How New Vets Can Manage School Debt and Build Financial Stability: The Ultimate Guide

Are you feeling overwhelmed by the weight of your veterinary school debt and wondering how to achieve financial stability as you advance in your career? Exploring veterinary debt repayment strategies is crucial for new graduates.

As a life coach, I’ve guided many new professionals through similar challenges. Navigating substantial debt while making early career decisions can feel daunting, especially when considering income-based repayment plans for vet school loans.

In this article, you’ll discover actionable veterinary debt repayment strategies to manage your veterinary school debt and build a stable financial future. From budgeting tips for new veterinary graduates to exploring loan repayment assistance programs for veterinary professionals, we’ve got you covered.

Let’s dive in and explore student loan repayment options for veterinarians.

Understanding the Weight of Veterinary School Debt

The average veterinary school graduate faces an overwhelming debt load, often nearing $200,000. This financial burden can cause significant stress, impacting both emotional well-being and professional performance. Exploring veterinary debt repayment strategies is crucial for new graduates.

For many, the pressure of high debt levels can lead to feelings of anxiety and uncertainty about the future. It’s common to feel trapped and unsure of how to move forward, especially when considering the debt-to-income ratio for veterinarians.

Effective financial planning for early-career veterinarians is crucial. Without it, the dream of helping animals may feel overshadowed by the reality of managing substantial debt. Exploring income-based repayment plans for vet school loans and loan forgiveness programs for veterinary professionals can provide some relief.

A Roadmap to Managing Veterinary School Debt

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress with veterinary debt repayment strategies:

- Create a detailed budget and track expenses: List all monthly expenses and categorize them. This is crucial for budgeting tips for new veterinary graduates.

- Explore income-driven repayment plan options: Research and apply for suitable plans, including income-based repayment plans for vet school loans.

- Apply for loan repayment assistance programs: Identify and apply for relevant loan forgiveness programs for veterinary professionals.

- Pursue additional income through part-time work: Explore part-time roles and side hustles for veterinarians to boost income.

- Seek mentorship for financial guidance: Join professional organizations and find a mentor for financial planning for early-career veterinarians.

Let’s dive in!

1: Create a detailed budget and track expenses

Creating a detailed budget is essential for managing your veterinary school debt and achieving financial stability. This is a crucial step in developing effective veterinary debt repayment strategies.

Actionable Steps:

- List all monthly expenses and categorize them: Identify necessities like rent and groceries, and separate discretionary spending like dining out. This is key for budgeting tips for new veterinary graduates.

- Use a budgeting tool or app to monitor daily spending: Utilize apps to track expenses and make adjustments as needed, which can help with financial planning for early-career veterinarians.

- Set specific savings goals: Aim to save a set amount each month, such as $200, for an emergency fund. This can be part of your overall strategy for student loan repayment options for veterinarians.

Explanation:

These steps help you gain control over your finances, ensuring that every dollar is accounted for. Understanding your spending patterns allows you to allocate funds more effectively towards debt repayment and savings, which is crucial for managing your debt-to-income ratio as a veterinarian.

For more detailed budgeting advice, you can refer to this resource from Purdue University College of Veterinary Medicine.

Key benefits of budgeting include:

- Improved financial awareness

- Reduced stress about money

- Ability to prioritize spending

Starting with a solid budget sets a strong foundation for tackling debt and achieving long-term financial wellness, which is essential for successful veterinary debt repayment strategies.

2: Explore income-driven repayment plan options

Exploring income-driven repayment plan options can significantly ease the burden of your veterinary school debt by aligning your monthly payments with your income. This is a crucial veterinary debt repayment strategy for managing student loan repayment options for veterinarians.

Actionable Steps:

- Research different income-driven repayment plans: Identify plans such as Income-Based Repayment (IBR) or Pay As You Earn (PAYE) that are available for federal student loans. These income-based repayment plans for vet school loans can be particularly beneficial for early-career veterinarians.

