6 Proven Methods to Balance FIRE Goals with Shared Expenses for Couples

Imagine achieving financial independence while maintaining harmony in your relationship. Is it possible to balance FIRE goals for couples?

As a life coach, I’ve helped many men navigate these challenges. In my experience, balancing personal financial goals with shared expenses in relationships can be tough.

In this post, you’ll discover proven strategies for balancing FIRE goals for couples with shared expenses. We’ll cover actionable steps, tools, and tips to help you achieve financial independence for couples without sacrificing relationship harmony. Learn about the FIRE movement for partners and effective budgeting as a couple.

Let’s dive in to explore joint savings strategies and retirement planning for two.

Understanding the Financial Strain of Balancing FIRE and Shared Expenses

Balancing FIRE goals for couples while managing shared expenses is a significant challenge for many partnerships. In my experience, couples often find it difficult to align their individual financial independence objectives with their joint financial commitments in the FIRE movement for partners.

Many clients initially struggle with the financial strain of caregiving, which can severely impact their joint savings strategies. Caregiving responsibilities often lead to reduced work hours or even job loss, making it harder to save aggressively towards retirement planning for two.

Additionally, the pressure to maintain a certain lifestyle can conflict with frugal living as a team. This balance becomes even more complicated when there’s a significant income disparity between partners, affecting their dual income FIRE approach.

Navigating these challenges requires careful planning and open communication in relationship money management. Without it, the pursuit of financial independence for couples can become a source of tension rather than a shared journey in aligning financial goals in marriage.

Strategic Steps to Balance FIRE Goals with Shared Expenses

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in balancing FIRE goals for couples.

- Open a Joint Account for Shared Expenses: Set up a joint bank account for rent, utilities, and groceries to manage shared expenses in relationships.

- Create a Proportional Expense-Sharing Plan: Contribute to shared expenses based on each partner’s income percentage, a crucial aspect of relationship money management.

- Set Individual and Couple FIRE Savings Goals: Define personal and shared financial independence and early retirement targets, essential for the FIRE movement for partners.

- Track Expenses Together Using Budgeting Apps: Use apps like YNAB for tracking and adjusting spending, supporting budgeting as a couple.

- Discuss Financial Values and Long-Term Plans: Align your financial goals and values through regular discussions, crucial for financial independence for couples.

- Establish Monthly Finance Check-Ins as a Couple: Schedule regular meetings to review progress and address concerns, aiding in joint savings strategies and retirement planning for two.

Let’s dive in to explore these strategies for balancing FIRE goals for couples!

1: Open a joint account for shared expenses

Opening a joint account for shared expenses is a crucial step in balancing personal financial goals with relationship commitments, especially for couples pursuing FIRE (Financial Independence, Retire Early) goals.

Actionable Steps:

- Identify all shared expenses: List out all recurring costs like rent, utilities, and groceries to support your journey towards financial independence as a couple.

- Set up a joint bank account: Open an account dedicated to these shared expenses to streamline payments and enhance your dual income FIRE approach.

- Automate contributions: Ensure both partners contribute a predetermined amount to the joint account regularly, aligning with your shared budgeting strategy as a couple.

Explanation: Establishing a joint account helps in managing shared financial commitments efficiently, supporting your path to balancing FIRE goals for couples.

It ensures transparency and accountability, reducing misunderstandings over money and fostering a frugal living approach as a team.

According to NPR, having clear financial arrangements can prevent conflicts and foster a cooperative approach to household expenses, which is essential for relationship money management.

Taking these steps will simplify managing shared expenses and help you stay on track with your financial goals, supporting your journey towards financial independence for couples.

2: Create a proportional expense-sharing plan

Creating a proportional expense-sharing plan is crucial for balancing FIRE goals for couples while managing shared commitments.

Actionable Steps:

- Calculate each partner’s income: Determine the percentage of total household income each partner earns, essential for dual income FIRE approaches.

- Proportional contributions: Each partner contributes to shared expenses based on their income percentage, aligning financial goals in marriage.

