7 Simple Steps to Create a Budget for Retirees on Fixed Income

Are you struggling to manage your expenses on a fixed income during retirement? Retirement budgeting on fixed income can be challenging, but it’s essential for financial stability.

Imagine balancing your budget without constantly worrying about rising costs or the impact of inflation on your retirement budget.

As a life coach, I’ve guided many retirees through the complexities of retirement financial planning. I understand the unique challenges you face, from Social Security budgeting to managing Medicare expenses in retirement.

In this article, you’ll learn practical budgeting strategies to help you maintain financial stability. From tracking expenses to leveraging senior discounts and benefits, we’ve got you covered with effective cost-cutting strategies for seniors.

Let’s dive into fixed income management for seniors and explore budgeting tips for retirees.

The Challenges of Budgeting on a Fixed Income

Balancing a budget during retirement is increasingly difficult due to rising living costs. Many retirees face skyrocketing healthcare expenses, housing costs, and inflation, making retirement budgeting on fixed income a complex task.

In my experience, people often find these financial pressures overwhelming when managing fixed income in retirement.

Consider the constant adjustments needed for your budget as costs rise. Healthcare and housing expenses can eat away at your fixed income, leaving little room for discretionary spending. Effective retirement financial planning becomes crucial in this scenario.

Several clients report struggling to cover basic needs, highlighting the importance of budgeting tips for retirees.

The impact is real. It’s common for retirees to feel anxious about their financial future, especially when dealing with Social Security budgeting and Medicare expenses in retirement.

With careful planning, you can navigate these challenges effectively, utilizing cost-cutting strategies for seniors and adjusting lifestyle to fixed income.

Your Roadmap to Budgeting Success

Overcoming this challenge requires a few key steps. Here are the main areas to focus on for effective retirement budgeting on a fixed income.

- Track monthly income and expenses: Use budgeting tools to document all income and expenses, including Social Security and Medicare expenses in retirement.

- Categorize spending into essential and discretionary: Prioritize essentials and set limits for discretionary spending as part of your retirement financial planning.

- Create an emergency fund: Save three to six months’ worth of essential expenses for fixed income management for seniors.

- Identify areas for potential cost reduction: Review your budget for savings opportunities and cost-cutting strategies for seniors.

- Explore senior discounts and assistance programs: Research and utilize available resources to maximize your fixed income in retirement.

- Adjust budget for inflation and rising costs: Regularly update your retirement budget to reflect cost changes and the inflation impact on retirement budget.

- Consider part-time work for additional income: Explore flexible job opportunities to supplement your income and aid in adjusting lifestyle to fixed income.

Let’s dive in to these budgeting tips for retirees!

1: Track monthly income and expenses

Keeping a close eye on your income and expenses is crucial for managing your retirement budgeting on fixed income.

Actionable Steps:

- Use budgeting tools: Start with tools like YNAB, Personal Capital, or Mint to document all income sources and monthly expenses, including Social Security budgeting and Medicare expenses in retirement.

- Review and update regularly: Dedicate time each month to review and update your budget, ensuring it reflects any changes in fixed income management for seniors or expenses.

- Keep a financial journal: Note down irregular expenses like car repairs or medical bills, and plan for them in advance as part of your retirement financial planning.

Explanation:

Tracking your income and expenses helps you understand where your money goes and identify areas for improvement in your retirement budgeting on fixed income. Tools like YNAB, Personal Capital, or Mint can simplify this process by providing a clear overview of your finances, including retirement savings allocation.

Regular updates ensure your budget stays accurate and relevant. According to Landberg Bennett, using such tools is essential for financial stability amid economic uncertainty.

Key benefits of tracking your finances include:

- Increased awareness of spending habits and cost-cutting strategies for seniors

- Better control over your financial decisions when adjusting lifestyle to fixed income

- Ability to set and achieve financial goals while considering the inflation impact on retirement budget

Next, let’s categorize your spending into essentials and discretionary items.

2: Categorize spending into essential and discretionary

Effectively managing your retirement budgeting on fixed income starts with understanding the difference between essential and discretionary expenses.

Actionable Steps:

- List and categorize expenses: Write down all your expenses and classify them as essential, such as housing and Medicare expenses in retirement, or discretionary, like dining out and hobbies.

- Prioritize essentials: Ensure essential expenses are covered first in your retirement budget. This helps maintain financial stability for seniors.

