How Professionals Can Evaluate a Pay Cut for Better Work-Life Balance in 6 Steps

Are you constantly weighing the benefits of a high salary against the need for a fulfilling personal life? Evaluating a pay cut for balance can be a challenging decision for many professionals.

As a life coach, I’ve helped many professionals navigate these challenging decisions. I understand the fear of leaving money on the table when considering work-life balance benefits.

In this article, you’ll learn how to evaluate a potential pay cut for better work-life balance. We’ll cover practical strategies, benefits, and tools to help you make an informed decision, including salary negotiation strategies and job satisfaction factors.

Let’s dive into evaluating pay cut for balance and explore professional growth opportunities.

The High Pay vs. Quality of Life Dilemma

Balancing a high salary with a fulfilling personal life is a common struggle. Many corporate executives face the dilemma of choosing between financial security and personal happiness when evaluating pay cut for balance.

I often see clients initially struggle with the decision to take a pay cut. It’s not just about the money but also the fear of losing status and security, which are key job satisfaction factors.

For instance, a high-earning executive might consider a significant pay cut to regain personal time. This choice can feel daunting, especially when financial obligations loom large, necessitating careful financial planning for pay cuts.

Anecdotally, several clients report burnout and contemplate pay cuts as a solution. They seek more time for family, hobbies, and mental well-being, highlighting the work-life balance benefits.

It’s a tough choice, but with the right approach, it’s manageable. Let’s explore how to navigate this decision effectively, considering career development vs. pay cut options.

Steps to Evaluate a Pay Cut for Better Work-Life Balance

Overcoming this challenge requires a few key steps. Here are the main areas to focus on when evaluating a pay cut for balance and making progress.

- Calculate minimum required income for expenses: Create a detailed budget to understand essential expenses and aid in financial planning for pay cuts.

- Assess current work-life balance satisfaction: Reflect on your current situation and identify areas of imbalance to improve job satisfaction factors.

- List non-monetary benefits of potential new role: Evaluate flexible work arrangements, remote work options, and company culture that may contribute to stress reduction in the workplace.

- Quantify the value of additional free time: Determine the monetary value of your free time and calculate its total value, considering time management skills and work-life balance benefits.

- Explore alternative work arrangements: Investigate flexible work options within your current role as part of your salary negotiation strategies.

- Consult with financial advisor on long-term impact: Discuss the impact of a pay cut on long-term financial goals and perform a cost-benefit analysis of job offers.

Let’s dive in to further explore evaluating a pay cut for balance!

1: Calculate minimum required income for expenses

Understanding your minimum required income for expenses is crucial when evaluating a pay cut for balance in your work life.

Actionable Steps:

- Create a detailed budget: Use a budgeting app or spreadsheet to track monthly expenses.

- Identify essential expenses versus discretionary spending: Categorize each expense and find areas where you can cut back.

- Calculate the minimum income needed: Sum up essential expenses to determine your baseline income requirement.

Explanation: Knowing your minimum required income helps you make informed decisions about a potential pay cut. By accurately tracking your expenses, you can confidently evaluate if a lower salary will still cover your needs while considering work-life balance benefits.

According to Randstad, 52 percent of workers would accept a pay cut to improve their quality of life.

Key areas to focus on when calculating expenses:

- Housing costs (rent/mortgage, utilities)

- Transportation expenses

- Food and groceries

- Healthcare and insurance

This clarity sets the foundation for assessing other factors like work-life balance and job satisfaction when evaluating a pay cut for balance in your career.

2: Assess current work-life balance satisfaction

Evaluating your current work-life balance is crucial when considering a pay cut for better quality of life. This step is essential in evaluating pay cut for balance.

Actionable Steps:

- Reflect on your current work-life balance: Keep a daily journal to log work hours, stress reduction in the workplace, and personal time.

- Use a work-life balance assessment tool: Complete an online survey or self-assessment to measure your satisfaction and job satisfaction factors.

- Identify areas of imbalance: Highlight specific aspects of your life that are lacking due to work demands, considering work-life balance benefits.

Explanation: Evaluating your work-life balance helps you understand the areas that need improvement. This step is essential to make informed decisions about potential changes and career development vs. pay cut considerations.

By logging your experiences and using assessment tools, you can pinpoint the exact issues affecting your well-being. According to Doradaar, understanding these imbalances is key to negotiating better work arrangements and exploring flexible work arrangements.

Reflecting on your current balance paves the way for exploring new opportunities and conducting a cost-benefit analysis of job offers. Let’s move on to evaluating non-monetary benefits of potential new roles.

3: List non-monetary benefits of potential new role

Identifying the non-monetary benefits of a potential new role is crucial when evaluating a pay cut for balance and improved work-life balance.