- Adjust for changes: Revisit and adjust the plan if there are significant changes in income or expenses, maintaining flexibility in relationship money management.

Explanation: Implementing a proportional expense-sharing plan ensures fairness and flexibility in managing shared costs for couples pursuing financial independence.

This approach helps both partners contribute equitably based on their earnings, fostering financial harmony and supporting joint savings strategies.

According to NPR, such clear financial arrangements can prevent conflicts and promote cooperation in household expenses, essential for frugal living as a team.

Taking these steps will help you and your partner maintain financial balance while pursuing your FIRE goals together, enhancing your budgeting as a couple and retirement planning for two.

3: Set individual and couple FIRE savings goals

Setting both individual and couple FIRE savings goals is crucial for balancing FIRE goals for couples and achieving financial independence together.

Actionable Steps:

- Define individual FIRE goals: Each partner should outline personal financial independence and early retirement targets for the FIRE movement.

- Establish couple goals: Discuss and set shared financial goals, such as saving for a home or a joint retirement planning for two.

- Utilize the rule of 25 and 4% rule: Estimate the amount needed for both individual and couple goals using these guidelines for dual income FIRE approach.

Key benefits of setting FIRE savings goals:

- Provides clear direction for financial independence for couples

- Motivates consistent saving and investing for shared expenses in relationships

- Allows for better alignment of individual and shared financial aspirations in relationship money management

Explanation: Setting clear FIRE savings goals helps maintain focus and motivation. Individual goals allow personal growth, while couple goals foster unity in balancing FIRE goals for couples.

Following the 4% rule and rule of 25 provides a practical framework for these goals. This approach ensures both partners are aligned and committed to their financial journey through joint savings strategies.

Achieving these goals together can strengthen your relationship and financial future through frugal living as a team.

4: Track expenses together using budgeting apps

Tracking expenses together using budgeting apps is essential for maintaining transparency and achieving your financial goals when balancing FIRE goals for couples.

Actionable Steps:

- Select a budgeting app: Choose an app like YNAB or Google Sheets that both partners can access for joint savings strategies.

- Log expenses regularly: Ensure both partners update the app with their spending to keep track of shared expenses in relationships.

- Review monthly: Conduct monthly reviews to assess spending patterns and adjust the budget as needed, supporting your dual income FIRE approach.

Explanation: Using budgeting apps helps keep both partners accountable and on the same page financially, crucial for the FIRE movement for partners.

According to Web Goddess, using technology for expense tracking can simplify financial management and enhance goal achievement in relationship money management.

This approach ensures you stay focused on your FIRE goals while maintaining financial harmony in your relationship, supporting financial independence for couples.

5: Discuss financial values and long-term plans

Discussing financial values and long-term plans is essential for balancing FIRE goals for couples and ensuring harmony in your relationship.

Actionable Steps:

- Set up a financial values meeting: Schedule a time to discuss each partner’s financial independence goals and long-term plans.

- Align goals: Find common ground and align your financial goals and values for the FIRE movement as partners.

- Document plans: Write down your agreed-upon financial plans for joint savings strategies and revisit them periodically.

Important topics to cover in financial discussions:

- Retirement planning for two and lifestyle expectations

- Risk tolerance for investments in your dual income FIRE approach

- Priorities for shared expenses in relationships and frugal living as a team

Explanation: Open discussions about financial values and long-term plans can prevent misunderstandings and foster stronger relationship money management.

According to NPR, clear financial arrangements can help avoid conflicts and promote cooperation.

Aligning your goals ensures you are both working towards a shared future in the FIRE movement for partners.

This approach will help you maintain financial harmony and strengthen your relationship through budgeting as a couple.

6: Establish monthly finance check-ins as a couple

Establishing monthly finance check-ins as a couple is essential for balancing FIRE goals for couples and maintaining financial harmony while working towards financial independence together.

Actionable Steps:

- Schedule regular meetings: Set a consistent date and time each month for finance check-ins to discuss your dual income FIRE approach.

- Review progress: Discuss your progress toward both individual and shared FIRE goals during these meetings, focusing on joint savings strategies.

