How to Start Budgeting for Young Professionals with No Finance Experience: A Step-by-Step Guide

Feeling overwhelmed by your finances after graduation? You’re not alone. Budgeting for young professionals can be challenging, but it’s an essential personal finance basic.

As a life coach, I’ve guided many professionals through these exact challenges. I’ve seen firsthand how daunting it can be to balance entry-level salaries and expenses, especially when managing student loan debt.

In this article, you’ll learn practical strategies to manage your budget effectively. We’ll cover actionable steps, useful tools like budgeting apps for beginners, and expert advice on creating a monthly budget plan. From saving money on an entry-level salary to setting up an emergency fund for young adults, we’ve got you covered.

Let’s dive into budgeting for young professionals and start your journey towards financial goal setting and stability.

Understanding the Financial Struggles of New Graduates

Many new graduates face significant financial challenges when it comes to budgeting for young professionals. Student loans, entry-level salaries, and unexpected expenses can quickly overwhelm anyone trying to grasp personal finance basics.

In my experience, people often find it difficult to manage their finances without prior experience. The pressure to balance loan repayments and daily living costs while creating a monthly budget plan is immense.

Several clients report feeling stuck, unable to save money on entry-level salary or plan for their future. This stress can make budgeting seem impossible, even with budgeting apps for beginners.

But there’s hope. By breaking down these challenges, we can find manageable steps forward in managing student loan debt and setting financial goals.

Overcoming this challenge of budgeting for young professionals requires a few key steps. Here are the main areas to focus on to make progress with your personal finance basics.

- Track income and expenses for one month: Record all sources of income and expenditures to start creating a monthly budget plan.

- Create categories for essential and non-essential costs: Identify and separate your necessary and optional expenses, which is crucial for saving money on an entry-level salary.

- Set up an emergency fund with a specific goal: Save for unexpected expenses by setting a clear target, essential for young adults managing their finances.

- Use a simple budgeting app to monitor spending: Select one of many budgeting apps for beginners to track your budget in real-time.

- Prioritize debt repayment in your budget: Focus on paying off high-interest debts first, including managing student loan debt.

- Learn basic financial terms and concepts: Educate yourself on personal finance, including budgeting percentages for millennials.

- Set short-term financial goals to work towards: Define and pursue achievable financial objectives, an important aspect of budgeting for young professionals.

Let’s dive in to these budgeting strategies for young professionals!

1: Track income and expenses for one month

Understanding where your money goes is the first step to effective budgeting for young professionals. This fundamental personal finance basics exercise helps you gain control over your finances.

Actionable Steps:

- Record all sources of income and every expense for one month using a spreadsheet, notebook, or budgeting apps for beginners.

- Categorize each transaction to identify spending habits and patterns, crucial for creating a monthly budget plan.

- Review the data to find areas where you can cut back and save, essential for saving money on entry-level salary.

Explanation: Tracking your income and expenses helps you to identify spending patterns and areas where you can cut costs, laying the groundwork for managing student loan debt and building an emergency fund for young adults.

This step is critical for building a sustainable budget and ensuring financial stability, aligning with financial goal setting practices.

According to an article on Journey of an Architect, understanding your spending habits is crucial for managing your finances effectively.

This tracking exercise sets the foundation for your budgeting journey, making it easier to allocate funds wisely in the future and apply budgeting percentages for millennials. It’s a key component of frugal living tips for new graduates.

2: Create categories for essential and non-essential costs

Creating categories for essential and non-essential costs is crucial to understanding and managing your budget effectively, especially when budgeting for young professionals.

Actionable Steps:

- Identify essential expenses: List all necessary costs such as rent, utilities, and groceries as part of your personal finance basics.

- List non-essential expenses: Include items like dining out, subscriptions, and entertainment when creating a monthly budget plan.

- Allocate specific amounts for each category: Base your allocations on your tracking expenses effectively from the previous month.

Explanation: Categorizing expenses helps you prioritize your spending and make informed financial decisions, which is crucial for saving money on an entry-level salary.

This process ensures that your essential needs are met while allowing you to control discretionary spending, aiding in financial goal setting.

According to Talladega College News, understanding spending patterns can significantly improve financial management.

This step sets the stage for a balanced budget and financial stability, crucial for managing student loan debt and building an emergency fund for young adults.

