How to Revise Financial Forecasts for Regulatory Compliance in 5 Essential Steps

Are you struggling to keep your financial forecasts updated with the ever-changing regulatory requirements? Updating financial forecasts for compliance can be a challenging task.

As a life coach, I’ve helped many professionals navigate these challenges. I understand the impact that financial compliance regulations can have on financial projections and budgets. Regulatory reporting requirements often necessitate forecast revision techniques.

In this article, you’ll discover strategies to ensure compliance while maintaining financial accuracy. We’ll explore actionable steps, benefits, and tools that can help you adjust your financial forecasts effectively. From financial data analysis for compliance to budgeting and forecasting best practices, we’ll cover essential aspects of updating financial projections.

Let’s dive into the world of compliance risk assessment in forecasting and creating audit-ready financial forecasts.

Current Challenges in Financial Forecasting

Navigating regulatory changes is no small feat. Many accountants struggle with updating financial forecasts for compliance amidst constant updates to financial compliance regulations.

These changes can dramatically impact projections and budgets, leading to significant issues in regulatory reporting requirements.

For instance, several clients report that outdated forecasts caused missed opportunities and financial strain. Imagine the pressure of realizing your financial models no longer align with new regulations, necessitating forecast revision techniques.

The urgency is palpable.

Moreover, adapting to new standards often requires substantial time and resources for financial data analysis for compliance. This can be overwhelming.

But don’t worry, there are solutions for updating financial projections. Let’s explore them.

Overcoming this challenge in updating financial forecasts for compliance requires focusing on key steps. Here are the main areas to make progress:

- Review and update forecasting assumptions: Regularly revise assumptions based on the latest data for financial compliance regulations.

- Implement revision history tracking: Track all changes for transparency and accuracy in regulatory reporting requirements.

- Align projections with new regulatory standards: Ensure compliance with updated standards when updating financial projections.

- Conduct scenario analysis for compliance impact: Assess different regulatory scenarios using financial data analysis for compliance.

- Establish cross-functional review process: Collaborate across departments for thorough reviews, following budgeting and forecasting best practices.

Let’s dive into updating financial forecasts for compliance!

1: Review and update forecasting assumptions

Regularly reviewing and updating forecasting assumptions is crucial for maintaining financial accuracy amidst regulatory changes and updating financial forecasts for compliance.

Actionable Steps:

- Conduct quarterly reviews of all financial forecasting assumptions to ensure they reflect the latest economic and regulatory data, focusing on financial compliance regulations.

- Engage with industry experts for insights on emerging trends and potential regulatory changes by scheduling monthly expert consultations, considering regulatory impact on financial planning.

- Implement a feedback loop with stakeholders to gather input on the realism of assumptions, conducting bi-monthly meetings with key stakeholders to discuss forecast revision techniques.

Key benefits of regular assumption reviews include:

- Improved accuracy in financial projections and regulatory reporting requirements

- Enhanced risk management capabilities and compliance risk assessment in forecasting

- Increased adaptability to market changes and regulatory impacts

Explanation: Reviewing and updating assumptions ensures that your financial forecasts remain accurate and compliant with the latest regulations, supporting budgeting and forecasting best practices.

This proactive approach helps in mitigating risks and identifying opportunities. For instance, staying informed about regulatory changes can provide a competitive edge in financial data analysis for compliance.

According to the Congressional Budget Office, updating budget projections is essential for clear trend analysis.

Staying proactive with assumption reviews sets a solid foundation for effective financial forecasting and updating financial projections, ensuring audit-ready financial forecasts.

2: Implement revision history tracking

Implementing revision history tracking is essential for ensuring transparency and accuracy when updating financial forecasts for compliance.

Actionable Steps:

- Integrate a robust revision history tracking system into your financial management software for regulatory reporting requirements.

- Ensure 100% of changes are tracked and logged for compliance risk assessment in forecasting.

- Train your team on best practices for documenting changes and maintaining transparency in financial data analysis for compliance.

