How Financial Managers Can Navigate Conflicting Industry Advice in 4 Essential Steps

Are you feeling overwhelmed by navigating conflicting financial advice you encounter as a small business owner?

Imagine Sarah, a client who was paralyzed by contradictory guidance from textbooks and professionals on financial decision-making strategies.

As a life coach, I’ve helped many navigate these challenges in corporate finance best practices.

In my experience, the uncertainty of financial management strategies and investment portfolio diversification can be daunting.

In this article, you’ll learn how to evaluate source credibility, cross-reference reputable sources for economic forecasting techniques, and consult industry-specific experts on risk management in finance.

Let’s dive into resolving conflicting financial advice.

Understanding the Impact of Conflicting Financial Advice

Navigating conflicting financial advice can create significant challenges for small business owners. Many clients initially struggle with choosing the right financial decision-making strategies when different experts offer opposing views.

This confusion can lead to hesitation and missed opportunities in investment portfolio diversification.

For example, textbooks might emphasize conservative financial management, while industry professionals advocate for aggressive growth strategies in corporate finance best practices. This disparity leaves business owners uncertain about which path to follow when navigating conflicting financial advice.

The stakes are high. Misguided decisions can result in financial losses, stunted growth, or even business failure, highlighting the importance of risk management in finance.

It’s essential to address these conflicting messages to ensure sound financial management and regulatory compliance.

Key Steps to Navigate Conflicting Financial Advice

Overcoming this challenge of navigating conflicting financial advice requires a few key steps. Here are the main areas to focus on to make progress in financial decision-making strategies:

- Evaluate Source Credibility and Expertise: Verify the qualifications, background, and reliability of the sources, considering financial regulatory compliance.

- Cross-Reference Multiple Reputable Sources: Compare advice from various trusted sources and look for a consensus on industry trends analysis for managers.

- Consult Industry-Specific Financial Experts: Seek insights from certified professionals and participate in industry events to understand corporate finance best practices.

- Apply Context Analysis to Conflicting Advice: Understand the context of the advice and test it on a small scale, considering risk management in finance and investment portfolio diversification.

Let’s dive into these strategies for navigating conflicting financial advice!

1: Evaluate source credibility and expertise

Evaluating the credibility and expertise of sources is crucial for financial managers navigating conflicting financial advice and industry trends.

Actionable Steps:

- Verify the qualifications and background of the source.

- Measure: Check certifications, education, and professional experience in financial decision-making strategies.

- Assess the reputation and reliability of the source.

- Measure: Look for reviews, testimonials, and industry recognition in financial regulatory compliance.

- Analyze the consistency and track record of the advice provided.

- Measure: Compare past recommendations with actual outcomes in economic forecasting techniques.

Explanation:

These steps matter because they help ensure the advice you follow is both reliable and applicable to your situation when navigating conflicting financial advice.

Credibility checks and expert consultations reduce the risk of following misguided recommendations in corporate finance best practices. For further insights on evaluating expertise, you can refer to this LinkedIn article about navigating contradictory signals.

Key factors to consider when evaluating source credibility for conflicting financial advice resolution:

- Professional certifications and qualifications in risk management in finance

- Years of experience in investment portfolio diversification

- Publication history and peer reviews on financial technology adoption

By using these steps, you can confidently sift through conflicting advice and find strategies that work best for your business, improving stakeholder communication in finance.

2: Cross-reference multiple reputable sources

Cross-referencing multiple reputable sources is crucial for navigating conflicting financial advice and ensuring the accuracy and reliability of financial information.

Actionable Steps:

- Compile a diverse list of reputable sources.

- Measure: Use industry reports, academic journals, and trusted financial websites for industry trends analysis for managers.

- Compare and contrast advice from these sources.

- Measure: Create a comparison chart to highlight similarities and differences in financial decision-making strategies.

- Look for a consensus among credible sources.

- Measure: Note common recommendations and discard outliers for effective conflicting financial advice resolution.

Explanation:

These steps matter because they help you filter through conflicting advice, ensuring you follow the most reliable strategies for risk management in finance.

By cross-referencing sources, you reduce the risk of following misleading recommendations, which is crucial for navigating conflicting financial advice.

According to LibGuides, using multiple sources is essential for comprehensive financial analysis and economic forecasting techniques.

This thorough approach will enable you to make informed financial decisions and improve your investment portfolio diversification strategies.

3: Consult industry-specific financial experts

Consulting industry-specific financial experts is essential for navigating conflicting financial advice in financial management.

Actionable Steps:

- Schedule consultations with financial experts.

- Arrange meetings with certified financial planners or accountants for tailored advice on resolving conflicting financial advice.

- Attend industry workshops and seminars.

- Participate in events hosted by reputable financial institutions to gain deeper insights into industry trends analysis for managers.

