5 Powerful Strategies for Couples Adjusting to Financial Imbalance During Unemployment

Imagine waking up one morning to find that your partner has lost their job. Suddenly, the financial balance in your relationship is thrown off, and you’re faced with the challenge of managing finances during partner unemployment.

As a life coach, I’ve helped many couples navigate these challenges. In my experience, financial imbalance during unemployment can strain even the strongest relationships. Job loss coping mechanisms and communication during financial hardship are crucial during this time.

In this blog, you’ll discover actionable strategies to help you and your partner navigate this tough time. From open communication to revised budgeting tips for unemployed couples, we’ll cover it all. We’ll explore managing expenses on a single income and maintaining relationship stability in crisis.

Let’s dive in and explore resources for unemployed partners and temporary income solutions for couples.

Understanding the Depth of the Problem

Financial stress can create tension and conflict in a relationship when managing finances during partner unemployment. When one partner becomes unemployed, the resulting imbalance can be challenging.

Many clients initially struggle with the sudden financial strain and the accompanying emotional stress, requiring job loss coping mechanisms.

Gender disparities can exacerbate the problem. Women often face greater burdens due to layoffs and increased childcare duties, affecting budgeting for unemployed couples.

This adds another layer of complexity to financial stress in relationships.

Addressing mental health is crucial. Financial instability often leads to anxiety and depression, necessitating emotional support during unemployment.

Ignoring these issues can strain the relationship further, impacting communication during financial hardship.

However, there is hope. By acknowledging these challenges and working together, you can navigate this difficult time while managing finances during partner unemployment.

Let’s explore actionable strategies next for maintaining relationship stability in crisis.

Effective Strategies for Navigating Financial Imbalance During Unemployment

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress when managing finances during partner unemployment:

- Communicate openly about finances and feelings: Regular check-ins help maintain transparency and emotional support during unemployment.

- Create a revised joint budget for the interim: Adjust your budget to reflect the current financial reality, implementing budgeting tips for unemployed couples.

- Explore free or low-cost activities together: Enjoy quality time without spending much, a crucial job loss coping mechanism.

- Seek affordable couple’s therapy if needed: Find cost-effective counseling options to address financial stress in relationships.

- Support partner’s job search efforts actively: Assist with applications, resumes, and networking, aiding in the job transition.

Let’s dive in to these strategies for managing finances during partner unemployment!

1: Communicate openly about finances and feelings

Effective communication about finances and feelings is crucial when managing finances during partner unemployment and navigating financial imbalance.

Actionable Steps:

- Schedule a weekly financial check-in to discuss your current status, concerns, and plans for budgeting during unemployment.

- Use “I” statements to express your feelings without blaming, e.g., “I feel stressed about our bills,” which is essential for communication during financial hardship.

- Set aside time to discuss non-financial feelings and stressors to maintain emotional intimacy and provide emotional support during unemployment.

Explanation: Open communication helps maintain transparency and emotional connection during tough times. Regular check-ins ensure that both partners stay updated and involved in the financial situation, which is crucial for managing finances during partner unemployment.

Effective emotional expression can prevent resentment and misunderstandings. According to research from the RSF Journal, addressing both financial and emotional stressors is essential for overall well-being, especially when coping with job loss.

Key benefits of open communication:

- Builds trust and understanding

- Reduces misunderstandings and conflicts

- Fosters a sense of teamwork in facing challenges and maintaining relationship stability in crisis

By fostering open communication, couples can work together more effectively and maintain their emotional bond while managing finances during partner unemployment.

2: Create a revised joint budget for the interim

Creating a revised joint budget is essential for managing finances during partner unemployment and coping with job loss effectively.

Actionable Steps:

- Identify all essential expenses and differentiate them into fixed and variable categories to aid in budgeting for unemployed couples.

- Reduce or eliminate non-essential expenses, like dining out or subscription services, to save money and manage expenses on a single income.

- Allocate a small, flexible spending amount for each partner to maintain a sense of normalcy and autonomy, which can help in maintaining relationship stability during crisis.

Explanation: Revising your budget helps ensure that your essential needs are met while also cutting unnecessary costs. This approach maintains financial stability and allows both partners to feel a level of independence, reducing financial stress in relationships.

According to the World Bank, economic inclusion programs that combine cash transfers with training and savings can help individuals manage financial challenges effectively, serving as temporary income solutions for couples.

By managing your budget wisely during partner unemployment, you can reduce financial stress and maintain a balanced relationship, which is crucial for communication during financial hardship.

