How to Balance Financial Priorities as an Overwhelmed Parent: A Comprehensive Guide

Are you a recent college graduate trying to manage your student loan debt while also navigating the financial demands of parenthood? Managing finances as new parents can be challenging, especially when balancing work-life and financial stability.

As a life coach, I’ve helped many clients like you balance their financial priorities. I understand how overwhelming it can be to juggle multiple financial responsibilities, including prioritizing expenses as a parent.

In this blog, I’ll guide you through actionable steps to create a prioritized financial goals list, set up an automated budgeting system for busy parents, schedule weekly family money talks, and explore income-based loan repayment options. These strategies will help with managing family finances and debt reduction for families.

Let’s dive in.

The Overwhelming Financial Juggle

Managing finances as new parents while navigating student loan debt and family expenses is an uphill battle. Many clients initially struggle to balance immediate needs with long-term goals, leading to stress and anxiety. Budgeting tips for busy parents become crucial in this scenario.

For instance, one parent shared how the pressure to save for their child’s education while paying off loans left them feeling stretched thin. This financial strain often impacts mental health and family harmony. Work-life balance and financial stability can become challenging to maintain.

Addressing these issues requires a strategic approach to managing family finances. Understanding the root causes and acknowledging the stress they bring is the first step towards finding solutions. Financial planning for overwhelmed parents often involves prioritizing expenses and exploring time-saving money management techniques.

Key Steps to Balance Your Financial Priorities

Overcoming this challenge requires a few key steps for managing finances as new parents. Here are the main areas to focus on to make progress:

- Create a prioritized financial goals list: List, rank, and align financial goals with family values, focusing on budgeting tips for busy parents.

- Set up an automated budgeting system: Choose a tool, automate savings, and review monthly to aid in managing family finances.

- Schedule weekly family money talks: Set regular meetings, create agendas, and encourage communication about saving money with kids.

- Explore income-based loan repayment options: Research plans, contact servicers, and apply for the best option as part of debt reduction strategies for families.

Let’s dive in to these time-saving money management techniques!

1: Create a prioritized financial goals list

Creating a prioritized financial goals list is essential to balance your financial priorities effectively when managing finances as new parents.

Actionable Steps:

- Write down every financial goal: Include goals like paying off student loans and saving for your child’s education.

- Rank these goals by urgency and impact: Prioritize expenses as a parent based on their importance and how they affect your financial health.

- Discuss with family: Ensure everyone is aligned by having a discussion and creating a shared vision board for managing family finances.

Key benefits of prioritizing your financial goals:

- Improved focus on what matters most

- Better allocation of financial resources

- Reduced financial stress for the family

Explanation:

These steps are vital because they help you focus on what matters most and ensure your family is on the same page. By prioritizing goals, you can allocate resources more efficiently and reduce financial stress.

According to research from the Family Stress Model, financial strain can impact mental health and family relationships, so addressing these priorities is crucial.

This foundation will guide you toward financial stability and harmony.

2: Set up an automated budgeting system

Setting up an automated budgeting system is crucial for managing finances as new parents efficiently.

Actionable Steps:

- Choose a budgeting tool: Research and select a budgeting app that suits your needs for managing family finances.

- Automate savings and bill payments: Schedule automatic transfers to savings accounts and bill payments, aiding in debt reduction strategies for families.

- Review and adjust monthly: Set a monthly date to review your budget and make necessary adjustments, prioritizing expenses as a parent.

Explanation:

These steps matter because they simplify budgeting, reduce the risk of missed payments, and ensure consistent savings. Automating your finances can help you stay on track and reduce stress, supporting work-life balance and financial stability.

According to a study by the Yale Tobin Center for Economic Policy, financial planning improves family financial trajectories. This foundation will guide you towards financial stability and harmony.

By automating your budget, you can focus more on your family and less on financial worries, implementing time-saving money management techniques for managing finances as new parents.

3: Schedule weekly family money talks

Regular family money talks are vital for managing finances as new parents and maintaining financial transparency and teamwork.

Actionable Steps:

- Set a consistent meeting time: Pick a day and time each week to discuss finances and budgeting tips for busy parents.

- Prepare an agenda: List topics such as upcoming expenses, savings, and debt reduction strategies for families to cover during the meeting.

- Foster open communication: Create a safe space for family members to share concerns and ideas about managing family finances.

