How to Create a Step-by-Step Retirement Plan for Young Professionals: Your Comprehensive Guide

Are you finding it tough to figure out how to start your retirement planning journey as a young professional?

As a life coach, I’ve helped many young professionals like you overcome the overwhelming task of planning for retirement. I understand the challenges of focusing too much on the end goal without a clear, actionable plan for long-term financial planning.

In this article, you’ll find a step-by-step guide to assess your current financial situation, implement retirement savings strategies, budget effectively, explore employer-sponsored plans like 401(k) contributions, diversify investments, educate yourself on Roth IRA benefits and compound interest, and establish an emergency fund. These strategies will help you balance retirement savings with other financial goals.

Let’s dive into retirement planning for young professionals.

The Challenge of Creating a Clear Retirement Plan

Many young professionals feel overwhelmed by the complexity of retirement planning for young professionals. They often focus too much on the end goal without breaking it down into manageable steps, such as setting up a 401(k) or exploring Roth IRA benefits.

This can make the entire process of long-term financial planning feel daunting.

In my experience, people often struggle with where to start. They don’t know how to assess their current financial situation or set realistic retirement savings strategies.

Furthermore, starting early is crucial for compound interest and early investing, yet many delay because the task seems insurmountable. This delay can cost you the benefits of compound interest and impact your investment options for millennials.

Ultimately, a clear, actionable plan is essential for retirement planning for young professionals. It helps demystify the process and makes the goal of a comfortable retirement achievable through effective budgeting for retirement.

Overcoming this challenge of retirement planning for young professionals requires a few key steps. Here are the main areas to focus on to make progress in your long-term financial planning.

- Assess Current Financial Situation and Goals: Calculate your net worth, set SMART goals, and understand your finances for effective retirement planning.

- Start Saving Early to Leverage Compound Interest: Automate contributions and increase your retirement savings rate over time, a crucial strategy for young professionals.

- Create a Budget to Maximize Retirement Savings: Track expenses, cut back on unnecessary spending, and allocate funds for retirement, balancing retirement savings with other financial goals.

- Explore Employer-Sponsored Retirement Plans: Enroll in your 401(k) and take advantage of employer matches and benefits, optimizing your 401(k) contributions.

- Diversify Investments with Low-Cost Index Funds: Invest in a mix of funds and regularly rebalance your portfolio, considering various investment options for millennials.

- Educate Yourself on Retirement Planning Basics: Read books, take courses, and stay updated on financial trends, including Roth IRA benefits and debt management for young adults.

- Establish an Emergency Fund for Financial Security: Save 3-6 months of living expenses in an accessible account, building an emergency fund alongside your retirement planning efforts.

Let’s dive into these retirement savings strategies!

1: Assess current financial situation and goals

Understanding your financial situation and setting clear goals is the first step toward a solid retirement planning for young professionals.

Actionable Steps:

- Calculate your net worth by listing all assets and liabilities.

- Set short-term and long-term financial planning goals using the SMART criteria.

- Use financial planning tools or consult a financial advisor to understand your current financial health and explore investment options for millennials.

Key benefits of assessing your financial situation:

- Identifies areas for improvement in retirement savings strategies

- Helps prioritize financial goals, including 401(k) contributions and Roth IRA benefits

- Provides a clear starting point for planning and building an emergency fund

Explanation: Assessing your financial situation helps you identify where you stand and what you need to achieve your retirement goals.

Setting SMART goals ensures they are specific, measurable, achievable, relevant, and time-bound, which is crucial for long-term financial planning.

Tools like financial planning calculators or consulting a financial advisor can offer personalized insights on budgeting for retirement and compound interest and early investing. For detailed guidance, refer to Western & Southern’s retirement income plan resources.

This groundwork is crucial for making informed decisions about saving and investing, while balancing retirement savings with other financial goals.

2: Start saving early to leverage compound interest

Starting early with your retirement savings is crucial for young professionals to take advantage of the power of compound interest, which can significantly boost your wealth over time. Effective retirement planning for young professionals involves understanding the importance of long-term financial planning.

Actionable Steps:

- Automate your monthly contributions to a retirement account, such as a 401(k) or Roth IRA. This ensures consistent savings without manual intervention.

- Open a high-yield savings account to earn more interest on your additional savings. This maximizes your returns and supports building an emergency fund.

- Gradually increase your savings rate, aiming to save at least 15% of your income over time. This is a key retirement savings strategy for millennials.

