4 Proven Methods to Gain Financial Independence as a Young Professional

Are you struggling to balance your entry-level salary with rising living expenses and student debt? Many young professionals face challenges on their journey to financial independence.

As a life coach, I’ve helped many young professionals navigate these financial challenges and develop effective financial planning strategies for beginners. In my experience, it’s common to feel overwhelmed by financial constraints when you’re just starting your career.

In this article, I’ll share actionable steps to help you achieve financial independence for young professionals. You’ll learn strategies to budget effectively, develop multiple income streams including side hustle ideas for extra income, automate savings for your emergency fund and retirement, and prioritize debt reduction techniques.

Let’s dive into these investing strategies for millennials and budgeting tips for young adults to help you start building wealth in your 20s and 30s.

Understanding the Financial Struggles of Young Professionals

Balancing entry-level salaries with rising living expenses and student debt is daunting. Many young professionals find themselves stressed due to financial constraints, hindering their journey towards financial independence.

This often leads to living paycheck to paycheck, even with decent salaries, making financial planning for beginners crucial.

The emotional toll of these financial struggles is significant. It’s common to feel overwhelmed, which can affect mental health and overall well-being. Building wealth in your 20s and 30s becomes challenging under these circumstances.

To make matters worse, the pressure to achieve financial independence for young professionals can clash with the realities of high living costs. From my experience, several clients initially struggle with prioritizing their finances amidst these challenges, often overlooking important aspects like retirement savings.

But there is hope. Let’s explore actionable steps to navigate these obstacles and pave the way for financial independence for young professionals.

Actionable Steps to Financial Independence

Overcoming financial challenges requires a strategic approach for young professionals seeking financial independence. Here are the main areas to focus on to make progress:

- Create a Budget and Track Expenses Religiously: List all your income and expenses, and set financial goals. This is crucial for financial planning for beginners and budgeting tips for young adults.

- Develop Multiple Income Streams Through Side Gigs: Identify your skills and explore gig economy platforms. This is essential for building wealth in your 20s and 30s and exploring side hustle ideas for extra income.

- Automate Savings and Invest in Low-Cost Index Funds: Set up automatic transfers and invest wisely. This aligns with investing strategies for millennials and retirement savings for young professionals.

- Live Below Means and Prioritize Debt Repayment: Adopt a minimalist lifestyle and create a debt repayment plan. This supports debt reduction techniques and emergency fund management.

Let’s dive in to these strategies for achieving financial independence for young professionals.

1: Create a budget and track expenses religiously

Creating a budget and tracking expenses is crucial for achieving financial independence for young professionals.

Actionable Steps:

- List all your monthly income and expenses.

- Use a budgeting app to categorize each expense and set limits for each category, essential for financial planning for beginners.

- Identify and eliminate unnecessary spending.

- Review spending habits and cut out non-essential expenses like dining out frequently, a key budgeting tip for young adults.

- Set financial goals and allocate funds towards them.

- Utilize the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment, aiding in building wealth in your 20s and 30s.

Explanation:

These steps help you understand where your money goes and make informed decisions. By tracking expenses, you can identify wasteful spending and redirect funds toward your financial goals, including retirement savings for young professionals.

This approach aligns with industry trends, emphasizing the importance of budgeting for financial stability and independence for young professionals. For more insights on financial planning, check out this Investopedia article.

Key benefits of budgeting include:

- Greater financial awareness

- Improved spending habits

- Faster progress towards financial goals

Establishing a robust budget sets the foundation for managing your finances effectively and achieving financial independence for young professionals.

2: Develop multiple income streams through side gigs

Developing multiple income streams through side gigs is crucial for achieving financial independence for young professionals.

Actionable Steps:

- Identify marketable skills.

- List skills you possess that can be monetized, such as graphic design, tutoring, or freelance writing, to create passive income streams.

- Explore gig economy platforms.

- Sign up for platforms like Upwork, Fiverr, or TaskRabbit to find freelance opportunities fitting your skills and boost your side hustle ideas for extra income.

- Network and seek mentorship.

- Join professional groups and attend networking events to find mentors who can guide you in growing your side gigs and advancing your career for financial growth.

Explanation:

These steps diversify your income sources and reduce reliance on a single paycheck. They also align with recent trends where many young professionals are turning to the gig economy to boost their earnings and build wealth in their 20s and 30s.

For more insights on balancing finances as a young professional, check out this article by Tim Ung.

These side gigs can significantly contribute to achieving your financial goals and support your journey towards financial independence for young professionals.

