Retirees: 5 Smart Strategies to Invest Your Inheritance for Long-Term Security

What if you suddenly received a $150k inheritance? Would you know how to invest inheritance for retirement and ensure long-term financial security in your golden years?

As a life coach, I’ve helped many individuals navigate these kinds of financial decisions. In my experience, balancing immediate needs with future security is crucial when it comes to retirement investment planning and estate management for retirees.

In this article, you’ll discover strategic ways to invest your inheritance for retirement. We’ll cover diversifying inherited assets, tax-efficient strategies, legacy planning with inherited funds, Social Security optimization, and long-term care funding.

Let’s dive in to explore wealth preservation strategies and income-generating investments for seniors.

The Dilemma of Immediate Comforts vs. Future Security

Deciding between spending on immediate comforts and investing inheritance for retirement is a common challenge. Many clients initially struggle with prioritizing long-term financial security in retirement over short-term desires.

Without a strategic retirement investment planning approach, you risk running out of funds or missing out on tax benefits.

In my experience, people often find it painful to balance these needs. It’s essential to think about the potential pitfalls of not having a clear plan for estate management for retirees.

For example, you might not optimize your investments, leading to a less secure retirement. Diversifying inherited assets is crucial for risk management for retired investors.

Strategic financial planning can maximize your long-term benefits. By carefully allocating your inheritance, you ensure both present comfort and future security through income-generating investments for seniors.

This balance is crucial for a stress-free retirement and effective wealth preservation strategies.

Key Steps to Secure Your Inheritance for Long-Term Financial Stability

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to invest inheritance for retirement and make progress.

- Diversify inheritance with low-cost index funds: Spread investments across different sectors to reduce risk and enhance retirement investment planning.

- Establish a tax-efficient Roth conversion strategy: Convert portions of your inheritance strategically to avoid higher tax brackets and manage inheritance tax implications.

- Create an estate plan to protect inherited assets: Set up trusts and update your will to manage asset distribution and ensure long-term financial security in retirement.

- Optimize Social Security claiming strategy: Determine the best age to claim benefits to maximize income and support wealth preservation strategies.

- Develop a long-term care funding plan: Allocate funds for future care needs and explore insurance options as part of estate management for retirees.

Let’s dive in!

1: Diversify inheritance with low-cost index funds

Diversifying your inheritance with low-cost index funds is crucial for minimizing risk and maximizing returns when you invest inheritance for retirement.

Actionable Steps:

- Research and select reputable low-cost index funds. Use online tools or consult a financial advisor to identify funds with low expense ratios for effective retirement investment planning.

- Allocate a portion of the inheritance into a diversified portfolio. Spread investments across different sectors and asset classes to reduce risk and implement wealth preservation strategies.

- Monitor and adjust the portfolio as needed. Set quarterly reviews to assess performance and adjust in response to market changes, employing retirement portfolio rebalancing techniques.

Explanation:

These steps matter because they help you build a solid, diversified portfolio that minimizes risk. By spreading investments, you reduce dependency on any single asset class, which is crucial for long-term financial security in retirement.

According to AARP, diversification is key to minimizing volatility in investments. Regular monitoring ensures your investment strategy remains aligned with market conditions and your financial goals, supporting effective estate management for retirees.

Key benefits of diversification include:

- Reduced overall portfolio risk

- Potential for more stable returns over time

- Protection against market volatility

This foundational approach sets the stage for a secure and comfortable retirement when you invest inheritance for retirement.

2: Establish tax-efficient Roth conversion strategy

Establishing a tax-efficient Roth conversion strategy is vital for minimizing taxes and maximizing your retirement savings when you invest inheritance for retirement.

Actionable Steps:

- Consult a tax advisor to understand Roth conversion benefits. Schedule a consultation to review your current tax bracket and future projections for effective retirement investment planning.

- Plan and execute Roth conversions over several years. Convert a manageable portion each year to avoid jumping into a higher tax bracket, considering inheritance tax implications.