Next, let’s explore how to enjoy quality time without spending much, an important aspect of managing finances during partner unemployment.

3: Explore free or low-cost activities together

Finding affordable ways to spend time together can help maintain your bond without straining your finances when managing finances during partner unemployment.

Actionable Steps:

- Research local parks, trails, and free events to enjoy nature and community activities together, which can serve as job loss coping mechanisms.

- Plan regular at-home date nights with activities like movie marathons or cooking new recipes, helping maintain relationship stability in crisis.

- Join community groups or clubs that offer free or low-cost social activities, providing emotional support during unemployment.

Explanation: Engaging in free or low-cost activities helps maintain your relationship’s emotional connection without adding financial stress in relationships.

According to RSF Journal, spending quality time together can alleviate stress and promote mental well-being during tough times, which is crucial when managing finances during partner unemployment.

By participating in these activities, you can strengthen your relationship and find joy in simple moments while managing expenses on single income.

Ideas for free or low-cost activities when managing finances during partner unemployment:

- Picnics in local parks or scenic spots

- Home-based game nights or puzzles

- Exploring free local museums or galleries

These shared experiences can serve as a foundation for a resilient and supportive partnership during unemployment, helping with communication during financial hardship.

4: Seek affordable couple’s therapy if needed

Seeking affordable couple’s therapy can be crucial when managing finances during partner unemployment to maintain a healthy relationship and cope with job loss.

Actionable Steps:

- Research local universities or clinics offering sliding scale fees for therapy to address financial stress in relationships.

- Utilize online therapy platforms that provide free or low-cost sessions as part of budgeting tips for unemployed couples.

- Attend free workshops or support groups for couples facing similar challenges to improve communication during financial hardship.

Explanation: Affordable therapy options can provide the necessary support without adding financial strain, helping maintain relationship stability in crisis.

For instance, the MSU Couple and Family Therapy Clinic offers services on a sliding scale, making it accessible to more couples managing expenses on single income.

By seeking therapy, you can address emotional stress and improve communication, ultimately strengthening your relationship while managing finances during partner unemployment.

Investing in your mental well-being through affordable therapy can be a game-changer during unemployment, serving as one of the essential resources for unemployed partners.

5: Support partner’s job search efforts actively

Actively supporting your partner’s job search can significantly reduce the stress of unemployment and bring you closer together while managing finances during partner unemployment.

Actionable Steps:

- Help revise and update your partner’s resume and LinkedIn profile as part of job loss coping mechanisms.

- Create a job search schedule and set daily or weekly goals for applications and networking to maintain relationship stability in crisis.

- Encourage and assist in practicing for interviews through mock sessions and feedback, offering emotional support during unemployment.

Explanation: Supporting your partner’s job search efforts not only shows your commitment but also helps streamline the process. By setting a schedule and practicing for interviews, you can increase their chances of finding employment faster, which is crucial for managing finances during partner unemployment.

According to the RSF Journal, having a structured approach to job searching can alleviate stress and improve outcomes.

Ways to support your partner’s job search:

- Offer emotional encouragement during setbacks, addressing financial stress in relationships

- Help research potential job opportunities and temporary income solutions for couples

- Celebrate small wins and milestones together while managing expenses on single income

Actively participating in your partner’s job search can foster a sense of teamwork and shared responsibility during this challenging time of financial planning during job transition.

Partner with Alleo to Navigate Financial Imbalance

We’ve explored the challenges of managing finances during partner unemployment. Did you know you can work directly with Alleo to make this journey smoother and faster? Our AI coach provides support for job loss coping mechanisms and helps maintain relationship stability in crisis.

Setting up an account with Alleo is easy. Create a personalized plan and work with our AI coach to overcome specific challenges, including financial stress in relationships and budgeting tips for unemployed couples.

Our coach follows up on progress, handles changes, and keeps you accountable via text and push notifications, offering emotional support during unemployment and guidance on managing expenses on single income.

Ready to get started for free? Let me show you how to access resources for unemployed partners and improve communication during financial hardship!