- Calculate potential monthly payments: Use online calculators to estimate payments under various plans considering your income, family size, and loan balance. This step is crucial for financial planning for early-career veterinarians.

- Apply for the most suitable plan: Complete and submit the necessary forms for the income-driven repayment plan that best suits your financial situation. This can help improve your debt-to-income ratio for veterinarians.

Explanation:

These steps are crucial for ensuring your loan repayments are manageable and aligned with your current income. This approach allows you to focus on building your career without the constant pressure of unmanageable loan payments, which is essential when considering veterinary practice ownership financing.

For detailed information on repayment plans and options, refer to this resource from Purdue University College of Veterinary Medicine.

Exploring these repayment options can provide much-needed financial relief, helping you stay on track with your professional and personal goals while implementing effective veterinary debt repayment strategies.

3: Apply for loan repayment assistance programs

Applying for loan repayment assistance programs can significantly reduce your veterinary school debt and ease financial strain, making it a crucial veterinary debt repayment strategy.

Actionable Steps:

- Identify relevant loan repayment assistance programs: Look for programs like the Veterinary Medicine Loan Repayment Program and check eligibility requirements for student loan repayment options for veterinarians.

- Gather necessary documentation: Collect all required documents, including proof of debt and employment status, to apply for income-based repayment plans for vet school loans.

- Submit applications and follow up: Complete and submit the applications, then regularly follow up with program administrators to explore loan forgiveness programs for veterinary professionals.

Explanation:

These steps are crucial for maximizing available financial assistance and reducing your debt load. By taking advantage of these programs, you can focus more on your career and less on financial stress, improving your debt-to-income ratio for veterinarians.

For more details on specific programs, visit the HRSA Faculty Loan Repayment Program.

Common types of loan repayment assistance programs:

- Federal programs

- State-specific initiatives

- Employer-sponsored repayment plans

Taking proactive steps to apply for assistance can offer substantial relief and support your journey to financial stability as part of your veterinary debt repayment strategies.

4: Pursue additional income through part-time work

Finding additional income through part-time work can be a game-changer in managing your veterinary school debt and implementing effective veterinary debt repayment strategies.

Actionable Steps:

- Explore part-time veterinary roles: Look for opportunities at emergency clinics or animal shelters that align with your career goals and can contribute to your student loan repayment options for veterinarians.

- Consider non-veterinary side gigs: Take on flexible jobs like tutoring or freelance writing to supplement your income, which can be an effective side hustle for veterinarians to boost income.

- Allocate additional income directly to loan repayments: Use any extra earnings to pay down your debt faster or build savings, improving your debt-to-income ratio for veterinarians.

Explanation:

These steps provide practical ways to boost your income and reduce financial stress, which are crucial aspects of financial planning for early-career veterinarians.

By diversifying your income sources, you can make a significant dent in your debt. For more insights, check out this resource from the AVMA.

Taking these actions can help you manage debt and achieve financial stability, which are key components of veterinary debt repayment strategies.

5: Seek mentorship for financial guidance

Seeking mentorship for financial guidance can be instrumental in navigating veterinary school debt and achieving financial stability. Effective veterinary debt repayment strategies often include expert advice and support.

Actionable Steps:

- Join professional organizations: Connect with experienced veterinarians by joining groups like AVMA to learn about student loan repayment options for veterinarians.

- Attend financial literacy workshops: Participate in workshops or webinars focused on financial management for veterinary professionals, including budgeting tips for new veterinary graduates.

- Establish a mentor relationship: Find a mentor who can provide personalized financial advice and support, including guidance on income-based repayment plans for vet school loans.

Explanation:

These steps are crucial because mentors offer valuable insights and personalized strategies to manage debt. Engaging with professional organizations and attending financial workshops can broaden your knowledge and network, especially regarding veterinary practice ownership financing and debt-to-income ratio for veterinarians.