- Join professional financial networks and forums.

- Engage with experts on platforms like LinkedIn or industry-specific groups for ongoing support in financial decision-making strategies.

Explanation:

These steps matter because they allow you to gather specialized knowledge and practical advice directly relevant to your industry, aiding in navigating conflicting financial advice.

Engaging with experts helps you stay updated on best practices and industry trends, including risk management in finance and financial regulatory compliance.

According to the AICPA-CIMA study, CFOs who consult with industry experts are more effective in strategic planning and decision-making.

Benefits of consulting industry-specific financial experts:

- Gain tailored advice for your unique business needs, including investment portfolio diversification

- Stay updated on the latest industry trends and regulations, enhancing economic forecasting techniques

- Access a network of professionals for ongoing support in corporate finance best practices

By following these steps, you can confidently navigate conflicting financial advice and make well-informed decisions for your business, including financial technology adoption and stakeholder communication in finance.

4: Apply context analysis to conflicting advice

Applying context analysis to conflicting financial advice is essential for tailoring financial strategies to your specific situation when navigating conflicting financial advice.

Actionable Steps:

- Evaluate the economic, regulatory, and market conditions at the time.

- Measure: Understand the environment in which the advice was given, considering economic forecasting techniques.

- Consider business size, industry, and financial goals.

- Measure: Assess the relevance of the advice to your own business context, incorporating industry trends analysis for managers.

- Test advice on a small scale before full implementation.

- Measure: Conduct pilot projects or simulations to gauge effectiveness, applying risk management in finance principles.

Explanation:

These steps matter because they ensure the financial decision-making strategies you follow are relevant and effective for your unique circumstances. By understanding the context, you can better align corporate finance best practices with your business needs.

According to LinkedIn, context analysis helps to navigate historical economic data accurately.

Key aspects of context analysis in financial decision-making:

- Current market trends and economic indicators

- Regulatory environment and financial regulatory compliance requirements

- Company-specific factors such as growth stage and resources

This approach will help you make informed decisions amidst conflicting financial advice, incorporating investment portfolio diversification and financial technology adoption where appropriate.

Partner with Alleo to Navigate Conflicting Financial Advice

We’ve explored the challenges of navigating conflicting financial advice and the steps to handle them. But did you know you can work with Alleo to simplify this journey and enhance your financial decision-making strategies?

Imagine Sarah used Alleo to sift through conflicting financial advice. She set up an account, created a personalized plan for risk management in finance, and received tailored coaching support to aid in resolving conflicting financial advice.

Alleo’s AI coach offers full coaching sessions, just like a human coach. It provides advice on navigating conflicting financial advice, follows up on your progress in financial regulatory compliance, and keeps you accountable via text and push notifications, helping you stay informed about industry trends analysis for managers.

You get all this with a free 14-day trial, no credit card required. It’s an excellent opportunity to explore economic forecasting techniques and investment portfolio diversification.

Ready to get started for free and improve your approach to navigating conflicting financial advice? Let me show you how!

Step 1: Log in or Create Your Account

To start navigating conflicting financial advice with Alleo’s AI coach, simply log in to your existing account or create a new one in just a few clicks.

Step 2: Choose Your Financial Management Goal

Select “Setting and achieving personal or professional goals” to focus on navigating conflicting financial advice and improving your business’s financial management strategies, aligning with your need to make informed financial decisions for your company’s success.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on navigating conflicting financial advice, helping you make informed decisions for your small business and achieve financial stability.

Step 4: Starting a coaching session

Begin your journey with Alleo by initiating an intake session, where you’ll discuss your financial management challenges and set up a personalized plan to navigate conflicting advice more effectively.