- Conduct a workshop within the next month to train all team members on forecast revision techniques.

- Regularly audit the revision history to ensure compliance and accountability in financial modeling for compliance purposes.

- Perform quarterly audits to verify accuracy and adherence to financial compliance regulations.

Explanation: Implementing revision history tracking ensures that all changes are documented, allowing for greater accountability and transparency when updating financial forecasts for compliance.

This practice helps in maintaining the integrity of financial forecasts and aids in regulatory compliance, aligning with budgeting and forecasting best practices.

For instance, according to Brixx, revision history is crucial for maintaining accuracy and transparency in financial forecasting.

Having a robust revision history tracking system in place sets a strong foundation for accurate and compliant financial forecasting, supporting the creation of audit-ready financial forecasts and addressing the regulatory impact on financial planning.

3: Align projections with new regulatory standards

Aligning projections with new regulatory standards is essential for updating financial forecasts for compliance and maintaining accuracy in financial forecasting.

Actionable Steps:

- Stay updated with the latest financial compliance regulations through continuous education and subscription to industry newsletters.

- Specific: Subscribe to three reputable industry newsletters focusing on regulatory reporting requirements.

- Collaborate with regulatory bodies to understand the nuances of new standards and their impact on financial planning.

- Measurable: Schedule bi-annual meetings with regulatory representatives to discuss compliance risk assessment in forecasting.

- Update financial models to reflect changes in regulatory requirements accurately, incorporating forecast revision techniques.

- Actionable: Revise models within one month of any regulatory update, focusing on financial modeling for compliance purposes.

Explanation: Ensuring that your projections align with new regulatory standards is crucial for compliance and accuracy when updating financial forecasts for compliance.

Regular updates and collaboration can help you stay informed and adapt swiftly, adhering to budgeting and forecasting best practices.

According to the IFRS, timely updates are vital for aligning financial models with evolving standards and creating audit-ready financial forecasts.

Following these steps can help you stay ahead of regulatory changes and maintain accurate financial forecasts through effective financial data analysis for compliance.

4: Conduct scenario analysis for compliance impact

To ensure compliance when updating financial forecasts, conducting scenario analyses can help you anticipate the effects of regulatory changes on your financial projections.

Actionable Steps:

- Develop multiple financial scenarios to assess the impact of different regulatory changes on updating financial forecasts for compliance.

- Create at least three scenarios for each potential regulatory change.

- Use simulation tools to predict outcomes and prepare contingency plans for financial compliance regulations.

- Implement simulations quarterly to anticipate changes.

Key components of effective scenario analysis for regulatory reporting requirements:

- Comprehensive financial data analysis for compliance

- Robust modeling techniques for updating financial projections

- Regular review and adjustment of scenarios for compliance risk assessment in forecasting

Explanation: Conducting scenario analysis helps you prepare for various regulatory changes and their potential impacts on your financial forecasts, ensuring budgeting and forecasting best practices.

By using simulation tools, you can predict outcomes and create contingency plans for updating financial forecasts for compliance.

According to the OCC, regular scenario analysis is essential for assessing financial resilience and ensuring compliance.

Staying ahead of regulatory changes through scenario analysis helps maintain accurate and audit-ready financial forecasts while considering the regulatory impact on financial planning.

5: Establish cross-functional review process

Creating a cross-functional review process is essential for updating financial forecasts for compliance and ensuring comprehensive regulatory adherence.

Actionable Steps:

- Form a dedicated team that includes finance, legal, and compliance departments. Hold monthly review meetings to assess forecasts and address financial compliance regulations.

- Develop a detailed checklist to cover all regulatory aspects during the review, including forecast revision techniques. Finalize this checklist within two weeks.

- Implement a tracking system for issues identified during reviews, focusing on regulatory reporting requirements. Resolve these issues within two weeks of identification.

