How to Invest in CFP Certification for Employees on a Tight Budget: 5 Powerful Techniques

Imagine empowering your nonprofit staff with affordable CFP certification, enhancing their skills and credibility, all within your budget constraints.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, nonprofits often struggle to balance tight budgets with essential professional development, including cost-effective financial planning education.

In this blog, you’ll discover actionable strategies for affordable CFP certification for nonprofits without breaking the bank. We’ll cover budget-friendly CFP certification courses, funding options, and budgeting tools to support employee investment strategies.

Let’s dive into maximizing CFP investment for small companies.

The Challenge of Balancing Budgets and Professional Development

Managing tight budgets is a significant challenge for many nonprofits. Financial resources are often limited, making it difficult to invest in staff development and explore affordable CFP certification for nonprofits.

The benefits of CFP certification are clear. It enhances staff skills and the organization’s credibility, serving as an effective employee retention through CFP support strategy.

However, costs and time commitments can be daunting, even with budget-friendly CFP certification options.

Many organizations face high expenses, time constraints, and lack of funding options. These barriers can prevent nonprofits from providing essential professional development and pursuing cost-effective financial planning education.

It’s a tough balancing act between employee investment strategies and financial constraints.

Several clients report struggling with these issues. The key is finding effective strategies to overcome these challenges and maximize CFP investment for small companies.

Let’s explore how to achieve affordable CFP certification for nonprofits.

Strategic Steps to Invest in CFP Certification on a Tight Budget

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress towards affordable CFP certification for nonprofits:

- Explore online CFP courses for cost-effectiveness: Find and compare budget-friendly CFP certification options through affordable online courses.

- Utilize employer training grants for funding: Research and apply for relevant training grants as part of employee investment strategies.

- Implement YNAB for better budget management: Use YNAB to plan and prioritize spending for cost-effective financial planning education.

- Seek special funding for nonprofit education: Look for dedicated education funds and scholarships to support affordable CFP training options.

- Opt for certificate programs over full degrees: Choose shorter, cost-effective certificate programs for low-cost financial advisor development.

Let’s dive in!

1: Explore online CFP courses for cost-effectiveness

Finding affordable CFP certification for nonprofits through online courses can significantly lower the financial burden on your organization.

Actionable Steps:

- Research and compare online courses: Identify reputable providers and compare their costs and curricula. Prioritize budget-friendly CFP certification options that offer the best value for money.

- Utilize free resources: Supplement paid courses with free webinars and online materials. Encourage staff to join online communities for peer support in CFP exam preparation on a budget.

- Track progress: Set up a system to monitor course completion and knowledge retention. Schedule regular check-ins to discuss learning outcomes and assess the CFP certification ROI for businesses.

Explanation: These steps help ensure that your staff gains essential skills without excessive costs. By leveraging affordable CFP training options and free resources, you can make professional development more accessible.

Monitoring progress ensures that the investment is worthwhile and aligns with your goals. For more information, you can check out DMACC’s continuing education offerings for cost-effective financial planning education options.

Key benefits of online CFP courses:

- Flexible learning schedules

- Reduced travel and accommodation costs

- Access to a wide range of instructors and perspectives

Taking these steps will empower your staff while staying within budget constraints, supporting employee retention through CFP support.

2: Utilize employer training grants for funding

Finding and applying for employer training grants can provide essential funding for affordable CFP certification for nonprofits.

Actionable Steps:

- Research available grants: Identify training grants that your nonprofit qualifies for. Make a list of grants, including deadlines and requirements for budget-friendly CFP certification.

- Prepare compelling applications: Gather necessary documents and write persuasive grant proposals. Emphasize how cost-effective financial planning education aligns with your organization’s goals.

- Follow up on applications: Monitor the status of your applications and follow up if needed. Ensure that received funds are allocated to affordable CFP training options expenses.

Explanation: These steps help secure funding for professional development without straining your budget. By researching and applying for grants, you can access external resources to support your employee investment strategies.

For more information, you can explore the Employer Training Grant to see if it fits your needs for affordable CFP certification for nonprofits.

Securing grants will ease financial pressure, allowing you to invest in staff development and maximize CFP investment for small companies.

3: Implement YNAB for better budget management

Implementing YNAB can help your nonprofit manage its budget more effectively, ensuring funds are available for affordable CFP certification for nonprofits.

Actionable Steps:

- Set up YNAB: Create a detailed nonprofit budget using YNAB, focusing on professional development allocations for budget-friendly CFP certification. Categorize expenses to gain a clear financial overview.

- Plan and prioritize spending: Use YNAB to plan and prioritize spending, ensuring funds are available for cost-effective financial planning education. Adjust budget categories as needed.

- Conduct regular budget reviews: Review the budget monthly to assess progress and make necessary adjustments. Engage staff in the process for transparency, promoting employee investment strategies.

Explanation: These steps help ensure that your nonprofit can allocate funds effectively, making affordable CFP certification for nonprofits more attainable. By using YNAB, you can better manage your budget and plan for professional development expenses, including low-cost financial advisor development.

For more insights on setting up YNAB, check out this guide on using YNAB.