- Track the impact on Medicare premiums and adjust accordingly. Use tools or apps to monitor your IRMAA and adjust conversion amounts to stay within desired thresholds, ensuring long-term financial security in retirement.

Explanation:

These steps matter because they help you convert your inheritance into tax-free growth without incurring unnecessary tax burdens. By spreading conversions over multiple years, you avoid higher tax brackets, which can save you money in the long run and contribute to wealth preservation strategies.

Additionally, monitoring IRMAA ensures that your Medicare premiums remain manageable. According to AARP, managing Roth conversions effectively can help optimize your retirement savings.

This approach ensures your inheritance grows efficiently and supports your financial goals when you invest inheritance for retirement.

3: Create estate plan to protect inherited assets

Creating an estate plan to protect inherited assets is crucial for ensuring your wealth is securely and efficiently passed down to your beneficiaries, especially when you invest inheritance for retirement.

Actionable Steps:

- Draft or update your will and designate beneficiaries. Work with an estate planning attorney to ensure your legal documents are current and reflect your wishes for retirement investment planning.

- Set up trusts where appropriate to manage asset distribution. Establish living trusts to avoid probate and provide clear instructions for asset management and wealth preservation strategies.

- Review and adjust estate plans regularly. Schedule annual reviews or life event-triggered updates to your estate plan, considering long-term financial security in retirement.

Explanation:

These steps matter because they help ensure your assets are distributed according to your wishes and can help avoid legal complications. A clear and updated estate plan can significantly reduce the burden on your loved ones and support income-generating investments for seniors.

According to AARP, updating your will when your assets increase is essential for maintaining financial security. Regular reviews keep your plan aligned with your current situation and goals, including how you invest inheritance for retirement.

Taking these steps will give you peace of mind knowing your inheritance is protected and distributed as intended, supporting your retirement portfolio rebalancing techniques and overall estate management for retirees.

4: Optimize Social Security claiming strategy

Optimizing your Social Security claiming strategy is essential for maximizing your retirement income and securing financial stability when you invest inheritance for retirement.

Actionable Steps:

- Determine your optimal claiming age. Use Social Security calculators or consult with a financial advisor to project different scenarios and identify the best age to claim benefits, considering your long-term financial security in retirement.

- Coordinate withdrawals from other retirement accounts. Plan the timing of withdrawals from your 401(k) or IRAs to complement Social Security income and minimize tax burdens, as part of your overall retirement investment planning.

- Consider the impact on spousal benefits. Ensure your strategy maximizes benefits for both you and your spouse, especially in the event of one spouse’s passing, as part of your estate management for retirees.

Explanation:

These steps matter because they help you maximize your Social Security benefits while coordinating with other income sources. By choosing the optimal claiming age, you can significantly increase your lifetime benefits and support your wealth preservation strategies.

According to Fidelity, careful planning of retirement account distributions can complement Social Security income and provide a steady financial foundation. Considering spousal benefits ensures long-term security for both partners when you invest inheritance for retirement.

Factors to consider when optimizing your Social Security strategy:

- Your health and life expectancy

- Your overall retirement savings and income sources, including diversifying inherited assets

- Your spouse’s age and benefit eligibility

This approach ensures your inheritance supports a robust and secure retirement plan that adapts to your evolving needs, incorporating risk management for retired investors.

5: Develop long-term care funding plan

Developing a long-term care funding plan is crucial for ensuring your future healthcare needs are met without depleting your retirement savings when you invest inheritance for retirement.

Actionable Steps:

- Explore long-term care insurance options. Research policies and compare costs and benefits to find suitable coverage as part of your retirement investment planning.

- Allocate funds for potential long-term care needs. Set aside a portion of the inheritance in a dedicated savings or investment account for future care expenses, focusing on long-term financial security in retirement.

- Plan for various scenarios. Create a detailed plan covering different possibilities, from in-home care to assisted living facilities, considering wealth preservation strategies.