3: Automate savings and invest in low-cost index funds

Automating savings and investing in low-cost index funds can significantly simplify your path to financial independence for young professionals.

Actionable Steps:

- Set up automatic transfers to savings accounts.

- Automate a portion of your paycheck to go directly into a high-yield savings account, supporting your emergency fund management.

- Invest in low-cost index funds.

- Research and select index funds with low fees, then automate monthly investments through platforms like Vanguard or Fidelity, an essential investing strategy for millennials.

- Take advantage of employer-sponsored retirement plans.

- Contribute to your employer’s 401(k) plan and take full advantage of any matching contributions, boosting your retirement savings as a young professional.

Explanation:

These steps ensure that saving and investing happen consistently without requiring continuous effort. Automated savings and investments help you build wealth in your 20s and 30s and reduce the risk of missing contributions.

This approach aligns with industry trends emphasizing the importance of starting early and automating finances. For more detailed advice on financial planning for beginners, you can read this Investopedia article.

Popular low-cost index funds to consider:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Fidelity ZERO Total Market Index Fund (FZROX)

- Schwab Total Stock Market Index Fund (SWTSX)

By automating these processes, you can focus on other aspects of your financial journey, such as exploring passive income streams or career advancement for financial growth.

4: Live below means and prioritize debt repayment

Living below your means and focusing on debt repayment is crucial for achieving financial independence for young professionals.

Actionable Steps:

- Adopt a minimalist lifestyle.

- Prioritize needs over wants. Focus on cost-effective activities and avoid impulse purchases, essential for budgeting tips for young adults.

- Create a debt repayment plan.

- List all debts and use the avalanche or snowball method to pay off high-interest debts first, employing effective debt reduction techniques.

- Avoid new debt.

- Use cash or debit cards instead of credit cards to prevent accumulating more debt, a key aspect of financial planning for beginners.

Explanation:

These steps help you manage your finances and reduce debt. Prioritizing debt repayment and avoiding new debt builds a stronger financial foundation, essential for building wealth in your 20s and 30s.

This approach aligns with trends emphasizing the importance of financial stability. For more insights, explore this article by Tim Ung.

Taking these actions can significantly accelerate your journey to financial independence for young professionals.

![]()

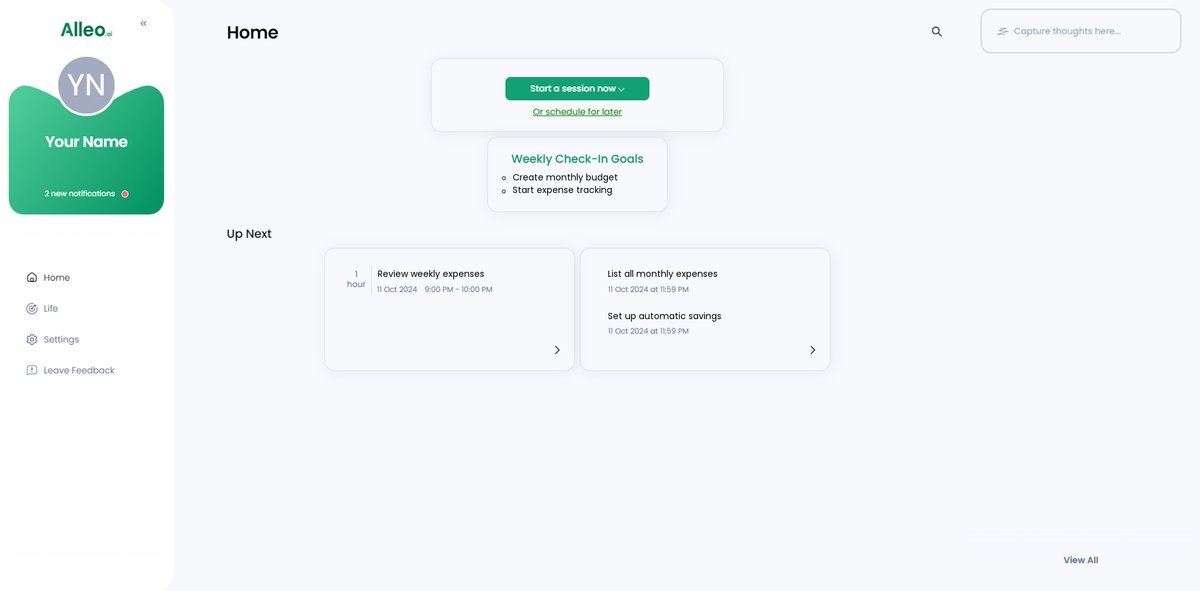

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of achieving financial independence for young professionals, balancing entry-level salaries and expenses, and the steps to overcome these obstacles. Did you know you can work directly with Alleo to make this journey easier and faster, especially when it comes to financial planning for beginners?

