6 Powerful Strategies for Financial Advisors to Expand Their Client Base and Assets

Are you struggling to grow your financial advisor client base and assets in the competitive financial services market?

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, financial advisors often face high competition and client acquisition costs when trying to grow their client base and assets under management.

In this article, you’ll discover proven strategies to grow your financial advisor client base and assets. We’ll cover leveraging technology for digital marketing, personalized marketing techniques for financial advisors, and strategic networking strategies for financial professionals.

Let’s dive in.

![]()

Understanding the Challenges in Financial Services

Navigating the financial advisory market is tough. High competition and expensive client acquisition techniques for financial advisors make it challenging to grow financial advisor client base.

Many clients initially struggle with finding effective strategies for growing assets under management.

Traditional methods, like cold calling, often fall short. Today’s clients demand more personalized approaches, including digital marketing for financial planners.

This shift requires innovative tactics, such as networking strategies for financial advisors.

In my experience, several advisors find client retention strategies for wealth managers difficult. They need to offer customized solutions to stand out and grow financial advisor client base.

Embracing new strategies, like niche targeting in financial advisory services, is crucial for success.

Strategic Roadmap for Expanding Your Client Base and Assets

Overcoming this challenge requires a few key steps to grow your financial advisor client base. Here are the main areas to focus on to make progress and boost your assets under management.

- Leverage LinkedIn for High-Net-Worth Prospecting: Optimize your profile and connect with targeted networks to attract wealthy clients, enhancing your networking strategies for financial advisors.

- Implement Personalized Seminar Selling Strategy: Develop tailored seminars to engage and convert potential clients, an effective client acquisition technique for financial advisors.

- Offer Charitable Giving Advisory Services: Partner with charities to provide specialized giving programs, aiding in niche targeting in financial advisory services.

- Develop Niche Expertise for Targeted Marketing: Focus on a niche market to establish your expertise and attract specific clients, enhancing your prospecting methods as a financial professional.

- Utilize AI for Enhanced Client Engagement: Implement AI tools to personalize interactions and automate routine tasks, improving digital marketing for financial planners.

- Pursue Strategic Mergers or Acquisitions: Identify and integrate complementary firms to expand your client base and services, effectively growing your financial advisor client base.

Let’s dive in to explore these strategies for growing assets under management!

1: Leverage LinkedIn for high-net-worth prospecting

LinkedIn is a powerful tool for financial advisors aiming to grow their client base and connect with high-net-worth clients.

Actionable Steps:

- Optimize your LinkedIn profile: Highlight your expertise and use keywords that attract high-net-worth individuals, enhancing your client acquisition techniques as a financial advisor.

- Engage with alumni and professional networks: Join relevant LinkedIn groups and share valuable insights to build credibility, an essential networking strategy for financial advisors.

- Utilize LinkedIn Sales Navigator: Use advanced search features to identify and connect with potential high-net-worth clients, aiding in growing assets under management.

Explanation:

These steps are essential because they help you establish a professional presence and build relationships with potential clients, key to growing your financial advisor client base.

By participating in LinkedIn groups, you can share your knowledge and attract high-net-worth individuals. Using LinkedIn Sales Navigator, you can find and connect with prospects more efficiently, improving your prospecting methods as a financial professional.

For more insights on leveraging LinkedIn, check out this article.

Key benefits of LinkedIn for financial advisors:

- Expand your professional network

- Showcase your expertise through content sharing, a crucial aspect of content marketing strategies for financial services

- Access targeted prospect data

By following these steps, you’ll be well on your way to expanding your client base through LinkedIn prospecting and enhancing your social media marketing as a financial advisor.

2: Implement personalized seminar selling strategy

In today’s competitive landscape, personalized seminar selling can effectively engage potential clients and showcase your expertise, helping you grow your financial advisor client base.

Actionable Steps:

- Identify your target audience: Conduct research to understand the demographics and preferences of your ideal clients. Tailor seminar topics to address their specific needs, incorporating niche targeting in financial advisory services.

- Develop engaging content: Create presentations that provide value and demonstrate your expertise. Include real-life case studies and success stories to build trust, utilizing content marketing strategies for financial services.

