How Millennials Can Master Budgeting and Long-Term Savings: 3 Proven Techniques

Are you struggling to balance your budget while saving for long-term goals? Millennial budgeting and saving tips can help you navigate these financial challenges.

As a life coach, I’ve helped many recent college graduates master personal finance for millennials. I understand the specific financial pressures you face, including balancing student loans and savings.

In this article, you’ll discover actionable strategies to:

- Automate your savings and build an emergency fund

- Create a detailed budget using the 50/30/20 rule for budgeting tips for young adults

- Explore side hustles for additional income and saving money in your 20s and 30s

Let’s dive into these millennial budgeting and saving tips.

The Financial Struggles of Recent Graduates

Starting your career with an entry-level salary can be daunting. Many recent graduates find it hard to balance essential expenses with saving for the future, making millennial budgeting and saving tips crucial for financial success.

It’s a common struggle.

In my experience, clients often report feeling overwhelmed by student loan debt. This debt can make it challenging to save for long-term goals, highlighting the importance of personal finance for millennials.

For instance, it’s not uncommon to see clients who must choose between paying off loans and setting aside money for an emergency fund. The financial pressure is real, and it can feel like there’s no way out, especially when balancing student loans and savings.

However, with the right strategies and tools, achieving financial stability is possible. Let’s explore how you can take control of your finances and implement effective budgeting tips for young adults.

Steps to Balance Budgeting and Saving for Long-Term Goals

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with millennial budgeting and saving tips:

- Set up automated transfers for savings goals: Automate your savings to ensure consistency and discipline, a crucial aspect of personal finance for millennials.

- Create a detailed budget using the 50/30/20 rule: Divide your income into needs, wants, and savings to manage your finances effectively, a key strategy in budgeting tips for young adults.

- Explore side hustles for additional income: Generate extra income to boost your savings and achieve financial goals faster, supporting long-term financial planning strategies.

Let’s dive into these millennial budgeting and saving tips!

1: Set up automated transfers for savings goals

Setting up automated transfers for your savings goals is one of the essential millennial budgeting and saving tips that ensures consistency and helps you stay disciplined with your finances.

Actionable Steps:

- Define Specific Savings Goals: Use Alleo to establish clear, specific savings goals such as an emergency fund, retirement planning for millennials, or a down payment.

- Schedule Automated Transfers: Set up automatic transfers from your checking to savings accounts on payday to ensure regular contributions, a key aspect of personal finance for millennials.

- Track Progress: Monitor your savings progress regularly with Alleo’s tracking features to stay on course with your long-term financial planning strategies.

Key benefits of automated savings:

- Reduces the temptation to spend

- Ensures consistent contributions

- Builds savings habits effortlessly

Explanation: Automating your savings removes the temptation to spend extra money and ensures you consistently contribute toward your goals, which is crucial for saving money in your 20s and 30s.

According to Money with Katie, automated systems can help eliminate human error and willpower from the equation, making it easier to achieve financial stability.

By setting up automated transfers, you can focus on other aspects of financial planning without constantly worrying about saving enough each month, allowing you to balance student loans and savings effectively.

2: Create a detailed budget using the 50/30/20 rule

Creating a detailed budget using the 50/30/20 rule is crucial for managing your finances effectively and ensuring you save for long-term goals. This approach is one of the most effective millennial budgeting and saving tips for personal finance.

Actionable Steps:

- Categorize Your Expenses: Use Alleo to classify all monthly expenses into needs, wants, and savings categories. This helps in understanding your spending patterns and is essential for budgeting tips for young adults.

- Adjust Your Spending: Identify areas where you can cut back on wants and reallocate those funds towards savings and debt management for young professionals. This ensures you follow the budget proportions and supports long-term financial planning strategies.

- Review Your Budget Monthly: Schedule monthly budget reviews with Alleo to adjust for any changes in income or expenses. Regular reviews keep your budget relevant and effective, which is crucial for saving money in your 20s and 30s.

Explanation: Implementing the 50/30/20 rule helps you allocate your income wisely, ensuring essential needs are met while also saving for the future. This is a key aspect of retirement planning for millennials.

According to Fidelity, balancing current expenses with long-term savings goals is essential for financial stability.

Regularly reviewing and adjusting your budget allows you to stay on track and meet your financial goals, including building an emergency fund and exploring investment options for beginners.

