How to Manage Student Loan Payments: A New Graduate’s Guide to Financial Success

Are you feeling overwhelmed by the prospect of managing student loans after graduation as you step into the workforce?

As a life coach, I’ve guided many recent graduates through the maze of student loan repayment strategies. I understand the emotional and financial stress that comes with large monthly payments, especially when balancing student loan payments with other financial goals.

In this article, you’ll discover actionable strategies to tackle your student loans. We’ll cover income-driven repayment plans, entry-level salary budgeting, loan forgiveness programs, loan consolidation options, and building an emergency fund while managing debt and starting a career.

Let’s dive in to explore these financial planning tips for recent graduates.

The Financial and Emotional Toll of Student Loan Payments

Managing student loans after graduation can feel like a daunting task. Many clients initially struggle with balancing living expenses and hefty monthly loan payments while navigating entry-level salary budgeting.

The dilemma of whether to start a new job or pursue further education complicates things. For some, further education means deferring loan payments, but this isn’t always feasible. Exploring income-driven repayment plans or loan consolidation options may provide relief.

Additionally, the emotional stress of large financial obligations can impact your well-being. I often see clients feeling trapped by their debt, which can affect their career choices and personal lives. Understanding student loan forgiveness programs and employer student loan assistance benefits can help ease this burden.

Understanding and managing this challenge is crucial. By addressing both the financial and emotional aspects of managing student loans after graduation, you can take control of your student loan payments and move towards financial stability while balancing student loan payments with other financial goals.

Key Steps to Manage Student Loan Payments Effectively

Managing student loans after graduation requires a few key steps. Here are the main areas to focus on to make progress with your student loan repayment strategies:

- Enroll in an income-driven repayment plan: Research and apply for the best plan that suits your financial situation, especially when balancing student loan payments with other financial goals.

- Create a budget prioritizing loan payments: List income sources and expenses to allocate funds effectively, focusing on entry-level salary budgeting.

- Explore loan forgiveness program eligibility: Identify and apply for relevant student loan forgiveness programs to reduce your debt.

- Consider refinancing for lower interest rates: Compare lenders and apply for refinancing to save on interest, exploring loan consolidation options.

- Build an emergency fund while making payments: Set savings goals and automate transfers to secure financial stability while managing student loans after graduation.

Let’s dive in!

1: Enroll in income-driven repayment plan

Enrolling in an income-driven repayment plan can significantly ease the burden of student loan payments for new graduates, making it a crucial strategy for managing student loans after graduation.

Actionable Steps:

- Research available plans: Identify the different income-driven repayment plans (IDR, IBR, PAYE, REPAYE) and compare their benefits as part of your student loan repayment strategies.

- Use online calculators: Estimate your monthly payments under each plan to determine which one best suits your financial situation and entry-level salary budgeting.

- Submit your application: Gather all necessary documentation and apply through the federal student aid website to enroll in your chosen income-driven repayment plan.

Explanation:

These steps ensure your monthly payments are manageable and proportionate to your income, reducing financial stress while managing student loans after graduation.

By using tools like online calculators, you can make informed decisions about managing debt while starting a career. For more details on how these plans work, visit the Chalkbeat website.

Taking these actions can help you manage your student loans more effectively and focus on your career growth, balancing student loan payments with other financial goals.

2: Create budget prioritizing loan payments

Creating a budget that prioritizes your student loan payments is crucial for managing student loans after graduation and effectively managing your finances.

Actionable Steps:

- List all income sources and expenses: Identify all your income and expenses to get a clear financial picture for entry-level salary budgeting.

- Allocate a specific percentage of your income: Dedicate a portion of your income to loan payments each month and adjust as needed, considering income-driven repayment plans.

- Use budgeting apps or spreadsheets: Track your spending and make changes to prioritize loan payments as part of your student loan repayment strategies.

Explanation:

By listing your income and expenses, you can see where your money goes and make informed decisions. Tools like budgeting apps can help you stay on track while managing student loans after graduation.

For more tips on managing your budget, visit the Morgan Stanley website.

Key benefits of creating a budget for loan payments:

- Improved financial awareness and control when managing debt while starting a career

- Ability to identify areas for potential savings and explore loan consolidation options

- Greater confidence in meeting payment obligations and balancing student loan payments with other financial goals

Taking these steps can help you manage your student loans more effectively and focus on your career growth while building credit while repaying student loans.

3: Explore loan forgiveness program eligibility

Exploring loan forgiveness program eligibility is crucial for managing student loans after graduation and reducing your student loan burden.

Actionable Steps:

- Identify relevant programs: Research student loan forgiveness programs related to your career, such as Public Service Loan Forgiveness or Teacher Loan Forgiveness.

- Check eligibility requirements: Ensure you meet the criteria for these programs by reviewing guidelines and maintaining necessary documentation.