- Follow up with attendees: Send personalized thank-you emails and offer free consultations. Use attendee feedback to improve future seminars, enhancing your client acquisition techniques for financial advisors.

Explanation:

These steps help you connect with potential clients on a personal level, which is crucial for building trust and credibility while growing assets under management.

By tailoring your content and following up, you can effectively address client needs and demonstrate your value. For more insights on personalized client engagement, check out this article.

Personalized seminars can be a game-changer in expanding your client base and implementing effective networking strategies for financial advisors.

3: Offer charitable giving advisory services

Offering charitable giving advisory services can attract clients seeking to align their financial plans with their values, helping you grow your financial advisor client base.

Actionable Steps:

- Partner with charitable organizations: Collaborate with local and national charities to provide specialized advisory services on charitable giving, enhancing your client acquisition techniques for financial advisors.

- Develop a charitable giving program: Create a structured program that guides clients in setting up donor-advised funds, highlighting tax benefits and personal fulfillment, which can aid in growing assets under management.

Explanation:

These steps matter because they add a meaningful dimension to your services, appealing to clients’ desire for purposeful financial planning and helping you grow your financial advisor client base.

By partnering with charities and offering structured programs, you can provide valuable guidance and foster long-term relationships, which are essential networking strategies for financial advisors.

For more details on the benefits of charitable giving, explore Fidelity Charitable.

Benefits of offering charitable giving advisory services:

- Differentiate your practice from competitors

- Attract socially conscious clients

- Deepen existing client relationships

Offering charitable giving advisory services can set you apart in the competitive financial services market and help grow your financial advisor client base.

4: Develop niche expertise for targeted marketing

Developing niche expertise is crucial for financial advisors to grow their client base and establish themselves as industry leaders. This approach is particularly effective for client acquisition techniques for financial advisors looking to expand their assets under management.

Actionable Steps:

- Identify a niche market: Research and select a niche market where you can position yourself as an expert. Focus on areas like estate planning for lawyers or investment strategies for doctors, which can help grow your financial advisor client base.

- Create specialized content: Develop content that addresses the unique challenges within your niche. Publish articles, whitepapers, and blog posts that showcase your expertise, utilizing content marketing strategies for financial services.

- Host niche-specific events: Organize webinars, workshops, or networking events tailored to your niche market. Invite industry experts to co-host and share insights, enhancing your networking strategies for financial advisors.

Explanation:

These steps matter because they help you stand out in a crowded market by offering specialized knowledge and services. By focusing on a niche, you can address specific client needs more effectively and grow your financial advisor client base through targeted marketing.

For more insights on niche marketing, check out this article.

Building niche expertise can significantly enhance your marketing efforts and client acquisition, helping you grow your financial advisor client base and increase assets under management.

5: Utilize AI for enhanced client engagement

Leveraging AI can greatly enhance client engagement and streamline your operations in today’s financial services market, helping you grow your financial advisor client base.

Actionable Steps:

- Implement AI-powered tools: Analyze client data to provide personalized financial recommendations. Use AI chatbots for instant client support, improving client acquisition techniques for financial advisors.

- Automate routine tasks: Automate scheduling, follow-ups, and document management to save time and enhance efficiency, allowing more focus on growing assets under management.

- Personalize client communications: Use AI to tailor emails, newsletters, and social media posts based on client preferences and behaviors, enhancing digital marketing for financial planners.

Explanation:

These steps matter because they help you offer personalized and efficient client service, which is crucial in a competitive market. By leveraging AI, you can better understand client needs and provide timely advice, supporting your efforts to grow your financial advisor client base.

For more insights on integrating AI in financial services, explore this resource.

Key advantages of AI in financial advising:

- Improve decision-making with data-driven insights

- Enhance customer experience through personalization

- Increase operational efficiency and productivity

Utilizing AI can significantly boost your client engagement and operational efficiency, supporting your efforts to grow your financial advisor client base and implement effective networking strategies for financial advisors.

6: Pursue strategic mergers or acquisitions

Pursuing strategic mergers or acquisitions is crucial for expanding your client base and assets, helping you grow your financial advisor client base effectively.

