How to Consolidate Retirement Accounts for Better Financial Management in 4 Simple Steps

Are you struggling to manage multiple retirement accounts and keep track of your overall asset allocation? Consolidating retirement accounts effectively can help simplify your financial planning.

As a life coach, I’ve helped many retirees face this exact challenge of streamlining retirement investments and optimizing their retirement portfolio.

In this article, you’ll learn how to consolidate your retirement accounts for better financial management. We’ll cover practical strategies for 401(k) rollover and IRA consolidation, the benefits of consolidation, and useful tools to simplify your retirement account transfer process. We’ll also touch on tax implications of consolidating accounts and best practices for account consolidation.

Let’s dive in and explore how to effectively consolidate retirement accounts and simplify your retirement savings.

Understanding the Challenges of Managing Multiple Retirement Accounts

One common issue retirees face is the complexity of managing multiple retirement accounts spread across various institutions. It’s easy to lose track of your overall asset allocation when juggling multiple accounts, making it crucial to consolidate retirement accounts effectively.

This can lead to imbalances and missed opportunities in retirement portfolio optimization.

Many clients initially struggle with higher fees and administrative costs from maintaining several retirement accounts. These costs add up over time, eating into your retirement savings, highlighting the benefits of IRA consolidation.

Additionally, not consolidating accounts can result in missed required minimum distributions (RMDs), which could incur penalties. This underscores the importance of simplifying retirement savings.

The risks also extend to making emotional decisions during market downturns. With funds scattered across different accounts, it becomes more challenging to stay disciplined and avoid rash choices, emphasizing the need for streamlining retirement investments.

Overcoming the challenge to consolidate retirement accounts effectively requires a few key steps. Here are the main areas to focus on to make progress:

- Assess current retirement accounts and balances: List all accounts and evaluate their performance and fees, focusing on simplifying retirement savings.

- Choose a single provider for consolidation: Research potential providers for IRA consolidation benefits and consult a financial advisor about 401(k) rollover strategies.

- Initiate direct rollovers to avoid tax penalties: Contact the chosen provider and ensure direct rollovers, following best practices for account consolidation.

- Review and adjust overall asset allocation: Analyze and rebalance your consolidated portfolio, aiming for retirement portfolio optimization.

Let’s dive into the retirement account transfer process!

1: Assess current retirement accounts and balances

Understanding the importance of assessing your current retirement accounts and balances is the first step to effectively consolidate retirement accounts.

Actionable Steps:

- List all retirement accounts: Create a comprehensive inventory of your 401(k), IRA, and other retirement accounts. Use a spreadsheet or financial management tool to document balances and account details for simplifying retirement savings.

- Evaluate account performance and fees: Review each account’s historical performance. Compare management fees and other associated costs as part of your retirement portfolio optimization.

- Identify accounts with special considerations: Note any accounts with employer-specific benefits or unique terms, such as lower fees or better investment options, which may impact your 401(k) rollover strategies.

Explanation: Taking these steps ensures you have a clear picture of your retirement landscape. Identifying high-fee accounts and underperformers helps you make informed decisions when managing multiple retirement accounts.

According to GWAdvisors, evaluating account performance and fees is crucial for optimizing your retirement strategy.

Key benefits of assessing your retirement accounts:

- Gain clarity on your overall retirement savings

- Identify opportunities for fee reduction

- Uncover underperforming accounts that need attention

Accurately assessing your current accounts sets the foundation for successful consolidation and is a best practice for account consolidation.

2: Choose a single provider for consolidation

Choosing a single provider to consolidate retirement accounts effectively is crucial for simplifying your retirement account management.

Actionable Steps:

- Research potential providers: Look into various financial institutions and their offerings. Evaluate customer service, fees, and investment options for streamlining retirement investments.

- Consult a financial advisor: Schedule a meeting with a trusted advisor to discuss 401(k) rollover strategies and IRA consolidation benefits. Consider their recommendations on the best practices for account consolidation.

- Select the provider that aligns with your goals: Choose a provider offering comprehensive services, low fees, and robust support for managing multiple retirement accounts. Ensure they can handle all types of retirement accounts you hold, including pension plan consolidation options.

Explanation: Consolidating accounts with a single provider reduces complexity and helps you manage your retirement more efficiently, optimizing your retirement portfolio.

According to RBC Wealth Management, choosing a provider with excellent services and support is key to achieving your financial goals.

This step sets the stage for a smoother retirement account transfer process.

Now, let’s move on to initiating direct rollovers.

3: Initiate direct rollovers to avoid tax penalties

Initiating direct rollovers is crucial to avoid unnecessary tax penalties when you consolidate retirement accounts effectively.

Actionable Steps:

- Contact your chosen provider: Reach out to the selected financial institution to start the rollover process. Gather necessary paperwork and details for each account, including 401(k) rollover strategies.

