How Financial Advisors Evaluate 0% Tesla Financing: 3 Essential Strategies for Client Success

Imagine advising a client to purchase a new Tesla Model Y with 0% financing, only to find out later it wasn’t the best financial decision due to unexpected economic shifts. How can financial advisors navigate this complex terrain when evaluating 0% Tesla financing offers?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, evaluating enticing offers like the 0% Tesla financing deal requires careful consideration of Tesla financing options and long-term costs of Tesla ownership.

In this article, we’ll explore strategies to assess total ownership costs, credit implications, and the overall financial impact on your clients. We’ll compare Tesla financing vs. traditional auto loans and discuss budgeting for Tesla monthly payments.

Let’s dive into the world of zero-interest auto loans and electric vehicle investment analysis.

Understanding the Risks of 0% Financing Offers

Navigating the complexities of 0% financing offers, including evaluating 0% Tesla financing offers, can be daunting. Although these deals seem appealing, the hidden costs often outweigh the benefits when considering Tesla financing options.

Many clients initially struggle with the allure of no interest, overlooking potential long-term financial strain. During economic uncertainty, it’s critical to consider market volatility and overall financial health before recommending such moves, especially when comparing EV loan options.

In my experience, people often find the reality of these offers is far from the promise. The risk of inflated vehicle prices and strict credit requirements can lead to unexpected financial burdens, particularly when budgeting for Tesla monthly payments.

Financial advisors must be vigilant and thorough in evaluating these offers to protect their clients’ interests, considering long-term costs of Tesla ownership. For more insights on car financing, check the FTC guidelines.

Strategic Steps to Evaluate 0% Tesla Financing Offers

Evaluating 0% Tesla financing offers requires a few key steps. Here are the main areas to focus on when considering Tesla financing options and comparing them to traditional auto loans.

- Analyze Total Cost of Ownership vs. Other Options: Break down all costs, conduct scenario analysis, and compare with other vehicles, including long-term costs of Tesla ownership.

- Assess Client’s Credit Score and Approval Odds: Evaluate credit history, check debt-to-income ratio, and use credit score simulators to understand credit score requirements for Tesla financing.

- Evaluate Impact on Client’s Overall Financial Plan: Assess financial goals, review liquidity needs, and stress-test the financial plan, considering budgeting for Tesla monthly payments and potential tax incentives for electric vehicle purchases.

Let’s dive into this electric vehicle investment analysis!

1: Analyze total cost of ownership vs. other options

Understanding the total cost of ownership is crucial when evaluating 0% Tesla financing offers for potential electric vehicle investments.

Actionable Steps:

- Break down all associated costs: Calculate maintenance, insurance, and potential depreciation for the Tesla Model Y, considering long-term costs of Tesla ownership.

- Conduct a scenario analysis: Create multiple financial scenarios to see how different economic conditions might impact the total cost when evaluating 0% Tesla financing offers.

- Compare with other vehicles: Benchmark the Tesla Model Y’s total cost against other electric and non-electric vehicles for a comprehensive EV loan comparison.

Key factors to consider in your analysis:

- Energy costs and efficiency

- Potential tax incentives for electric vehicle purchases

- Resale value projections

Explanation:

These steps matter because they provide a comprehensive view of the financial implications. By understanding the complete cost, you can help clients make more informed decisions when evaluating 0% Tesla financing offers.

For further guidance, refer to the FTC guidelines on car financing. Proper analysis ensures that clients are not caught off-guard by hidden costs or market changes when comparing Tesla financing options to traditional auto loans.

This thorough evaluation will prepare you for the next step: assessing your client’s credit score and approval odds for Tesla financing.

2: Assess client’s credit score and approval odds

Understanding your client’s credit score and approval odds is essential to navigate the complexities of 0% financing offers, especially when evaluating 0% Tesla financing offers.

Actionable Steps:

- Evaluate the client’s credit history: Review the client’s credit report to determine their likelihood of approval for the 0% financing deal, considering credit score requirements for Tesla financing.

