economic instability.

Explanation:

These steps matter because visual aids simplify complex information, making it more accessible for clients navigating economic uncertainty.

According to Enrich.org, using tools like the Andex Chart helps clients understand market trends better, fostering informed decision-making during economic volatility.

By providing clear visual summaries and interactive presentations, clients can stay informed and confident during economic uncertainty, aiding in financial crisis preparation.

Effective visual tools for client communication in turbulent markets:

- Interactive market cycle diagrams for guiding clients through economic uncertainty

- Animated portfolio allocation charts for asset allocation during economic shifts

- Real-time performance dashboards for retirement planning amid uncertainty

This approach will enhance your clients’ understanding and trust, aiding them in navigating market volatility effectively while guiding clients through economic uncertainty.

Partner with Alleo to Guide Clients Through Uncertainty

We’ve explored guiding clients through economic uncertainty and the steps to achieve it. Did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to economic volatility strategies?

Setting up an account with Alleo is simple. Start with a free 14-day trial, no credit card needed. This is crucial for those looking to enhance their market downturn planning capabilities.

Once you create an account, Alleo helps you develop a personalized plan tailored to your needs for guiding clients through economic uncertainty. The AI coach will assist in scheduling regular client meetings and provide reminders to ensure consistent check-ins, vital for client communication in turbulent markets.

Alleo helps you create and manage personalized financial roadmaps, tracking goals and progress. It generates educational content and visual aids tailored to each client’s needs, making complex information more accessible, especially when discussing recession-proof investment advice and long-term wealth preservation strategies.

The AI coach follows up on your progress, handles changes, and keeps you accountable with text and push notifications, ensuring you stay on top of risk management for uncertain times.

Ready to get started for free? Let me show you how to enhance your approach to guiding clients through economic uncertainty!

Step 1: Log In or Create Your Account

To start guiding your clients through economic uncertainty with our AI coach, log in to your existing account or create a new one to begin your 14-day free trial, no credit card required.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your financial advising practice with your clients’ long-term objectives, helping you provide more targeted guidance during economic uncertainty.

Step 3: Selecting the life area you want to focus on

Choose “Finances” as your focus area to align with your goal of guiding clients through economic uncertainty, allowing Alleo to provide tailored strategies for financial planning, market education, and visual tools to explain complex economic trends.

Step 4: Starting a coaching session

Begin with an intake session to assess your client’s financial situation and set up a personalized plan for guiding them through economic uncertainty.

