How to Balance Mortgage Prepayment and Retirement Savings: The Ultimate Guide for Young Professionals

Are you struggling to decide between mortgage prepayment vs retirement savings? This common financial dilemma affects many, from first-time homebuyer savings to long-term wealth building techniques.

As a life coach, I’ve helped many professionals navigate these financial challenges. In my experience, finding the right balance is key to long-term security, especially when considering debt reduction strategies and retirement savings timelines.

In this article, you’ll discover actionable strategies to balance mortgage prepayment and retirement savings. We’ll explore creating budgets, maximizing 401(k) contribution strategies, and more, all while considering the tax implications of mortgage prepayment and investment diversification for young adults.

Let’s dive into financial planning for millennials and how to achieve work-life balance and financial goals.

The Crucial Balance: Mortgage Prepayment vs. Retirement Savings

Balancing mortgage prepayment and retirement savings is essential for financial health. Ignoring either can lead to serious issues in your long-term wealth building techniques.

Many people struggle to decide where to allocate their funds when considering mortgage prepayment vs retirement savings. Failing to prepay your mortgage can mean more interest over the years, impacting your debt reduction strategies.

On the other hand, neglecting retirement savings can leave you unprepared for the future, affecting your retirement savings timeline.

I’ve seen clients who focus solely on paying off their mortgage. They often find themselves without enough retirement savings, highlighting the importance of investment diversification for young adults.

Conversely, some prioritize retirement savings and end up overwhelmed by mortgage debt, a common issue in financial planning for millennials.

The key is balance. You need a strategy that allows you to address both goals effectively, considering aspects like 401(k) contribution strategies.

This approach can help you avoid financial pitfalls and ensure long-term security, aligning with work-life balance and financial goals.

Ready to explore actionable strategies? Let’s continue.

Actionable Steps to Balance Mortgage Prepayment and Retirement Savings

Overcoming this challenge of mortgage prepayment vs retirement savings requires a few key steps. Here are the main areas to focus on to make progress in your financial planning for millennials.

- Maximize 401(k) Contributions with Employer Match: Take full advantage of your employer’s match policy for increased retirement savings and effective 401(k) contribution strategies.

- Create a Balanced Budget for Savings Allocation: Allocate your income effectively to cover both savings and investments, focusing on long-term wealth building techniques.

- Explore Partial Mortgage Prepayment Options: Research and plan partial prepayments to reduce your mortgage timeline, considering debt reduction strategies.

- Build an Emergency Fund Before Extra Payments: Ensure you have a safety net before making additional mortgage payments, a crucial step in mortgage vs. retirement prioritization.

- Consider Refinancing for Lower Interest Rates: Monitor rates and explore refinancing to save on interest, which can impact your retirement savings timeline.

Let’s dive in!

1: Maximize 401(k) contributions with employer match

Maximizing 401(k) contributions with your employer’s match is vital for boosting your retirement savings. When considering mortgage prepayment vs retirement savings, this strategy can be particularly effective for long-term wealth building techniques.

Actionable Steps:

- Review and understand your employer’s 401(k) match policy: Look into the details of your employer’s match to ensure you are contributing enough to get the full match, which is crucial for retirement savings timeline planning.

- Adjust your contributions to meet the match: Increase your 401(k) contributions if needed, to maximize the employer’s match, an important aspect of 401(k) contribution strategies.

- Set up automatic annual increases: Schedule automatic increases to your 401(k) contributions each year to ensure consistent growth, aligning with financial planning for millennials.

Explanation:

These steps matter because they help you take full advantage of free money from your employer, significantly boosting your retirement savings. This approach is key when balancing mortgage vs. retirement prioritization.

According to Investopedia, maximizing your 401(k) contributions can help ensure a more secure financial future.

Staying consistent with contributions and taking advantage of employer matches can provide a substantial impact over time, supporting investment diversification for young adults.

Key benefits of maximizing your 401(k) contributions:

- Increased retirement savings potential

- Tax advantages on contributions, which can affect the decision between mortgage prepayment vs retirement savings

- Compound growth over time

These steps set a solid foundation for your retirement, ensuring you don’t miss out on valuable employer contributions, while also considering work-life balance and financial goals.

