How Financial Advisors Can Leverage API Data to Transform Client Relationships: 3 Essential Strategies

Imagine having seamless access to all your client’s financial data at your fingertips, enabling you to provide tailored advice instantly through integrating API data for advisors. This approach revolutionizes financial advisor data integration and API-driven wealth management.

As a life coach, I’ve helped many financial consultants navigate these challenges. In my experience, effective data integration can transform client relationships, facilitating client data analysis for advisors and enabling personalized financial advice using APIs.

In this article, you’ll discover strategies for integrating API data for advisors into CRM systems, creating personalized dashboards, and setting up automated alerts. These API automation techniques in financial services can significantly enhance your ability to offer data-driven investment strategies and client portfolio optimization with APIs.

Let’s dive into these financial advisor technology solutions that leverage real-time market data for financial planning.

Why Integrating API Data Can Be Challenging

Many financial advisors struggle with integrating API data for advisors and leveraging client data shared via API. This can be overwhelming, leaving advisors with scattered information that is difficult to manage in their financial advisor technology solutions.

In my experience, effective data integration is essential for improving client service and communication. Without it, you might face delays, inaccuracies, and missed opportunities to provide timely advice using API-driven wealth management techniques.

Imagine trying to piece together a client’s financial picture from multiple sources. It’s frustrating and time-consuming, especially when attempting client data analysis for advisors.

For example, several clients report feeling overwhelmed by the volume of data they need to handle. This is where effective integration becomes crucial for personalized financial advice using APIs.

By streamlining data into a centralized system, you can enhance your service quality. This is not just about efficiency; it’s about building stronger client relationships through API-enhanced client communication.

I often see clients benefit from a well-integrated system, which allows them to focus more on client needs rather than administrative tasks. Integrating API data for advisors into your CRM can transform your practice, enabling data-driven investment strategies and client portfolio optimization with APIs.

Key Steps to Effectively Use API Data for Client Relationships

Overcoming this challenge requires a few key steps when integrating API data for advisors. Here are the main areas to focus on to make progress:

- Integrate API Data into CRM for Client Profiles: Assess your CRM capabilities and set up secure API connections to keep client profiles updated, enhancing financial advisor data integration.

- Create Personalized Dashboards Using API Data: Design dashboards that reflect client goals and preferences with visualization tools, supporting API-driven wealth management and client data analysis for advisors.

- Set Up Automated Alerts Based on API Insights: Identify key metrics and configure real-time notifications for timely advice, enabling personalized financial advice using APIs and leveraging real-time market data for financial planning.

Let’s dive into integrating API data for advisors!

1: Integrate API data into CRM for client profiles

Integrating API data for advisors into your CRM is crucial for keeping client profiles up-to-date and accurate, enhancing financial advisor data integration practices.

Actionable Steps:

- Conduct a thorough audit of your existing CRM system to determine compatibility with different APIs, focusing on API-driven wealth management solutions.

- Engage with a trusted API integration service to establish a secure and efficient connection for client data analysis for advisors.

- Schedule periodic reviews to ensure client profiles are continually updated with the latest financial data, supporting personalized financial advice using APIs.

Explanation:

These steps are essential for maintaining accurate and current client profiles. Regular updates enhance your ability to offer personalized advice and improve decision-making through API-enhanced client communication.

According to Mirketa, integrating real-time market data for financial planning into your CRM system can significantly improve the efficiency and effectiveness of client interactions. This integration ensures that you always have the most relevant information at your fingertips, which is critical for client satisfaction and retention.

Key benefits of integrating API data for advisors into your CRM include:

- Enhanced client profiling accuracy through API automation in financial services

- Improved decision-making capabilities for data-driven investment strategies

- Streamlined workflow processes for client portfolio optimization with APIs

Implementing these financial advisor technology solutions will streamline your workflow and lead to stronger client relationships.

2: Create personalized dashboards using API data

Creating personalized dashboards by integrating API data for advisors is vital for providing tailored insights to your clients, enhancing their engagement and satisfaction in API-driven wealth management.

Actionable Steps:

- Design dashboards that reflect individual client goals and preferences.

- Use client data analysis for advisors to create customizable dashboard templates tailored to different client segments.

- Implement data visualization tools to simplify complex information.

- Integrate visualization tools like graphs and charts that make data interpretation straightforward for both advisors and clients, leveraging real-time market data for financial planning.

- Enable clients to access their personalized dashboards.