Tips for successful family money talks:

- Keep meetings short and focused

- Involve all family members, including children, in financial planning for overwhelmed parents

- Celebrate financial wins together, such as progress on saving money with kids

Explanation:

These steps are essential because they encourage financial communication and teamwork. Consistent meetings ensure everyone is informed and aligned with family financial goals, including prioritizing expenses as a parent.

According to Generations College, open communication is crucial for balancing various commitments effectively, including work-life balance and financial stability.

This practice will help your family stay financially coordinated and reduce misunderstandings, which is crucial for managing finances as new parents.

4: Explore income-based loan repayment options

Exploring income-based loan repayment options is crucial for managing student loan debt effectively, especially when managing finances as new parents.

Actionable Steps:

- Research available plans: Investigate income-driven repayment plans and other options to find the best fit for your situation, considering your family finances.

- Contact your loan servicers: Reach out to your loan servicers to discuss your options and gather detailed information for better financial planning.

- Apply for the best plan: Complete and submit the application for the repayment plan that suits your needs and helps with debt reduction strategies for families.

Benefits of income-based repayment plans:

- Lower monthly payments based on income, aiding in budgeting tips for busy parents

- Potential loan forgiveness after a set period, helping with saving money with kids

- Flexibility to adjust as your income changes, supporting work-life balance and financial stability

Explanation:

These steps matter because they can significantly reduce your monthly payments and ease financial stress. Income-based plans adjust payments according to your income, which helps balance other financial priorities when managing finances as new parents.

According to the Student Debt Crisis Center, understanding and utilizing these options can offer substantial relief.

Taking these steps will help you manage your student loans more effectively and reduce your financial burden, allowing you to prioritize expenses as a parent and potentially build an emergency fund for parent households.

Partner with Alleo on Your Financial Journey

We’ve explored managing finances as new parents and balancing financial priorities as an overwhelmed parent. Did you know Alleo can make this journey easier and faster for busy parents managing family finances?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your financial situation, including budgeting tips for busy parents and debt reduction strategies for families.

Alleo’s AI coach provides affordable, tailored coaching support for financial planning for overwhelmed parents.

The coach monitors your progress and adjusts plans as needed, helping with prioritizing expenses as a parent. Alleo keeps you accountable with text and push notifications, offering time-saving money management techniques.

Ready to get started for free? Let me show you how to begin managing finances as new parents!

Step 1: Log In or Create Your Account

To begin your journey towards financial balance, log in to your existing Alleo account or create a new one to access personalized guidance from our AI coach.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a structured approach for managing your finances, which will help you balance student loan payments with family expenses more effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on managing student loans, budgeting for family expenses, and achieving your financial goals as a new parent.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized financial plan tailored to your unique situation as a parent managing student loans and family expenses.