Benefits of a cross-functional review process for updating financial forecasts for compliance:

- Enhanced compliance oversight and financial data analysis for compliance

- Improved communication between departments for updating financial projections

- More comprehensive compliance risk assessment in forecasting

Explanation: Establishing a cross-functional review process ensures that all regulatory aspects are thoroughly examined when updating financial forecasts for compliance. This collaboration helps maintain compliance and accuracy in financial modeling for compliance purposes.

According to NAIC, such processes are vital for effective risk management and regulatory compliance, aligning with budgeting and forecasting best practices.

By fostering collaboration across departments, you ensure robust and audit-ready financial forecasts that account for regulatory impact on financial planning.

Partner with Alleo for Financial Forecasting Compliance

We’ve explored the challenges of updating financial forecasts for compliance with regulatory reporting requirements. Did you know you can work directly with Alleo to make this journey of financial compliance regulations easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan for updating financial projections, and our AI coach will guide you through the process of forecast revision techniques.

Alleo’s coach provides tailored coaching support for compliance risk assessment in forecasting. You’ll receive full coaching sessions just like with a human coach, focusing on budgeting and forecasting best practices.

The coach will follow up on progress and handle changes to keep you accountable in financial data analysis for compliance.

Receive updates via text and push notifications to stay on track with regulatory impact on financial planning. With Alleo, you’ll navigate regulatory changes with ease, ensuring audit-ready financial forecasts.

Plus, there’s a free 14-day trial with no credit card required for financial modeling for compliance purposes.

Ready to get started for free? Let me show you how to begin updating financial forecasts for compliance!

Step 1: Log In or Create Your Account

To begin your journey with Alleo’s AI coach for regulatory compliance in financial forecasting, simply log in to your account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop a structured approach for staying on top of regulatory changes and maintaining accurate financial forecasts – this goal will help you establish consistent practices for reviewing assumptions, tracking revisions, and aligning projections with new standards.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo’s AI coach, as this will provide targeted guidance for navigating regulatory changes and improving your financial forecasting accuracy.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you create a personalized plan to keep your financial forecasts updated and compliant with changing regulations.

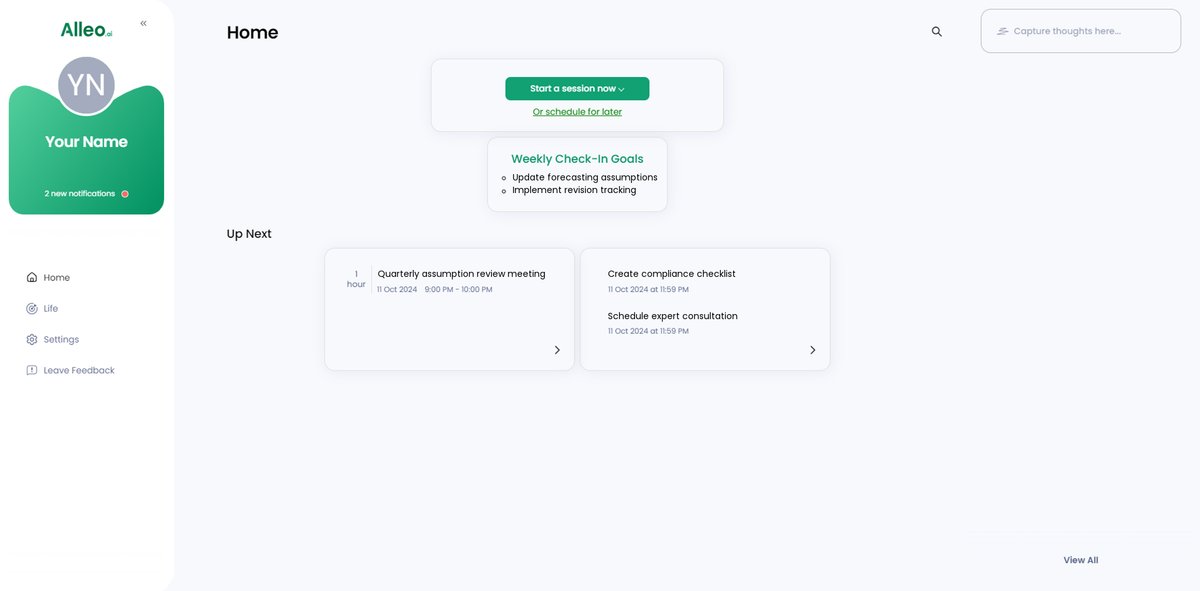

Step 5: Viewing and managing goals after the session

After your coaching session, easily access and manage the financial forecasting goals you discussed by viewing them on the home page of the Alleo app, allowing you to track your progress in maintaining regulatory compliance.

