Budget Mastery for Young Professionals: Thriving on Entry-Level Salaries

Are you a recent graduate feeling overwhelmed by entry-level salaries and rising living costs? Budgeting on entry-level salaries can be challenging, but it’s crucial for financial stability.

As a life coach, I’ve helped many young professionals navigate these financial challenges. In my experience, effective budgeting is key to achieving financial stability. Money management for recent graduates often requires creative strategies and discipline.

In this article, you’ll discover practical strategies to manage your finances, from creating a detailed budget on limited income to exploring low-cost living options. You’ll also learn how to maximize benefits and build an emergency fund, essential for personal finance for first-time earners. These budgeting tips for entry-level jobs will help you make the most of your starting salary.

Let’s dive in and explore saving strategies on a starting salary that can set you up for long-term financial success.

The Financial Struggles Faced by Young Professionals

Balancing an entry-level salary with rising living costs can feel like an uphill battle. Many recent graduates are grappling with significant student loan debt, making budgeting on entry-level salaries challenging. This financial pressure can lead to stress and anxiety, affecting overall well-being.

In my experience, people often find themselves prioritizing loan repayments over essential costs like rent and groceries. Creating a budget on limited income becomes crucial for managing expenses effectively.

High living costs further compound this issue. In cities where rents and daily expenses are exorbitant, young professionals struggle to save money. Implementing saving strategies on a starting salary is essential for financial stability.

This financial pressure can lead to stress and anxiety, affecting overall well-being.

Effective budgeting and financial planning are crucial for personal finance for first-time earners. However, many new graduates make common mistakes, such as underestimating expenses or failing to track their spending.

Learning to manage your finances effectively can alleviate some of this burden. Exploring cost-cutting ideas for new professionals can help maximize entry-level paychecks.

It’s a challenging journey, but there are steps you can take to regain control. Budgeting on entry-level salaries requires dedication and smart money management for recent graduates.

Roadmap to Financial Stability on Entry-Level Salaries

Overcoming financial challenges requires a few key steps when budgeting on entry-level salaries. Here are the main areas to focus on to make progress with your money management for recent graduates.

- Create a detailed monthly budget: List income and categorize expenses to manage your finances effectively, a crucial step in budgeting for entry-level jobs.

- Track all expenses for 30 days: Keep a daily log to identify spending patterns and areas for improvement, essential for saving strategies on a starting salary.

- Prioritize student loan repayment: Focus on paying off high-interest loans to save on interest over time, a key aspect of financial planning for young adults.

- Explore low-cost living arrangements: Consider different living options to reduce housing costs, one of the best cost-cutting ideas for new professionals.

- Maximize employer benefits and 401(k) match: Take full advantage of your benefits package to optimize savings, crucial when creating a budget on limited income.

- Build an emergency fund with automatic savings: Set up automatic transfers to save for unexpected expenses, a cornerstone of frugal living for career beginners.

- Develop additional income streams or side hustles: Monetize skills or hobbies for extra income, helping with personal finance for first-time earners.

Let’s dive into these strategies for budgeting on entry-level salaries!

1: Create a detailed monthly budget

Creating a detailed monthly budget is crucial for managing your finances effectively, especially when budgeting on entry-level salaries.

Actionable Steps:

- List all sources of income: Write down every source of income, including your salary, side gigs, or any other earnings for maximizing entry-level paychecks.

- Categorize expenses: Break down your spending into categories like rent, utilities, groceries, and transportation, essential for money management for recent graduates.

- Allocate specific amounts: Use the 50/30/20 rule to allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment, a key strategy for financial planning for young adults.

Explanation:

These steps help you understand where your money goes and ensure you live within your means when budgeting on entry-level salaries. By categorizing expenses, you can spot areas to cut back, which is crucial for cost-cutting ideas for new professionals.

According to Kiplinger, following a structured budget can significantly improve financial management. This approach aligns with industry trends emphasizing financial literacy among young professionals.

Key benefits of budgeting include:

- Increased awareness of spending habits

- Better control over financial decisions

- Ability to set and achieve financial goals

Creating a budget is your first step toward financial stability and mastering personal finance for first-time earners.

2: Track all expenses for 30 days

Tracking your expenses for 30 days is essential for understanding your spending habits and identifying areas for improvement, especially when budgeting on entry-level salaries.

Actionable Steps:

- Record every expense: Write down each purchase, no matter how small, using a notebook or an expense-tracking app. This is crucial for creating a budget on limited income.

- Review weekly: Analyze your expenses weekly to spot patterns and adjust your spending, which is key to money management for recent graduates.