Managing your budget effectively can make affordable CFP training options more accessible without straining your finances, maximizing CFP investment for small companies.

4: Seek special funding for nonprofit education

Seeking special funding for nonprofit education is crucial for managing budget constraints while investing in staff certification, including affordable CFP certification for nonprofits.

Actionable Steps:

- Explore dedicated education funds: Research foundations and organizations that offer special funding for nonprofit education and budget-friendly CFP certification. Compile a list of potential funding sources with application details.

- Apply for scholarships and sponsorships: Encourage staff to apply for individual scholarships and sponsorships specific to CFP courses. Provide support in crafting personal statements and gathering references, focusing on cost-effective financial planning education options.

- Partner with local businesses: Approach local businesses for sponsorships or partnerships that benefit both parties. Propose mutually beneficial arrangements, such as volunteer work in exchange for funding, exploring corporate CFP sponsorship programs.

Explanation: These steps are essential for securing additional resources without straining your budget. By exploring dedicated funds and scholarships, you can access external support for professional development and affordable CFP training options.

For more insights on potential grants, check out this Employer Training Grant resource. Partnering with businesses also fosters community relationships and mutual benefits, potentially maximizing CFP investment for small companies.

Types of special funding to consider:

- Foundation grants

- Corporate sponsorships

- Professional association scholarships

Investing in special funding options ensures that your nonprofit can support staff development effectively, including low-cost financial advisor development and CFP exam preparation on a budget.

5: Opt for certificate programs over full degrees

Choosing certificate programs instead of full degrees can save your nonprofit significant time and money. This approach is particularly relevant when considering affordable CFP certification for nonprofits.

Actionable Steps:

- Evaluate certificate programs: Compare the cost and duration of certificate programs versus full degree programs. Choose programs that offer specific skills relevant to your nonprofit’s needs, such as budget-friendly CFP certification options.

- Encourage incremental learning: Promote a step-by-step approach where staff complete one certificate program at a time. Allow staff to apply learned skills immediately, demonstrating tangible benefits and maximizing CFP investment for small companies.

- Monitor ROI: Track the return on investment (ROI) of certificate programs through performance metrics. Use success stories to justify further investments in certification programs, focusing on CFP certification ROI for businesses.

Explanation: These steps help ensure that your staff gains essential skills without incurring the high costs and time commitments of full degrees. By focusing on specific, relevant skills through certificates, you can enhance staff capabilities efficiently and explore cost-effective financial planning education options.

For more details on affordable certificate programs, check out DMACC’s continuing education offerings.

Advantages of certificate programs:

- Shorter completion time

- Lower overall cost

- Focused, practical skill development, such as CFP exam preparation on a budget

Making these strategic choices will help your nonprofit invest in professional development within budget constraints, potentially including affordable CFP training options and employee retention through CFP support.

Partner with Alleo on Your CFP Certification Journey

We’ve explored the challenges of investing in affordable CFP certification for nonprofits on a tight budget. Did you know you can work directly with Alleo to make this journey easier and faster?

Get Started with Alleo:

- Set Up: Create your Alleo account in minutes. No credit card required for budget-friendly CFP certification.

- Personalized Plan: Alleo helps you craft a tailored plan for cost-effective financial planning education.

- Full Coaching: Enjoy affordable CFP training options like any human coach provides.

- Progress Tracking: Alleo follows up on your progress and keeps you accountable, maximizing CFP investment for small companies.

- Notifications: Receive text and push notifications to stay on track with your CFP exam preparation on a budget.

Ready to get started for free? Let me show you how to begin your affordable CFP certification for nonprofits journey!