- Check the client’s current debt-to-income ratio: Calculate the client’s debt-to-income ratio to ensure they can manage additional payments if economic conditions change, which is crucial when budgeting for Tesla monthly payments.

- Use a credit score simulator: Leverage tools like credit score simulators to predict how acquiring new debt might impact the client’s credit score, an important factor when comparing Tesla financing options to traditional auto loans.

Explanation:

These steps are crucial to ensure clients can handle the financial commitment without jeopardizing their overall financial health. By understanding their credit history and debt-to-income ratio, you can provide more accurate advice on zero-interest auto loans and long-term costs of Tesla ownership.

For more insights, refer to the AmerFirst guide on auto loan offers. Evaluating these aspects helps you anticipate potential challenges and make informed recommendations for electric vehicle investment analysis.

This detailed evaluation sets the stage for the next step: evaluating the impact on the client’s overall financial plan, including tax incentives for electric vehicle purchases.

3: Evaluate impact on client’s overall financial plan

Assessing the impact on your client’s overall financial plan is crucial for making an informed decision when evaluating 0% Tesla financing offers.

Actionable Steps:

- Assess short-term and long-term financial goals: Discuss with the client how the new Tesla purchase aligns with their financial goals, both short-term and long-term, considering EV loan comparison and electric vehicle investment analysis.

- Review liquidity needs: Ensure the client has sufficient liquidity to cover emergencies, even after acquiring the new Tesla, factoring in budgeting for Tesla monthly payments.

- Stress-test the financial plan: Perform stress tests on the client’s financial plan to see how it holds up under various economic conditions, including long-term costs of Tesla ownership.

Potential impacts on financial health:

- Changes in monthly cash flow due to Tesla financing options

- Adjustments to savings and investment strategies

- Effects on retirement planning and overall financial planning for Tesla purchase

Explanation:

These steps matter because they help ensure the financial stability of your clients. By aligning the Tesla purchase with their goals, reviewing liquidity, and stress-testing their plan, you can better safeguard their financial health while considering zero-interest auto loans and Tesla financing vs. traditional auto loans.

For additional insights, refer to the FTC guidelines on car financing. This thorough evaluation helps you make well-rounded recommendations, including consideration of tax incentives for electric vehicle purchases.

Now, let’s explore how Alleo can support you in this process of evaluating 0% Tesla financing offers.

Partner with Alleo to Navigate Financial Decisions

We’ve explored the complexities of evaluating 0% Tesla financing offers. Did you know you can work with Alleo to simplify this process of comparing Tesla financing options?