Explanation: Saving early allows your investments to grow exponentially due to compound interest, a fundamental concept in retirement planning for young professionals.

Automating contributions ensures discipline, while high-yield accounts can enhance your returns. This approach helps in balancing retirement savings with other financial goals.

Increasing your savings rate gradually can help you reach your retirement goals faster. For more details on maximizing your savings and investment options for millennials, refer to Investopedia’s guide for young investors.

By starting early, you can take full advantage of compound interest and early investing, making your retirement goals more achievable. This approach is crucial for effective retirement planning for young professionals.

3: Create a budget to maximize retirement savings

Creating a budget is essential for maximizing your retirement savings and ensuring financial stability, especially when it comes to retirement planning for young professionals.

Actionable Steps:

- Track your monthly expenses and identify areas where you can reduce spending to boost retirement savings strategies.

- Allocate a specific percentage of your income towards retirement savings, such as 401(k) contributions.

- Use budgeting apps or spreadsheets to maintain and adjust your budget regularly, supporting long-term financial planning.

Explanation: Tracking expenses helps you pinpoint unnecessary spending, freeing up more money for retirement savings and building an emergency fund.

Allocating a set percentage of your income ensures consistent contributions to your retirement fund, taking advantage of compound interest and early investing.

Budgeting tools can help you stay organized and adapt to changes. For more insights on effective budgeting, check out Johnson Financial Group’s tips for young professionals.

A well-planned budget can significantly enhance your ability to save for retirement while maintaining your financial health, balancing retirement savings with other financial goals.

4: Explore employer-sponsored retirement plans

Employer-sponsored retirement plans are essential for maximizing retirement savings and taking advantage of employer contributions, making them a crucial part of retirement planning for young professionals.

Actionable Steps:

- Enroll in your employer’s 401(k) plan and contribute at least up to the employer match. This can significantly boost your retirement savings strategies.

- Investigate other benefits your employer offers, such as stock options or profit-sharing plans. These can enhance your retirement portfolio and long-term financial planning.

- Attend HR workshops or webinars to fully understand your retirement plan options. This ensures you make informed decisions about investment options for millennials.

Key advantages of employer-sponsored plans:

- Tax benefits on contributions

- Potential employer matching

- Automatic payroll deductions

Explanation: Maximizing employer-sponsored plans can greatly increase your retirement savings due to employer contributions and potential tax benefits, which is crucial for balancing retirement savings with other financial goals.

Understanding all available options helps you optimize your retirement strategy. For more insights, refer to the IRS guidance on retirement plans.

Exploring these plans can set a strong foundation for your retirement savings, leveraging compound interest and early investing for young professionals.

5: Diversify investments with low-cost index funds

Diversifying your investments with low-cost index funds is crucial for spreading risk and maximizing returns in your retirement planning for young professionals.

Actionable Steps:

- Invest in a mix of low-cost index funds: This helps you spread risk and gain exposure to a broad market, an essential long-term financial planning strategy.

- Regularly review and rebalance your investment portfolio: Ensure it stays aligned with your retirement goals and risk tolerance, focusing on investment options for millennials.

- Consult a financial advisor: Get professional advice to make informed investment decisions, including guidance on 401(k) contributions and Roth IRA benefits.

Explanation: Diversifying with low-cost index funds can provide stable returns and reduce risk in your retirement savings strategies.

Regular rebalancing keeps your portfolio on track, helping you balance retirement savings with other financial goals.

Consulting a financial advisor ensures you’re making informed choices. For more insights on this strategy, refer to Investopedia’s retirement planning guide.

This approach helps you achieve a balanced and robust investment portfolio, leveraging compound interest and early investing for your retirement planning.

6: Educate yourself on retirement planning basics

Understanding the fundamentals of retirement planning for young professionals is crucial for creating a successful long-term financial planning strategy.

Actionable Steps:

- Read books or take online courses: Gain a solid foundation by exploring reputable books and online courses on retirement planning and investment options for millennials.

- Join financial literacy workshops or community programs: Participate in workshops or programs to enhance your understanding of retirement savings strategies and network with like-minded individuals.

- Follow reputable financial blogs and forums: Stay updated on trends and tips by following credible financial blogs and forums that discuss topics such as 401(k) contributions and Roth IRA benefits.

Explanation: Educating yourself on the basics of retirement planning is essential for making informed decisions about budgeting for retirement and building an emergency fund.

Reading, attending workshops, and following blogs help you stay informed about compound interest and early investing. For example, Empower’s guide to retirement planning offers valuable insights.