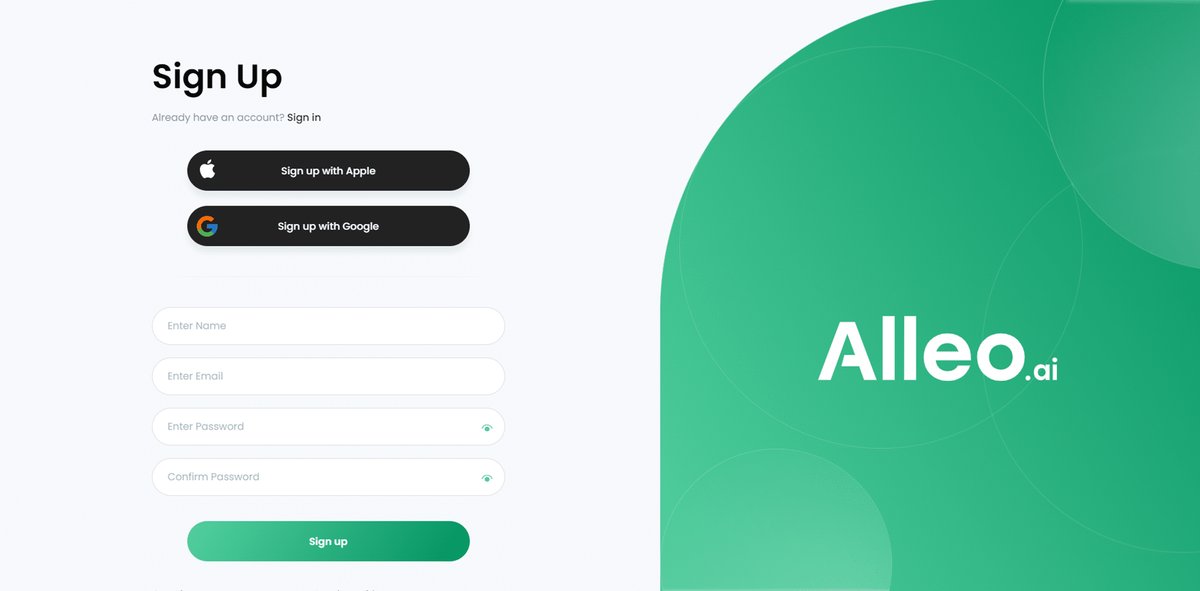

Step 1: Logging in or Creating an Account

To begin managing your financial imbalance during unemployment, log in to your existing Alleo account or create a new one to access personalized guidance and support.

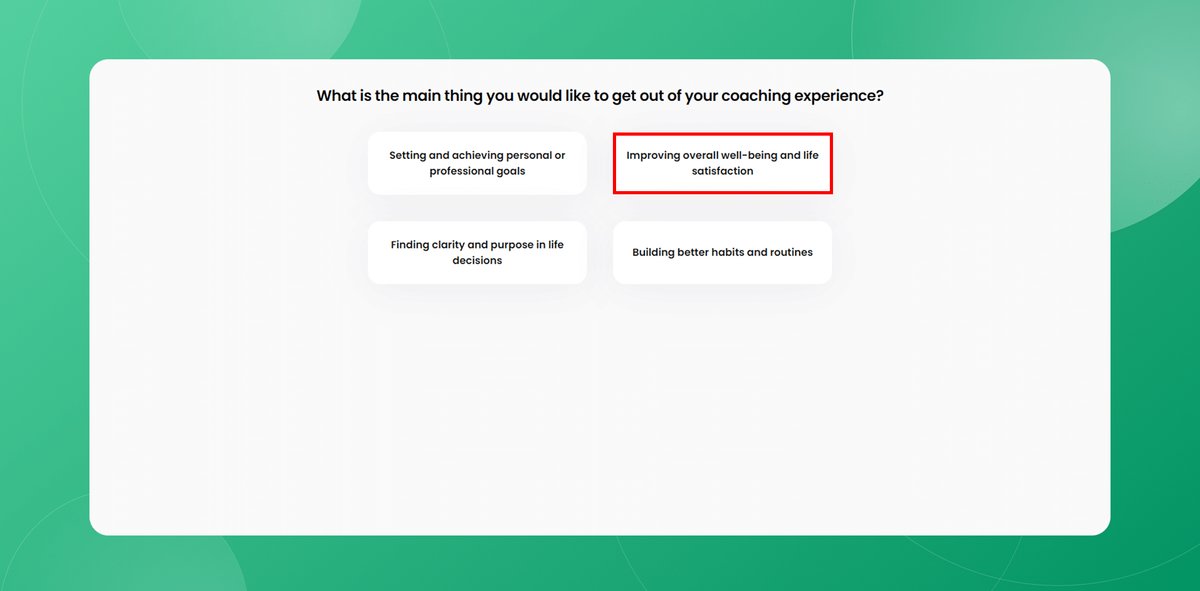

Step 2: Choose “Improving overall well-being and life satisfaction”

Select “Improving overall well-being and life satisfaction” as your goal to address the emotional and financial challenges of unemployment, helping you and your partner navigate this difficult period with greater resilience and harmony.