Actionable Steps:

- Research the new role’s non-monetary benefits: Speak with current employees or read company reviews to gather insights on work-life balance benefits.

- Evaluate benefits such as flexibility, remote work, and company culture: Create a pros and cons list for each benefit, considering flexible work arrangements.

- Consider long-term career development vs. pay cut: Map out potential career paths and professional growth opportunities.

Explanation: Understanding the non-monetary benefits of a new role helps you make an informed decision when evaluating a pay cut for balance. Benefits like flexibility and positive company culture can significantly improve work-life balance and job satisfaction factors.

According to Achievers, flexible work options are essential for attracting and retaining talent. This insight allows you to weigh the overall value of the new role beyond just salary when considering salary negotiation strategies.

Key non-monetary benefits to consider:

- Flexible working hours

- Professional development opportunities

- Positive work environment for stress reduction in the workplace

Taking these steps will provide a clearer picture of how the new role can improve your overall well-being and aid in financial planning for pay cuts.

4: Quantify the value of additional free time

Understanding the value of additional free time is essential when evaluating a pay cut for balance and improved work-life balance.

Actionable Steps:

- Estimate the amount of additional free time the new role would provide: Compare your current work hours with the expected hours in the new role, considering flexible work arrangements.

- Assign a monetary value to your free time: Determine how much your free time is worth based on personal preferences, opportunities, and job satisfaction factors.

- Calculate the total value of additional free time: Multiply the additional free time by the monetary value you assigned as part of your cost-benefit analysis of job offers.

Explanation: These steps help you understand the tangible work-life balance benefits of a new role’s free time.

According to VA Whole Health Library, work-life balance involves time balance, satisfaction balance, and involvement balance across different life activities.

Quantifying this value allows you to make a well-informed decision about evaluating a pay cut for balance, considering both career development vs. pay cut aspects.

This understanding will guide you in assessing the overall impact on your quality of life, including potential stress reduction in the workplace and professional growth opportunities.

5: Explore alternative work arrangements

Exploring alternative work arrangements can help you maintain your income while improving work-life balance when evaluating a pay cut for balance.

Actionable Steps:

- Propose a hybrid or remote work schedule: Approach your employer with a well-thought-out plan for working from home part-time, considering flexible work arrangements.

- Discuss part-time or reduced hours: Talk to your manager about the possibility of shifting to a part-time role as part of your salary negotiation strategies.

- Identify job-sharing opportunities: Find a colleague who might be interested in job-sharing and present the idea to HR, focusing on job satisfaction factors.

Explanation: These steps allow you to explore options that can provide flexibility without a significant pay cut, balancing career development vs. pay cut considerations.

According to Stanford, hybrid work models improve employee retention and productivity. By considering these alternatives, you can find a balance that supports both your career and personal life while evaluating pay cut for balance.

Benefits of alternative work arrangements:

- Increased job satisfaction

- Better work-life integration

- Reduced commute time and costs

Exploring these options can lead to a more balanced and fulfilling professional experience, contributing to stress reduction in the workplace and improved time management skills.

6: Consult with financial advisor on long-term impact

Understanding the long-term financial implications when evaluating a pay cut for balance is vital for making an informed decision.

Actionable Steps:

- Schedule a meeting with a financial advisor: Gather your financial documents and prepare questions to discuss, including financial planning for pay cuts.

- Discuss the impact on long-term financial goals: Review your retirement plans, savings, and investments with the advisor, considering work-life balance benefits.

- Develop a financial plan to accommodate the pay cut: Create a strategy for managing finances with the reduced income, focusing on career development vs. pay cut considerations.

Explanation: These steps ensure you understand how a pay cut will affect your financial future and job satisfaction factors.

Consulting a financial advisor helps you make a well-informed decision that aligns with your long-term goals and professional growth opportunities.

According to Randstad, evaluating financial stability is crucial before considering a pay cut for mental health reasons or stress reduction in the workplace.

This thorough evaluation will help you confidently move forward with your decision when evaluating a pay cut for balance.

Partner with Alleo on Your Work-Life Balance Journey

We’ve explored the challenges of evaluating a pay cut for better work-life balance and the benefits it can bring. But did you know you can work directly with Alleo to make this decision easier and faster when evaluating a pay cut for balance?

Alleo’s Role:

Step 1: Use Alleo to set and track financial goals.

- Input expenses and savings goals into Alleo for personalized advice on financial planning for pay cuts.

Step 2: Utilize Alleo’s scheduling feature to plan a balanced work-life routine.

- Schedule work, personal time, and hobbies using Alleo’s planner to improve time management skills.

Step 3: Get decision-making support from Alleo’s AI coach.

- Use Alleo’s decision-making tools to weigh the pros and cons of the pay cut, including work-life balance benefits and job satisfaction factors.