- Set limits for discretionary spending: Allocate a fixed amount for discretionary expenses and stick to it to avoid overspending, which is crucial for fixed income management for seniors.

Explanation:

Categorizing expenses helps you prioritize spending and ensures you cover essential costs first. This strategy can prevent financial stress and help you manage your retirement budgeting on fixed income more effectively.

According to Western Southern Financial Group, understanding and managing your expenses is crucial for a successful retirement budget.

Next, let’s discuss creating an emergency fund for unexpected costs.

3: Create an emergency fund for unexpected costs

Saving for unexpected expenses is crucial for maintaining financial stability during retirement, especially when retirement budgeting on fixed income.

Actionable Steps:

- Aim to save three to six months’ worth of essential expenses: Start by calculating your monthly essential costs and set a savings goal accordingly, considering your retirement financial planning.

- Set up automatic transfers to your emergency fund: Automate monthly contributions to ensure consistent savings without extra effort, which is crucial for fixed income management for seniors.

- Use high-yield savings accounts: Choose accounts that offer competitive interest rates to maximize your emergency fund’s growth, an important aspect of budgeting tips for retirees.

Explanation:

Building an emergency fund helps cushion financial shocks and provides peace of mind. Automating transfers ensures you stay on track with your savings goals, which is essential for retirement budgeting on fixed income.

According to Kiplinger, having a robust emergency fund is essential for retirees facing rising costs and unexpected expenses, including potential Medicare expenses in retirement.

Next, let’s look at identifying areas for potential cost reduction and cost-cutting strategies for seniors.

4: Identify areas for potential cost reduction

Reducing unnecessary expenses can significantly improve your financial stability during retirement budgeting on fixed income.

Actionable Steps:

- Review and cancel non-essential subscriptions: Audit your recurring expenses and cancel services you no longer need or use as part of your retirement financial planning.

- Negotiate better rates: Contact your service providers to negotiate lower rates on utilities, insurance, and other recurring bills, a crucial cost-cutting strategy for seniors.

- Consider downsizing: Evaluate the benefits of moving to a smaller home or a more affordable area to reduce housing costs, helping you adjust your lifestyle to fixed income.

Explanation:

Implementing these steps helps free up funds for essential expenses and savings. Reducing non-essential costs ensures you can stretch your fixed income management for seniors further.

According to Kiplinger, negotiating better rates and downsizing can be effective ways to manage rising living costs in retirement.

Common areas for potential cost reduction in retirement budgeting on fixed income:

- Cable and streaming services

- Cell phone plans

- Dining out and entertainment

Next, let’s explore how to take advantage of senior discounts and benefits.

5: Explore senior discounts and assistance programs

Leveraging available discounts and assistance programs can significantly ease your financial burden when retirement budgeting on a fixed income.

Actionable Steps:

- Research senior discounts: Look for discounts at grocery stores, restaurants, and entertainment venues that cater to seniors, which can help with fixed income management for seniors.

- Apply for assistance programs: Consider programs like LIHEAP for energy bill aid and Medicare for healthcare costs, essential for retirement financial planning.

- Join local senior centers: Participate in community groups to learn about additional resources and benefits available to you, enhancing your Social Security budgeting strategies.

Explanation:

These steps help maximize your savings and stretch your fixed income further. Senior discounts and benefits offer valuable support for daily expenses and Medicare expenses in retirement.

According to LIHEAP, eligible households can receive help with home heating bills, preventing shutoffs, and more, which is crucial for retirement budgeting on a fixed income.

Next, let’s discuss adjusting your budget for inflation and rising costs.

6: Adjust budget for inflation and rising costs

As living costs rise, adjusting your retirement budgeting on fixed income becomes crucial to maintain financial stability.

Actionable Steps:

- Update your budget regularly: Review and adjust your retirement budget every few months to reflect changes in the cost of living and inflation rates.

- Allocate for inflation-adjusted expenses: Set aside a portion of your fixed income management for seniors specifically for expenses like Medicare expenses in retirement and groceries, which are prone to inflation.

- Invest in inflation-protected securities: Consider investing in financial instruments, like TIPS, to safeguard your retirement savings allocation against inflation.

Explanation:

These budgeting tips for retirees help you stay ahead of rising costs and ensure your retirement budgeting on fixed income remains realistic. Regular updates and dedicated allocations for inflation-sensitive expenses are essential.

According to Western Southern Financial Group, planning for inflation is crucial for a sustainable retirement budget. Proper retirement financial planning can mitigate the impact of rising living costs.

