Mastering the Balance: Car Loans and Savings for Young Professionals

Are you struggling to balance car loans and savings while managing your finances as a young professional?

As a life coach, I’ve helped many professionals navigate these challenges. Understanding your financial priorities is crucial for achieving lasting stability, especially when it comes to balancing car loans and savings.

In this article, you’ll learn strategies to manage your car loan while building substantial savings. We’ll explore car loan budgeting tips, automating finances, and leveraging high-yield savings accounts for maximizing income for savings and debt.

Let’s dive in.

Understanding the Challenges of Balancing Car Loan Payments and Savings

Managing car loan payments while trying to build savings can be overwhelming for many young professionals. Unexpected expenses like car repairs and job instability add stress to the process of balancing car loans and savings.

Many clients, particularly recent college grads, initially struggle with prioritizing their finances. They often face tough decisions between paying down debt and saving for future goals, especially when juggling student loans and car payments.

In my experience, people find it difficult to stay on track without a clear plan for car loan budgeting and savings strategies. This lack of direction leads to financial stress and uncertainty, particularly for first-time auto buyers.

A well-balanced approach to managing finances as a young professional can make a significant difference. Let’s explore how to achieve that balance between debt repayment and building an emergency fund.

Strategic Approach to Balancing Car Loan Payments and Savings

Overcoming the challenge of balancing car loans and savings requires a few key steps. Here are the main areas to focus on to make progress, especially for new graduates and young professionals managing finances.

- Create a Budget Prioritizing Loan and Savings: Track income and expenses, and allocate funds strategically for car loan budgeting and savings strategies.

- Automate Car Payments and Savings Contributions: Set up auto-pay for loans and automatic savings transfers to help build credit while saving money.

- Compare Loan Refinancing Options for Better Rates: Research refinancing options and consult advisors for auto financing tips.

- Build Emergency Fund Alongside Car Payments: Set a realistic goal and automate contributions to balance debt repayment vs. emergency fund.

- Use High-Yield Savings for Short-Term Goals: Open a high-yield savings account and allocate short-term savings as part of financial planning for recent college grads.

- Explore Side Hustles to Boost Income for Both: Identify skills, start small, and reinvest earnings to maximize income for savings and debt.

Let’s dive in!

1: Create a budget prioritizing loan and savings

Creating a budget that prioritizes loan payments and savings is essential for balancing car loans and savings, especially for financial stability.

Actionable Steps:

- Analyze your income and expenses: Track all sources of income and categorize your expenses. Use a budgeting tool or spreadsheet for clarity, focusing on car loan budgeting tips.

- Allocate funds strategically: Prioritize car loan payments and essential savings. Implement the 50/30/20 rule (50% needs, 30% savings/debt, 20% wants) as part of your savings strategies for new graduates.

- Regularly review and adjust your budget: Schedule monthly budget reviews. Adjust allocations based on changing circumstances or goals, which is crucial when managing finances as a young professional.

Key benefits of budgeting include:

- Improved financial awareness

- Better control over spending

- Increased likelihood of achieving financial goals

Explanation:

These steps help you manage your finances efficiently, ensuring you meet both loan obligations and savings goals. By tracking and adjusting your budget regularly, you can stay on top of your financial health while balancing car loans and savings.

According to USSFCU, understanding and managing cash flow is crucial for financial success.

This balanced approach sets the foundation for achieving your financial goals, including building credit while saving money.

2: Automate car payments and savings contributions

Automating your car payments and savings is crucial when balancing car loans and savings, ensuring consistency and reducing financial stress.

Actionable Steps:

- Set up auto-pay for car loans: Enroll in your lender’s auto-pay program to ensure timely payments and avoid late fees, a key aspect of car loan budgeting tips.

- Automate savings transfers: Schedule automatic transfers from your checking account to your savings account on payday, an essential savings strategy for new graduates.

