How Young Professionals Can Repair Credit After Missed Student Loan Payments: A Comprehensive Guide

Have you ever felt that a few missed student loan payments could haunt you for years? This is a common concern when it comes to the need to repair student loan credit damage.

As a life coach, I’ve helped many professionals navigate these challenges. I often encounter clients who are frustrated by how long it takes to recover from financial missteps, especially when it comes to student loan rehabilitation and credit score improvement.

In this article, I’ll share specific strategies to repair your credit, even years after missed student loan payments. You’ll learn actionable steps like setting up automatic payments and requesting goodwill deletions. We’ll explore credit repair strategies and debt management tips to help you overcome late payment consequences.

Let’s dive in to discover how you can effectively repair student loan credit damage and work towards loan default recovery.

Understanding the Depth of the Problem

It’s disheartening to realize that missed student loan payments from six years ago continue to haunt your credit score. Even just missing the first three payments can create long-lasting negative impacts, making it crucial to explore options to repair student loan credit damage.

Many clients initially struggle with the emotional toll of poor credit. Stress levels rise, and securing new loans becomes nearly impossible due to higher interest rates, highlighting the importance of credit repair strategies.

In my experience, young professionals often face financial constraints that compound the issue. High-interest rates on any new credit further complicate their financial stability, emphasizing the need for effective financial planning for young professionals.

Several clients report feeling stuck in a cycle of debt. This isn’t just frustrating—it’s financially debilitating, which is why considering student loan rehabilitation and debt management tips is crucial.

It’s essential to tackle this problem head-on to regain financial freedom and improve your credit score.

For more context, many borrowers face similar hardships, with negative marks staying on credit reports for up to seven years (source). This makes proactive steps vital, such as exploring credit counseling services and income-driven repayment plans to repair student loan credit damage.

Steps to Repair Your Credit After Missed Student Loan Payments

Overcoming this challenge requires a few key steps to repair student loan credit damage. Here are the main areas to focus on to make progress:

- Contact loan servicer to explore repayment options: Schedule a meeting to discuss various repayment plans and student loan rehabilitation.

- Set up automatic payments for on-time repayment: Automate payments to ensure consistency and avoid late payment consequences.

- Enroll in an income-driven repayment plan: Find a plan that fits your financial situation for effective debt management.

- Add positive credit through a secured credit card: Build credit by responsibly using a secured card for credit score improvement.

- Request goodwill deletion for missed payments: Write a letter to your lender requesting the removal of negative marks as part of your credit repair strategy.

Let’s dive in to these strategies for repairing student loan credit damage!

1: Contact loan servicer to explore repayment options

Contacting your loan servicer is crucial for exploring repayment options tailored to your needs and can be an essential step to repair student loan credit damage.

Actionable Steps:

- Schedule a meeting: Use a meeting scheduler to find a suitable time to discuss repayment plans and credit repair strategies.

- Prepare questions: Write down specific repayment options you want to learn more about, including income-driven repayment plans and student loan rehabilitation.

- Document the conversation: Create a follow-up plan based on the agreed next steps during the meeting, focusing on debt management tips and credit score improvement.

Explanation: These steps help you understand and select the best repayment options, ensuring a proactive approach to managing your student loans and addressing late payment consequences.

Engaging with your loan servicer can clarify your options and improve your financial situation, potentially assisting with loan default recovery.

According to Pew Trusts, many borrowers struggle with repayments due to financial constraints, making it vital to explore all available options, including credit counseling services.

Taking these steps can set a solid foundation for your financial recovery and help repair student loan credit damage.

2: Set up automatic payments for on-time repayment

Setting up automatic payments ensures you never miss a payment, which is crucial for improving your credit score and helping to repair student loan credit damage.

Actionable Steps:

- Set up automatic payments: Use online banking tools to automate student loan payments through your bank or loan servicer’s website, a key credit repair strategy.

- Create a monthly budget: Track income and expenses to ensure your account has sufficient funds each month for payments, an essential part of debt management.

- Monitor payments regularly: Use reminders or alerts to check your account before the payment due date to avoid late payment consequences.

Explanation: Automating your payments eliminates the risk of forgetting due dates, which helps maintain a positive payment history and can contribute to credit score improvement.

According to Experian, payment history is a significant factor in credit score calculations. Ensuring consistent, on-time payments is critical for financial stability and repairing student loan credit damage.

Benefits of automatic payments include:

- Reduced stress from manual payment management

- Potential interest rate reductions from lenders

- Improved credit score over time, aiding in loan default recovery

Taking these steps can help you stay on top of your loan payments and build a solid financial foundation, which is crucial for financial planning for young professionals.

3: Enroll in an income-driven repayment plan

Enrolling in an income-driven repayment plan can significantly ease the burden of student loan payments and help repair student loan credit damage over time.

Actionable Steps:

- Research different income-driven repayment plans: Compare options like IBR, PAYE, and SAVE to find the best fit for your financial situation and credit repair strategies.

- Gather necessary documents for application: Collect pay stubs, tax returns, and other financial documents needed for the application process and potential student loan rehabilitation.