How to Get Started:

1. Set up your account: Sign up for a free 14-day trial—no credit card required.

2. Create a personalized plan: Alleo’s AI coach will guide you through setting up your goals, including stress reduction in the workplace and professional growth opportunities.

3. Work with Alleo’s coach: Receive tailored advice, follow-ups, and accountability via text and push notifications to help with salary negotiation strategies and evaluating pay cut for balance.

Ready to get started for free? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards better work-life balance, log in to your existing Alleo account or create a new one to access personalized guidance and tools for evaluating potential pay cuts.

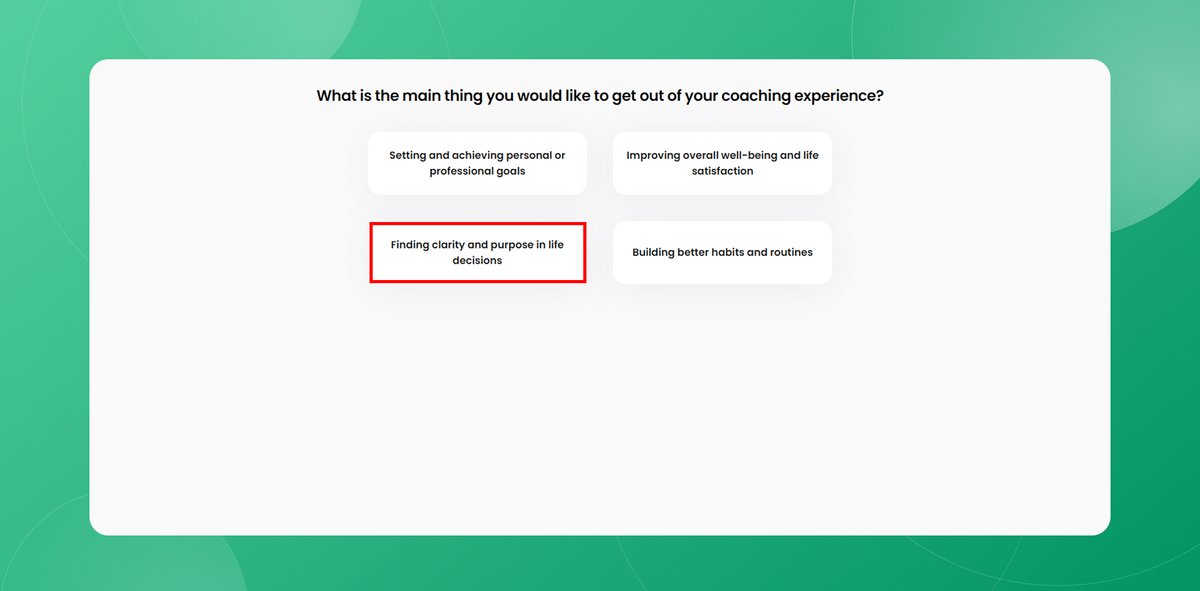

Step 2: Choose Your Work-Life Balance Goal

Select “Finding clarity and purpose in life decisions” to gain insights on evaluating a potential pay cut for better work-life balance, helping you make an informed choice that aligns with your personal and professional aspirations.

Step 3: Select “Personal” as Your Focus Area

Choose “Personal” as your focus area in Alleo to address work-life balance concerns, allowing the AI coach to provide tailored strategies for improving your quality of life while considering potential pay cuts.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll work with your AI coach to create a personalized plan for evaluating your work-life balance and potential pay cut decisions.

