How to Create a Flexible Monthly Budget: 6 Essential Tips for Entrepreneurs

Imagine the ease of managing your flexible monthly budget for entrepreneurs with a system that adapts to your changing needs, ensuring smooth financial operations and effective cash flow management for entrepreneurs.

As a life coach, I’ve helped many entrepreneurs navigate these challenges. In my experience, flexible budgeting is crucial for success, especially when it comes to monthly budgeting for small businesses.

In this post, you’ll discover specific strategies to create a flexible monthly budget for entrepreneurs. We’ll cover tools and techniques that make budget planning easier, including business expense tracking tools and adjustable budget templates for self-employed individuals.

Let’s dive in.

Understanding the Unique Budgeting Challenges for Event Planners

Managing a flexible monthly budget for entrepreneurs in event planning can be incredibly challenging. The dynamic nature of client demands and unexpected costs often throws a wrench in even the most meticulous plans.

Many clients initially struggle with fluctuating expenses that make sticking to a rigid budget nearly impossible, highlighting the need for entrepreneur financial planning tips.

The need for flexibility is critical. Imagine you’ve allocated a significant portion of your budget for a high-profile event, but unexpected expenses arise, impacting your cash flow management as an entrepreneur.

Without a flexible budget strategy for startups, this can quickly derail your financial plans.

In my experience, people often find that traditional monthly budgeting for small businesses fail to accommodate the unpredictable nature of event planning. You need a solution that allows for automatic recalculations and adjustments, similar to adjustable budget templates for self-employed professionals.

It’s not just about tracking expenses but also about being able to adapt swiftly to financial changes, which is crucial for scaling business budgets for growth.

In the end, having a flexible budgeting approach can transform your workflow, ensuring smoother operations and fewer financial headaches for entrepreneurs managing fluctuating incomes.

Key Steps for Creating a Flexible Monthly Budget for Entrepreneurs

To tackle the budgeting challenges of event planning, entrepreneurs need a strategic approach. Here are the main areas to focus on for creating a flexible monthly budget for entrepreneurs:

- Start with short-term, activity-based budgeting: Identify and budget for upcoming events and activities, essential for monthly budgeting for small businesses.

- Set specific financial goals and work backwards: Define monthly objectives and break them down into weekly targets, a key aspect of entrepreneur financial planning tips.

- Use flexible budgeting for unexpected expenses: Allocate a contingency fund and adjust as needed, employing flexible budget strategies for startups.

- Adopt accounting software for streamlined tracking: Choose software that supports flexible budgeting and serves as a business expense tracking tool.

- Separate personal and business finances: Open dedicated accounts to manage funds efficiently, crucial for cash flow management for entrepreneurs.

- Review and adjust budget regularly: Schedule periodic reviews to stay on track with your flexible monthly budget for entrepreneurs.

Let’s dive in!

1: Start with short-term, activity-based budgeting

Beginning with short-term, activity-based budgeting is essential for managing ever-changing event planning needs and creating a flexible monthly budget for entrepreneurs.

Actionable Steps:

- Identify and list all upcoming events and activities for the month.

- Create a calendar of events, specifying dates and estimated costs for your monthly budgeting for small businesses.

- Allocate budget to each activity based on priority and expected ROI.

- Use a spreadsheet or business expense tracking tools to assign funds to each event.

- Track actual expenses against the allocated budget.

- Record all expenditures in real-time to monitor variances, implementing cash flow management for entrepreneurs.

Explanation:

These steps are crucial because they allow you to pinpoint where your money is going and adjust accordingly. By starting with short-term, activity-based budgeting, you stay agile and responsive to changes, which is key for flexible budget strategies for startups.

This approach aligns with industry trends favoring flexibility and precision, as noted in resources like US Chamber of Commerce. For event planners, this method ensures that financial plans remain accurate despite fluctuations, supporting entrepreneur financial planning tips.

Benefits of short-term, activity-based budgeting:

- Increased financial visibility

- Improved resource allocation

- Better decision-making for event planning and scaling business budgets for growth

Transitioning to the next step, setting specific financial goals helps further fine-tune your flexible monthly budget for entrepreneurs.

2: Set specific financial goals and work backwards

Setting specific financial goals and working backwards is essential to ensure your flexible monthly budget for entrepreneurs aligns with your business objectives.

