How Freelancers Can Calculate Billable Hours for Target Income: 4 Essential Steps

Are you struggling to determine the right hourly rate to achieve your desired annual income as a freelancer? Calculating freelance billable hours is a crucial skill for setting profitable rates and meeting your income goals.

As a life coach, I’ve guided many freelancers through the intricacies of setting their rates effectively. I often see the same challenges pop up: underestimating non-billable hours and not accounting for all expenses. Effective freelance time tracking and understanding the distinction between billable vs non-billable hours are key to accurate hourly rate calculation.

In this article, you’ll learn how to calculate your billable hours accurately and set profitable rates. We’ll cover practical steps and tools you can use right away for freelance income planning and time management for freelancers. These strategies will help you with freelance business budgeting and maintaining work-life balance as a freelancer.

Let’s dive in and explore how calculating freelance billable hours can transform your freelance career.

Why Setting the Right Rate is Crucial

Many freelancers underestimate non-billable hours and don’t account for all expenses when calculating freelance billable hours. Inaccurate rate setting can destabilize finances and hinder business growth.

I’ve seen clients struggle with low profits despite high workloads, often due to poor freelance time tracking.

Misjudging costs and time can lead to stress and burnout. You might find yourself overworked and underpaid, struggling with work-life balance for freelancers.

It’s essential to avoid these pitfalls to maintain a healthy business and achieve your income goals for freelancers.

From my experience, structured approaches make all the difference. You need to accurately calculate billable hours and set a profitable hourly rate calculation.

Let’s explore how to achieve this together, focusing on effective freelance income planning.

Mastering Your Freelance Rates: A Step-by-Step Guide

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in calculating freelance billable hours and setting your rates.

- Calculate Total Available Work Hours Per Year: Identify your working days and hours to determine your total work hours, essential for freelance time tracking.

- Determine Target Annual Income and Expenses: List all personal and business expenses, and set income goals for freelancers to ensure proper freelance business budgeting.

- Estimate Percentage of Billable vs. Non-Billable Time: Track and analyze your time to find the balance between billable and non-billable hours, crucial for freelance productivity.

- Divide Target Income by Billable Hours for Rate: Use your data to calculate an hourly rate that meets your financial goals, considering project-based pricing strategies as well.

Let’s dive in to master the art of calculating freelance billable hours and optimizing your freelance income planning!

1: Calculate total available work hours per year

Understanding your total available work hours is the first step in calculating freelance billable hours and setting a profitable rate.

Actionable Steps:

- Mark non-working days: Use a calendar to identify holidays and planned vacations for effective freelance time tracking.

- Deduct non-working days: Subtract these from the total number of days in the year to determine billable vs non-billable hours.

- Calculate work hours: Multiply the remaining days by your daily work hours for accurate hourly rate calculation.

Explanation:

These steps help you determine your actual working time, which is crucial for accurate rate setting and freelance income planning.

Knowing your available work hours allows for better planning and achievable income goals for freelancers. For more on this, check out this guide on calculating billable hours.

Key benefits of calculating your work hours:

- Improved time management for freelancers

- More accurate project estimates for project-based pricing strategies

- Better work-life balance for freelancers

Next, we will look at determining your target annual income and expenses for effective freelance business budgeting.

![]()

2: Determine target annual income and expenses

To set a profitable rate when calculating freelance billable hours, it’s vital to determine your target annual income and expenses.

Actionable Steps:

- List all expenses: Include personal and business costs like taxes, insurance, and software subscriptions for effective freelance business budgeting.

- Set a target income: Ensure it covers all expenses and includes a profit margin, aligning with your income goals for freelancers.

- Adjust for flexibility: Build a buffer for unexpected costs and financial stability, considering both billable vs non-billable hours.

Explanation:

These steps help you understand your financial needs and set realistic income goals for freelance income planning.

A thorough expense list ensures you don’t miss crucial costs when calculating freelance billable hours. For more insights, check out this guide on billable hours best practices.

Next, we will estimate the percentage of billable vs. non-billable time for effective freelance time tracking.

3: Estimate percentage of billable vs. non-billable time

Understanding the balance between billable and non-billable hours is essential for calculating freelance billable hours and setting accurate rates.

Actionable Steps:

- Track your time: Use time tracking software like Toggl or Harvest for at least a month to see where your time goes. This freelance time tracking helps in income planning for freelancers.