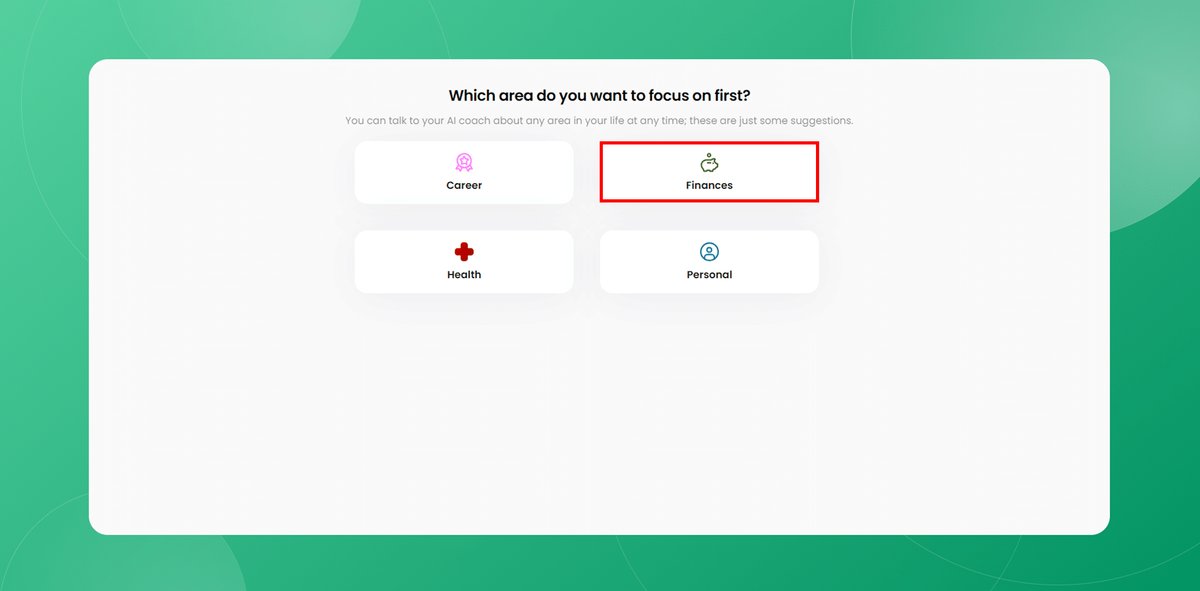

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in the AI coach to address the financial imbalance caused by unemployment, allowing you to work on budgeting, communication about money, and strategies for financial stability during this challenging time.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan for managing financial imbalance during unemployment, setting the stage for productive future coaching sessions.