Next, we’ll explore how to consider part-time work for additional income.

7: Consider part-time work for additional income

Earning additional income through part-time work can greatly enhance your financial stability during retirement, especially when budgeting on a fixed income.

Actionable Steps:

- Explore part-time job opportunities: Look for roles that suit your skills and interests, like consulting or freelancing, to supplement your retirement financial planning.

- Seek remote or flexible work options: Consider jobs that allow you to work from home or have flexible hours to fit your retirement lifestyle and assist with fixed income management for seniors.

- Use extra income wisely: Allocate extra earnings to bolster your savings, reduce debts, or cover discretionary expenses as part of your retirement savings allocation strategy.

Explanation:

These steps can provide a financial cushion and reduce the stress of relying solely on fixed income. Part-time work offers both financial benefits and a chance to stay engaged and active, helping retirees adjust their lifestyle to fixed income.

According to Kiplinger, supplementing your income with part-time work can be a practical solution for managing retirement expenses and enhancing your retirement budgeting on fixed income.

Benefits of part-time work in retirement:

- Additional income for financial security, helping with Social Security budgeting and Medicare expenses in retirement

- Mental stimulation and social engagement

- Opportunity to pursue new interests or hobbies while implementing cost-cutting strategies for seniors

Considering part-time work can lead to a more comfortable retirement and improved budgeting for retirees.

Work with Alleo for Financial Peace

We’ve explored the budgeting challenges retirees face and actionable steps to overcome them, especially when it comes to retirement budgeting on fixed income. Did you know you can work with Alleo to make this journey easier?

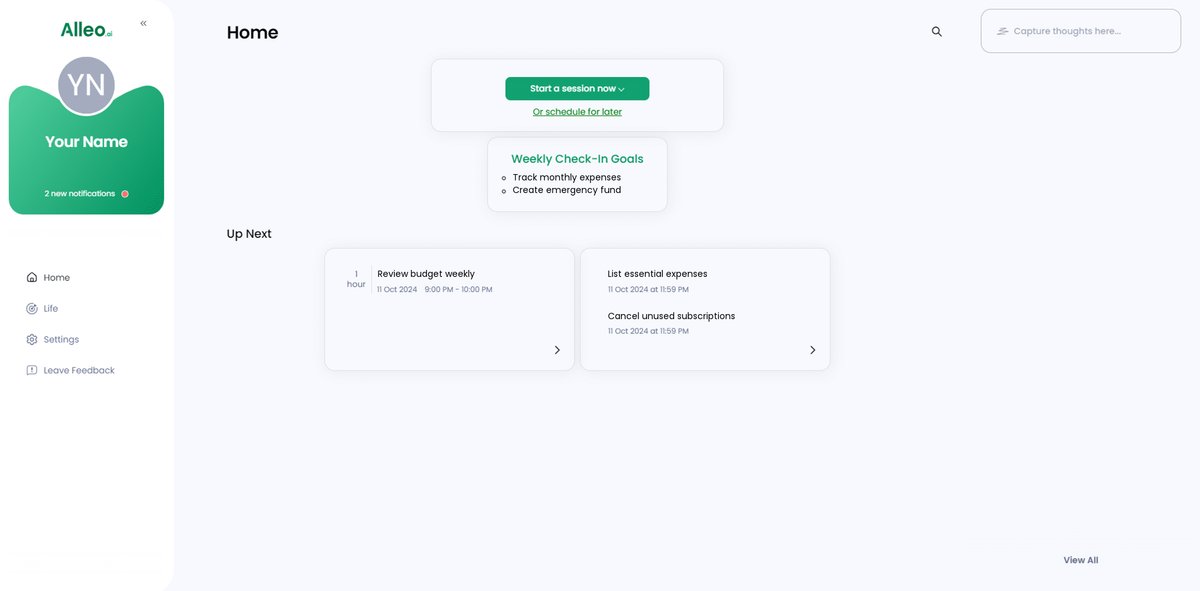

Setting up an Alleo account is simple. Create a personalized retirement financial planning strategy and work with our AI coach to tackle your budgeting tips for retirees and fixed income management for seniors challenges.

The coach follows up on progress, manages changes, and keeps you accountable via texts and push notifications, helping you with everything from Social Security budgeting to adjusting lifestyle to fixed income.