- Provide clients with secure login credentials to view their personalized financial advice using APIs, enhancing transparency and engagement.

Explanation:

These steps help deliver clear, actionable insights to your clients, making the financial data easier to understand. According to Salesforce, using personalized dashboards can significantly improve client relationships by offering a more customized experience.

This approach not only boosts client satisfaction but also positions you as a proactive advisor who values their unique needs, utilizing API-enhanced client communication and data-driven investment strategies.

Start implementing these steps today to transform your client interactions through financial advisor data integration.

![]()

3: Set up automated alerts based on API insights

Setting up automated alerts based on API insights is essential for integrating API data for advisors and providing proactive and timely advice to your clients.

Actionable Steps:

- Define specific financial milestones or changes that warrant an automatic alert for API-driven wealth management.

- Configure your CRM system to send real-time notifications for these key metrics, enhancing client data analysis for advisors.

- Regularly review and adjust alert settings to align with evolving client needs and real-time market data for financial planning.

Explanation:

These steps ensure that you can promptly respond to significant changes in your clients’ financial situations. Automated alerts help maintain a high level of service and keep clients informed through API-enhanced client communication.

As highlighted by Salesforce, real-time notifications can significantly enhance client engagement and satisfaction. By staying ahead of key financial events, you can offer more timely and relevant personalized financial advice using APIs.

Effective automated alerts can help you:

- Anticipate client needs proactively using financial advisor technology solutions

- Respond swiftly to market changes with data-driven investment strategies

- Demonstrate your commitment to client success through client portfolio optimization with APIs

This approach will streamline your advisory process and improve client relationships while integrating API data for advisors.

Partner with Alleo for Seamless Financial Data Integration

We’ve explored the challenges of integrating API data for advisors into CRM systems, and the steps to solve them. Did you know Alleo can make this journey easier and faster for financial advisor data integration?

Setting up an account with Alleo is simple. First, create a personalized plan tailored to your needs, perfect for API-driven wealth management.

Alleo’s AI coach provides affordable, tailored coaching support for client data analysis for advisors. You’ll get full coaching sessions, just like with a human coach, focusing on personalized financial advice using APIs.

The coach will follow up on your progress and handle changes in real-time market data for financial planning. You’ll stay accountable with text and push notifications, enhancing API automation in financial services.

Ready to get started for free with our financial advisor technology solutions? Let me show you how!