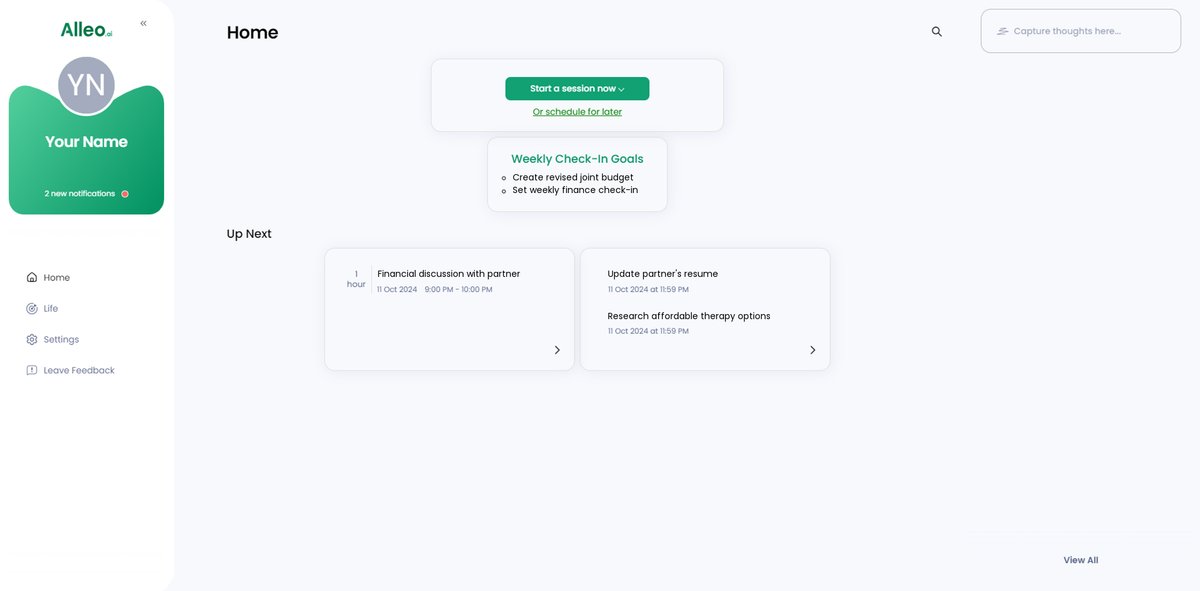

Step 5: Viewing and managing goals after the session

After your coaching session on financial imbalance, check the Alleo app’s home page to review and manage the goals you discussed, helping you stay on track with your partner during this challenging time.

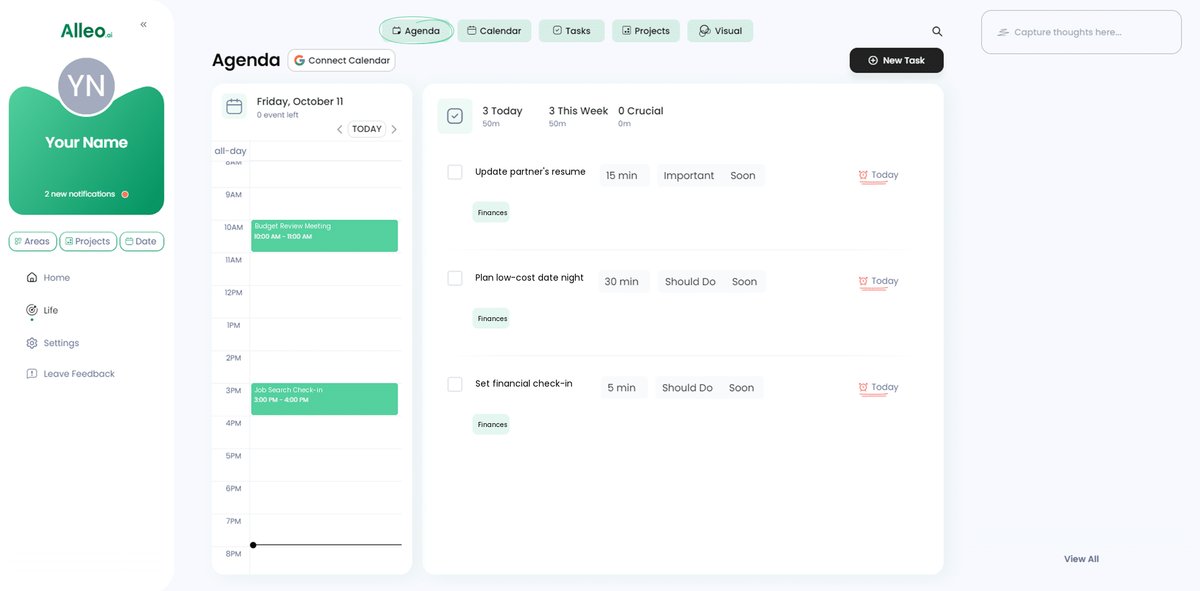

Step 6: Adding events to your calendar or app

Use the Alleo app’s calendar and task features to schedule and track your financial check-ins, budget revisions, and job search activities, helping you stay organized and accountable as you navigate unemployment together.

Bringing It All Together

As you navigate this challenging time of managing finances during partner unemployment, remember that you’re not alone. Financial stress in relationships can be tough, but with the right strategies, you and your partner can overcome it.

Key to success is open communication during financial hardship. Make sure to talk about both finances and feelings.

Adjust your budget to reflect your new reality when managing expenses on single income. Cut unnecessary expenses and maintain a sense of autonomy with small, flexible spending amounts.

Enjoy quality time together with free or low-cost activities. This strengthens your bond without adding financial stress.

Don’t hesitate to seek affordable therapy. It’s an investment in your mental well-being and relationship stability in crisis.

Actively support your partner’s job search. Your encouragement and assistance can make a big difference in coping with job loss.

Finally, consider using Alleo. It can help you stay organized and on track with financial planning during job transition.

You’ve got this. Keep moving forward together while managing finances during partner unemployment.