- Categorize expenses: Group your expenses into categories like food, transportation, and entertainment to see where your money is going. This helps in maximizing entry-level paychecks.

Explanation:

These steps will help you gain a clear picture of your financial situation. By regularly reviewing and categorizing your expenses, you’ll identify unnecessary spending and make better financial decisions, which are essential budgeting tips for entry-level jobs.

According to Investopedia, tracking expenses is a crucial aspect of managing your finances. This process aligns with current trends that emphasize the importance of financial literacy for young professionals and personal finance for first-time earners.

This will set a solid foundation for your financial planning and saving strategies on a starting salary.

![]()

3: Prioritize student loan repayment

Prioritizing student loan repayment is essential for managing your financial health and reducing long-term debt, especially when budgeting on entry-level salaries.

Actionable Steps:

- List all student loans: Write down each loan, including interest rates and minimum payments.

- Focus on high-interest loans: Prioritize paying off high-interest loans first to save money in the long run.

- Explore refinancing options: Consider consolidating or refinancing loans to achieve lower interest rates and more manageable payments.

Explanation:

These steps matter because they help you tackle your debt strategically, ensuring you save on interest and make progress faster, which is crucial for personal finance for first-time earners.

According to Journey of an Architect, managing student loans effectively is crucial for financial stability.

Understanding your loans and focusing on high-interest ones aligns with industry trends emphasizing financial literacy and money management for recent graduates.

Strategies for effective loan repayment:

- Make extra payments when possible

- Use windfalls or tax refunds for loan payments

- Consider income-driven repayment plans

Taking control of your student loans sets the stage for a more secure financial future, even when budgeting on entry-level salaries.

4: Explore low-cost living arrangements

Exploring low-cost living arrangements is essential for budgeting on entry-level salaries and managing finances effectively.

Actionable Steps:

- Consider living with parents: Move back home temporarily to save on rent and utilities while you build your savings, a key strategy for money management for recent graduates.

- Share an apartment with roommates: Split housing costs with roommates to reduce rent and utility expenses significantly, an effective cost-cutting idea for new professionals.

- Negotiate rental terms: Discuss rental agreements with landlords to lower rent or include utilities in the monthly payment, maximizing your entry-level paycheck.

Explanation:

These steps can help you manage housing costs effectively, freeing up money for other essential expenses when budgeting on entry-level salaries. By sharing living spaces or negotiating better terms, you can alleviate financial pressure.

According to Investopedia, reducing housing expenses is crucial for young professionals on a tight budget. This approach aligns with industry trends emphasizing financial literacy and practical money management for first-time earners.

Exploring affordable living arrangements is a smart step toward financial stability and creating a budget on limited income.

5: Maximize employer benefits and 401(k) match

Maximizing employer benefits and 401(k) match is crucial for young professionals to optimize their savings and secure their financial future, especially when budgeting on entry-level salaries.

Actionable Steps:

- Review your employer’s benefits package: Take full advantage of health insurance, commuter benefits, and other perks offered by your employer to support your financial planning for young adults.

- Contribute to your 401(k): Ensure you contribute enough to your 401(k) to get the full employer match, which is essentially free money for your retirement and a key strategy for maximizing entry-level paychecks.

- Attend HR workshops: Join HR workshops or consult with a financial advisor to understand and optimize your benefits package, enhancing your money management for recent graduates.

Explanation:

These steps matter because they help you take full advantage of the benefits your employer offers, which can significantly enhance your financial stability when creating a budget on limited income.

By contributing to your 401(k), you gain free money and compound interest, securing your financial future and implementing saving strategies on a starting salary.

According to Investopedia, understanding and maximizing employer benefits is essential for young professionals. This aligns with industry trends emphasizing the importance of financial literacy and planning for those budgeting on entry-level salaries.

Taking these actions can help you build a strong financial foundation while benefiting from what your employer offers, supporting your personal finance goals as first-time earners.

6: Build an emergency fund with automatic savings

Building an emergency fund with automatic savings is crucial for financial security when budgeting on entry-level salaries.

Actionable Steps:

- Set up a dedicated savings account: Open a separate account specifically for emergencies to avoid dipping into it for regular expenses, a key strategy for saving strategies on a starting salary.

- Automate savings transfers: Arrange automatic transfers from your checking account to your emergency fund every payday to ensure consistent contributions, an essential part of financial planning for young adults.

- Aim for a target amount: Save at least three to six months’ worth of living expenses to cover unexpected costs, which is crucial for maximizing entry-level paychecks.