- Address issues: Resolve any financial disagreements or concerns that arise promptly to ensure effective relationship money management.

Key elements to include in your monthly check-ins for balancing FIRE goals for couples:

- Review of spending patterns and budget adherence, emphasizing frugal living as a team

- Progress update on savings and investment goals for retirement planning for two

- Discussion of upcoming financial decisions or changes in shared expenses in relationships

Explanation: Regular finance check-ins foster open communication and ensure both partners stay aligned with their financial plans and FIRE movement strategies.

According to NPR, clear financial arrangements can help avoid conflicts and promote cooperation in budgeting as a couple.

This practice helps you stay on track and adjust your strategies as needed for achieving financial independence for couples.

This approach will keep your financial goals in focus and strengthen your partnership while aligning financial goals in marriage.

Partner with Alleo for Your Financial Independence Journey

We’ve explored the challenges of balancing FIRE goals for couples and managing shared expenses in relationships. Did you know you can work directly with Alleo to make this journey towards financial independence for couples easier and faster?

Alleo offers affordable, tailored coaching support for those pursuing the FIRE movement for partners. Set up an account, create a personalized plan for budgeting as a couple, and get full coaching sessions to align your financial goals in marriage.

Alleo’s AI coach follows up on your progress in joint savings strategies, handles changes in your dual income FIRE approach, and keeps you accountable via text and push notifications for effective relationship money management.

Ready to get started for free? Let me show you how to begin your journey towards retirement planning for two!

Step 1: Log In or Create Your Account

To start your journey towards financial independence as a couple, log in to your existing Alleo account or create a new one to access personalized coaching and tools for balancing FIRE goals with shared expenses.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your FIRE objectives with your relationship’s shared financial journey, helping you balance individual aspirations and joint expenses more effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo, as this will help you develop strategies for balancing your FIRE goals with shared expenses, aligning perfectly with your journey towards financial independence as a couple.

Step 4: Starting a Coaching Session

Begin your journey with an intake session to establish your personalized financial plan, aligning your FIRE goals with your shared expenses and relationship dynamics.