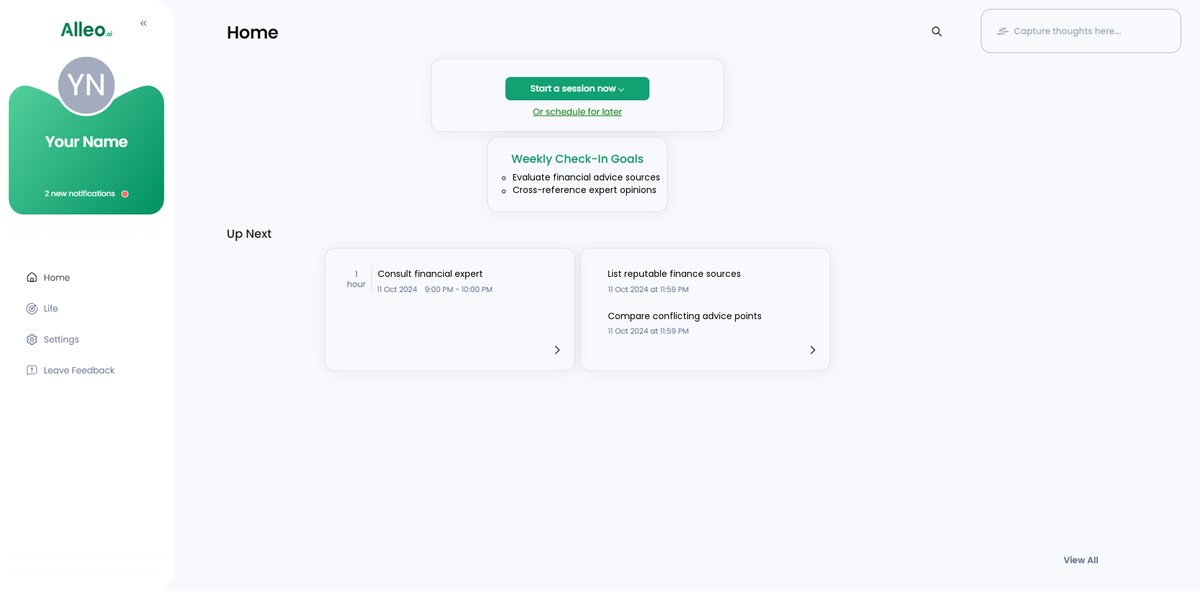

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app and check your home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your personalized plan.

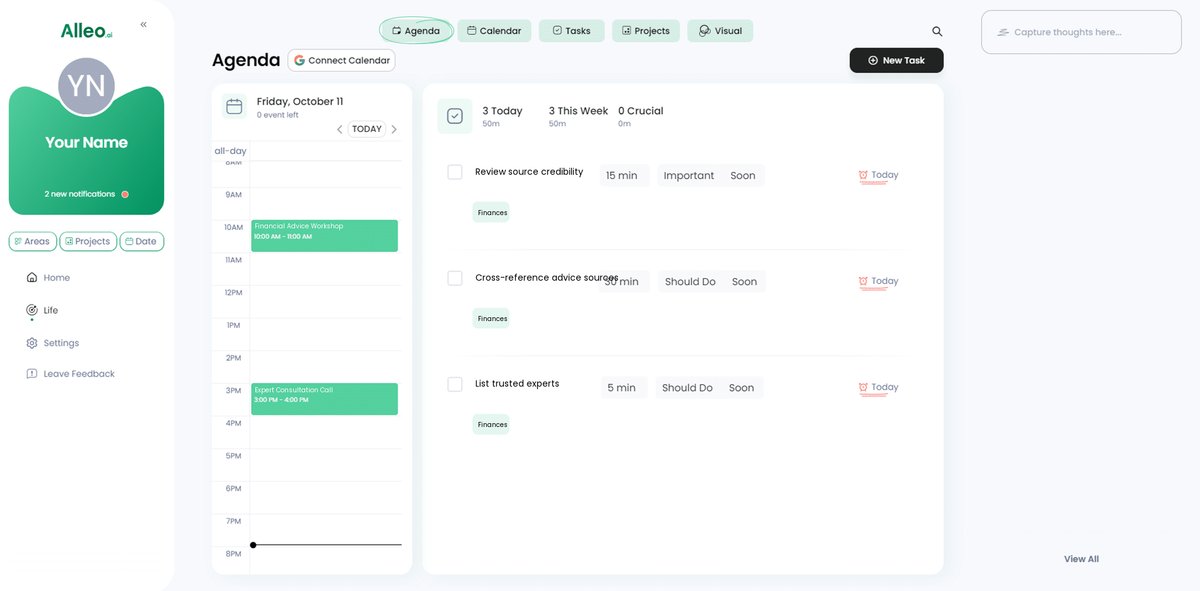

Step 6: Adding events to your calendar or app

To track your progress in navigating conflicting financial advice, use the Alleo app’s calendar and task features to add important events, deadlines, and milestones related to implementing your chosen strategies.

Bringing It All Together

Navigating conflicting financial advice can be overwhelming, especially for small business owners trying to implement effective financial decision-making strategies.

By evaluating source credibility, cross-referencing reputable sources, consulting industry-specific experts, and applying context analysis, you can make informed decisions when navigating conflicting financial advice. This approach aids in risk management in finance and ensures compliance with financial regulatory requirements.

Remember, you’re not alone in this journey of resolving conflicting financial advice.

Alleo is here to support you with personalized coaching and tailored financial strategies, helping you stay abreast of industry trends analysis for managers.

Take control of your financial management with the right tools and insights, including economic forecasting techniques and investment portfolio diversification.

You can confidently manage your finances despite conflicting advice, adhering to corporate finance best practices.

Try Alleo for free and experience the difference firsthand in financial technology adoption and stakeholder communication in finance.

Let’s get started together on navigating conflicting financial advice.