Explanation:

These steps matter because they provide a safety net for unforeseen expenses, reducing financial stress for personal finance for first-time earners.

By automating savings, you ensure regular contributions without the risk of forgetting or overspending, a key aspect of budgeting on entry-level salaries.

According to NEFE, having an emergency fund is essential for financial stability. This aligns with trends emphasizing the importance of financial planning for young professionals and money management for recent graduates.

Building an emergency fund is a vital step toward achieving financial stability when budgeting on entry-level salaries.

7: Develop additional income streams or side hustles

Developing additional income streams or side hustles can significantly enhance your financial stability when budgeting on entry-level salaries.

Actionable Steps:

- Identify monetizable skills or hobbies: Look for skills or hobbies you can monetize, like freelance writing, tutoring, or selling handmade crafts to boost your entry-level paycheck.

- Join gig economy platforms: Sign up for gig economy platforms or local markets to start earning extra income, a key strategy for saving on a starting salary.

- Allocate dedicated time: Dedicate a few hours each week to your side hustle, ensuring it doesn’t interfere with your primary job while maximizing your entry-level income.

Explanation:

These steps matter because they provide additional income, reducing financial stress and increasing savings potential for those budgeting on entry-level salaries.

By leveraging gig economy platforms, you can find flexible work opportunities that fit your schedule, enhancing your personal finance strategy as a first-time earner.

According to Investopedia, diversifying income sources is crucial for financial stability. This advice aligns with trends emphasizing financial literacy and practical money management for young adults.

Popular side hustle options include:

- Freelance writing or graphic design

- Online tutoring or teaching

- Driving for ride-sharing services

Exploring side hustles can give you a financial edge when budgeting on entry-level salaries, offering cost-cutting ideas for new professionals.

Partner with Alleo on Your Financial Journey

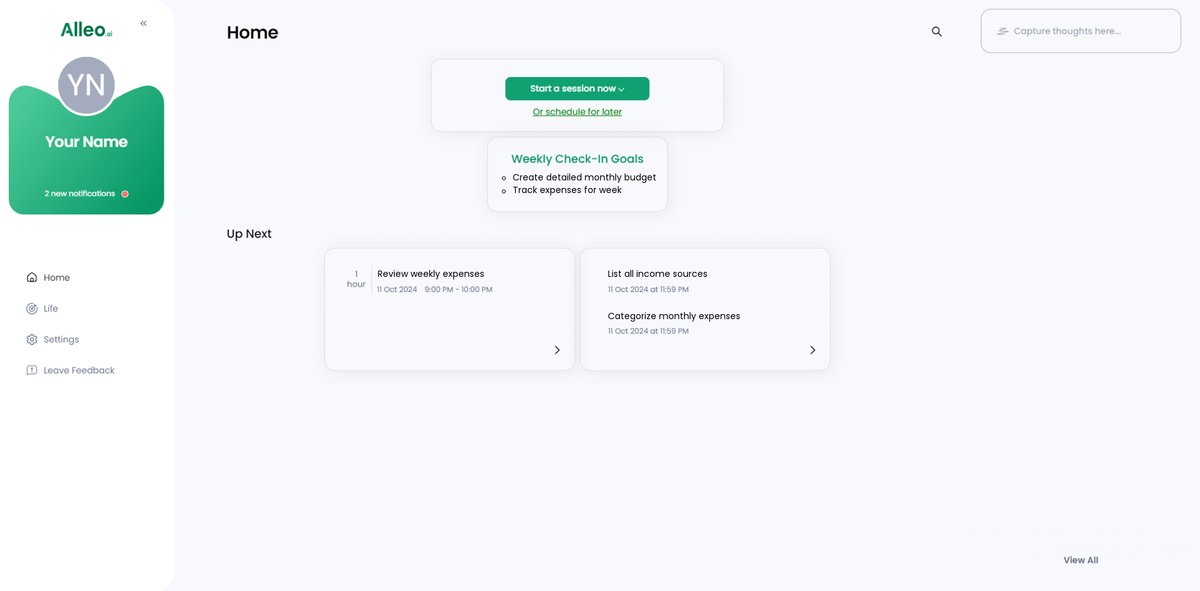

We’ve explored budgeting tips and strategies for entry-level salaries. But did you know you can work with Alleo to simplify this journey of budgeting on entry-level salaries?

Setting up an account with Alleo is easy. Create a personalized plan for maximizing entry-level paychecks and start working with Alleo’s AI life coach to master money management for recent graduates.