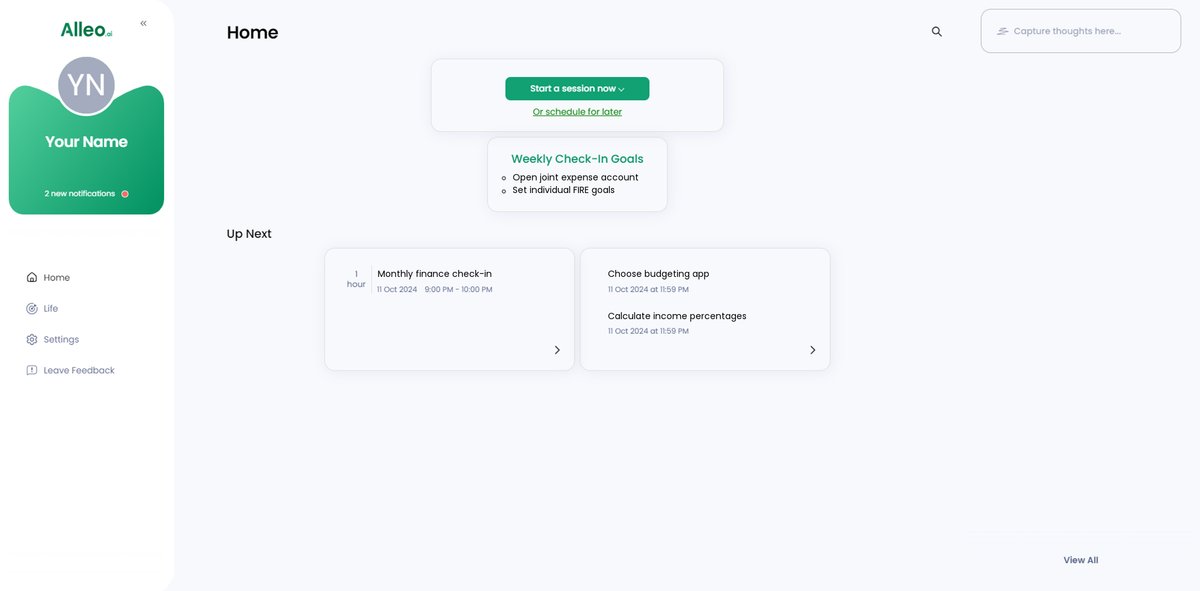

Step 5: Viewing and managing goals after the session

After your coaching session, check the app’s home page to view and manage the FIRE goals you discussed, allowing you to track progress and stay aligned with your partner on your shared financial journey.

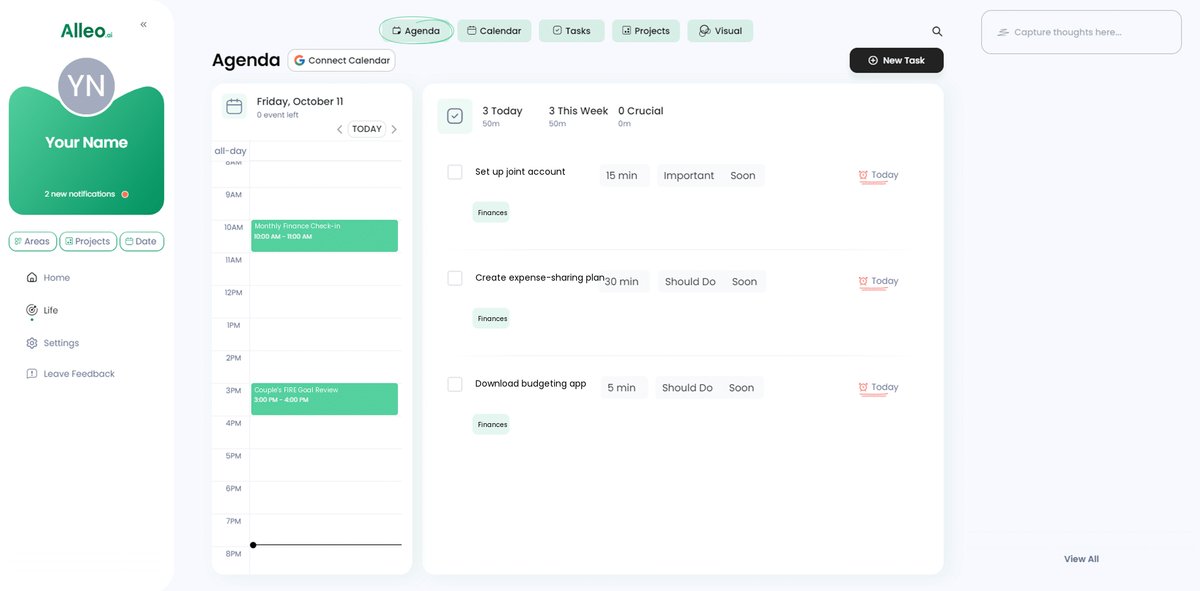

Step 6: Adding events to your calendar or app

Use the app’s calendar and task features to schedule and track your monthly finance check-ins, allowing you to monitor your progress towards balancing FIRE goals with shared expenses and maintain financial harmony in your relationship.

Bringing It All Together: Achieving Financial Independence as a Couple

Balancing FIRE goals for couples with shared expenses is no easy feat, but it is possible. By following the strategies outlined, you can work towards financial independence for couples without sacrificing relationship harmony.

Remember, open communication and regular check-ins are key. Discuss your financial values and goals to stay aligned in the FIRE movement for partners.

Use budgeting apps to track expenses and adjust plans as needed, embracing budgeting as a couple for effective relationship money management.

Now, it’s time to take action. Start implementing these steps today and see the difference they can make in your dual income FIRE approach.

And don’t forget, you can always rely on Alleo for personalized support and guidance in your joint savings strategies and retirement planning for two.

Together, you can achieve financial independence. Let’s get started on your frugal living as a team!