These steps ensure you are well-equipped to manage your retirement goals effectively while balancing retirement savings with other financial goals.

This knowledge will empower you to navigate the complexities of retirement planning for young professionals with confidence, including debt management for young adults.

7: Establish an emergency fund for financial security

Establishing an emergency fund is crucial for financial stability and security in your retirement planning journey, especially for young professionals focused on long-term financial planning.

Actionable Steps:

- Save 3-6 months’ worth of living expenses: Place this amount in a high-yield savings account that is easily accessible, supporting your overall retirement planning strategy.

- Regularly contribute to your emergency fund: Set up automatic transfers to ensure consistent growth until your goal is met, balancing retirement savings with other financial goals.

- Review and adjust annually: Assess your emergency fund annually to make sure it aligns with your current expenses and financial situation, as part of your ongoing retirement planning for young professionals.

Key reasons to maintain an emergency fund:

- Protects retirement savings

- Reduces financial stress

- Provides flexibility for unexpected expenses

Explanation: Having an emergency fund is essential to cover unexpected expenses without dipping into your retirement savings or disrupting your budgeting for retirement.

Regular contributions and annual reviews ensure that your fund keeps pace with your changing needs, supporting your long-term financial planning goals.

For more detailed advice on building an emergency fund, refer to Investopedia’s guide for young investors.

This approach safeguards your financial security, allowing you to stay on track with your retirement goals and continue focusing on investment options for millennials.

A solid emergency fund can provide peace of mind and financial resilience as you plan for your future, complementing other retirement savings strategies like 401(k) contributions and Roth IRA benefits.

Work with Alleo to Achieve Your Retirement Goals

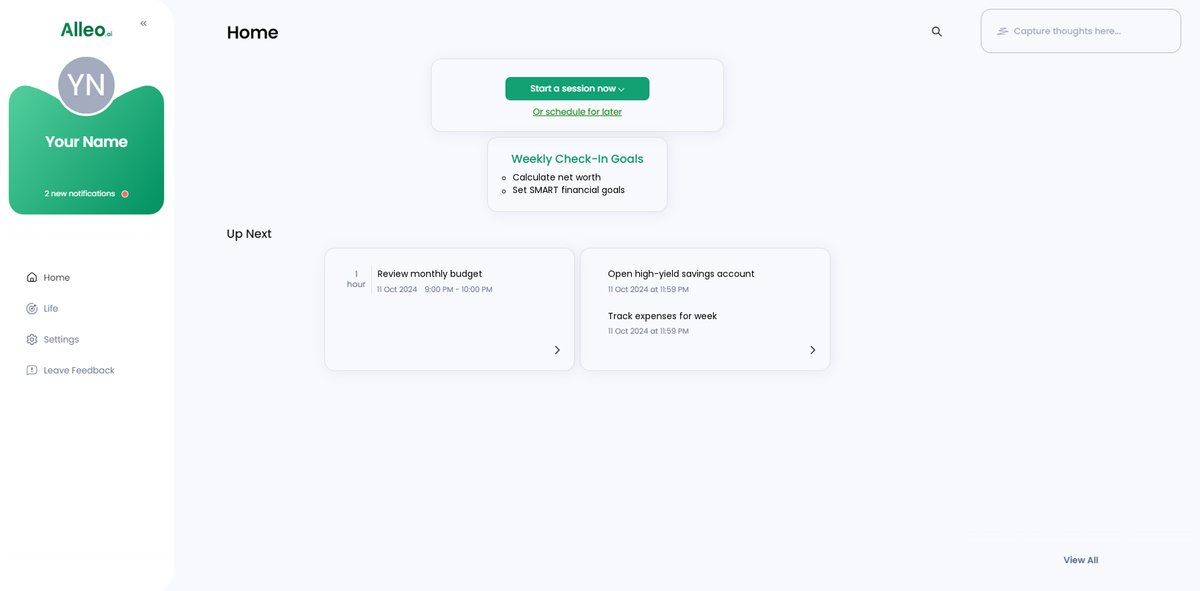

We’ve explored the steps to create a retirement plan for young professionals. But did you know you can work with Alleo to make this journey easier and faster, especially when it comes to retirement planning for young professionals?

Set up an Alleo account and create a personalized plan for long-term financial planning. Alleo’s AI coach provides tailored coaching support for retirement savings strategies, just like a human coach.

The coach will follow up on your progress, handle changes in investment options for millennials, and keep you accountable via text and push notifications, helping you balance retirement savings with other financial goals.