- Keep detailed records: Track your employment and payments meticulously to qualify for forgiveness.

Explanation:

These steps help you reduce your overall debt by taking advantage of loan forgiveness options when managing student loans after graduation.

For instance, programs like the NHSC Loan Repayment Program offer significant relief for healthcare professionals serving in underserved areas.

By meeting these requirements, you can focus more on career growth and less on financial stress while managing debt while starting a career.

By exploring these student loan forgiveness programs, you can make your loan repayment journey smoother and more manageable.

4: Consider refinancing for lower interest rates

Refinancing your student loans can help reduce your interest rates and make your monthly payments more manageable when managing student loans after graduation.

Actionable Steps:

- Compare different lenders: Research various private lenders to find the best refinancing rates available as part of your student loan repayment strategies.

- Check your credit score: Ensure your credit score is high and take steps to improve it if needed to secure better rates, which is crucial for building credit while repaying student loans.

- Apply for refinancing: Understand the terms and conditions before signing any agreement to ensure it benefits your financial situation and aligns with your goals for managing debt while starting a career.

Explanation:

These steps matter because refinancing can significantly lower your interest rates, saving you money over time. By improving your credit score, you increase your chances of getting favorable terms, which is essential for financial planning for recent graduates.

For more information on the benefits of refinancing, visit the Navy Federal Credit Union website.

Factors to consider when refinancing:

- Current market interest rates

- Your credit score and financial history

- Potential loss of federal loan benefits, such as income-driven repayment plans or student loan forgiveness programs

Implementing these steps can lead to more manageable loan payments and long-term financial stability, helping you balance student loan payments with other financial goals.

5: Build emergency fund while making payments

Building an emergency fund while managing student loans after graduation is crucial for financial security.

Actionable Steps:

- Set a realistic savings goal: Aim for an emergency fund covering three to six months of living expenses while balancing student loan payments with other financial goals.

- Automate your savings: Schedule regular transfers to a separate savings account to ensure consistent contributions as part of your student loan repayment strategies.

- Prioritize your emergency fund: Avoid using these savings unless it’s a genuine emergency to keep your financial cushion intact while managing debt while starting a career.

Explanation:

These steps help you prepare for unexpected expenses while managing student loans after graduation. Financial stability is essential as it allows you to focus on your career without worrying about unforeseen costs.

For more tips on financial planning for recent graduates, visit the LinkedIn article.

Strategies to boost your emergency fund:

- Cut non-essential expenses and redirect savings

- Explore side gigs or freelance opportunities to supplement your entry-level salary budgeting

- Sell unused items for quick cash injections

Taking these actions ensures you’re building a safety net while staying on top of your student loans and exploring income-driven repayment plans.

Partner with Alleo on Your Financial Journey

We’ve explored managing student loans after graduation, and the steps to achieve financial stability. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account is simple. Create a personalized plan with Alleo for student loan repayment strategies, and start overcoming your student loan challenges.

Alleo’s coach will follow up on your progress, handle changes in income-driven repayment plans, and keep you accountable via text and push notifications.

Ready to get started for free and explore loan consolidation options?

Let me show you how to balance student loan payments with other financial goals!