Actionable Steps:

- Identify potential partners: Research firms with complementary services or client bases. Evaluate partners based on financial health and cultural fit, considering niche targeting in financial advisory services.

- Conduct thorough due diligence: Assess potential risks and benefits. Engage legal and financial advisors to ensure compliance and a smooth transition, focusing on growing assets under management.

- Develop an integration plan: Create a detailed plan for merging the new firm into your business. Communicate transparently with clients and staff to ensure a seamless process, enhancing client retention strategies for wealth managers.

Explanation:

These steps matter because they help you expand efficiently while mitigating risks. By identifying the right partners and conducting due diligence, you can ensure a successful merger and grow your financial advisor client base.

For more insights on strategic growth through mergers, explore this resource.

Strategic mergers or acquisitions can significantly boost your client base and enhance your business growth, serving as effective client acquisition techniques for financial advisors.

Partner with Alleo to Expand Your Client Base and Assets

We’ve explored the challenges of expanding your client base and assets in the financial services market. Did you know you can work directly with Alleo to grow your financial advisor client base easier and faster?

Setting up an account with Alleo is simple. First, create a personalized plan tailored to your business needs, including client acquisition techniques for financial advisors and strategies for growing assets under management.

Alleo’s AI coach will follow up on your progress, handle changes, and keep you accountable through text and push notifications, supporting your networking strategies for financial advisors and digital marketing efforts for financial planners.

Our affordable coaching provides full sessions like any human coach, offering guidance on referral programs for wealth management and niche targeting in financial advisory services. Plus, enjoy a free 14-day trial with no credit card required.

Ready to get started for free and learn how to grow your financial advisor client base? Let me show you how!

Step 1: Logging in or Creating Your Account

To begin expanding your client base with Alleo’s AI coach, Log in to your account or create a new one to access personalized strategies tailored for financial advisors.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your efforts with expanding your client base and assets in financial services, addressing the key challenges outlined in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in the AI coach to align with your goal of expanding your client base and assets in financial services, allowing you to receive tailored strategies and support for growing your advisory business.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you create a personalized plan to expand your client base and assets in the financial services market.