Explanation:

These steps matter because they help you prepare for potential healthcare costs in retirement. By exploring insurance options and setting aside dedicated funds, you can ensure your needs are met without financial strain when you invest inheritance for retirement.

Planning for different scenarios also ensures you are ready for any eventuality. According to AARP, overcoming inheritance challenges includes planning for long-term care to protect your financial future.

Key components of a comprehensive long-term care plan:

- Insurance coverage options

- Dedicated savings or investment accounts

- Family care arrangements and support systems

This approach ensures you are well-prepared for future healthcare needs, safeguarding your financial security when you invest inheritance for retirement.

Partner with Alleo for Your Financial Planning Journey

We’ve explored the challenges of investing your inheritance for retirement and long-term security. Did you know you can work directly with Alleo to make this process easier and faster?

How to Get Started with Alleo:

- Set Up an Account: Sign up on the Alleo platform to begin your retirement investment planning.

- Create a Personalized Plan: Alleo’s AI coach will guide you through creating a customized financial plan, including strategies for diversifying inherited assets.

- Work with Your Coach: Receive tailored coaching sessions, just like with a human coach, to address your financial challenges, including estate management for retirees and inheritance tax implications.

- Track Progress: Alleo will follow up on your progress, handle changes, and keep you accountable via text and push notifications, ensuring long-term financial security in retirement.

Ready to get started for free and learn how to invest inheritance for retirement?

Let me show you how!

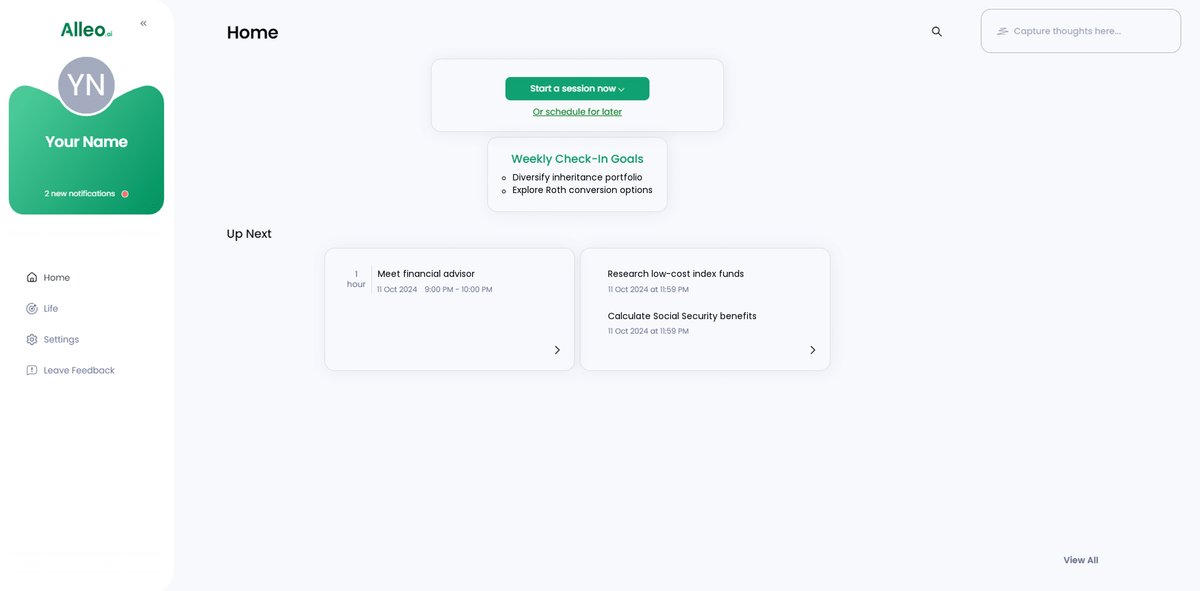

Step 1: Logging in or Creating an Account

To start securing your financial future with Alleo’s AI coach, log in to your existing account or create a new one if you haven’t already.