2: Create a balanced budget for savings allocation

Creating a balanced budget for savings allocation is key to managing both mortgage prepayment vs retirement savings effectively.

Actionable Steps:

- Track all income and expenses for three months: Use a spreadsheet or budgeting app to monitor your financial habits and identify areas to cut back, helping with debt reduction strategies.

- Allocate a specific percentage of your income to savings and investments: Decide on a fixed percentage, such as 20%, ensuring a portion goes to both retirement savings timeline and mortgage prepayment.

- Use budgeting tools to monitor and adjust your budget regularly: Utilize apps that offer real-time tracking and alerts to help you stay on target with your financial planning for millennials.

Explanation:

These steps are crucial because they help you gain a clear understanding of your finances and make informed decisions about mortgage prepayment vs retirement savings.

According to CNBC, balancing mortgage prepayment with other financial goals like retirement savings and emergency funds is essential for long-term wealth building techniques.

Taking these steps ensures that you can achieve a stable financial position without sacrificing one goal for another, addressing the mortgage vs. retirement prioritization dilemma.

Next, we’ll explore partial mortgage prepayment options.

3: Explore partial mortgage prepayment options

Exploring partial mortgage prepayment options can help you reduce your mortgage timeline and save on interest, which is crucial when considering mortgage prepayment vs retirement savings.

Actionable Steps:

- Research your mortgage terms: Understand any prepayment penalties or benefits outlined in your mortgage agreement, as this impacts your debt reduction strategies.

- Calculate the impact of prepayment: Use online calculators to see how different prepayment amounts affect your mortgage timeline and interest savings, considering your overall retirement savings timeline.

- Set a realistic prepayment goal: Decide on a manageable extra payment amount and automate these payments if possible, balancing this with your 401(k) contribution strategies.

Explanation:

These steps are vital because partial mortgage prepayments can significantly reduce the total interest paid and shorten your loan term, which is an important consideration in financial planning for millennials.

According to Bankrate, making extra principal payments can save you thousands in interest over the life of the loan.

By taking these steps, you ensure that your financial resources are used efficiently, supporting long-term wealth building techniques.

Next, we’ll focus on building an emergency fund before making extra payments.

4: Build an emergency fund before extra payments

Building an emergency fund is crucial before making extra mortgage payments to ensure financial stability, especially when considering mortgage prepayment vs retirement savings.

Actionable Steps:

- Determine your target emergency fund amount: Aim for 3-6 months of expenses to cover unexpected costs, aligning with long-term wealth building techniques.

- Open a high-yield savings account: Designate this account specifically for your emergency fund to earn more interest, supporting your debt reduction strategies.

- Contribute regularly to this account: Set up automatic transfers to build your fund consistently until you reach your goal, similar to 401(k) contribution strategies.

Explanation:

These steps matter because having a robust emergency fund prevents you from needing to dip into retirement savings or take on debt in emergencies, addressing the mortgage vs. retirement prioritization dilemma.

According to CNBC, balancing mortgage prepayment with emergency savings is essential for long-term financial health.

By following these steps, you ensure you are prepared for unexpected expenses while managing your mortgage payments effectively, which is crucial for financial planning for millennials.

Reasons to prioritize your emergency fund:

- Financial security during unexpected events

- Reduced reliance on high-interest debt

- Peace of mind for you and your family

Next, we’ll consider refinancing for lower interest rates.

5: Consider refinancing for lower interest rates

Considering refinancing can significantly reduce your overall mortgage costs and free up funds for retirement savings, which is crucial when balancing mortgage prepayment vs retirement savings.

Actionable Steps:

- Monitor current mortgage rates: Regularly check mortgage rates to see if they are lower than your existing rate, a key aspect of debt reduction strategies.

- Use online calculators to estimate savings: Calculate potential savings from refinancing by comparing your current rate with new offers, aiding in financial planning for millennials.

- Consult with a mortgage advisor: Speak with a professional to understand refinancing costs and benefits, including tax implications of mortgage prepayment.