Actionable Steps:

- Define clear financial objectives for the month.

- Write down specific, measurable financial goals, such as profit margins or cost savings for your monthly budgeting for small businesses.

- Break down these objectives into weekly targets.

- Create a detailed plan to achieve these targets step-by-step, incorporating entrepreneur financial planning tips.

- Allocate resources to meet your goals.

- Adjust budget allocations to align with weekly financial targets, utilizing flexible budget strategies for startups.

Explanation:

These steps matter because they provide a structured approach to budgeting, allowing you to stay focused on your financial objectives and improve cash flow management for entrepreneurs.

By breaking down goals into manageable tasks, you can track progress and make necessary adjustments to your flexible monthly budget for entrepreneurs.

This method aligns with industry trends highlighted by the US Chamber of Commerce, emphasizing the importance of setting and achieving financial goals for small businesses.

Transitioning to the next section, using flexible budgeting strategies helps manage unexpected expenses effectively.

3: Use flexible budgeting for unexpected expenses

Using a flexible monthly budget for entrepreneurs is vital for managing unexpected expenses in event planning.

Actionable Steps:

- Allocate a contingency fund within your flexible budget strategies for startups for unforeseen costs.

- Set aside a percentage of your total budget specifically for emergencies, a key aspect of entrepreneur financial planning tips.

- Conduct weekly budget reviews to assess and reallocate funds as needed.

- Regularly examine your financial situation to make timely adjustments, essential for cash flow management for entrepreneurs.

- Establish guidelines for rapid financial adjustments.

- Develop a clear protocol for reallocating funds quickly when unexpected expenses arise, crucial for scaling business budgets for growth.

Explanation:

These steps matter because they allow you to maintain financial stability despite unforeseen costs, a key principle in monthly budgeting for small businesses.

By creating a contingency fund and regularly reviewing your flexible monthly budget for entrepreneurs, you can adapt swiftly to changes and manage income fluctuation budgeting methods effectively.

This approach aligns with industry trends highlighted by the US Chamber of Commerce, which emphasizes the importance of flexible budgeting for small businesses.

Next, we’ll explore how adopting business expense tracking tools can streamline your budgeting process.

4: Adopt accounting software for streamlined tracking

Using accounting software simplifies the process of managing your flexible monthly budget for entrepreneurs, ensuring accurate tracking and adjustments.

Actionable Steps:

- Research and choose a software that meets your needs.

- Look for features that support flexible budgeting for small businesses.

- Integrate the software with your existing financial systems.

- Set up and import your financial data for effective entrepreneur financial planning.

- Utilize software features to automate budget tracking and adjustments.

- Configure automatic alerts for budget changes to support cash flow management for entrepreneurs.

Key features to look for in accounting software:

- Real-time expense tracking for flexible monthly budgets

- Customizable budget templates for self-employed individuals

- Integration with banking systems for comprehensive financial planning

Explanation:

These steps matter because they help you maintain accurate financial records and make timely adjustments. Using accounting software streamlines the budgeting process for entrepreneurs and ensures precision in managing flexible monthly budgets.

This approach aligns with industry trends emphasized by the US Chamber of Commerce, which highlights the importance of using technology for effective financial management in small businesses.

Next, we’ll explore the importance of separating personal and business finances in your flexible monthly budget for entrepreneurs.

5: Separate personal and business finances

Separating personal and business finances is essential for clear financial management and avoiding complications, especially when creating a flexible monthly budget for entrepreneurs.

Actionable Steps:

- Open dedicated bank accounts for personal and business use.

- Ensure funds are not mixed by keeping transactions separate, aiding in business expense tracking.

- Create a process for transferring funds between these accounts when necessary.

- Establish a clear system to handle transfers efficiently, supporting cash flow management for entrepreneurs.

- Regularly review and reconcile both accounts to ensure accuracy.

- Conduct monthly audits to maintain financial integrity, aligning with monthly budgeting for small businesses.

Explanation:

These steps matter because they help you track business expenses and income accurately. By keeping personal and business finances separate, you can avoid confusion and streamline your accounting processes, which is crucial for entrepreneur financial planning.

This approach aligns with industry trends, as highlighted by South Carolina Federal Credit Union, which emphasizes the importance of separating finances for better financial management.