With Alleo, you get full coaching sessions on topics like 401(k) contributions and Roth IRA benefits, and a free 14-day trial, with no credit card required.

Ready to get started for free and begin your journey in retirement planning for young professionals? Let me show you how!

Step 1: Log in or Create Your Alleo Account

To begin your personalized retirement planning journey, log in to your existing Alleo account or create a new one to access our AI coach and start building your tailored financial strategy.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish a strong foundation for your retirement planning journey. This goal will help you develop consistent saving habits, create a budget, and maintain discipline in your financial practices, all of which are crucial for achieving your long-term retirement goals.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to align with your retirement planning goals. This selection allows Alleo’s AI coach to provide targeted guidance on budgeting, saving, and investing strategies, helping you build a solid financial foundation for your retirement future.

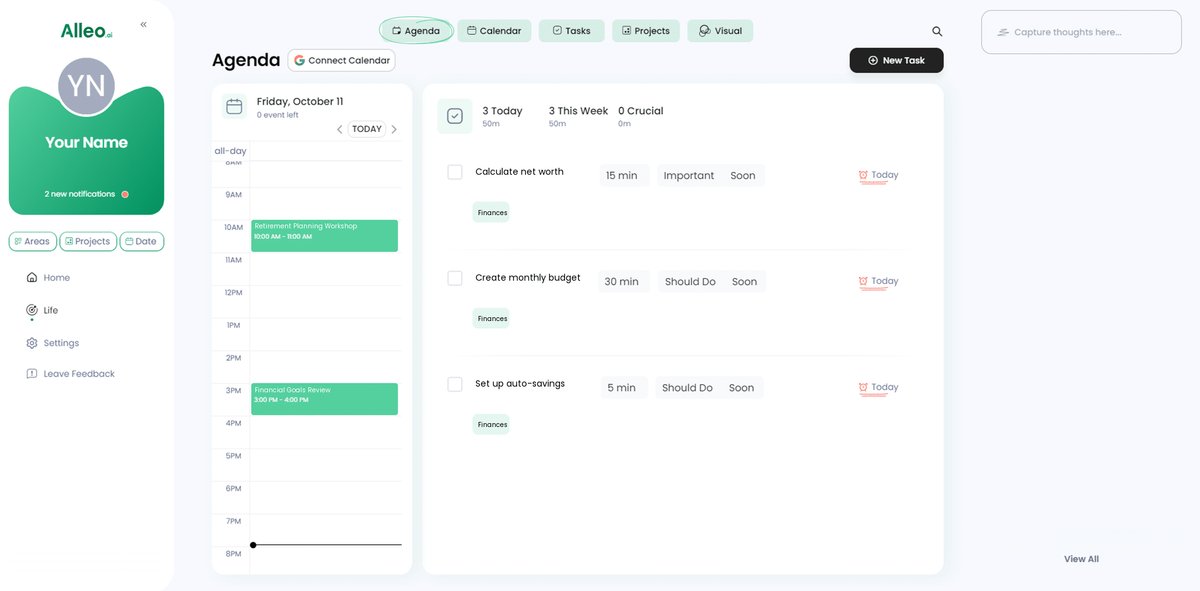

Step 4: Starting a Coaching Session

Begin your retirement planning journey with Alleo by scheduling an initial intake session, where you’ll set up your personalized plan and establish clear goals for your financial future.

Step 5: Viewing and managing goals after the session

After your coaching session, open the Alleo app and navigate to the home page to view and manage the retirement planning goals you discussed, allowing you to track your progress and stay accountable to your financial objectives.

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule and track your retirement planning activities, such as reviewing your budget, rebalancing your portfolio, or attending financial education workshops, ensuring you stay on top of your goals and make steady progress towards a secure retirement.

Wrapping Up Your Retirement Planning Journey

Now that we’ve covered the essential steps, you’re ready to take control of your financial future. Remember, starting early and having a clear plan can make all the difference in retirement planning for young professionals.

It’s normal to feel overwhelmed, but breaking it down into manageable steps can ease the process. Assess your finances, save early, budget wisely, leverage employer plans like 401(k) contributions, diversify investments, educate yourself on long-term financial planning, and establish an emergency fund.

You can do this.

As your coach, I’m here to support you. With Alleo, you can create a personalized retirement savings strategy and stay on track with your investment options for millennials.

Sign up today for a free 14-day trial. Your dream retirement is within reach, thanks to compound interest and early investing.