Step 2: Choose “Improving overall well-being and life satisfaction”

Select “Improving overall well-being and life satisfaction” as your goal to address the challenges of balancing immediate needs with long-term financial security, ensuring a holistic approach to managing your inheritance for a fulfilling retirement.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to tackle the challenge of wisely investing your inheritance and securing long-term financial stability for retirement.

Step 4: Starting a Coaching Session

Begin your financial planning journey with Alleo by scheduling an intake session, where you’ll discuss your inheritance goals and create a personalized plan to secure your long-term financial stability.

Step 5: Viewing and managing goals after the session

After discussing your inheritance investment strategy with Alleo, check your app’s home page to view and manage the financial goals you’ve set, allowing you to track your progress in securing your long-term financial future.

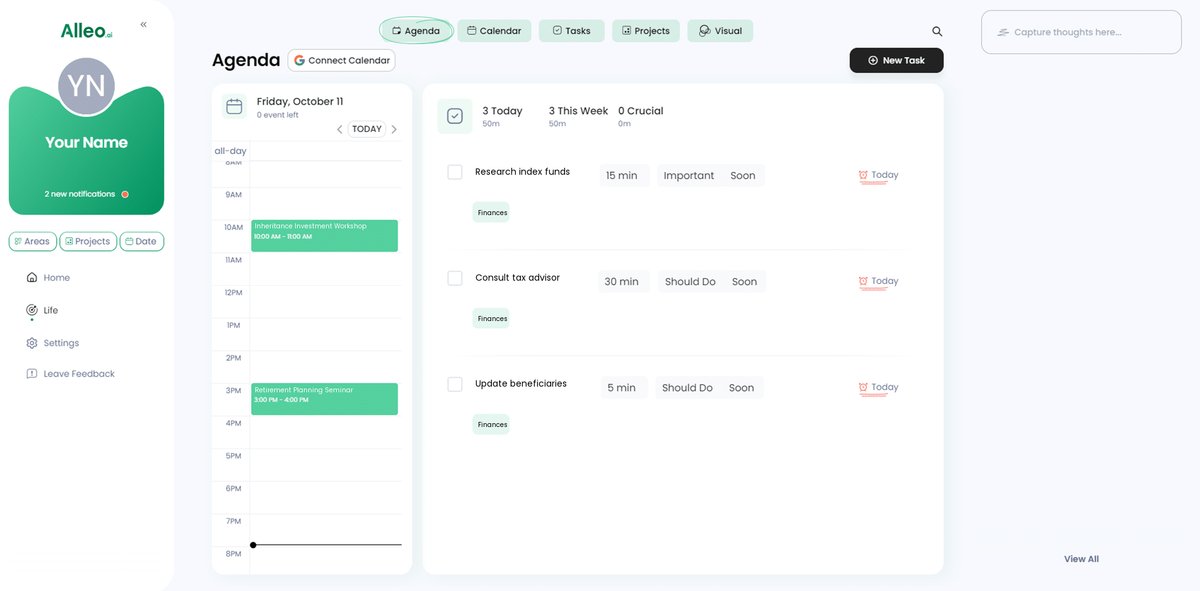

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important financial milestones, such as portfolio reviews, tax planning sessions, and estate plan updates, ensuring you stay on top of your long-term financial security goals.

Securing Your Financial Future Begins Now

Investing your inheritance wisely for retirement is crucial for your long-term financial security. By diversifying inherited assets, adopting tax-efficient strategies, and planning for estate management and healthcare needs, you create a solid foundation for wealth preservation.

Remember, balancing immediate comforts with future security is essential. Strategic retirement investment planning ensures you don’t run out of funds and maximize your retirement benefits while managing risks for retired investors.

Take action today to invest inheritance for retirement. Partner with Alleo to simplify your financial planning and explore income-generating investments for seniors.

Ready to get started with retirement portfolio rebalancing techniques? Alleo is here to guide you every step of the way in legacy planning with inherited funds. Sign up now and secure your financial future.