This structured budgeting approach can significantly improve your financial health and help you achieve stability, making it an essential millennial budgeting and saving tip.

3: Explore side hustles for additional income

Exploring side hustles can help you generate extra income, making it easier to save for long-term goals. This is a crucial millennial budgeting and saving tip that can boost your financial health.

Actionable Steps:

- Identify Skills and Interests: Use Alleo to pinpoint potential side hustles that match your skills and interests. This ensures you enjoy the work and stay committed, aligning with personal finance for millennials best practices.

- Start Small: Begin with manageable side hustles like freelance work or gig economy jobs. Gradually increase your engagement as you gain experience and confidence, a key strategy in saving money in your 20s and 30s.

- Allocate Extra Income: Direct additional income towards your savings goals or debt repayment using automated transfers. This ensures every dollar is put to good use, supporting long-term financial planning strategies.

Popular side hustle options to consider for millennials looking to improve their budgeting and saving:

- Freelance writing or graphic design

- Online tutoring or teaching

- Pet-sitting or dog-walking services

Explanation: Exploring side hustles provides additional income streams, crucial for boosting savings. According to Money with Katie, side hustles are popular among millennials for generating extra income.

Diversifying your income sources can significantly enhance your financial stability and help achieve your goals faster, which is essential in retirement planning for millennials.

Remember, starting small and gradually scaling your efforts can lead to meaningful financial progress over time, supporting your journey in balancing student loans and savings.

Achieve Financial Stability with Alleo

We’ve explored the financial struggles of recent graduates, millennial budgeting and saving tips, and strategies to overcome them and stay on track. But did you know you can work directly with Alleo to make this journey easier and faster for personal finance for millennials?

Setting up an account is simple. Start by creating a personalized plan tailored to your financial goals, including long-term financial planning strategies.

Alleo’s AI coach provides affordable, tailored coaching support, just like a human coach. With a free 14-day trial, you can experience Alleo’s benefits without any commitment, perfect for those looking to start saving money in their 20s and 30s.

Alleo will help you define clear savings goals, create detailed budgets, and explore side hustles. The coach follows up on your progress, handles changes, and keeps you accountable via text and push notifications, assisting with everything from debt management for young professionals to emergency fund building techniques.

This ensures you stay on track toward your financial goals, including retirement planning for millennials.

Ready to get started for free? Let me show you how to begin your journey with millennial budgeting and saving tips!