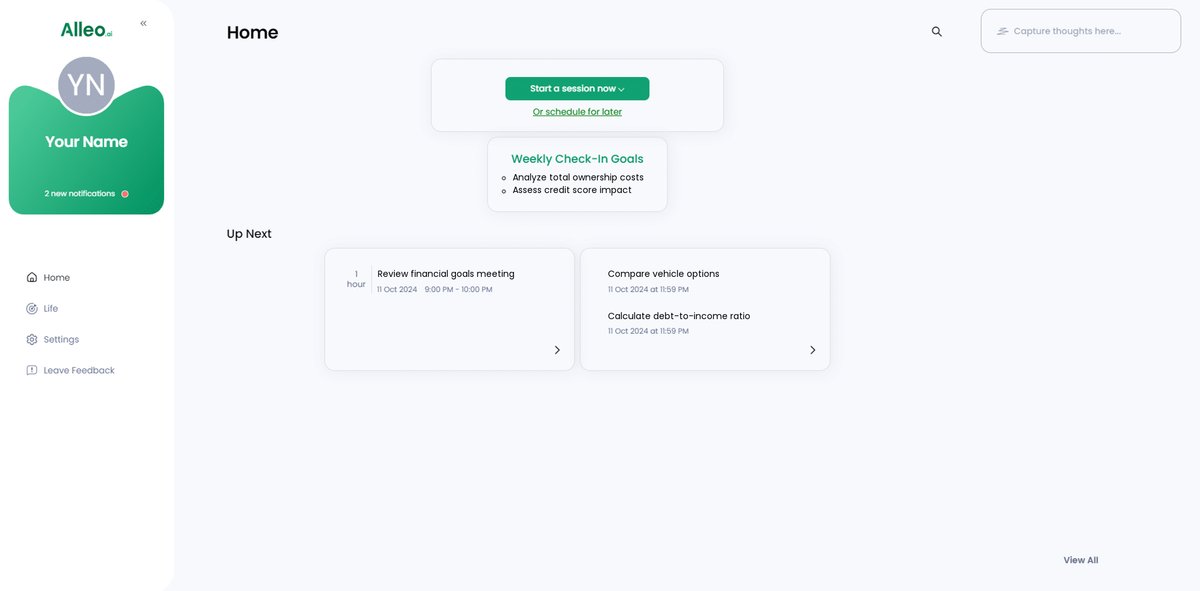

Set up an account and create a personalized plan. Alleo’s AI coach helps you evaluate financial decisions, including zero-interest auto loans and long-term costs of Tesla ownership, ensuring they align with your client’s goals.

The coach follows up on progress, manages changes, and keeps you accountable with text and push notifications, helping you stay on track with budgeting for Tesla monthly payments.

Ready to get started for free? Let me show you how to begin your electric vehicle investment analysis!

Step 1: Log In or Create Your Account

To start evaluating financial decisions with AI assistance, Log in to your account or create a new one on the Alleo platform.

Step 2: Choose Your Focus Area

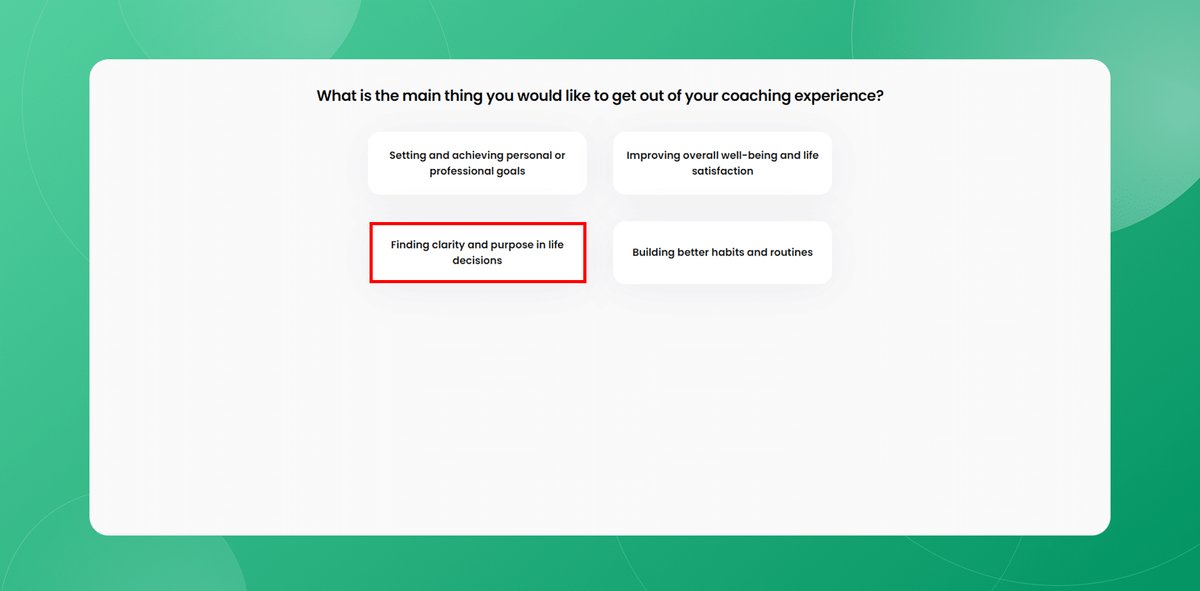

Select “Finding clarity and purpose in life decisions” to gain insights that will help you navigate complex financial choices, such as evaluating 0% Tesla financing offers, with greater confidence and alignment to your long-term goals.