- Ensure direct rollovers: Verify that rollovers are managed directly between institutions to prevent tax consequences. Follow up with both current and new providers to confirm the retirement account transfer process.

- Monitor the transfer: Track the progress of each account transfer, and address any issues promptly to ensure a smooth consolidation, simplifying retirement savings.

Common pitfalls to avoid during rollovers:

- Failing to meet transfer deadlines

- Accidentally triggering taxable events

- Overlooking required minimum distributions (RMDs)

Explanation: These steps help avoid costly tax penalties and streamline the consolidation process when managing multiple retirement accounts.

Ensuring direct rollovers is essential to prevent unnecessary taxes, as noted by GWAdvisors.

By following these steps, you can consolidate your accounts efficiently and avoid financial pitfalls, optimizing your retirement portfolio.

This sets the stage for reviewing and adjusting your overall asset allocation when you consolidate retirement accounts effectively.

4: Review and adjust overall asset allocation

Reviewing and adjusting your overall asset allocation is vital to ensure that your consolidated portfolio aligns with your retirement goals when you consolidate retirement accounts effectively.

Actionable Steps:

- Analyze your consolidated portfolio: Assess the combined portfolio’s asset allocation after retirement account transfer processes. Identify any imbalances or over-concentrations in specific asset classes.

- Rebalance your portfolio regularly: Make necessary adjustments to maintain a diversified and balanced portfolio. Consider factors like risk tolerance, time horizon, and retirement income needs when simplifying retirement savings.

- Set up ongoing reviews: Schedule periodic reviews of your portfolio. Adjust your strategy as needed based on market conditions and personal circumstances to optimize your retirement portfolio.

Explanation: These steps help ensure that your investments remain aligned with your retirement objectives. Regularly rebalancing your portfolio can prevent over-concentration in certain asset classes and maintain diversification when managing multiple retirement accounts.

According to First Interstate Bank, ongoing reviews are essential to adapting your strategy to changing market conditions and personal needs.

Benefits of regular portfolio reviews when you consolidate retirement accounts effectively:

- Maintain optimal risk-reward balance

- Capitalize on changing market conditions

- Ensure alignment with evolving retirement goals

Taking these actions will help you stay on track and achieve financial security in retirement through streamlining retirement investments.

Partner with Alleo for Seamless Retirement Account Consolidation

We’ve explored the challenges of managing multiple retirement accounts, the benefits of consolidation, and the steps to effectively consolidate retirement accounts. But did you know you can work directly with Alleo to make this process easier and faster?

Step 1: Use Alleo to streamline the consolidation process

Alleo can help you list and evaluate all your retirement accounts, simplifying retirement savings management. Leverage Alleo’s AI capabilities to research and choose the best provider for your 401(k) rollover strategy.

Step 2: Personalized advice for direct rollovers

Alleo provides step-by-step guidance to ensure direct rollovers are completed smoothly, optimizing the retirement account transfer process. Receive alerts and reminders to monitor the transfer process and understand the tax implications of consolidating accounts.

Step 3: Optimize your asset allocation with Alleo’s tools

Use Alleo’s portfolio analysis tools to review and adjust your asset allocation, streamlining retirement investments. Set up regular check-ins with Alleo to keep your retirement plan on track and explore pension plan consolidation options.

Ready to get started for free?

Let me show you how to consolidate retirement accounts effectively!