Alleo provides affordable, tailored coaching support, just like a human coach, assisting with retirement savings allocation and cost-cutting strategies for seniors. Plus, enjoy a free 14-day trial with no credit card required.

Ready to get started for free and improve your retirement budgeting on fixed income? Let me show you how!

Step 1: Log In or Create Your Alleo Account

To begin your journey towards financial stability in retirement, log in to your existing Alleo account or create a new one to access personalized AI coaching tailored to your budgeting needs.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a consistent financial management system that supports your retirement budget goals. This choice will help you develop the daily practices needed to track expenses, prioritize spending, and maintain financial stability on a fixed income.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in the Alleo app to receive tailored guidance on budgeting, expense tracking, and managing your fixed income during retirement, helping you achieve greater financial stability and peace of mind.

Step 4: Starting a coaching session

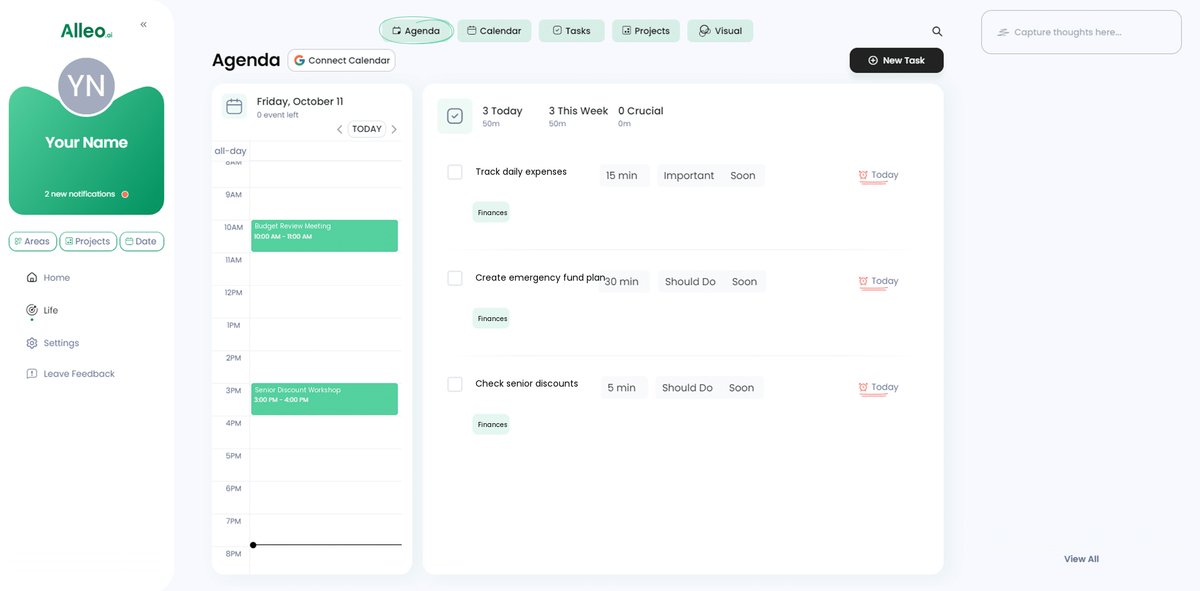

Begin your journey with Alleo by scheduling an intake session to create your personalized financial plan, addressing your retirement budgeting challenges and setting achievable goals for a stable financial future.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the budgeting goals you discussed, allowing you to easily track your progress towards financial stability in retirement.

Step 6: Adding events to your calendar or app

Use the calendar and task features in the Alleo app to track your progress on budgeting goals, such as scheduling regular expense reviews or setting reminders for bill payments, helping you stay on top of your financial planning efforts.

Wrapping Up: Your Path to Financial Stability

With part-time work offering additional income, you’re now better prepared for retirement budgeting on a fixed income.

Creating a budget on a fixed income can seem daunting, but you now have a comprehensive retirement financial planning strategy. Remember, tracking expenses and categorizing spending are crucial first steps in fixed income management for seniors.

Building an emergency fund and implementing cost-cutting strategies for seniors further strengthen your financial health.

Don’t forget to leverage senior discounts and benefits and assistance programs. Adjusting for inflation ensures your retirement budget remains realistic.

Consider part-time work to supplement your income and aid in Social Security budgeting.

By following these budgeting tips for retirees, you can achieve financial peace.

Ready to take control of your finances? Try Alleo for free today and experience personalized, AI-powered financial coaching for retirement budgeting on a fixed income.