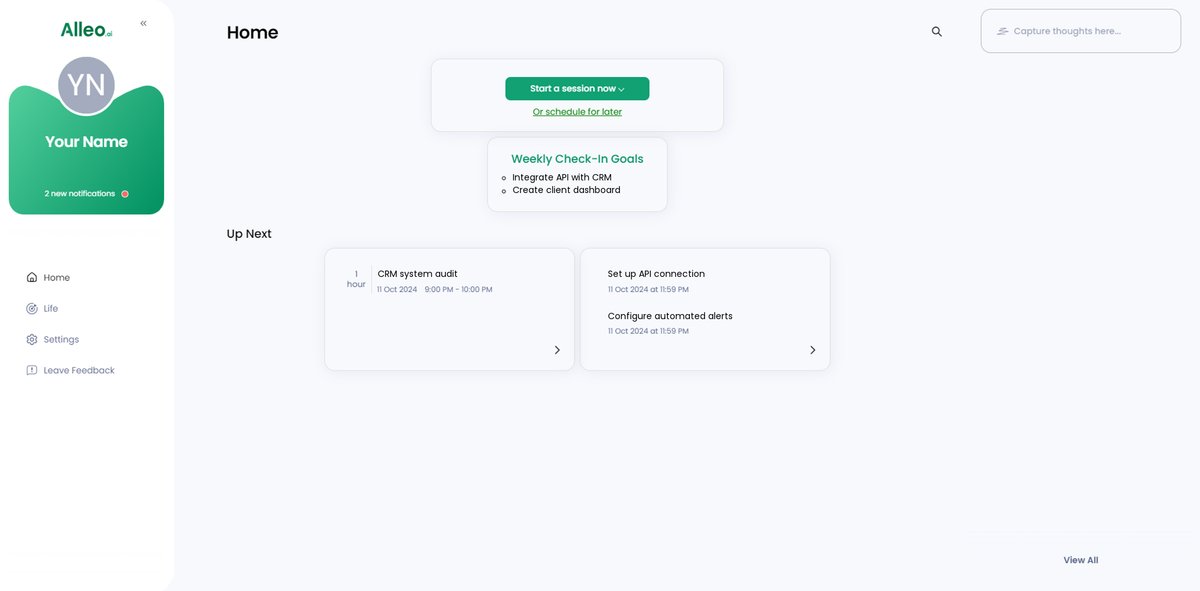

Step 1: Log In or Create Your Alleo Account

To start integrating your financial data seamlessly, Log in to your account or create a new one to access Alleo’s AI coach and personalized dashboard features.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop consistent practices for managing client data and integrating API insights, enhancing your ability to provide timely, personalized financial advice.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area to align with your goal of improving financial data integration and client relationships, enabling Alleo’s AI coach to provide targeted guidance on leveraging API data effectively in your financial advisory practice.

Step 4: Starting a Coaching Session

Begin your AI coaching journey with an intake session to establish your personalized plan for seamlessly integrating financial data and enhancing client relationships.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the goals you discussed, allowing you to track progress and stay aligned with your financial advisory objectives.

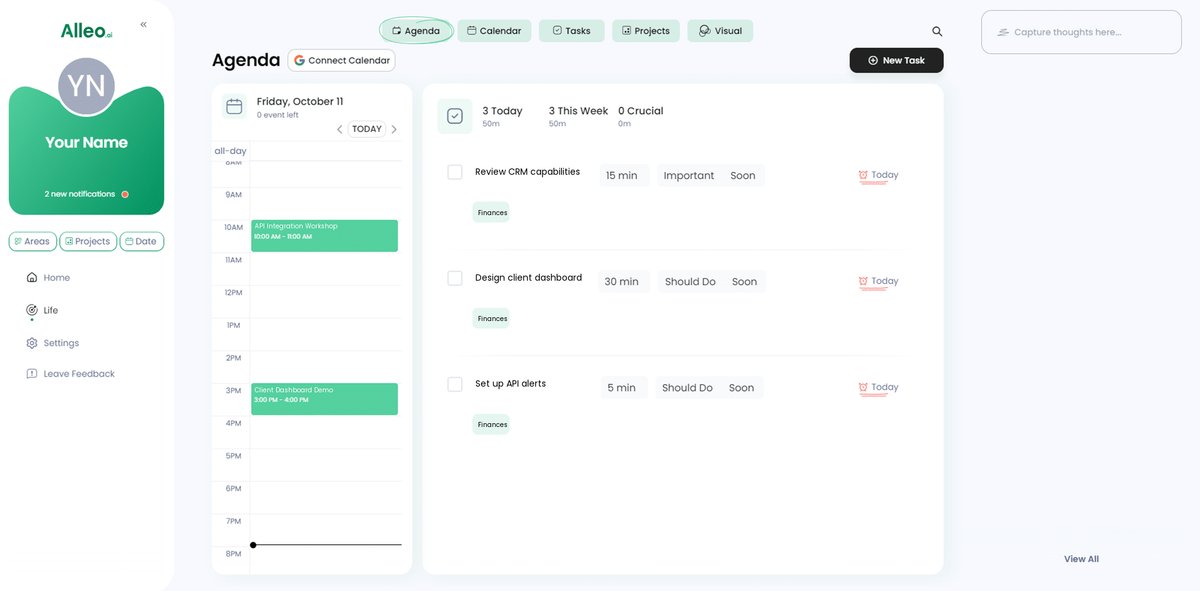

Step 6: Adding events to your calendar or app

Seamlessly integrate your financial milestones and client meetings by adding events to your calendar or app, allowing you to track your progress in solving data integration challenges and stay on top of important client interactions. With the calendar and task features in the Alleo app, you can easily monitor your advancement towards implementing API data integration strategies and improving client relationships.

Bringing It All Together

You now have the tools to integrate API data for advisors into your CRM, create personalized dashboards, and set up automated alerts for financial advisor data integration.

These steps will help you manage client information more effectively, provide timely advice, and enhance client satisfaction through API-driven wealth management.

Remember, data integration is not just about efficiency; it’s about building stronger, more meaningful client relationships through client data analysis for advisors.

By implementing these strategies, you can transform your practice and focus on what truly matters: your clients, using personalized financial advice using APIs.

Consider trying Alleo to streamline this process. It can help you stay on top of your client data and communications effortlessly, enhancing your financial advisor technology solutions.

Let’s get started. Your clients deserve the best in API-enhanced client communication and data-driven investment strategies.