- Analyze your data: Review your tracked time to calculate the average percentage of billable hours, which is crucial for hourly rate calculation.

- Set improvement goals: Identify non-billable tasks you can reduce or streamline to increase billable hours and improve freelance productivity.

Explanation:

These steps help you gain insights into your work patterns and optimize your time management for freelancers. By tracking and analyzing your time, you’ll identify areas for improvement in calculating freelance billable hours.

For more insights, check out this guide on billable hours best practices.

Common non-billable activities to monitor when calculating freelance billable hours:

- Administrative tasks

- Marketing and networking

- Professional development

Next, we will look at dividing your target income by billable hours to determine your rate, an essential step in freelance business budgeting.

4: Divide target income by billable hours for rate

Calculating freelance billable hours is crucial to ensure your freelance business is profitable and sustainable.

Actionable Steps:

- Calculate total billable hours: Use freelance time tracking data to find your total billable hours for the year.

- Divide target income by billable hours: Break your income goals for freelancers by the total billable hours to get your hourly rate calculation.

- Adjust based on market research: Compare your rate with industry standards to ensure competitiveness.

Explanation:

These steps ensure your hourly rate covers all expenses and meets your freelance income planning goals. Accurate calculations help avoid undercharging and overworking.

For more detailed guidance, check out this guide on calculating billable hourly rates.

Factors that may influence your rate:

- Experience level

- Industry demand

- Geographic location

Next, we will explore how Alleo can assist you in achieving your income goals and improving time management for freelancers.

Optimize Your Freelance Business with Alleo

We’ve explored the challenges of calculating freelance billable hours and setting your rates. But did you know you can work directly with Alleo to make this journey easier and faster?

Alleo’s AI coach offers affordable, tailored coaching support for setting profitable rates and managing your freelance time tracking. Start with a free 14-day trial, no credit card required.

Set up an account, create a personalized plan for your income goals as a freelancer, and let Alleo guide you. The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, helping you balance billable vs non-billable hours.

Ready to get started for free?

Let me show you how!

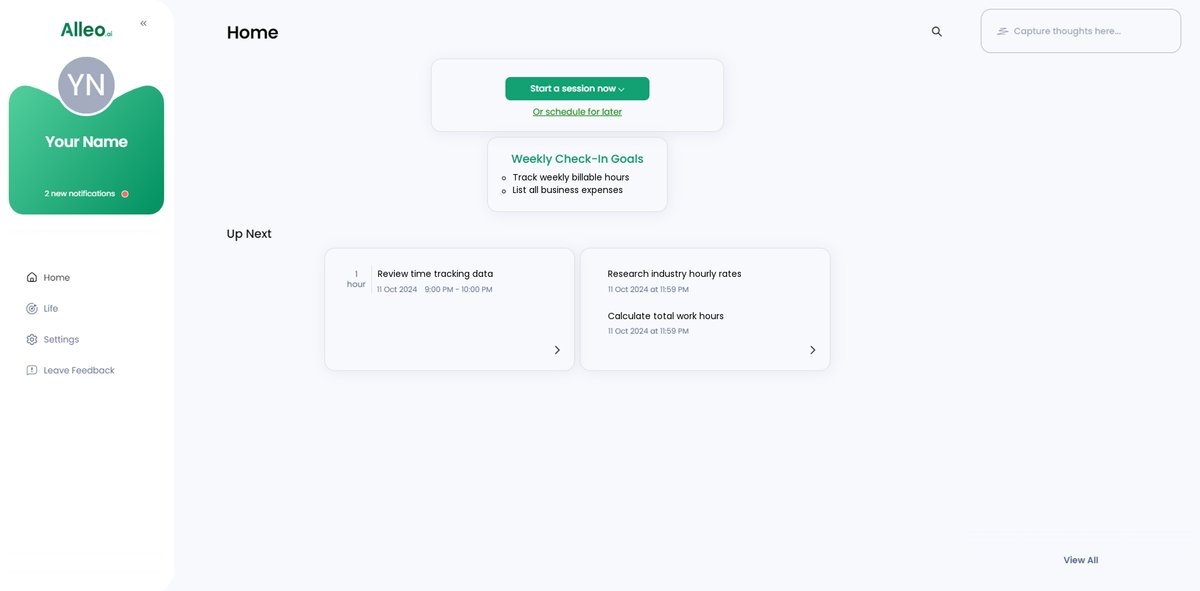

Step 1: Log In or Create Your Account

To start optimizing your freelance rates with Alleo’s AI coach, log in to your existing account or create a new one to begin your free 14-day trial.