Step 5: Viewing and managing goals after the session

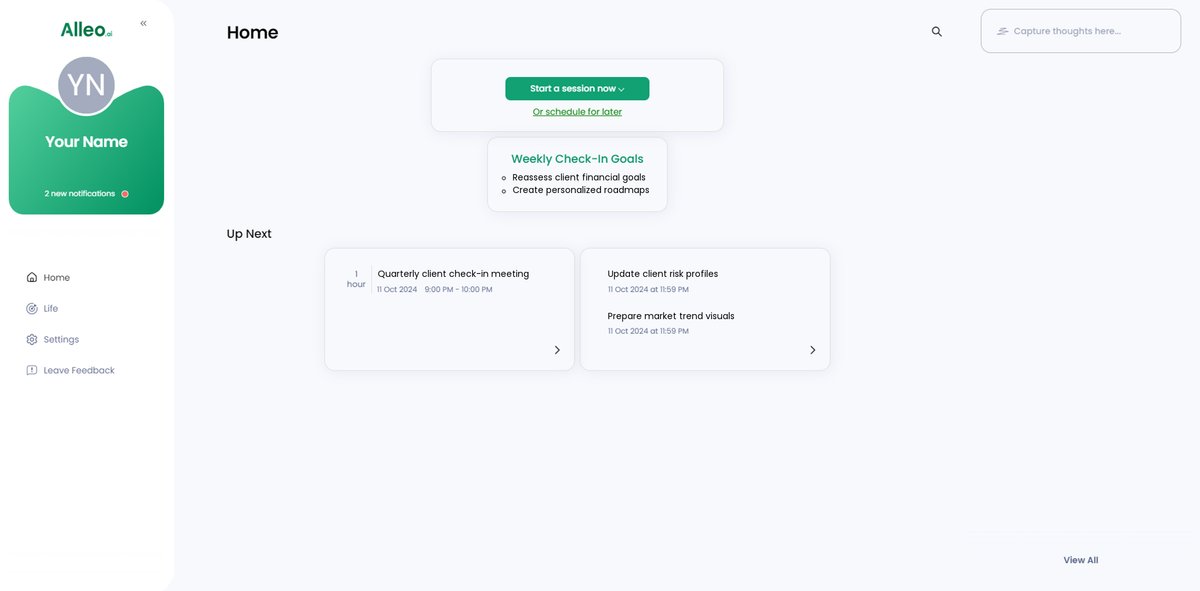

After your coaching session, open the Alleo app to find your discussed goals conveniently displayed on the home page, allowing you to easily track and manage your progress in guiding clients through economic uncertainty.

Step 6: Adding events to your calendar or app

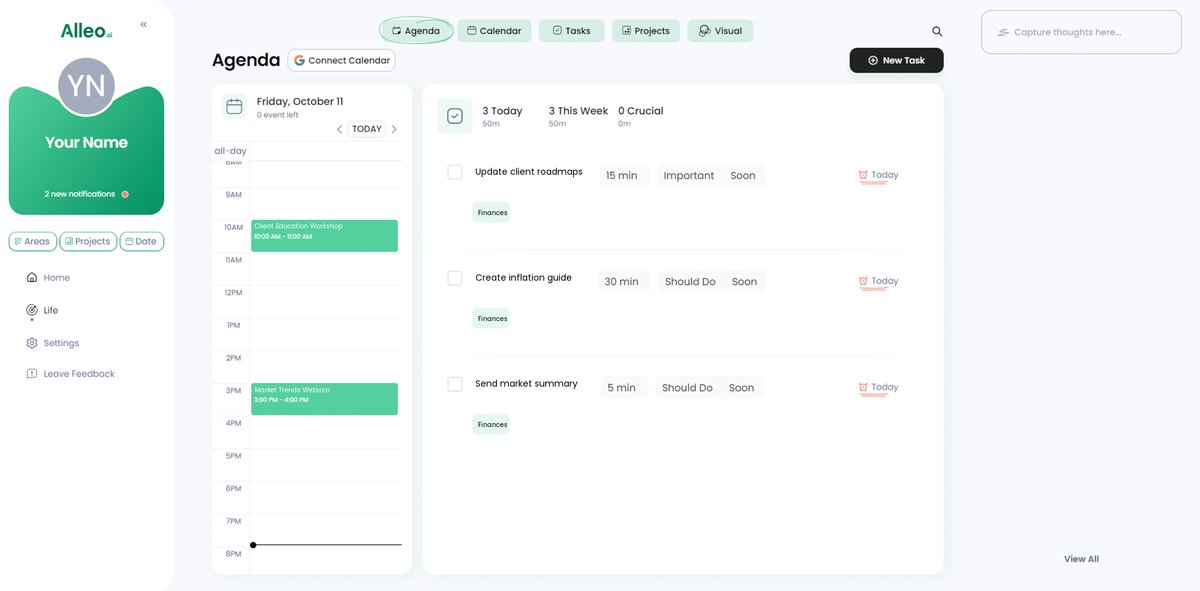

Use the calendar and task features in the Alleo app to schedule and track regular client meetings, educational workshops, and progress reviews, helping you stay organized and accountable as you guide clients through economic uncertainty.

Empowering Your Clients in Uncertain Times

As we wrap up, let’s reflect on the power of guidance in guiding clients through economic uncertainty.

Your clients depend on you to navigate economic volatility with confidence.

By implementing goals-based planning, you’re helping them stay focused during market downturns.

Educating them on inflation and diversification during economic instability empowers them with knowledge.

Using visual tools makes complex information about recession-proof investment advice more accessible.

These strategies build trust and resilience in turbulent markets.

Remember, Alleo is here to support you in financial crisis preparation.

With Alleo, you can streamline your processes and provide exceptional guidance for long-term wealth preservation.

Try it for free and see how it enhances your client communication in uncertain times.

You have the tools and support to lead your clients through any economic storm.

Let’s get started today on risk management for uncertain times!