3: Set up an emergency fund with a specific goal

Establishing an emergency fund is crucial for young professionals to handle unexpected expenses and is a key aspect of budgeting for young professionals.

Actionable Steps:

- Determine a realistic goal: Aim to save enough to cover three months of living expenses, an essential part of personal finance basics.

- Open a dedicated savings account: Keep this fund separate to avoid spending it accidentally and to aid in tracking expenses effectively.

- Automate monthly transfers: Set up automatic transfers to this account to ensure consistent savings, which is crucial when saving money on an entry-level salary.

Explanation: Having an emergency fund provides financial security and peace of mind. This fund ensures you’re prepared for unexpected costs, such as medical bills or car repairs, which is vital for managing student loan debt and other financial obligations.

According to Journey of an Architect, having a rainy day fund is crucial for financial stability. Automating your savings simplifies the process, making it easier to build this essential fund for young adults.

Here are some key benefits of an emergency fund:

- Reduces financial stress during unexpected situations

- Prevents reliance on high-interest credit cards

- Provides a safety net for job loss or income reduction

With an emergency fund in place, you’ll be better equipped to handle life’s uncertainties and achieve your financial goal setting objectives as part of your overall budgeting strategy for young professionals.

4: Use a simple budgeting app to monitor spending

Using a simple budgeting app can significantly streamline the process of monitoring your spending and managing your finances effectively, which is crucial for budgeting for young professionals.

Actionable Steps:

- Download a user-friendly budgeting app: Choose an app that suits your needs and offers easy-to-use features for tracking expenses effectively.

- Input your monthly budget and expenses: Regularly update the app with your income and spending to keep track of your financial activity and create a monthly budget plan.

- Set up alerts for spending limits: Enable notifications to get alerts when you approach or exceed your budget limits, helping with personal finance basics.

Explanation: Using a budgeting app helps you stay on top of your finances by providing a clear picture of your spending habits in real-time. This method reduces the chances of overspending and aids in making informed financial decisions, essential for budgeting for young professionals.

According to Investopedia, tracking your expenses is a crucial step in achieving financial stability. By automating this process, you free up time and mental energy for other important tasks like financial goal setting.

You’ll find managing your budget easier and more efficient with the right app, especially when budgeting for young professionals on an entry-level salary.

5: Prioritize debt repayment in your budget

Paying off debt is crucial for achieving financial freedom, especially when budgeting for young professionals.

Actionable Steps:

- List all debts: Identify each debt, including interest rates and minimum payments, as part of personal finance basics.

- Allocate extra funds: Focus on paying off the debt with the highest interest rate first, a key aspect of managing student loan debt.

- Consider debt consolidation: Simplify payments by consolidating debts into one with a lower interest rate, which can help with creating a monthly budget plan.

Explanation: Prioritizing debt repayment can reduce financial stress and save you money on interest, essential for saving money on an entry-level salary.

According to Peach State FCU, managing debt effectively is key to financial independence.

By tackling high-interest debts first, you minimize the total amount paid over time, leading to faster financial freedom and contributing to your emergency fund for young adults.

Taking these steps helps you regain control over your finances and move towards stability, aligning with financial goal setting for budgeting for young professionals.

6: Learn basic financial terms and concepts

Understanding basic financial terms and concepts is essential for young professionals managing their budgets and mastering personal finance basics.

Actionable Steps:

- Read introductory books and articles: Start with beginner-friendly resources on personal finance and budgeting for young professionals to build a strong foundation.

- Attend free online webinars and workshops: Participate in virtual events to gain practical knowledge about creating a monthly budget plan and ask questions.

- Join a financial literacy group or forum: Engage with communities to share experiences and learn from others about budgeting percentages for millennials and tracking expenses effectively.

Explanation: Learning financial terms helps you make informed decisions and manage your money better, especially when budgeting for young professionals.

According to Missouri Department of Higher Education & Workforce Development, financial literacy is crucial for managing personal finances effectively.

By staying educated, you can navigate complex financial situations with confidence, including saving money on an entry-level salary and managing student loan debt.

Essential financial concepts to understand include:

- Compound interest and its impact on savings and debt

- The difference between good debt and bad debt

- How credit scores are calculated and their importance for budgeting for young professionals

These steps will empower you to make smarter financial choices and set up an emergency fund for young adults.