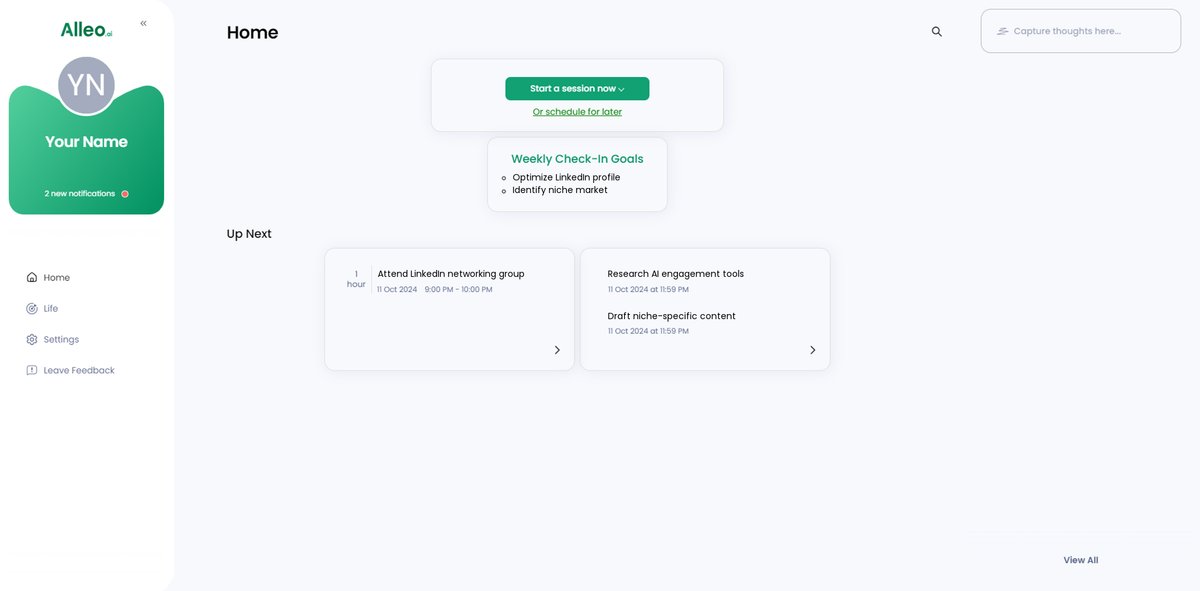

Step 5: Viewing and managing goals after the session

After your coaching session, easily track your progress by accessing the goals you discussed on the app’s home page, allowing you to stay focused on expanding your client base and assets in the financial services market.

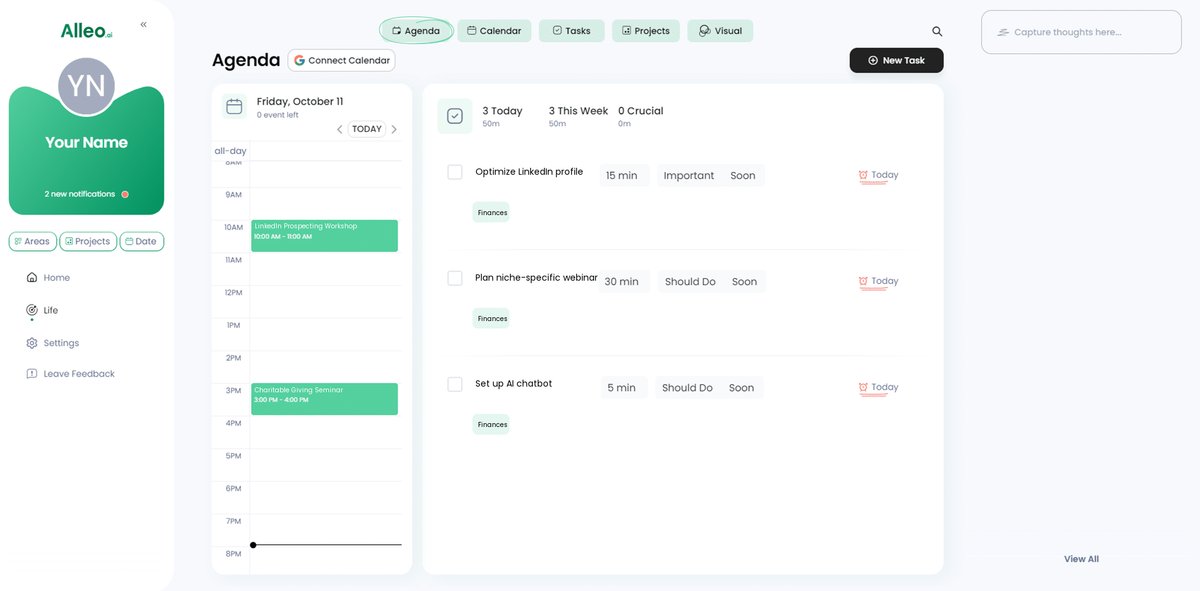

Step 6: Adding events to your calendar or app

Track your progress in expanding your client base and assets by adding key events and tasks to the Alleo app’s calendar, allowing you to monitor deadlines and milestones as you implement the strategies discussed in this article.

Wrapping Up: Your Path to Success

We’ve covered a lot of ground today, and I hope you’re feeling inspired. Expanding your client base and growing assets under management as a financial advisor is within reach.

Remember, leveraging LinkedIn, personalized seminars, and charitable giving can set you apart in client acquisition techniques for financial advisors. Developing niche expertise in financial advisory services and utilizing AI will further enhance your efforts to grow your financial advisor client base.

Strategic mergers can also provide significant growth opportunities for wealth management. Each of these networking strategies for financial advisors is a step toward achieving your goals.

Take action and start implementing these prospecting methods for financial professionals today. You’re not alone in this journey to grow your financial advisor client base—Alleo is here to support you.

With Alleo, you can streamline your business development plan and digital marketing for financial planners. Try our personalized coaching for free and see the difference it makes in your client retention strategies for wealth managers.

You’ve got this!