Setting up an account with Alleo is simple. Create a personalized plan, and our AI coach will help you every step of the way, offering budgeting tips for young adults and investing strategies for millennials.

Alleo follows up on your progress, handles changes, and keeps you accountable with text and push notifications, supporting your efforts in building wealth in your 20s and 30s.

Ready to get started for free? Let me show you how to begin your path to financial independence for young professionals!

Step 1: Log In or Create Your Alleo Account

To start your journey towards financial independence, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose Your Focus – Building Better Habits and Routines

Click on “Building better habits and routines” to start developing consistent financial practices that will help you budget effectively, create multiple income streams, automate savings, and prioritize debt repayment – all key steps towards achieving financial independence as a young professional.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to tackle the financial challenges discussed in the article, such as budgeting, developing multiple income streams, and prioritizing debt repayment, setting you on the path to financial independence.

Step 4: Starting a coaching session

Begin your journey to financial independence by scheduling an intake session with Alleo’s AI coach to create a personalized plan tailored to your specific financial goals and challenges.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your discussed financial goals displayed on the home page, allowing you to easily track and manage your progress towards financial independence.

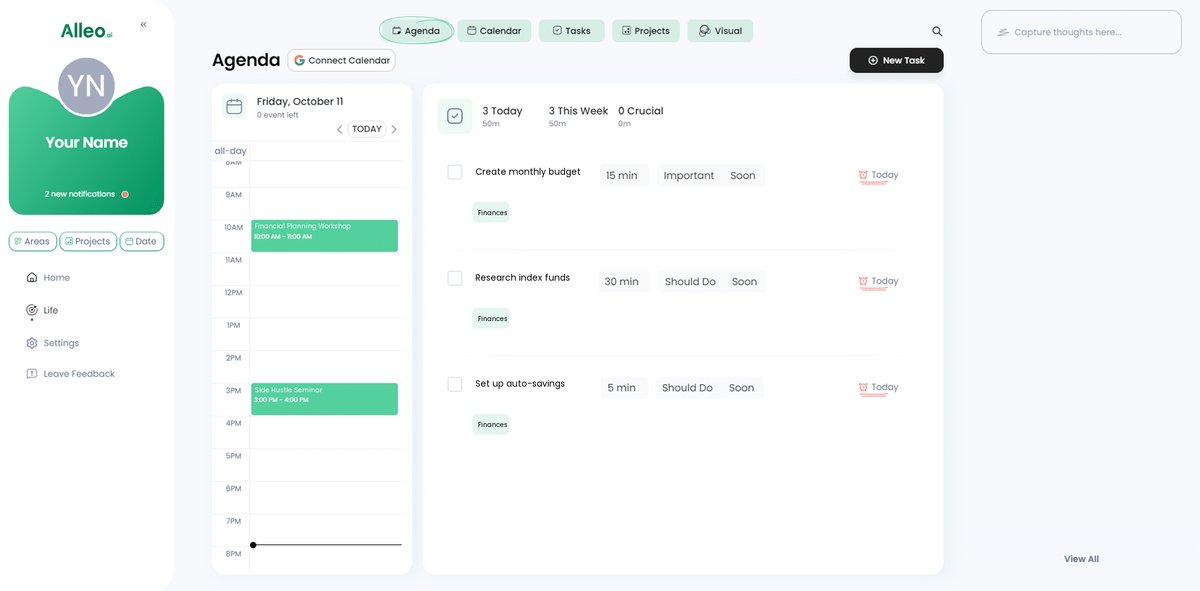

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress on budgeting, side gigs, saving, and debt repayment by adding key financial events and deadlines, helping you stay accountable and organized on your journey to financial independence.

Embrace Your Path to Financial Independence

We’ve covered a lot, haven’t we? From budgeting tips for young adults to side hustle ideas for extra income, and automated savings to debt reduction techniques, each step brings you closer to financial independence for young professionals.

Remember, achieving financial independence is a journey, not a sprint. It’s about making consistent, smart choices and sticking to your financial planning for beginners.

You’re not alone in this. Many young professionals share these challenges and triumphs in building wealth in their 20s and 30s.

Take the first step today. Try Alleo for free and let us support you on your journey to financial independence.

Believe in yourself. Financial independence is within your reach. Let’s make it happen together, from investing strategies for millennials to retirement savings for young professionals.