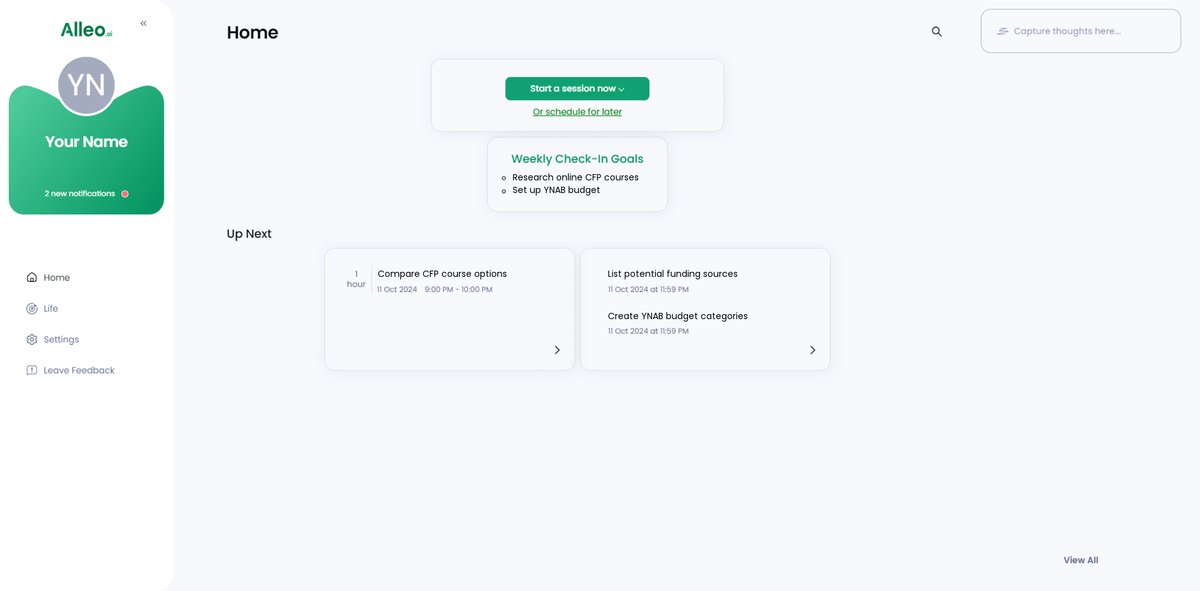

Step 1: Log In or Create Your Account

To begin your CFP certification journey with Alleo, log in to your existing account or create a new one in just a few clicks, setting the foundation for your personalized professional development plan.

Step 2: Choose Your Goal – CFP Certification

Select “Set and achieve personal or professional goals” to focus on your CFP certification journey, aligning with your nonprofit’s need for enhanced financial expertise and credibility while managing budget constraints.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to align with your goal of investing in CFP certification for your nonprofit staff while managing budget constraints. This selection will provide tailored guidance and strategies to help you balance professional development with financial limitations.

Step 4: Starting a Coaching Session

Begin your CFP certification journey with Alleo by scheduling an intake session to create a personalized plan that aligns with your nonprofit’s goals and budget constraints.

Step 5: Viewing and managing goals after the session

After your coaching session on CFP certification, check the Alleo app’s home page to review and manage the goals you discussed, helping you stay on track with your nonprofit’s professional development plans.

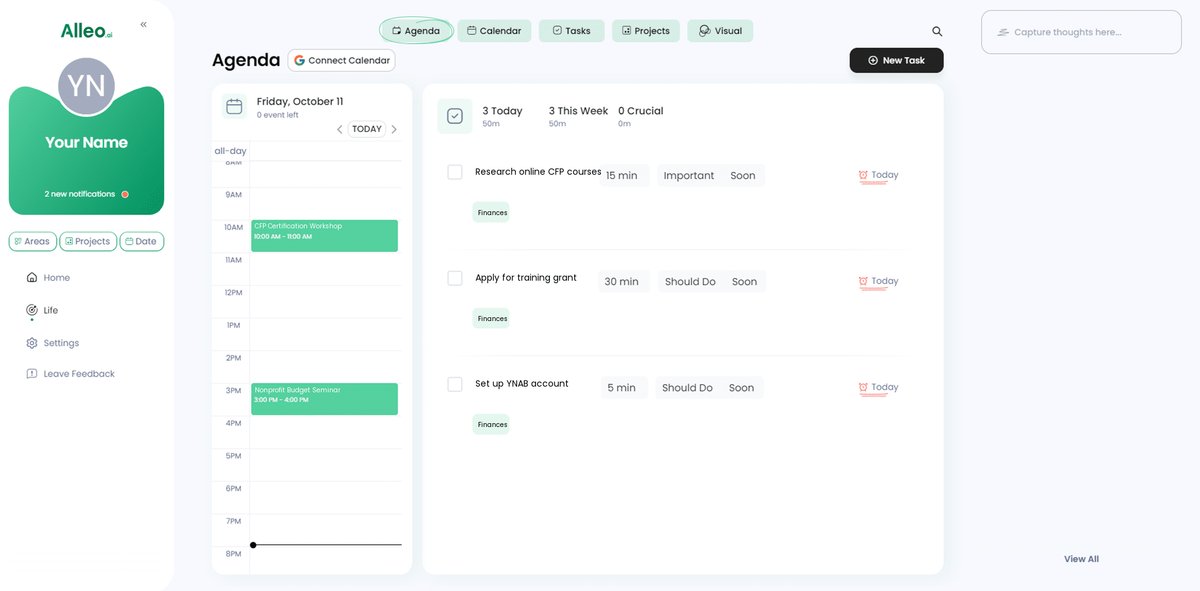

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to add important CFP certification milestones and deadlines, allowing you to easily track your progress and stay accountable throughout your professional development journey.

Empowering Your Nonprofit with CFP Certification

We’ve covered strategies to help you invest in affordable CFP certification for nonprofits on a tight budget.

Remember, balancing your budget while prioritizing professional development through cost-effective financial planning education is challenging but achievable.

By exploring online courses, utilizing grants, implementing budgeting tools like YNAB, seeking special funding, and opting for budget-friendly CFP certification programs, you can make this investment work.

I understand your challenges in finding affordable CFP training options.

You can do this!

With these actionable steps, you’ll empower your staff through employee investment strategies and boost your nonprofit’s credibility.

Consider trying Alleo to simplify this process of maximizing CFP investment for small companies and keep you on track.

Ready to get started with affordable CFP certification for nonprofits?

Take the next step towards low-cost financial advisor development today!