Transitioning to the next section, let’s explore how regular budget reviews keep your finances on track and support flexible budget strategies for startups.

6: Review and adjust budget regularly

Reviewing and adjusting your flexible monthly budget for entrepreneurs regularly is essential to ensure it stays aligned with your financial goals and changing circumstances.

Actionable Steps:

- Schedule regular budget reviews: Set calendar reminders for weekly or bi-weekly budget review sessions to maintain your monthly budgeting for small businesses.

- Compare actual expenses against the budget: Use budget reports to analyze discrepancies and identify variances in your entrepreneur financial planning.

- Make necessary adjustments: Reallocate funds based on the latest financial data to stay on track with your flexible budget strategies for startups.

Benefits of regular budget reviews:

- Early detection of financial issues

- Improved cash flow management for entrepreneurs

- Enhanced financial decision-making

Explanation:

These steps matter because they help you stay proactive in managing your finances. Regular reviews allow you to spot issues early and make timely adjustments to your flexible monthly budget for entrepreneurs.

This approach aligns with industry advice from the South Carolina Federal Credit Union, emphasizing the importance of ongoing budget management for entrepreneurs. Regular adjustments ensure your budget remains flexible and effective, especially when dealing with income fluctuation budgeting methods.

By keeping your budget dynamic, you can better manage your event planning finances and implement effective bootstrapping budget tips for entrepreneurs.

Partner with Alleo for Seamless Budget Management

We’ve dived into the challenges of flexible budgeting for event planning and creating a flexible monthly budget for entrepreneurs. Did you know you can tackle these hurdles with Alleo’s help?

Setting up an account is easy. Start with Alleo’s free 14-day trial (no credit card needed) to explore monthly budgeting for small businesses.

Alleo’s AI coach helps set personalized financial goals and creates a tailored budget plan, offering entrepreneur financial planning tips along the way.

Alleo tracks your progress, sends reminders, and adjusts your budget in real-time. Notifications keep you on track and motivated, supporting your cash flow management as an entrepreneur.

Ready to get started for free with flexible budget strategies for startups?

Let me show you how!