Step 2: Choose Your Goal – Setting Profitable Freelance Rates

Select “Setting and achieving personal or professional goals” from the options provided, then specify “Setting profitable freelance rates” as your focus area to align with the strategies discussed in this article and start working towards financial stability in your freelance career.

Step 3: Select ‘Finances’ as Your Focus Area

Choose ‘Finances’ as your focus area in Alleo to receive tailored guidance on setting profitable freelance rates and achieving your income goals, aligning perfectly with the challenges discussed in this article.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your freelance rate-setting goals and create a personalized plan to achieve your target income.

5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to review and manage the goals you discussed, helping you stay on track with implementing your new freelance rate strategy.

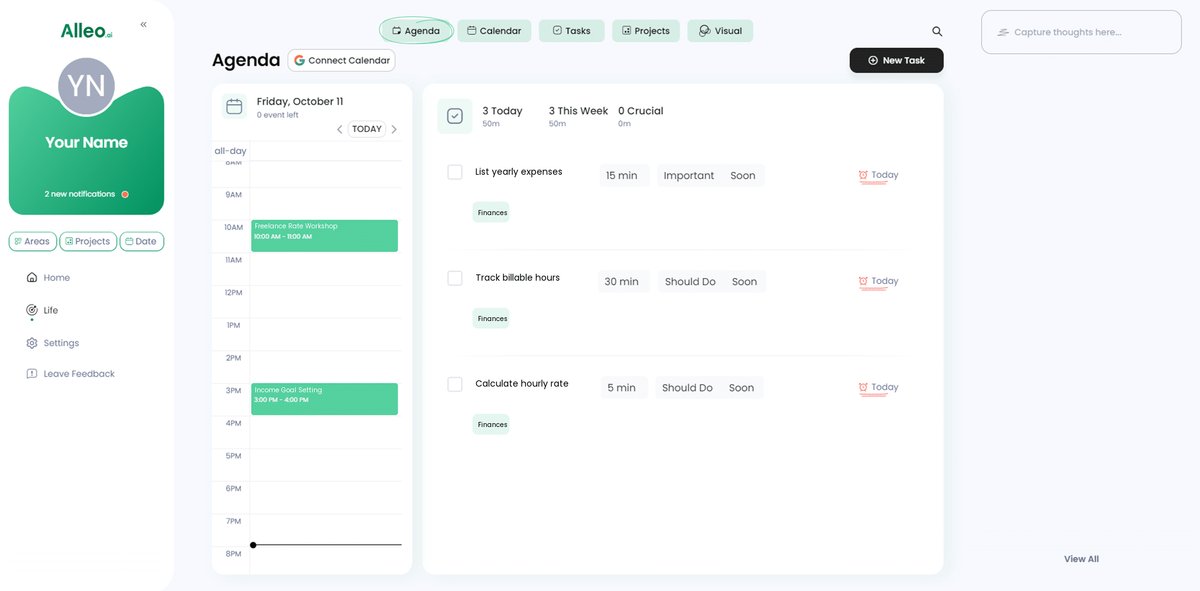

Step 6: Adding Events to Your Calendar or App

Use the calendar and task features in Alleo to track your progress on setting profitable freelance rates, allowing you to easily schedule time for rate calculations, expense tracking, and client work while monitoring your journey towards achieving your income goals.

Take Control of Your Freelance Future

You’ve learned the critical steps to set profitable rates and understand the importance of calculating freelance billable hours. By following these actionable steps, you can avoid common pitfalls and achieve your income goals for freelancers.

Remember, setting the right rate isn’t just about numbers; it’s about valuing your time and work. You’ve got the tools and insights needed to make informed decisions, including hourly rate calculation and project-based pricing strategies.

As you implement these strategies, consider leveraging Alleo’s AI coach to guide you. With Alleo, setting and achieving your freelance income planning becomes easier and more structured, helping you balance billable vs non-billable hours.

Don’t wait—start taking control of your financial future today. You deserve it, and with proper time management for freelancers, you can achieve the work-life balance you desire.