- Submit your application and follow up: Track the status of your application and ensure all documents are submitted correctly to avoid late payment consequences.

Explanation: By choosing the right income-driven repayment plan, you can lower your monthly payments, making them more manageable and aiding in credit score improvement.

This approach directly addresses financial constraints, which are a common reason for missed payments. According to Pew Trusts, many borrowers struggle with repayments due to financial constraints.

Lowering your payments can prevent future missed payments, thereby improving your credit score and potentially avoiding loan default recovery processes.

Taking these steps can help you manage your student loans more effectively and start repairing student loan credit damage.

4: Add positive credit through a secured credit card

Adding positive credit through a secured credit card can significantly improve your credit score over time, which is crucial when you’re looking to repair student loan credit damage.

Actionable Steps:

- Research and apply for a secured credit card: Compare secured credit card offers and choose the one that fits your needs as part of your credit repair strategies.

- Use the card responsibly: Make small, manageable purchases and pay off the balance each month to avoid late payment consequences.

- Monitor your credit score improvement: Use a credit monitoring service to track changes in your credit score, especially after implementing debt management tips.

Key factors to consider when choosing a secured credit card:

- Annual fees and interest rates

- Reporting to all three major credit bureaus

- Potential to graduate to an unsecured card

Explanation: Utilizing a secured credit card responsibly can help build a positive payment history, which accounts for 35% of your credit score. This is particularly beneficial for those seeking to repair student loan credit damage.

According to Experian, adding positive credit behaviors, like on-time payments, can gradually improve your credit score.

Monitoring your progress ensures you stay on track and adjust your strategies as needed, which is essential for effective loan default recovery.

This proactive approach to rebuilding credit can bring you closer to financial stability and is an important step in repairing student loan credit damage.

5: Request goodwill deletion for missed payments

Requesting a goodwill deletion can help remove negative marks from your credit report, improving your credit score and aiding in efforts to repair student loan credit damage.

Actionable Steps:

- Write a goodwill letter: Draft a letter explaining your situation and requesting the removal of missed payments from your credit report, which can be effective for student loan rehabilitation.

- Provide evidence of improved financial habits: Include documentation of on-time payments and responsible credit use to demonstrate your commitment to credit score improvement.

- Follow up with your lender: Call the lender to check the status of your goodwill request and discuss potential income-driven repayment plans.

Explanation: These steps matter because they provide a direct way to address past mistakes and show your commitment to financial responsibility, which is crucial for repairing student loan credit damage.

Removing negative marks can significantly improve your credit score. According to Experian, showing positive financial behavior can lead to goodwill adjustments, which is an essential credit repair strategy.

This proactive approach helps you rebuild your credit more effectively and can be part of a broader financial planning strategy for young professionals.

Tips for writing an effective goodwill letter:

- Be honest and sincere about your circumstances, including any late payment consequences you’ve faced

- Highlight your current responsible financial behavior and debt management tips you’ve implemented

- Keep the letter concise and to the point, mentioning any student loan forgiveness options you’re pursuing

Taking these steps can accelerate your journey toward financial stability and help in loan default recovery.

Partner with Alleo on Your Credit Repair Journey

We’ve explored repairing credit after missed student loan payments, but did you know Alleo can make this journey to repair student loan credit damage easier? Setting up an account is quick and simple.

Alleo creates a personalized plan for credit score improvement, tracks progress, and helps keep you accountable with reminders for effective debt management.

Ready to get started for free with our credit repair strategies?

Let me show you how to begin your student loan rehabilitation!