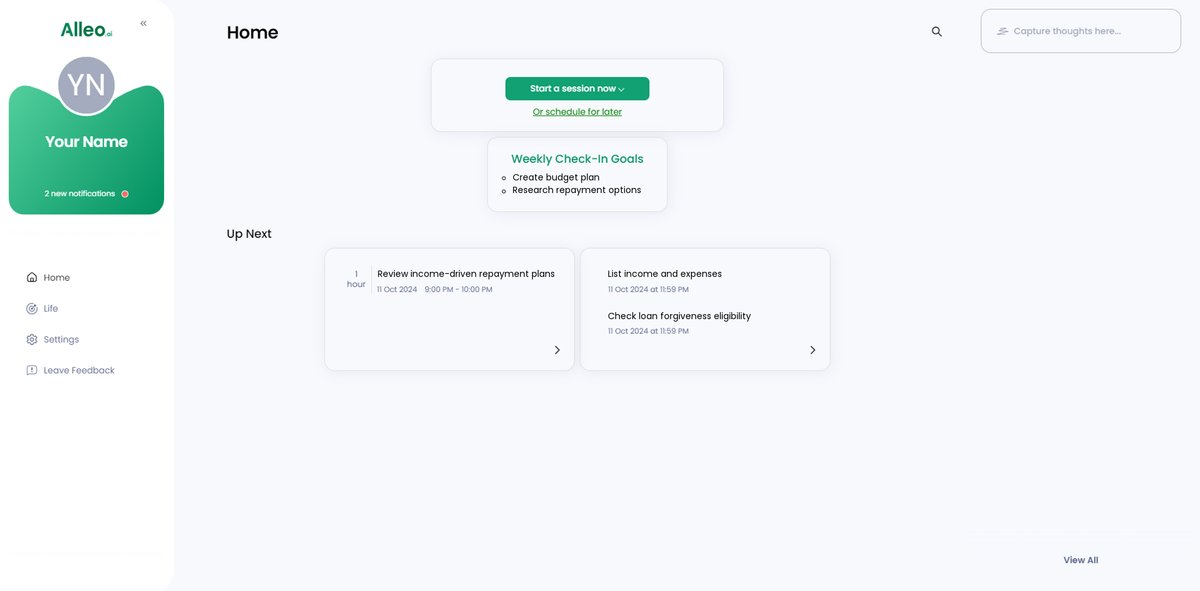

Step 1: Log In or Create Your Account

To start managing your student loans with Alleo’s AI coach, Log in to your account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start creating a structured approach for managing your student loans effectively. This goal will help you develop consistent financial practices, such as budgeting and saving, which are crucial for successfully navigating your loan repayment journey.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on managing your student loans, creating a budget, and building financial stability – key aspects covered in the article to help you overcome the challenges of post-graduation debt.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for managing your student loans and achieving financial stability.

Step 5: Viewing and managing goals after the session

After your coaching session on managing student loans, check the Alleo app’s home page to view and track the financial goals you discussed, such as creating a budget or exploring loan forgiveness programs.

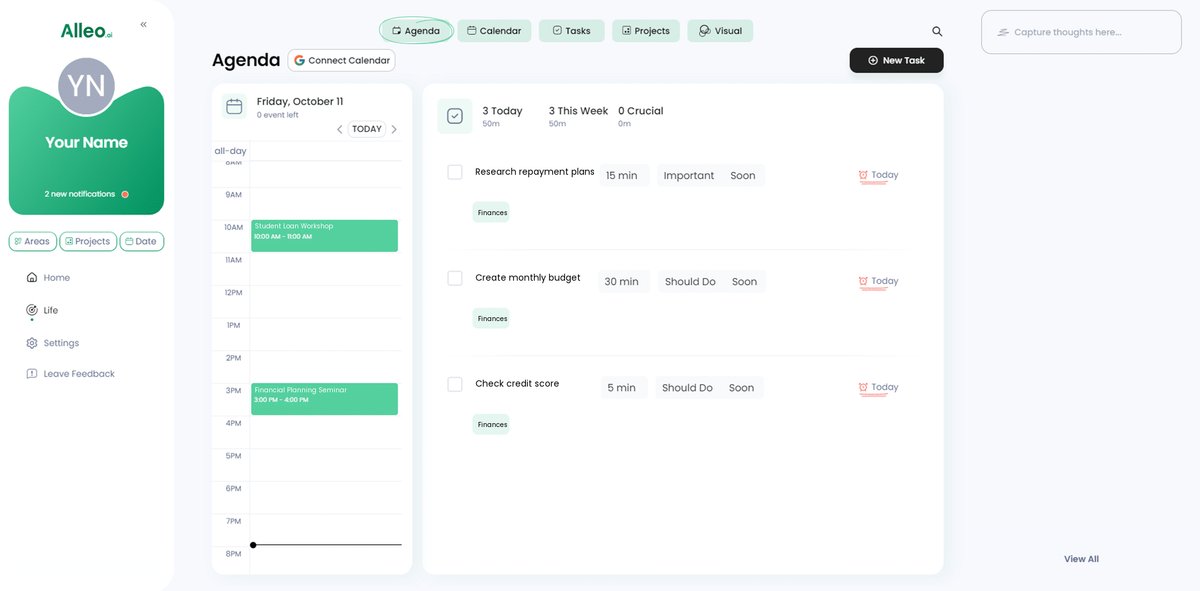

6: Add events to your calendar or app

Track your progress in managing student loan payments by adding important dates and tasks to your calendar or the Alleo app, allowing you to stay organized and on top of your financial goals.

Wrapping Up Your Student Loan Journey

We’ve covered a lot of ground on managing student loans after graduation. It might feel overwhelming, but you’ve got this.

Remember, you are not alone in this journey of student loan repayment strategies.

Taking small, consistent steps can make a big difference in balancing student loan payments with other financial goals.

Implementing income-driven repayment plans, entry-level salary budgeting, exploring loan forgiveness programs, considering loan consolidation options, and building an emergency fund will set you up for success.

Most importantly, take action.

Engage with these strategies and see how they can ease your financial stress while managing debt while starting a career.

Alleo is here to support you every step of the way in managing student loans after graduation.

Try Alleo for free and start managing your student loans with confidence, including exploring employer student loan assistance benefits.

You’ve got this!