- Use financial apps: Utilize budgeting apps to monitor automated payments and track your progress towards financial goals, helping you manage finances as a young professional.

Explanation:

Automating these tasks helps you stay on track without constant manual intervention. It ensures you’re meeting both debt obligations and savings targets, which is crucial when balancing car loans and savings.

As highlighted by Geisinger, effective loan repayment and proactive financial management are critical for financial health.

This approach simplifies your financial routine, allowing you to focus on other priorities while balancing car loans and savings effectively.

3: Compare loan refinancing options for better rates

Refinancing your car loan can reduce your interest rate and lower monthly payments, helping you balance car loans and savings more effectively.

Actionable Steps:

- Research refinancing options: Compare interest rates and terms from various lenders. Make sure to consider the total cost of refinancing versus potential savings, a crucial aspect of car loan budgeting tips.

- Consult financial advisors: Seek advice from a financial planner to evaluate the long-term benefits of refinancing. They can help you understand how refinancing fits into your overall financial plan, especially when managing finances as a young professional.

- Apply for refinancing: Gather necessary documents and submit applications. Negotiate for the best rates to maximize your savings and improve your strategy for balancing car loans and savings.

Explanation:

These steps are crucial for optimizing your car loan and freeing up funds for savings. Lower interest rates can lead to significant savings over time, allowing you to allocate more towards other financial goals, which is essential when balancing student loans and car payments.

According to Bankrate, researching and comparing refinancing options can help you find better rates and terms, ultimately improving your financial health and helping you build credit while saving money.

Refinancing can be a smart move to ease your financial burden and enhance savings, particularly for those focusing on financial planning for recent college grads.

4: Build emergency fund alongside car payments

Balancing car loans and savings is essential for financial stability, especially when it comes to building an emergency fund while making car loan payments.

Actionable Steps:

- Set a realistic emergency fund goal: Aim to save 3-6 months of living expenses. Start with small, achievable milestones when managing finances as a young professional.

- Automate contributions to the emergency fund: Schedule regular deposits into a high-yield savings account. Use windfalls like tax refunds to boost the fund, which is crucial for balancing student loans and car payments.

Consider these strategies to boost your emergency fund:

- Cut unnecessary expenses and redirect savings, a key aspect of car loan budgeting tips

- Sell unused items for extra cash

- Use cashback rewards from credit cards

Explanation:

These steps help ensure you have a safety net for unexpected expenses while meeting your loan obligations. Automating contributions makes it easier to stay consistent without much effort, which is vital for building credit while saving money.

According to USSFCU, having an emergency fund is crucial for maintaining financial health and avoiding debt.

This approach allows you to build a secure financial foundation while balancing car loans and savings.

5: Use high-yield savings for short-term goals

Using high-yield savings accounts for short-term goals can maximize your savings with higher interest rates while balancing car loans and savings.

Actionable Steps:

- Open a high-yield savings account (HYSA): Research and select an HYSA with competitive interest rates. Focus on accounts with no fees and low minimum balances to support your car loan budgeting tips.

- Allocate short-term savings to HYSA: Direct savings for short-term goals like vacations or home repairs to your HYSA. Benefit from higher interest earnings compared to traditional savings accounts, helping you manage finances as a young professional.

Explanation:

These steps ensure your savings grow faster, helping you reach your financial goals more efficiently while balancing car loans and savings.

According to CNBC, high-yield savings accounts offer better returns than traditional accounts, making them ideal for short-term savings and building credit while saving money.

This approach leverages higher interest rates, allowing you to achieve more with your savings and effectively manage your auto financing for first-time buyers.

Consider this strategy to enhance your financial stability while managing car loan payments and implementing savings strategies for new graduates.

6: Explore side hustles to boost income for both

Exploring side hustles can significantly increase your income, helping you balance car loans and savings while managing finances as a young professional.

Actionable Steps:

- Identify marketable skills: List skills and hobbies that can generate extra income. Research side hustles that fit your schedule and interests, considering affordable car options for millennials.