Step 3: Selecting the life area you want to focus on

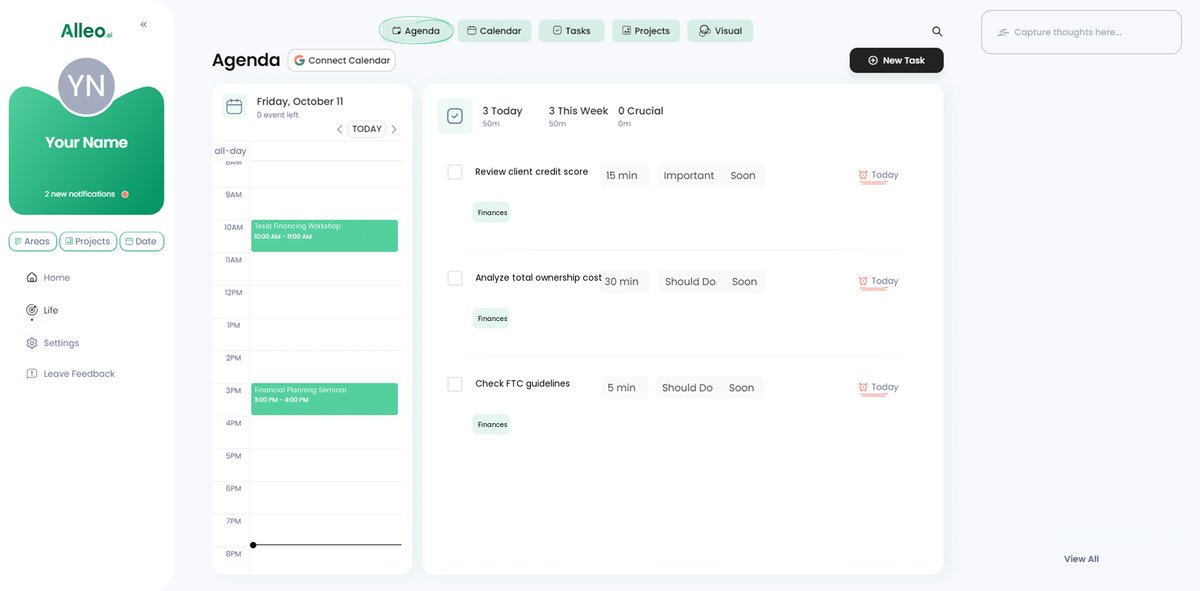

Choose “Finances” as your focus area to receive tailored guidance on evaluating complex financial decisions like 0% Tesla financing offers, ensuring you make informed choices that align with your overall financial goals and client needs.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session to discuss your financial advisory needs and set up a personalized plan for evaluating complex offers like Tesla’s 0% financing.

Step 5: Viewing and managing goals after the session

After your coaching session on evaluating 0% Tesla financing offers, check the Alleo app’s home page to view and manage the financial goals you discussed, ensuring you stay on track with your client’s overall financial plan.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important financial events and decisions, helping you stay on top of your client’s financial journey and ensuring you don’t miss crucial deadlines or opportunities.

Bringing It All Together: Making Informed Financial Decisions

You’ve seen how evaluating 0% Tesla financing offers requires careful analysis. These steps ensure you make well-informed decisions for your clients when considering Tesla financing options.

Remember, understanding the total cost of ownership, assessing credit score requirements for Tesla financing, and evaluating overall financial plans are crucial when comparing EV loan options.

You are not alone in this complex journey of analyzing long-term costs of Tesla ownership.

Alleo can help streamline this process, guiding you and your clients through each step of evaluating 0% Tesla financing offers.

With Alleo, you can confidently navigate financial decisions and build trust with your clients, whether comparing Tesla financing vs. traditional auto loans or considering zero-interest auto loans.

Start using Alleo today for smarter, informed financial advice on electric vehicle investment analysis.

Your clients’ financial health depends on it, including budgeting for Tesla monthly payments and understanding tax incentives for electric vehicle purchases.