7: Set short-term financial goals to work towards

Setting short-term financial goals is essential for creating a clear roadmap to financial success, especially when budgeting for young professionals.

Actionable Steps:

- Define specific goals: Identify clear, achievable financial goals such as saving $500 for a vacation or paying off a credit card in six months as part of your personal finance basics.

- Break down each goal: Divide your main goal into smaller, manageable tasks to make progress more attainable when creating a monthly budget plan.

- Regularly review and adjust: Assess your progress monthly and make necessary adjustments to stay on track with your budgeting for young professionals strategy.

Explanation: Setting short-term financial goals keeps you motivated and provides direction for your financial planning. This approach ensures that you have clear targets to work towards, which is crucial for managing student loan debt and saving money on an entry-level salary.

According to Investopedia, having specific goals can help you maintain focus and discipline in your budgeting efforts. Regular reviews help you stay aligned with your objectives and adjust as needed for better outcomes in tracking expenses effectively.

Here are some examples of short-term financial goals:

- Building a $1,000 emergency fund for young adults within 3 months

- Reducing dining out expenses by 30% in the next month as part of frugal living tips for new graduates

- Increasing retirement contributions by 2% in 6 months, aligning with budgeting percentages for millennials

Taking these steps helps you gain control over your finances and achieve your financial ambitions through effective budgeting for young professionals.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of budgeting for young professionals and the steps to achieve financial stability. But did you know you can work directly with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple and quick. First, sign up for our free 14-day trial, which requires no credit card. This budgeting app for beginners is perfect for those looking to master personal finance basics.

Then, create a personalized financial plan tailored to your needs and goals, including strategies for saving money on an entry-level salary and managing student loan debt.

Alleo’s AI coach will guide you through each step of your budgeting journey. You’ll receive customized advice on tracking expenses effectively, setting up categories, and prioritizing debt repayment as part of your monthly budget plan.

The coach will send follow-up messages to track your progress, handle changes, and keep you accountable to your financial goal setting.

You’ll get text and push notifications to stay on track with your budget. Alleo provides full coaching sessions just like a human coach, ensuring you have the support you need for budgeting as a young professional.

Ready to get started for free?

Let me show you how!