Step 5: Viewing and Managing Goals After the Session

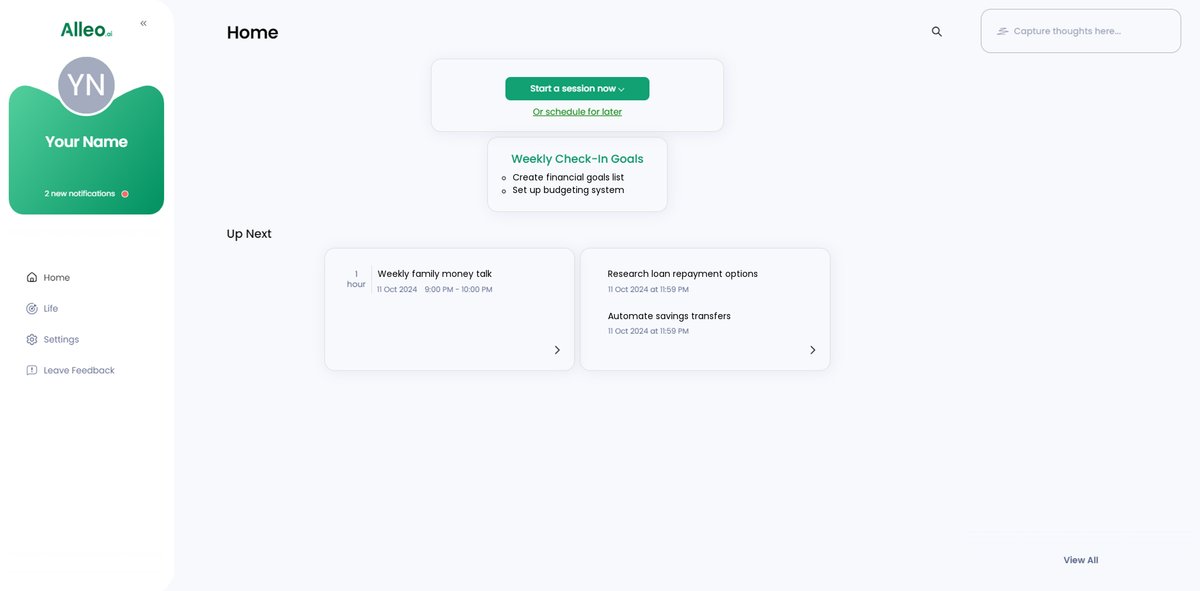

After your coaching session, open the Alleo app to find your discussed financial goals displayed on the home page, allowing you to easily track and adjust your priorities as you work towards balancing your student loan payments and family expenses.

Step 6: Adding events to your calendar or app

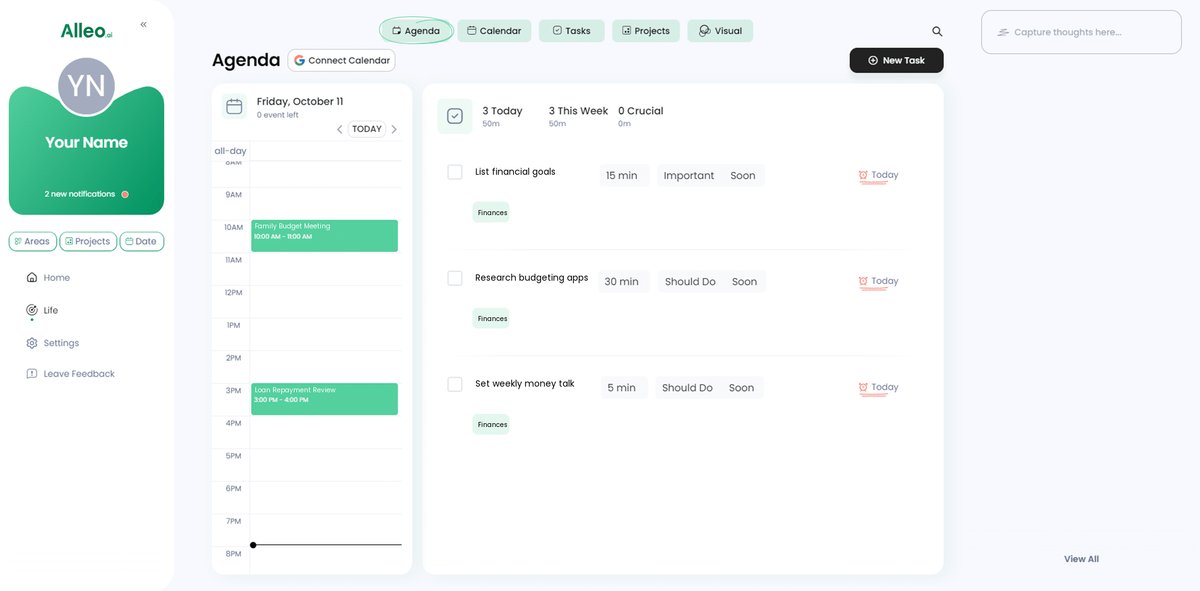

Use the Alleo app’s calendar and task features to schedule your weekly family money talks and track your progress on financial goals, helping you stay organized and accountable as you balance student loan payments with parenting responsibilities.

Taking Control of Your Financial Future

Managing finances as new parents can be overwhelming, but balancing financial priorities is challenging yet achievable. By following the steps we’ve outlined, you can create a roadmap to financial stability and work towards managing family finances effectively.

Remember, you are not alone in this journey of financial planning for overwhelmed parents. Many others face similar challenges and have successfully navigated them, including finding affordable childcare options for working parents.

Utilize the tools available to you, like automated budgeting systems and family money talks. These can make a significant difference in prioritizing expenses as a parent and implementing time-saving money management techniques.

At Alleo, we’re here to support you every step of the way in managing finances as new parents. Our AI coach can offer personalized guidance tailored to your needs, including budgeting tips for busy parents and debt reduction strategies for families.

Take the first step towards a balanced and stress-free financial future. Try Alleo for free and start your journey today to achieve work-life balance and financial stability while saving money with kids.