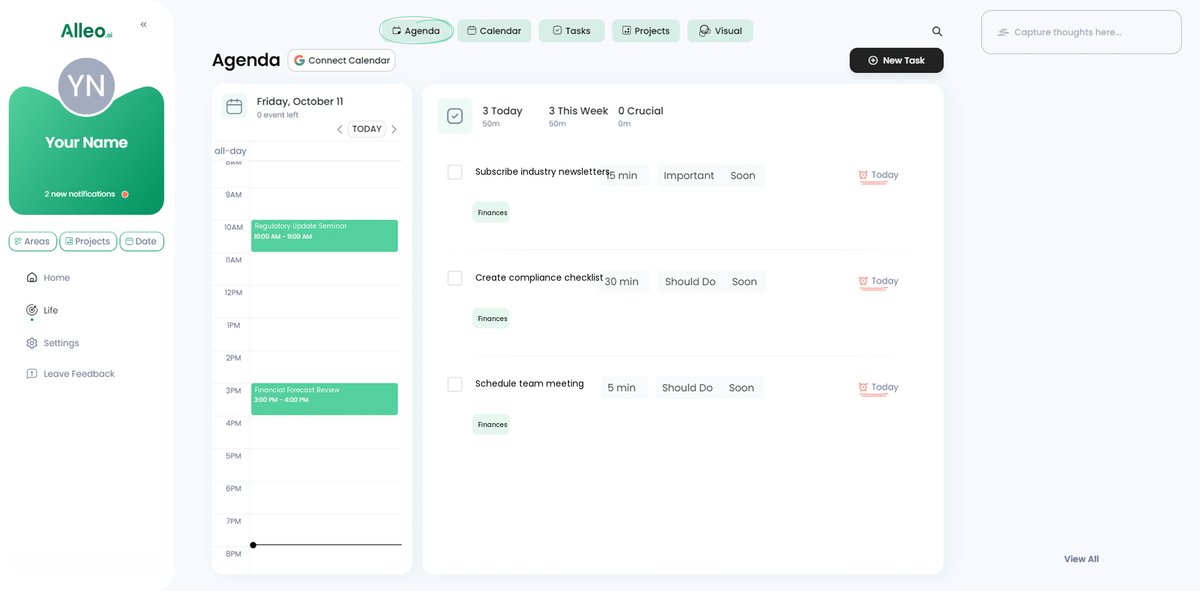

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in implementing regulatory changes and updating financial forecasts, ensuring you stay on top of deadlines and milestones as you work towards compliance.

Bringing It All Together for Regulatory Compliance

Keeping up with regulatory changes can be overwhelming, but it’s essential for updating financial forecasts for compliance. By following these steps, you can ensure your financial forecasts remain accurate and compliant with financial compliance regulations.

Remember, it’s all about staying proactive. Regularly updating assumptions, tracking revisions, and aligning with new standards are key to effective forecast revision techniques and meeting regulatory reporting requirements.

Don’t forget to conduct scenario analyses and establish a cross-functional review process. These actions will help you navigate the complexities of regulatory compliance and improve your financial data analysis for compliance purposes.

Lastly, let Alleo support you on this journey of updating financial projections. With our AI coach, you can streamline your processes and stay ahead of changes effortlessly, ensuring audit-ready financial forecasts.

Try Alleo for free today and make regulatory compliance a breeze while mastering budgeting and forecasting best practices!