For more information on mentorship and resources, visit the AVMA website. Taking these actions can significantly enhance your financial management skills and ensure a stable career path.

Benefits of financial mentorship:

- Personalized advice tailored to your situation, including loan forgiveness programs for veterinary professionals

- Access to industry-specific financial strategies and financial planning for early-career veterinarians

- Accountability for your financial goals, such as salary negotiation strategies for new veterinarians

Taking proactive steps to seek mentorship can offer substantial relief and support your journey to financial stability, including exploring side hustles for veterinarians to boost income and investing strategies for veterinarians with student debt.

Partner with Alleo on Your Financial Journey

We’ve explored the challenges of managing veterinary school debt and the steps to achieve financial stability. But did you know you can work with Alleo to make this journey easier and explore veterinary debt repayment strategies?

Setting up an account with Alleo is simple. Start by creating a personalized plan tailored to your needs, including student loan repayment options for veterinarians and budgeting tips for new veterinary graduates.

Alleo’s coach will follow up on your progress and handle any changes. They keep you accountable via text and push notifications, helping you with financial planning for early-career veterinarians.

Ready to get started for free? Let me show you how to improve your debt-to-income ratio for veterinarians!

Step 1: Log In or Create Your Account

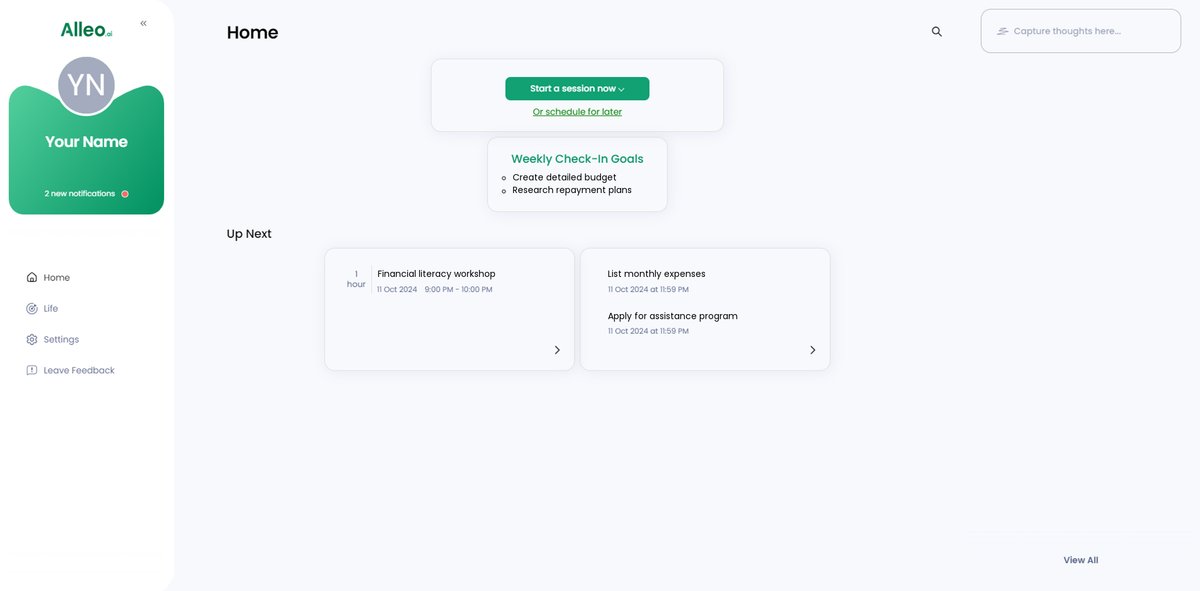

To begin your journey towards managing your veterinary school debt with personalized guidance, log in to your existing Alleo account or create a new one if you’re just getting started.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a solid financial foundation, which is crucial for managing your veterinary school debt and achieving long-term financial stability.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to receive tailored guidance on managing your veterinary school debt, creating budgets, and exploring loan repayment options, helping you achieve financial stability and reduce stress as you advance in your veterinary career.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session, where you’ll discuss your veterinary school debt and financial goals to create a personalized plan for achieving financial stability.

