How to Plan Finances Wisely While Expecting Inheritance: 3 Fundamental Principles for Success

Imagine waking up one day with the knowledge that a substantial inheritance is in your future. How would that change your approach to planning finances with expected inheritance?

As a life coach, I’ve helped many side hustlers navigate the complexities of financial planning for inheritance. In my experience, understanding how to wisely integrate potential inheritance into current strategies is crucial for long-term financial goals with inheritance.

In this article, you’ll discover actionable steps to manage your finances now, without relying too heavily on uncertain windfalls. We’ll cover budgeting with expected inheritance, creating an emergency fund, and investing inherited wealth in low-cost index funds while considering tax implications of inheritance.

Let’s dive into estate planning considerations and avoiding inheritance pitfalls.

Understanding the Challenges of Planning Finances with Potential Inheritance

When anticipating an inheritance, integrating it into your financial planning strategy can be tricky. Planning finances with expected inheritance presents unique challenges in balancing immediate needs with future expectations.

Many clients initially struggle to maintain their motivation and personal development, knowing a financial windfall is on the horizon. They often fall into the trap of neglecting their current financial goals, which can lead to overspending and underinvesting. This highlights the importance of budgeting with expected inheritance and focusing on long-term financial goals with inheritance in mind.

In my experience, people often find it difficult to avoid relying too heavily on uncertain future wealth. This can lead to financial instability, making it hard to achieve long-term goals. Understanding the tax implications of inheritance and considering estate planning are crucial aspects of managing windfall money effectively.

Navigating these challenges requires a thoughtful approach. Let’s explore how to manage finances wisely while expecting an inheritance, including investing inherited wealth and avoiding inheritance pitfalls.

High-Level Strategy for Financial Planning with Expected Inheritance

Overcoming this challenge of planning finances with expected inheritance requires a few key steps. Here are the main areas to focus on to make progress with your financial planning for inheritance.

- Develop a flexible budget for current income: Understand your current finances and set realistic budget goals, considering estate planning considerations.

- Create an emergency fund separate from inheritance: Save 3-6 months’ worth of living expenses in a high-yield savings account, avoiding inheritance pitfalls.

- Invest in low-cost index funds for long-term growth: Educate yourself on index funds and set investment goals aligned with your financial future, focusing on investing inherited wealth wisely.

Let’s dive into these strategies for planning finances with expected inheritance!

1: Develop a flexible budget for current income

Creating a flexible budget is crucial for planning finances with expected inheritance and managing your current financial situation effectively.

Actionable Steps:

- Assess your current financial situation: Collect all financial documents to understand your income, expenses, and debts. Use a budgeting tool to categorize and track expenses, considering estate planning considerations.

- Set realistic budget goals: Allocate a percentage of your income to essentials, savings, investments, and discretionary spending. Adjust your budget monthly to reflect changes, keeping in mind long-term financial goals with inheritance.

- Monitor and adjust regularly: Review your budget weekly to ensure you stay on track and adjust as needed for unexpected expenses or financial changes, which is crucial for financial planning for inheritance.

Key benefits of a flexible budget include:

- Adapts to changing financial circumstances

- Helps prioritize spending and saving

- Reduces financial stress and uncertainty

Explanation: Developing a flexible budget helps you maintain financial stability and avoid relying too heavily on an uncertain inheritance, assisting in avoiding inheritance pitfalls.

By regularly reviewing and adjusting your budget, you’ll be better prepared for both current and future financial needs, including managing windfall money.

For more budgeting tips, check out this resource.

Next, let’s explore the importance of creating an emergency fund separate from your inheritance, which is essential when planning finances with expected inheritance.

2: Create an emergency fund separate from inheritance

When planning finances with expected inheritance, it’s essential to establish an emergency fund independent of any anticipated windfall.

Actionable Steps:

- Calculate your emergency fund needs: Determine 3-6 months’ worth of living expenses to cover unforeseen events. Open a high-yield savings account for this purpose, considering your long-term financial goals with inheritance.

- Automate savings contributions: Set up automatic transfers from your primary account to your emergency fund account. Start with an amount you can manage and increase it gradually, aligning with your estate planning considerations.

- Replenish the fund as needed: Use the emergency fund strictly for genuine emergencies like medical expenses or job loss. Replenish any used funds promptly to maintain your safety net, a key aspect of financial planning for inheritance.