- Start small and scale up: Begin with low-investment opportunities. Gradually increase efforts as you gain experience and confidence in balancing car loans and savings.

- Reinvest earnings: Use side hustle income to pay down car loans faster. Allocate extra funds towards savings and investments, focusing on financial planning for recent college grads.

Popular side hustle options to consider:

- Freelance writing or graphic design

- Online tutoring or teaching

- Pet-sitting or dog-walking services

Explanation:

These steps help you boost your income, making it easier to balance car loan payments and savings. According to Investopedia, diversifying income sources is essential for financial stability.

By reinvesting earnings, you can accelerate your financial goals and reduce debt, which is crucial when balancing student loans and car payments.

Consider this strategy to enhance your financial stability and achieve your financial goals while balancing car loans and savings.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of balancing car loan payments and savings, and how to tackle them. But did you know you can work directly with Alleo to make this journey easier, especially when it comes to balancing car loans and savings?

Set up an account and create a personalized plan with Alleo’s AI coach. The coach will follow up on your progress and handle changes, offering car loan budgeting tips and savings strategies for new graduates.

You’ll stay accountable via text and push notifications, helping you manage finances as a young professional.

Ready to get started for free? Let me show you how to balance student loans and car payments while maximizing income for savings and debt!

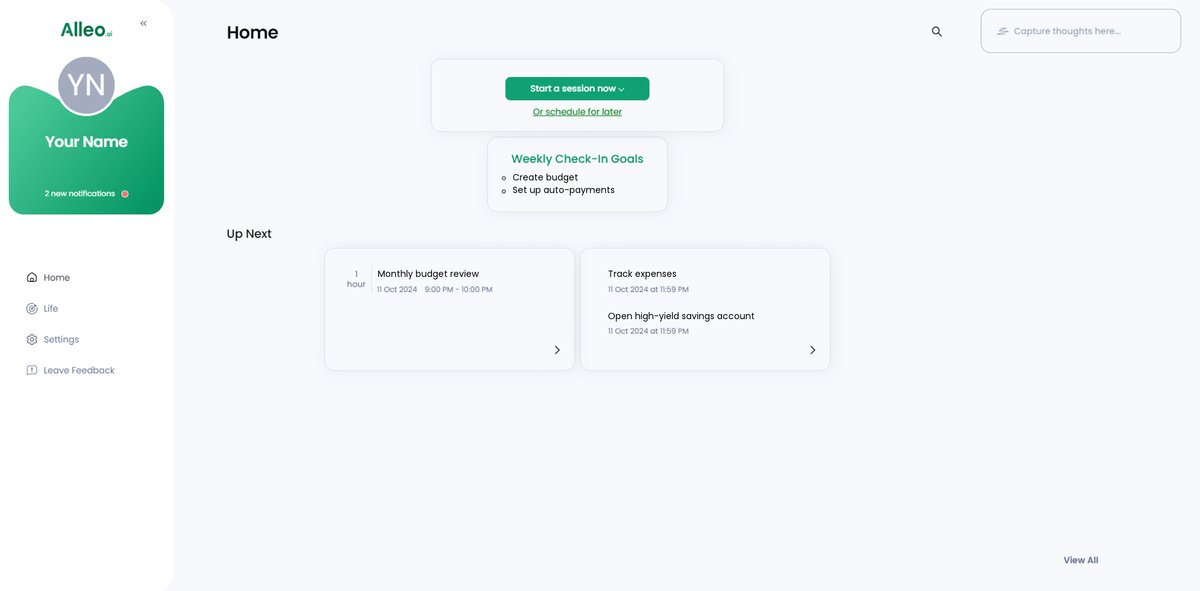

Step 1: Log In or Create Your Account

To start balancing your car loan payments and savings with our AI coach, Log in to your account or create a new one if you’re a first-time user.