The coach will help you track expenses, set reminders, and offer personalized advice on creating a budget on limited income.

Alleo’s coach will follow up on your progress and handle changes in your financial planning for young adults. You’ll get text and push notifications to keep you accountable with your saving strategies on a starting salary.

Ready to get started for free with budgeting on entry-level salaries? Let me show you how!

Step 1: Log In or Create Your Account

To begin your journey towards financial stability, log in to your existing Alleo account or create a new one in just a few clicks.

Step 2: Choose Your Financial Goal

Click on “Building better habits and routines” to start developing the financial discipline needed to manage your entry-level salary effectively and overcome the challenges of rising living costs.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address your budget challenges and work towards financial stability on your entry-level salary. This selection will provide you with tailored guidance, expense tracking tools, and personalized advice to help you create a budget, manage student loans, and build savings.

Step 4: Starting a Coaching Session

Begin your financial journey with Alleo by scheduling an initial intake session, where you’ll discuss your budget, expenses, and financial goals to create a personalized plan that aligns with the strategies outlined in this article.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to review and manage the financial goals you discussed, allowing you to track your progress and stay accountable on your journey to financial stability.

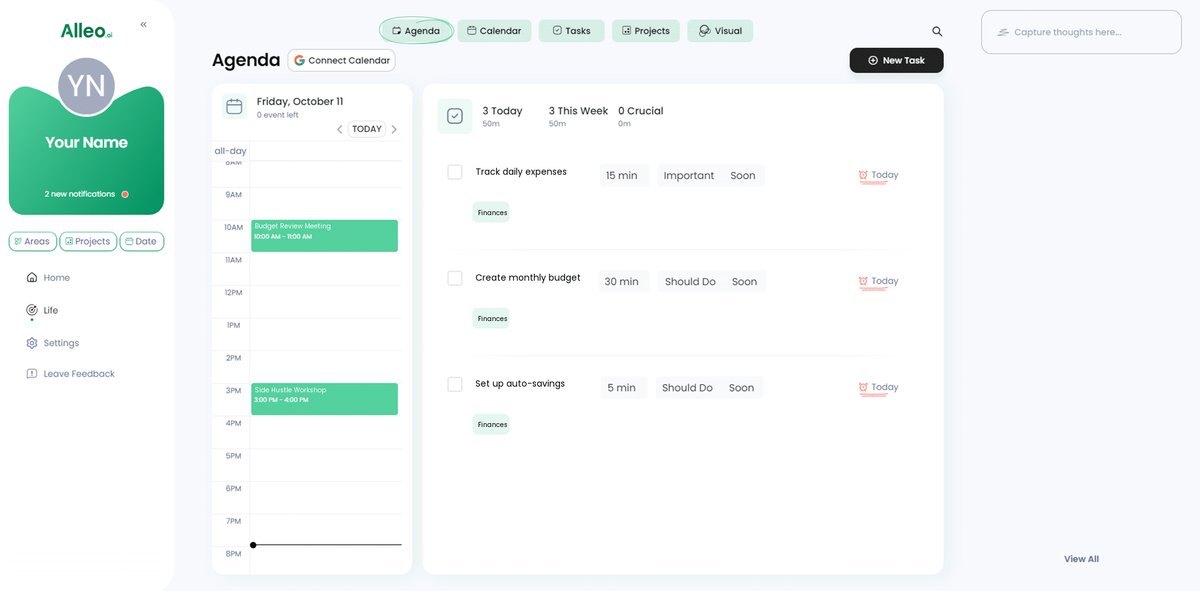

Step 6: Adding events to your calendar or app

Use the calendar and task features in Alleo to schedule and track your financial goals, such as bill payments, savings transfers, and expense reviews, helping you stay accountable and monitor your progress towards financial stability.

Taking the First Steps Toward Financial Freedom

Balancing an entry-level salary with rising living costs is tough. But with a solid plan, you can take control of your finances and master budgeting on entry-level salaries.

Start by creating a detailed budget and tracking your expenses. Prioritize repaying your student loans and explore affordable living options, essential for money management for recent graduates.

Maximize your employer benefits and build an emergency fund. Additionally, consider developing side hustles to boost your income, a key strategy for maximizing entry-level paychecks.

Remember, Alleo is here to help. Our AI life coach can guide you every step of the way in creating a budget on limited income.

You’re not alone in this journey. Let’s achieve your financial goals together, focusing on personal finance for first-time earners.

Ready to take control? Try Alleo for free and start your path to financial stability today, learning essential budgeting tips for entry-level jobs.