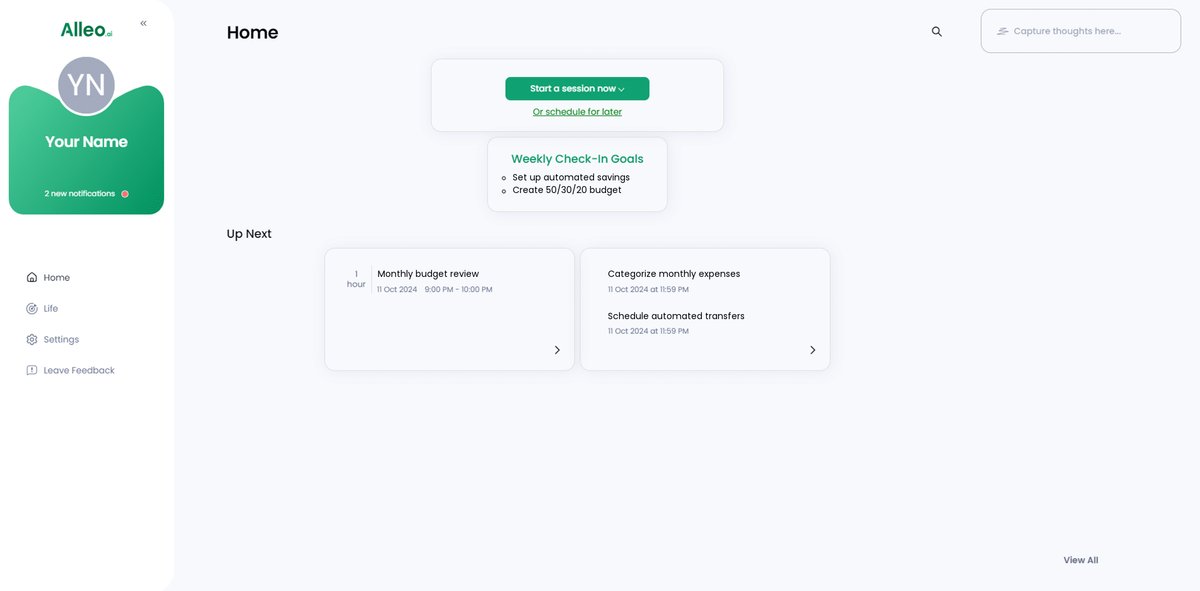

Step 1: Log In or Create Your Alleo Account

To begin your journey towards financial stability, log in to your existing Alleo account or create a new one to access personalized budgeting and savings tools tailored for recent graduates.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to establish consistent financial practices that will help you balance your budget and save for long-term goals more effectively.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to address your budgeting challenges and long-term savings goals, aligning perfectly with the strategies discussed for recent graduates facing financial pressures.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with the AI coach to set up your personalized financial plan and establish clear goals for budgeting and saving.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, open the Alleo app to find your discussed financial goals conveniently displayed on the home page, where you can easily track and manage your progress towards budgeting and long-term savings objectives.

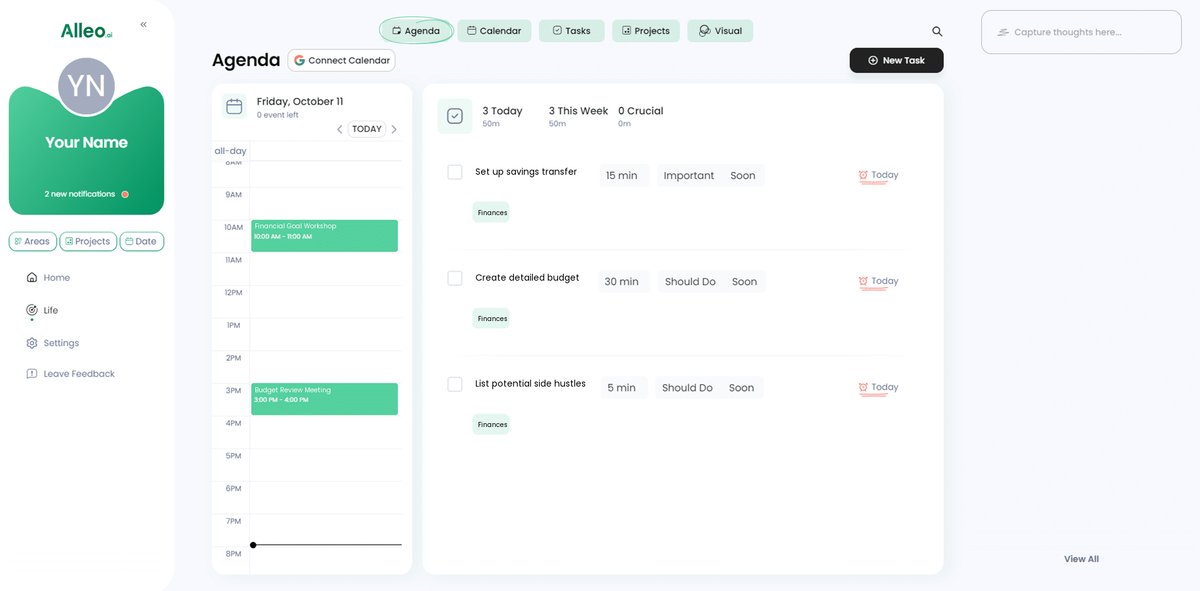

Step 6: Adding Events to Your Calendar or App

Use Alleo’s calendar and task features to schedule and track your financial activities, such as automated savings transfers, budget reviews, and side hustle commitments, helping you stay organized and accountable in achieving your money management goals.

Taking the First Step Toward Your Financial Goals

We’ve covered a lot of millennial budgeting and saving tips, but now it’s time to put everything into action.

Balancing your budget while saving for long-term financial planning strategies is challenging, but it’s absolutely achievable. Remember, you’re not alone in this journey of personal finance for millennials.

With automated transfers, a solid budget, and side hustles, you’ll see progress in saving money in your 20s and 30s.

Alleo is here to guide you every step of the way with budgeting tips for young adults.

Start today with Alleo’s free 14-day trial and experience how it can transform your financial life, including retirement planning for millennials.

Take control of your finances and build a secure future with effective millennial budgeting and saving tips.

You got this!