Step 2: Choose “Building Better Habits and Routines”

Select “Building Better Habits and Routines” from the available goals to develop consistent financial practices that will help you balance car loan payments and savings more effectively, aligning with the strategies discussed in the article.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area to address the challenges of balancing car loan payments and savings, allowing Alleo’s AI coach to provide targeted strategies for improving your financial health and achieving your monetary goals.

Step 4: Starting a coaching session

Begin your journey with an intake session to create a personalized plan for balancing your car loan payments and savings goals, setting the foundation for your financial success.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to view and manage the financial goals you discussed, including balancing car loan payments and savings targets.

Step 6: Adding events to your calendar or app

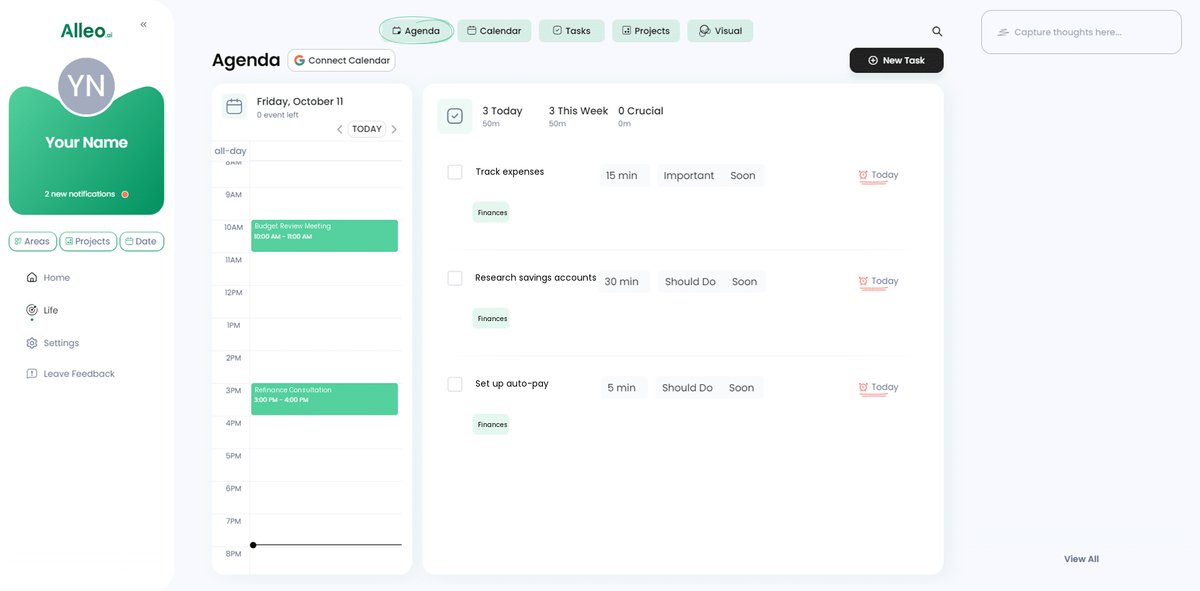

Use the calendar and task features in the Alleo app to track your progress on balancing car loan payments and savings goals, scheduling reminders for budget reviews, loan payments, and savings contributions to stay on top of your financial journey.

Achieve Financial Balance and Independence

By now, you understand the essential steps to balancing car loans and savings while building a secure financial future.

Remember, creating a budget and automating your finances can make a significant difference in managing finances as a young professional. Refinancing your car loan and building an emergency fund are also crucial steps for balancing student loans and car payments.

Using high-yield savings accounts and exploring side hustles can boost your income for savings and debt repayment, helping you maximize your financial potential.

I know balancing car loans and savings is challenging, but with a clear plan, you can achieve financial stability and work towards building credit while saving money.

Don’t forget to leverage Alleo’s tools to stay on track with your car loan budgeting tips and savings strategies.

Take the first step today and start your journey towards financial independence. You’ve got this!