Explanation: Creating an emergency fund ensures financial stability and helps you avoid relying too heavily on future inheritances, which is crucial for budgeting with expected inheritance.

By automating contributions, you build a robust safety net over time. For more insights on managing windfall money and avoiding inheritance pitfalls, visit this resource.

Next, let’s delve into the importance of investing in low-cost index funds for long-term growth, an essential strategy when planning finances with expected inheritance.

3: Invest in low-cost index funds for long-term growth

When planning finances with expected inheritance, investing in low-cost index funds is essential for achieving long-term financial growth while managing windfall money.

Actionable Steps:

- Research different types of index funds: Look into various index funds and evaluate their historical performance. Focus on funds that offer diversification and low fees, considering estate planning considerations.

- Set clear investment goals: Define your long-term financial goals with inheritance, such as retirement or a major purchase. Align your investment strategy with these objectives to ensure consistent growth.

- Regularly review and rebalance your portfolio: Schedule periodic reviews of your investments to ensure they match your goals. Rebalance your portfolio as needed to maintain your desired asset allocation when investing inherited wealth.

Consider these factors when choosing index funds for financial planning for inheritance:

- Expense ratio and management fees

- Historical performance and volatility

- Asset allocation and diversification

Explanation: Investing in low-cost index funds helps you grow your wealth steadily over time. This strategy minimizes fees and maximizes returns through diversification, helping you avoid inheritance pitfalls.

For more insights on managing financial windfalls, visit this resource.

Next, let’s explore how Alleo can assist you in managing these steps effectively while planning finances with expected inheritance.

Partner with Alleo on Your Financial Planning Journey

We’ve explored the challenges of planning finances with expected inheritance. But did you know you can work with Alleo to make this journey easier?

Alleo offers personalized coaching to help you navigate financial planning for inheritance. Sign up for a free 14-day trial with no credit card required.

Create a personalized plan and work directly with Alleo’s AI coach. They’ll help you set goals, track progress, and stay accountable in managing windfall money.

Alleo’s coach follows up on your progress, handles changes, and keeps you on track via text and push notifications, ensuring you avoid inheritance pitfalls.

Ready to get started for free with planning finances with expected inheritance?

Let me show you how!

Step 1: Log In or Create Your Account

To begin your financial planning journey with Alleo, Log in to your account or create a new one to access personalized coaching and start building your financial strategy.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a solid foundation for managing your finances effectively while anticipating a potential inheritance, helping you create consistent behaviors that support your long-term financial goals.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo, allowing you to effectively manage your current budget, emergency fund, and investments while planning for a potential inheritance.

Step 4: Starting a Coaching Session

Begin your financial planning journey with Alleo by scheduling an initial intake session to discuss your current situation, inheritance expectations, and set up a personalized plan that aligns with your long-term financial goals.