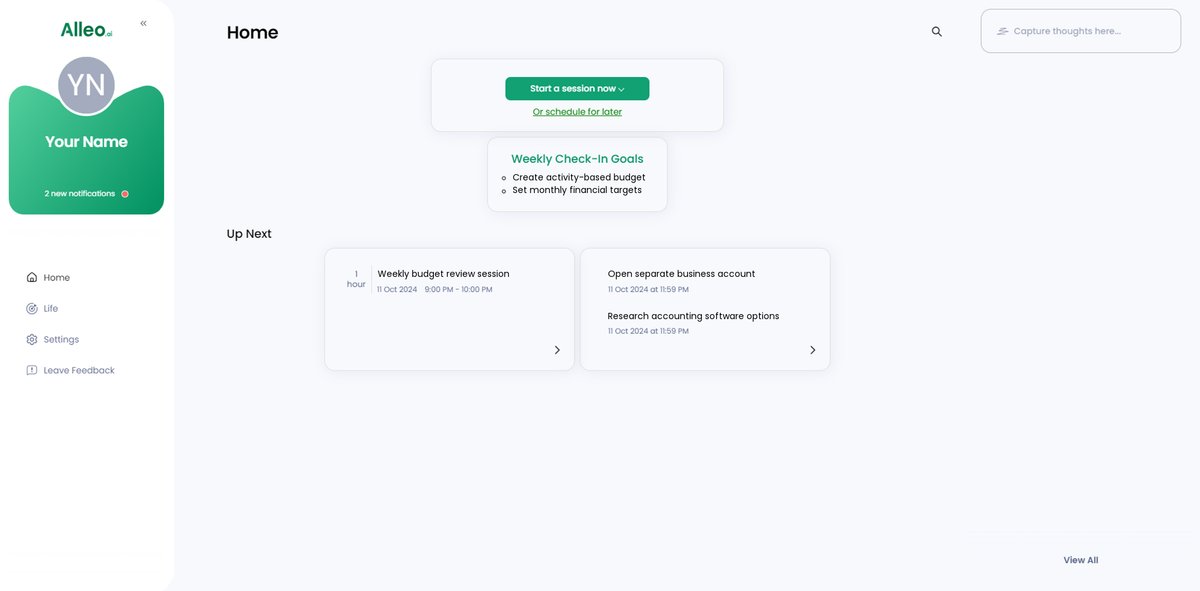

Step 1: Access Your Alleo Account

To begin your flexible budgeting journey with Alleo’s AI coach, simply Log in to your account or create a new one in seconds to start your free 14-day trial.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent financial practices that will help you create and maintain a flexible budget for your event planning business, ensuring you can adapt quickly to changing circumstances and unexpected expenses.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to align with your event planning budgeting needs. This selection will enable the AI coach to provide tailored guidance on flexible budgeting strategies, helping you manage your financial challenges more effectively and achieve your business goals.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized budget plan tailored to your event planning needs.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check your Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track progress and make adjustments to your flexible budget as needed.

Step 6: Adding Events to Your Calendar or App

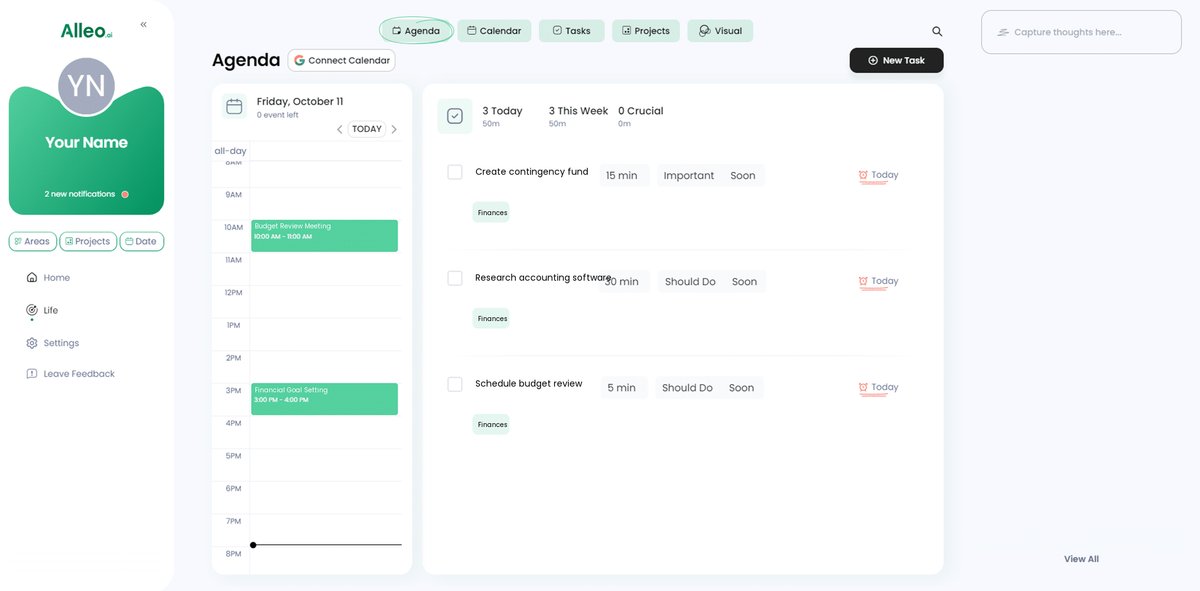

Use Alleo’s calendar and task features to add your upcoming events and activities, allowing you to easily track your progress and stay on top of your flexible budgeting goals for each event.

Bringing It All Together: Your Path to Flexible Budgeting Success

Now that we’ve covered the essential steps, it’s time to put this into action for your flexible monthly budget for entrepreneurs.

Creating a flexible monthly budget can transform your event planning business. It allows you to adapt to changes and maintain financial stability, crucial for monthly budgeting for small businesses.

Remember, flexibility is key. You need a system that can handle unexpected expenses and adjust swiftly, which is vital for entrepreneur financial planning.

These flexible budget strategies for startups will help you manage your finances more effectively. By following these steps, you can ensure smoother operations and fewer financial headaches.

And remember, Alleo is here to help. With our AI coach, you can set personalized financial goals and track your progress, aiding in cash flow management for entrepreneurs.

Ready to take control of your budget?

Try Alleo’s free 14-day trial today. Let’s make your budgeting worries a thing of the past and support your flexible monthly budget for entrepreneurs!