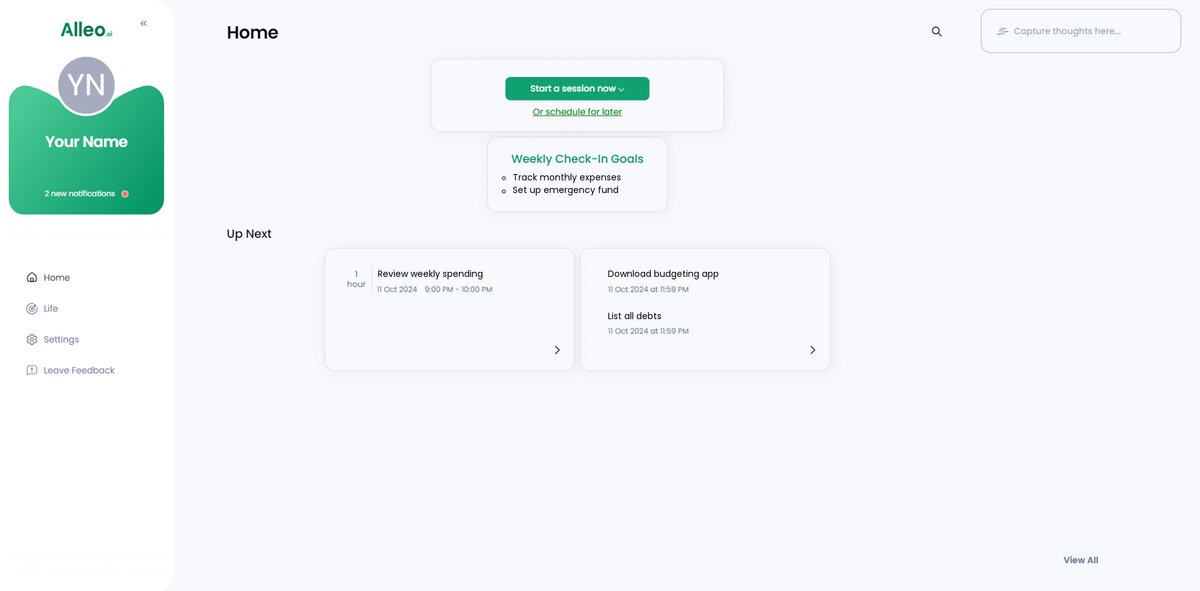

Step 1: Log In or Create Your Account

To begin your budgeting journey with Alleo, simply Log in to your account or create a new one to access personalized financial guidance and support.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing a structured approach to managing your finances. This goal directly addresses the challenges of budgeting and financial planning outlined in the article, helping you create sustainable practices for long-term financial success.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on budgeting, debt management, and achieving financial stability as a young professional, directly addressing the challenges outlined in the article.

Step 4: Starting a coaching session

Begin your financial journey with Alleo by scheduling an intake session, where our AI coach will guide you through setting up a personalized plan tailored to your budgeting goals and challenges as a young professional.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress and stay accountable to your budgeting plan.

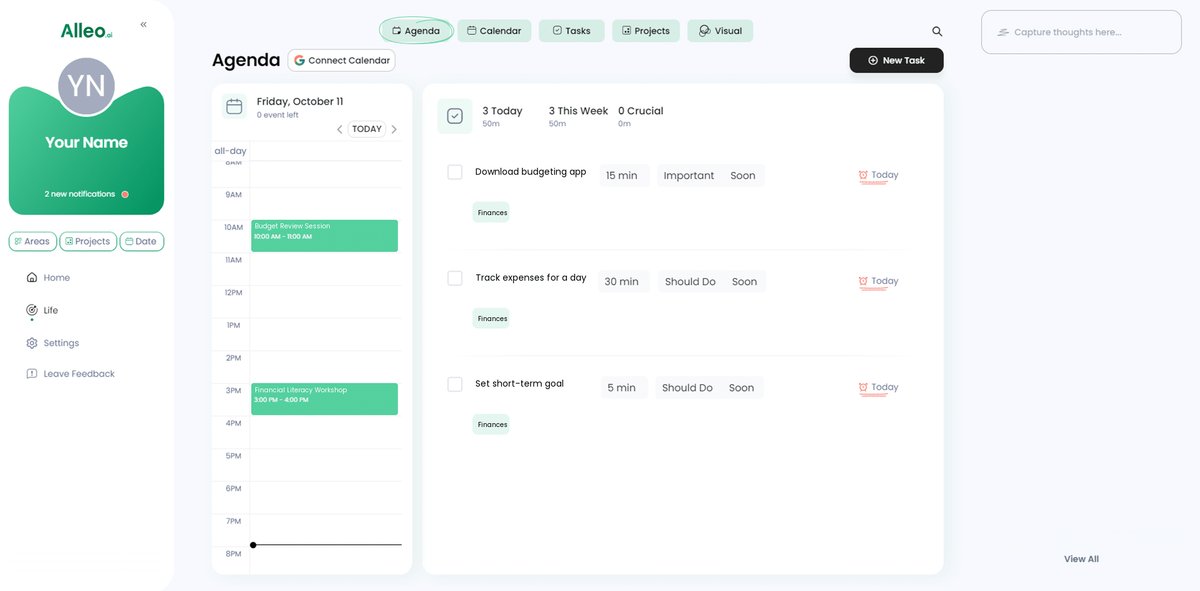

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to add important financial events and deadlines, such as bill due dates or savings goals, allowing you to easily track your progress and stay accountable to your budgeting plan.

Taking Control of Your Financial Future

Now that you’ve learned these essential budgeting for young professionals steps, it’s time to take action.

Remember, you’re not alone in this journey. Many recent graduates face similar challenges, but with the right personal finance basics and tools, you can succeed.

Start by tracking expenses effectively. Identify your essential and non-essential costs, and set up an emergency fund for young adults.

Use a budgeting app for beginners to make monitoring your spending easier. Prioritize managing student loan debt and educate yourself on creating a monthly budget plan.

Set short-term financial goals to keep yourself motivated.

I’m confident you can achieve financial stability while saving money on an entry-level salary.

For extra support, try Alleo’s free trial. Let Alleo guide you with personalized advice and keep you on track with budgeting for young professionals.

Your financial future starts today. Let’s make it happen with smart budgeting percentages for millennials and frugal living tips for new graduates.