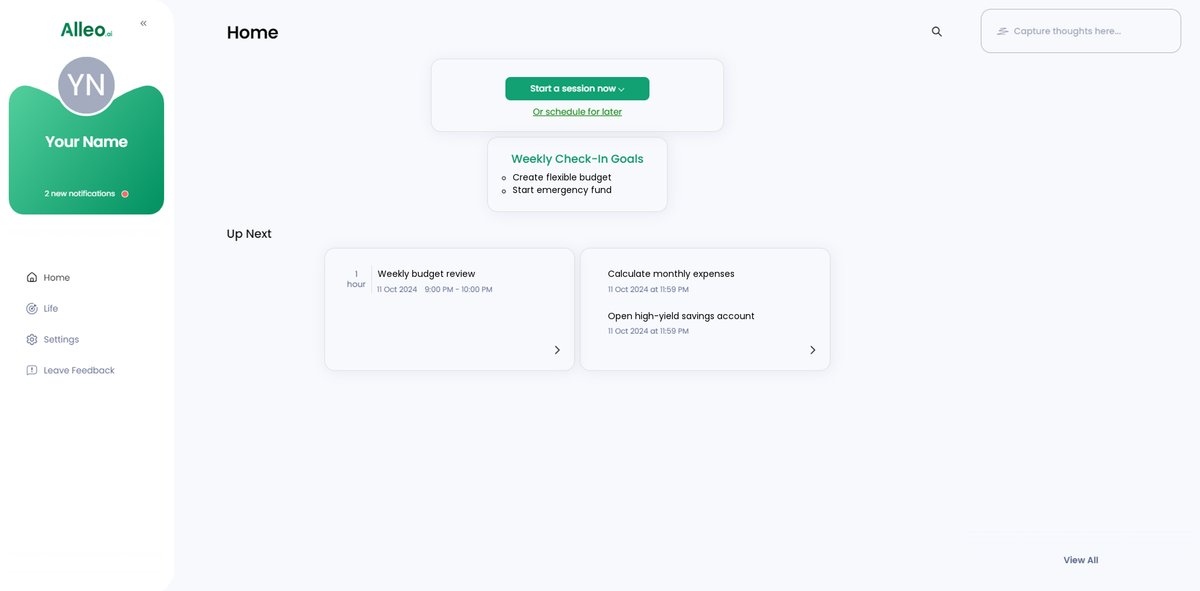

Step 5: Viewing and Managing Goals After the Session

After your coaching session on financial planning with inheritance, check the Alleo app’s home page to view and manage the goals you discussed, helping you stay on track with your budgeting, emergency fund, and investment strategies.

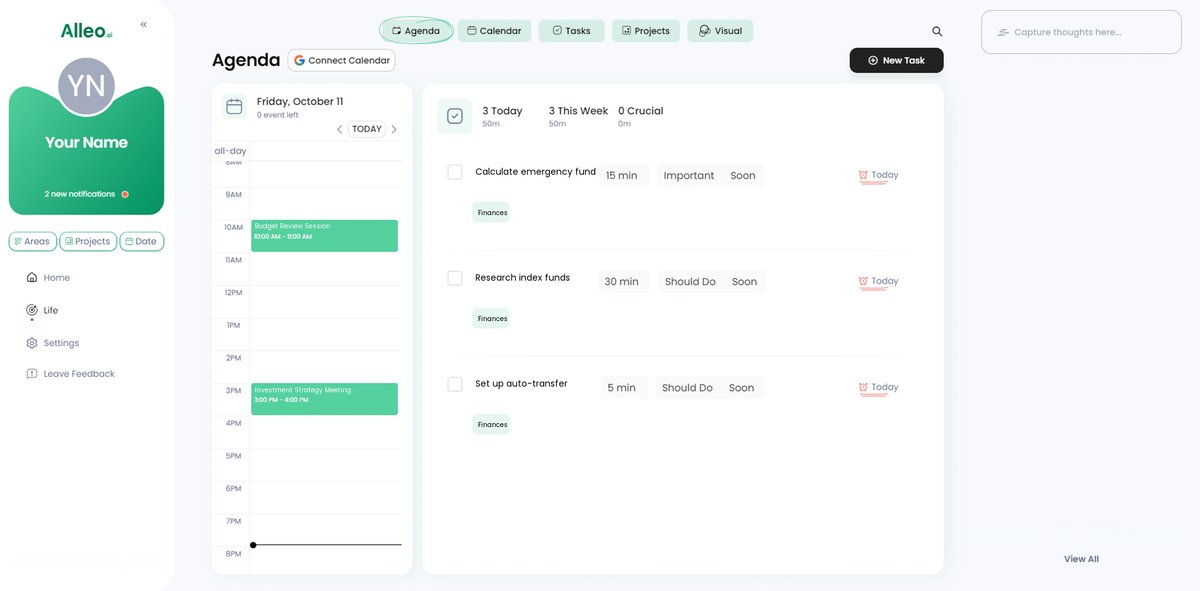

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to schedule and track your financial planning activities, such as budget reviews, emergency fund contributions, and investment check-ins, helping you stay on top of your goals while anticipating your inheritance.

Wrapping Up: Planning for Your Financial Future with Confidence

We’ve covered a lot of ground in planning finances with expected inheritance.

Balancing current finances while anticipating an inheritance can be challenging. But with a flexible budget, an emergency fund, and smart investing of inherited wealth, you can navigate this complexity.

Remember, it’s about staying prepared and not relying solely on future windfalls when considering estate planning and long-term financial goals with inheritance.

Addressing your financial needs today ensures stability tomorrow, helping you avoid inheritance pitfalls.

Alleo is here to help you every step of the way in your financial planning for inheritance.

Take charge of your financial future. Try Alleo for free and experience the benefits of personalized financial planning, including managing windfall money and inheritance and retirement planning.

You’ve got this!