Step 1: Log In or Create Your Account

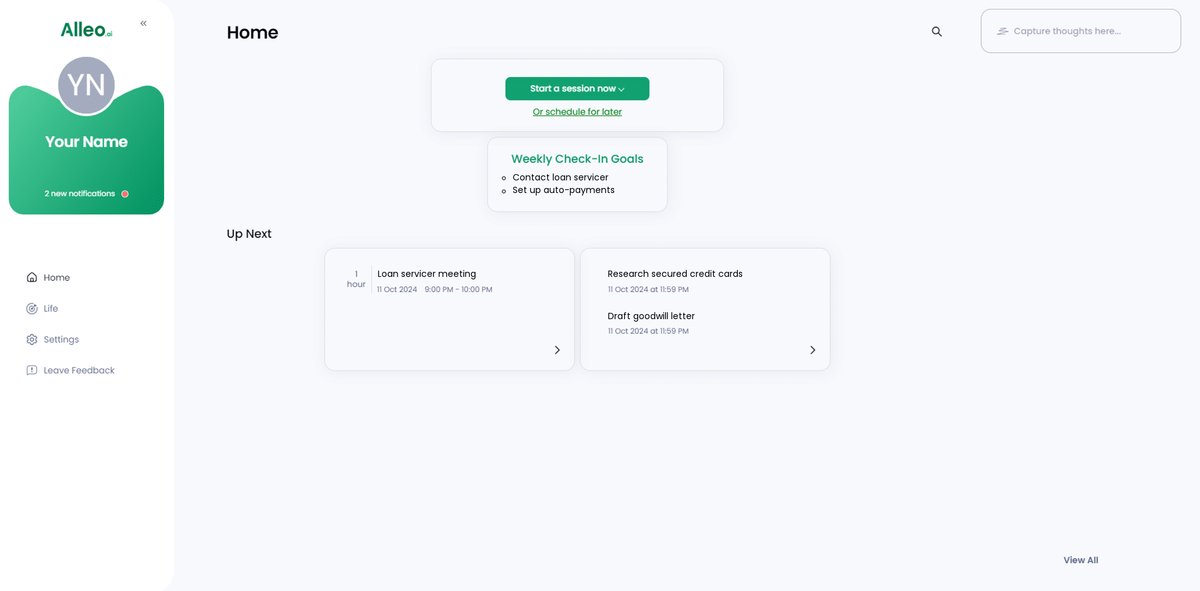

To start repairing your credit after missed student loan payments, log in to your existing Alleo account or create a new one to access personalized guidance and support.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent financial practices that will help you stay on top of loan payments and improve your credit score over time.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to address your credit repair needs after missed student loan payments, allowing the AI coach to provide tailored strategies for improving your financial health and credit score.

Step 4: Starting a Coaching Session

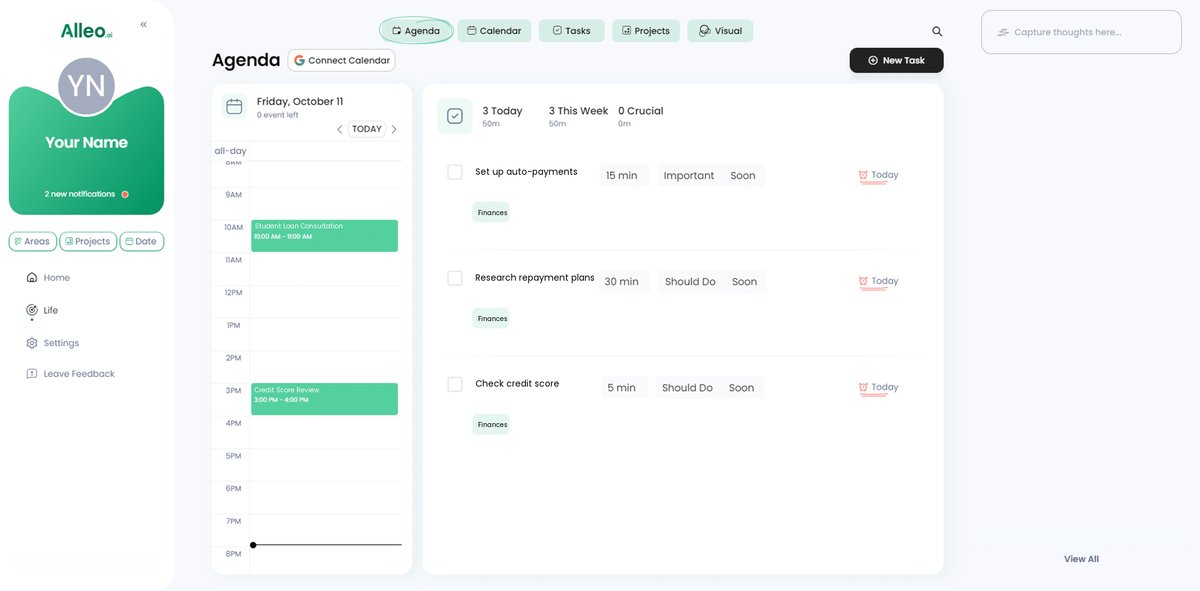

Begin your credit repair journey with Alleo by scheduling an initial intake session to create a personalized plan for improving your credit score and managing student loan payments.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on credit repair strategies, check the Alleo app’s home page to review and manage the personalized goals set for improving your credit score and financial habits.

6: Add events to your calendar or app

Use Alleo’s calendar and task features to track your progress in repairing your credit, scheduling important dates like loan payment due dates and follow-ups with lenders to ensure you stay on top of your credit improvement journey.

Taking the Next Steps Toward Credit Repair

As we wrap up, remember that tackling credit issues requires persistence and patience. You’ve learned actionable steps to repair student loan credit damage, from contacting your loan servicer to requesting goodwill deletions for late payment consequences.

I know this journey can be overwhelming, but you’re not alone. Many recent graduates face similar challenges with student loan rehabilitation and credit repair strategies.

The key is to stay proactive and consistent in your debt management and credit score improvement efforts.

Ultimately, your financial future is in your hands. By following these steps, including exploring income-driven repayment plans and student loan forgiveness options, you can regain control over your credit and recover from loan default.

Ready to make strides in your financial planning as a young professional?

Let Alleo guide you. Our AI life coach is here to support you every step of the way, offering personalized credit counseling services and debt management tips.

Sign up today and start your journey to financial freedom and successful student loan credit damage repair.