Explanation:

These steps matter because refinancing at a lower rate can save you thousands in interest over the life of your loan, impacting your mortgage vs. retirement prioritization.

According to CNBC, refinancing can provide significant financial relief and help prioritize other financial goals like retirement savings.

Staying informed and proactive about refinancing options ensures you make the most of your financial resources, contributing to long-term wealth building techniques.

Potential benefits of refinancing your mortgage:

- Lower monthly payments

- Reduced total interest over the loan term

- Opportunity to switch from adjustable to fixed-rate

By considering refinancing, you can optimize your overall financial health and prepare for future expenses, balancing work-life balance and financial goals.

Partner with Alleo to Balance Mortgage Prepayment and Retirement Savings

We’ve explored the challenges of balancing mortgage prepayment vs retirement savings. But did you know you can work directly with Alleo for personalized financial planning?

Alleo makes this journey easier and faster with tailored coaching support, helping you develop debt reduction strategies and long-term wealth building techniques.

First, set up your account with Alleo. Then, create a personalized financial plan that addresses mortgage vs. retirement prioritization.

Alleo’s AI coach will help you manage both mortgage prepayment and retirement savings timeline. The coach provides full coaching sessions, just like a human coach, offering guidance on investment diversification for young adults.

You’ll also get a free 14-day trial without needing a credit card, perfect for first-time homebuyer savings tips.

Alleo’s coach follows up on your progress. They’ll handle changes and keep you accountable via text and push notifications, ensuring you stay on track with your 401(k) contribution strategies.

Ready to get started for free and improve your work-life balance and financial goals?

Let me show you how!

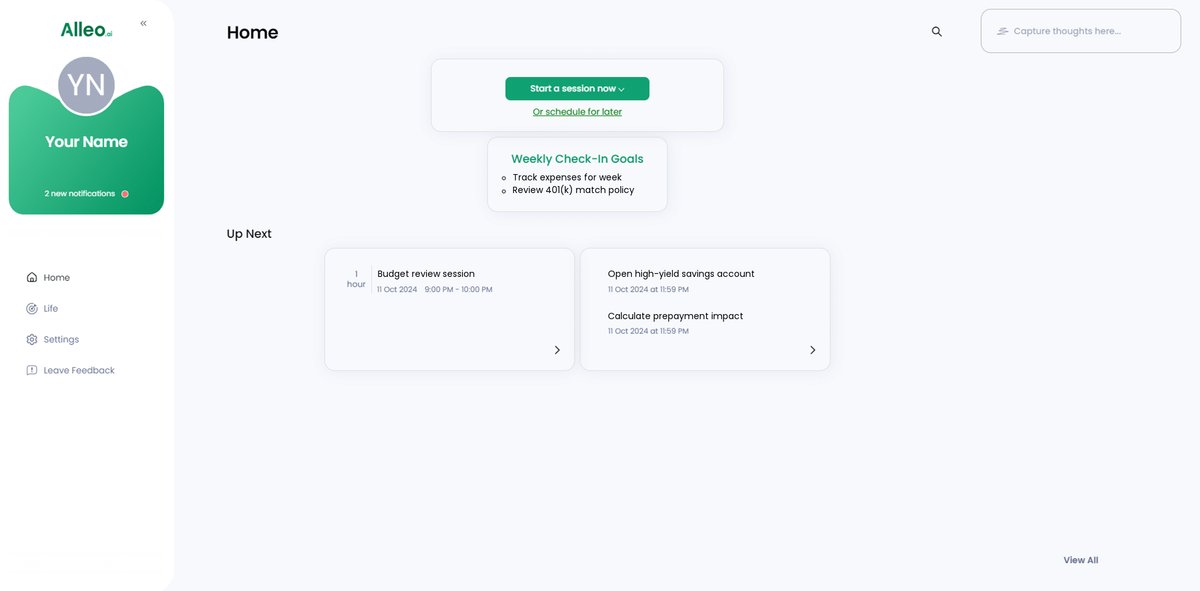

Step 1: Log In or Create Your Account

To start balancing your mortgage prepayment and retirement savings with Alleo’s AI coach, simply Log in to your account or create a new one to begin your personalized financial journey.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will help you balance mortgage prepayment and retirement savings effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address both mortgage prepayment and retirement savings effectively. This selection allows the AI coach to provide tailored advice on balancing these crucial financial goals, helping you create a comprehensive strategy for long-term financial security.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your mortgage prepayment and retirement savings goals to create a personalized financial plan that balances both priorities effectively.