Step 5: Viewing and managing goals after the session

After your coaching session on managing veterinary school debt, check the Alleo app’s home page to review and track the financial goals you discussed, helping you stay accountable and make progress towards financial stability.

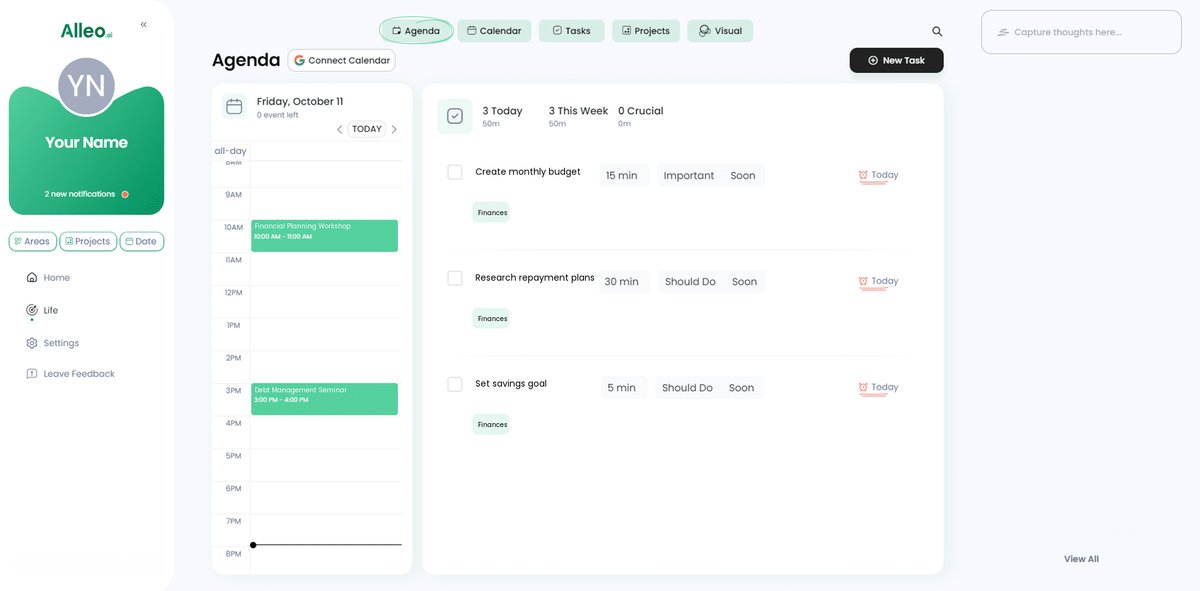

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to schedule important financial milestones, such as loan payment due dates or budget review sessions, allowing you to easily track your progress in managing your veterinary school debt and achieving financial stability.

Taking the Next Step Toward Financial Freedom

It’s clear that managing veterinary school debt can be overwhelming. But with the right veterinary debt repayment strategies, you can achieve financial stability.

By focusing on budgeting tips for new veterinary graduates, exploring student loan repayment options for veterinarians, seeking assistance through loan forgiveness programs for veterinary professionals, finding extra income through side hustles for veterinarians, and getting mentorship, you can take control of your finances.

Remember, you’re not alone in this journey. We’re here to support you every step of the way as you navigate income-based repayment plans for vet school loans and consider veterinary practice ownership financing.

With Alleo, you can get personalized financial guidance to stay on track with your veterinary debt repayment strategies and financial planning for early-career veterinarians.

Start your journey to financial freedom today. Try Alleo for free and see how it can make a difference in your life, helping you improve your debt-to-income ratio for veterinarians.