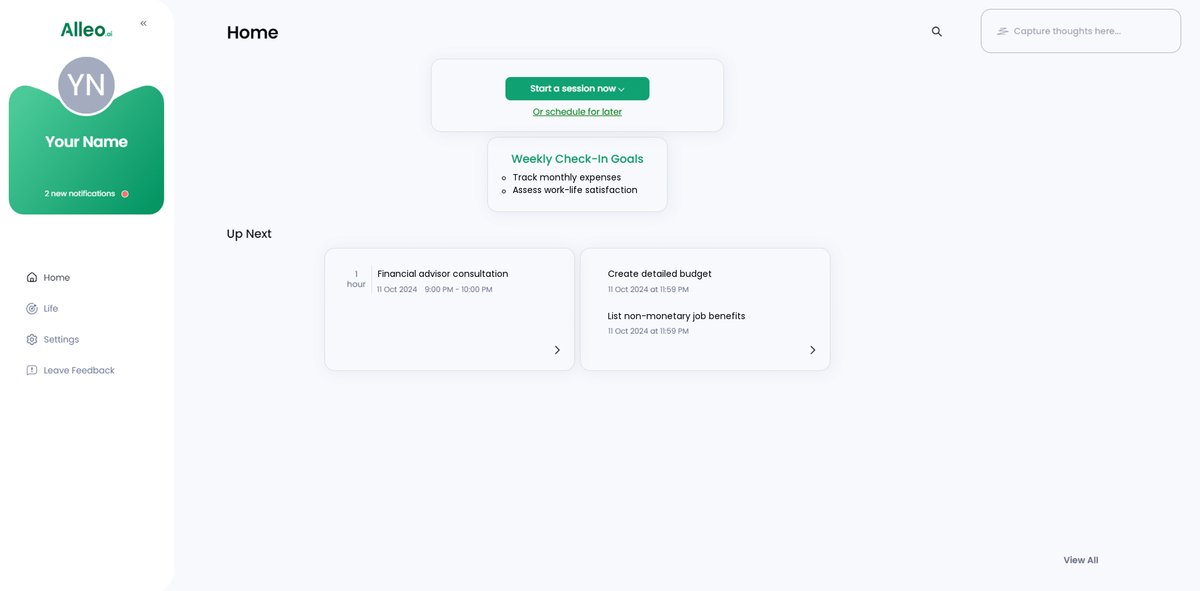

Step 5: Viewing and managing goals after the session

After your coaching session on work-life balance and potential pay cuts, check the Alleo app’s home page to review and manage the personalized goals you discussed, ensuring you stay on track with your financial and lifestyle objectives.

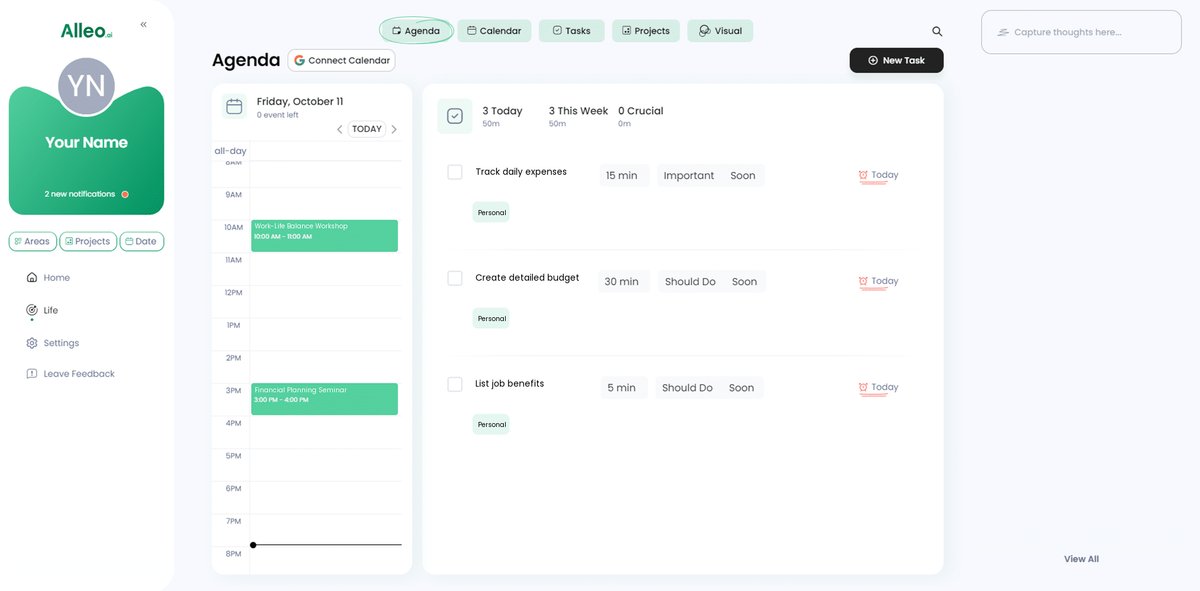

Step 6: Adding events to your calendar or app

Use Alleo’s calendar feature to schedule and track work hours, personal time, and activities that contribute to your improved work-life balance, allowing you to visually monitor your progress in achieving a better equilibrium between your professional and personal life.

Final Thoughts on Balancing Pay and Personal Life

Evaluating a pay cut for balance is a tough decision, but it can lead to a more fulfilling life. We’ve explored various steps to help you thoughtfully assess this choice, including salary negotiation strategies and cost-benefit analysis of job offers.

Remember, your well-being is crucial. Prioritizing work-life balance can improve your overall happiness and health. Stress reduction in the workplace and flexible work arrangements are key factors in job satisfaction.

Consider using Alleo to support your journey. It offers tools to manage finances, plan your time, and make informed decisions about career development vs. pay cut scenarios.

Take the first step today. Sign up for your free 14-day trial and see how Alleo can make this transition smoother, enhancing your time management skills and financial planning for pay cuts.

Your balanced, fulfilling life awaits. You can achieve it through professional growth opportunities and a focus on work-life balance benefits.