Step 5: Viewing and managing goals after the session

After your coaching session on balancing mortgage prepayment and retirement savings, check your Alleo app’s home page to view and manage the financial goals you’ve set, allowing you to track your progress and stay accountable to your personalized plan.

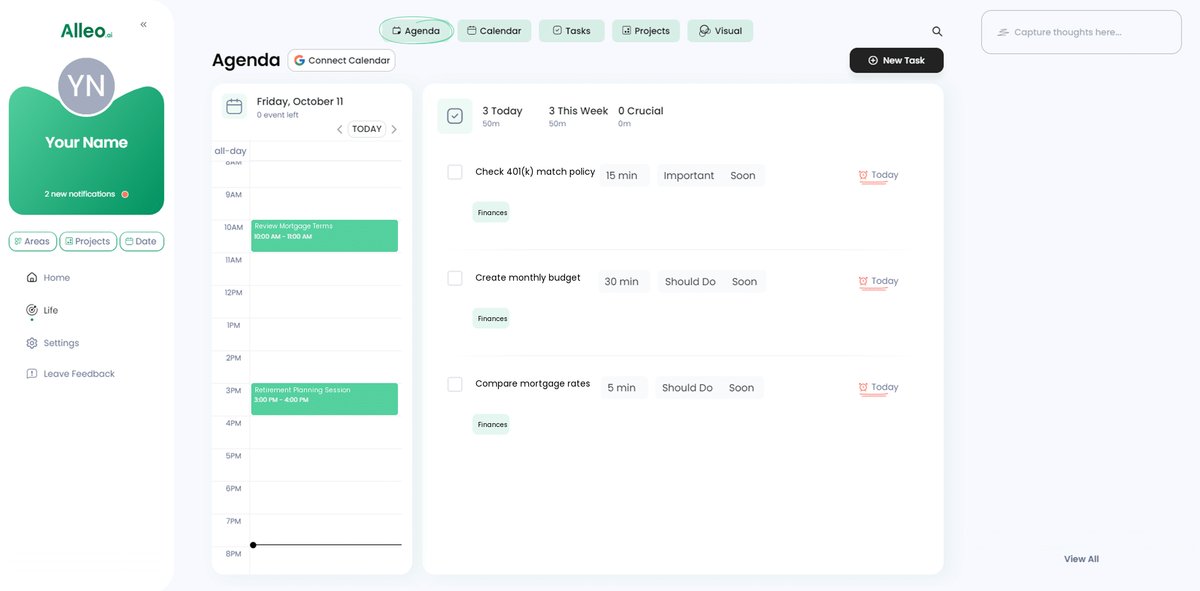

6: Add Events to Your Calendar or App

Use Alleo’s calendar and task features to track your progress in balancing mortgage prepayment and retirement savings, allowing you to easily schedule reminders for budget reviews, 401(k) contribution increases, and mortgage prepayment dates.

Final Thoughts: Achieving Financial Balance

Balancing mortgage prepayment vs retirement savings is essential for long-term financial health and wealth building techniques.

By following these actionable steps, you can plan effectively for both goals, including mortgage vs. retirement prioritization.

Remember, it’s all about strategy and consistency in your financial planning for millennials.

Don’t feel overwhelmed; take it one step at a time in your debt reduction strategies.

With Alleo, you’ll get the guidance and support you need for your retirement savings timeline.

Our AI coach helps keep you on track with personalized advice, including first-time homebuyer savings tips.

Start your journey to financial stability today, focusing on investment diversification for young adults.

Sign up for Alleo’s free 14-day trial and take control of your future, balancing work-life balance and financial goals.