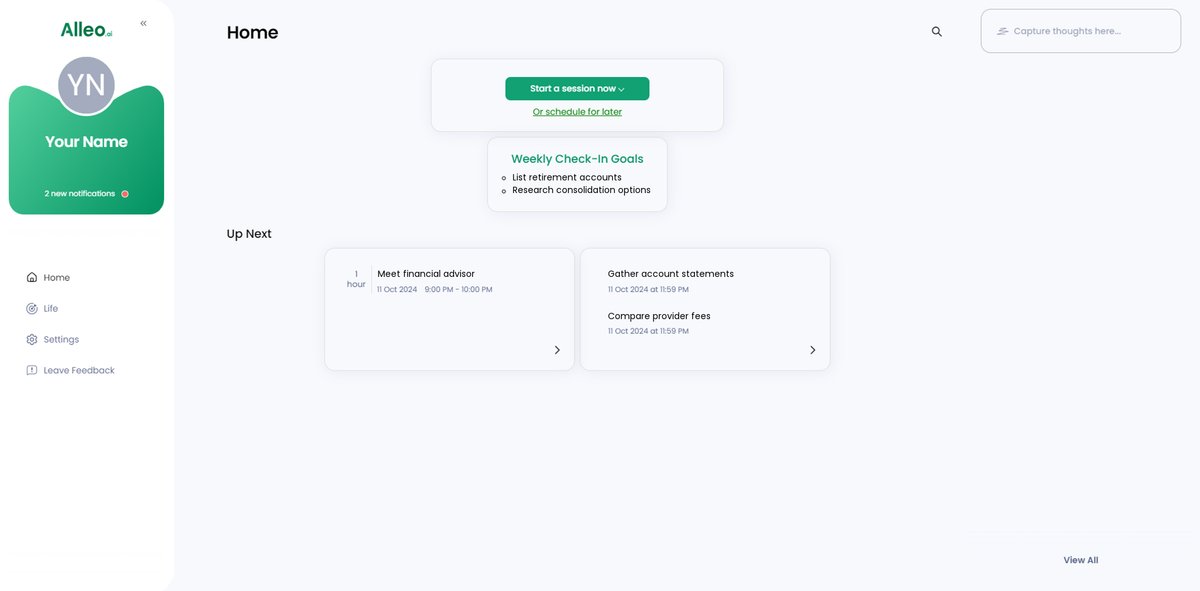

Step 1: Log in or Create Your Alleo Account

To start consolidating your retirement accounts with Alleo’s AI-powered assistance, log in to your existing account or create a new one if you’re a first-time user.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start organizing your financial life more effectively. This goal directly addresses the challenges of managing multiple retirement accounts by helping you develop consistent practices for tracking and consolidating your finances.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on with Alleo, as this directly addresses your retirement account consolidation needs and helps streamline your financial planning for a more secure future.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to assess your retirement accounts and create a personalized consolidation plan tailored to your financial goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the retirement account consolidation goals you discussed, allowing you to track your progress and stay motivated throughout the process.

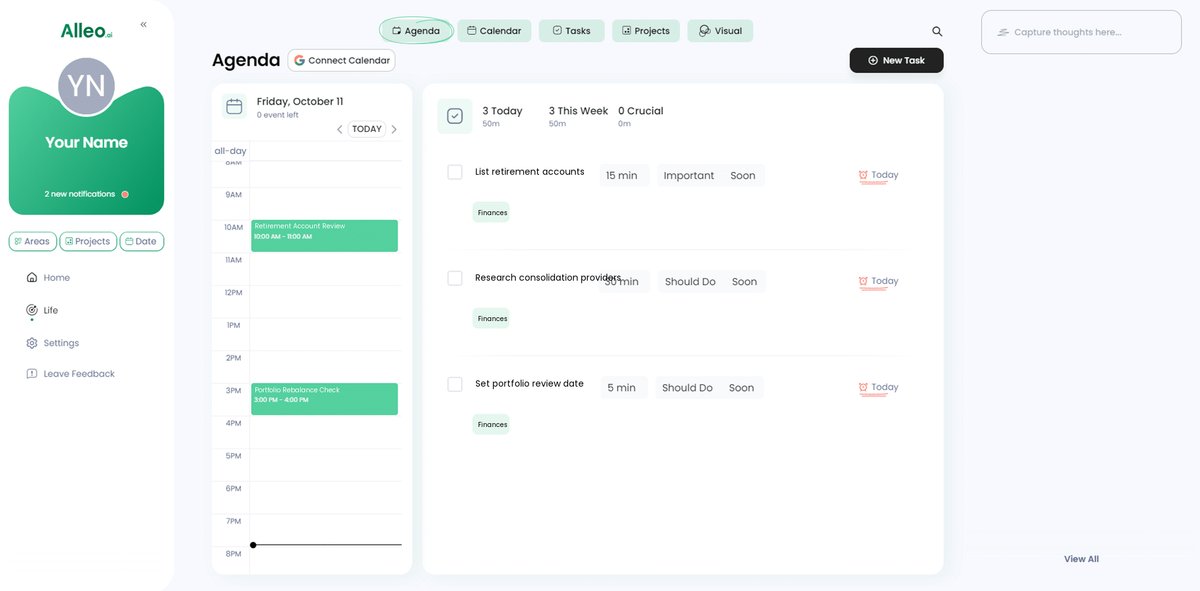

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in consolidating your retirement accounts, adding key dates like account transfer deadlines and review sessions to stay organized and on top of your financial goals.

Achieve Financial Clarity by Consolidating Your Retirement Accounts

As we’ve seen, managing multiple retirement accounts can be overwhelming. But consolidating retirement accounts effectively simplifies your financial life and enhances your retirement planning.

By assessing your current accounts, choosing a single provider, initiating direct rollovers, and regularly reviewing your asset allocation, you can take control of your financial future. This retirement account transfer process helps in streamlining retirement investments.

I understand the challenges you face. I’ve helped many retirees like you navigate this process successfully, including 401(k) rollover strategies and IRA consolidation benefits.

Alleo makes it easier to consolidate retirement accounts effectively. With personalized advice and powerful tools for retirement portfolio optimization, Alleo supports you every step of the way.

Take action today. Start consolidating your retirement accounts with Alleo’s help and gain peace of mind while simplifying retirement savings.