Revolutionize Your Approach: 6 Keys to Managing Work Stress for High-Pressure Professionals

Are you feeling overwhelmed by the demands of your financial advising career? Managing stress for financial advisors is crucial for long-term success and well-being.

As a life coach, I’ve helped many professionals navigate these challenges. I understand the unique stressors you face in high-pressure roles and the importance of work-life balance techniques.

In this blog, I’ll share actionable strategies to help you manage work stress effectively. We’ll explore stress reduction strategies for executives and time management skills for professionals, including:

- Mindfulness practices in the workplace

- Boundary-setting

- A growth mindset

- Support networks

- Task prioritization

- Self-care routines for corporate leaders

Let’s get started on managing stress for financial advisors and preventing burnout for high-achievers.

Understanding the Pressures Financial Advisors Face

Financial advisors often encounter intense stressors in their high-stakes roles. Managing stress for financial advisors involves meeting client expectations, managing complex financial portfolios, and staying updated with market trends, which can be overwhelming. Effective time management skills for professionals are crucial in this field.

In my experience, many clients initially struggle with balancing these demands, leading to chronic stress and burnout. This can negatively impact both career and personal life, making it difficult to find joy in either. Implementing work-life balance techniques and stress reduction strategies for executives is essential for long-term success.

Additionally, unmanaged stress can lead to serious health issues over time. It’s crucial to address these challenges head-on to maintain a healthy work-life balance. Managing stress for financial advisors often involves adopting mindfulness practices in the workplace and developing coping mechanisms for workplace anxiety.

Key Steps to Managing Stress for Financial Advisors

Managing stress for financial advisors requires a few key actions. Here are the main areas to focus on to make progress and improve work-life balance.

- Practice mindfulness and deep breathing exercises: Schedule daily mindfulness practices in the workplace and incorporate deep breathing into your routine for stress reduction.

- Set clear boundaries between work and personal life: Designate specific work hours and create a separate workspace to enhance work-life balance techniques.

- Develop a growth mindset for resilience: Embrace challenges and set realistic goals for continuous improvement, aiding in burnout prevention for high-achievers.

- Create a supportive network of colleagues: Engage in regular check-ins and join professional groups for peer support, fostering coping mechanisms for workplace anxiety.

- Prioritize tasks and break them into manageable chunks: Use productivity tools for busy professionals and divide large tasks into smaller steps to enhance time management skills for professionals.

- Implement regular self-care routines: Incorporate physical activity and schedule downtime for relaxation, essential for managing stress for financial advisors.

Let’s dive in to these stress management strategies for executives!

1: Practice mindfulness and deep breathing exercises

Mindfulness and deep breathing exercises are effective for managing stress for financial advisors and improving focus.

Actionable Steps:

- Schedule daily mindfulness sessions. Set aside 10 minutes in the morning and evening for mindfulness meditation, a key stress reduction strategy for executives.

- Incorporate deep breathing exercises into your routine. Practice the 4-7-8 breathing technique during breaks to reduce immediate stress, enhancing work-life balance techniques.

Explanation: These steps help lower stress levels and enhance overall well-being, crucial for burnout prevention for high-achievers.

Mindfulness practices can reduce stress by promoting relaxation and emotional regulation, serving as effective coping mechanisms for workplace anxiety.

According to a study, regular mindfulness practice can lower stress and improve mental health. For more on the benefits of mindfulness, visit this resource.

Key benefits of mindfulness practice:

- Reduces anxiety and stress

- Improves focus and concentration

- Enhances emotional regulation

Implementing these practices can make a big difference in your daily stress management, supporting self-care routines for corporate leaders.

2: Set clear boundaries between work and personal life

Establishing clear boundaries between work and personal life is essential for managing stress for financial advisors and maintaining a healthy work-life balance.

Actionable Steps:

- Designate specific work hours and adhere to them. Turn off work notifications after 6 PM to ensure personal time is uninterrupted, enhancing work-life balance techniques.

- Create a dedicated workspace separate from personal areas. Set up a home office to mentally separate work from leisure, aiding in stress reduction strategies for executives.

- Schedule regular downtime for personal activities. Dedicate evenings to hobbies or relaxation to recharge, incorporating self-care routines for corporate leaders.

Explanation: These steps help create a clear division between work and personal life, reducing stress and improving overall well-being for financial advisors.

According to a study, maintaining boundaries can significantly lower stress levels and enhance job satisfaction. For more tips on managing stress for financial advisors, visit this resource.

Implementing these practices can help you achieve a balanced and fulfilling professional life while effectively managing stress as a financial advisor.

3: Develop a growth mindset for resilience

Developing a growth mindset is essential for building resilience in high-pressure roles, especially when managing stress for financial advisors.

Actionable Steps:

- Embrace challenges as opportunities for growth: Reflect on past challenges and identify what you learned from them, a key stress reduction strategy for executives.

- Set realistic and achievable goals: Break down a large project into smaller, manageable tasks with specific deadlines, improving time management skills for professionals.

- Cultivate a positive outlook: Regularly remind yourself of past successes and how you overcame obstacles, an effective coping mechanism for workplace anxiety.

Explanation: These steps help you view challenges as learning experiences, which is crucial in high-stress environments and aids in burnout prevention for high-achievers.

A growth mindset can enhance your ability to adapt and thrive under pressure, supporting work-life balance techniques.

According to a study, adopting this mindset can significantly improve job satisfaction and reduce stress levels. For more details, visit this resource.

With a growth mindset, you’ll be better equipped to navigate the ups and downs of your career while managing stress for financial advisors.

4: Create a supportive network of colleagues

Building a supportive network of colleagues is vital for managing stress for financial advisors effectively.

Actionable Steps:

- Engage in regular check-ins with a trusted colleague or mentor: Schedule bi-weekly coffee meetings to discuss challenges and seek advice on stress reduction strategies for executives.

- Join professional groups or forums for peer support: Participate in online forums or local meetups for financial advisors to share time management skills for professionals.

- Collaborate on projects to foster a team environment: Work together on complex tasks to share the load and gain different perspectives, promoting effective delegation in high-pressure jobs.

Explanation: These steps help create a sense of community and shared responsibility, which can significantly reduce stress and improve work-life balance techniques.

According to a study, strong social support networks can enhance job satisfaction and reduce burnout. For more tips on managing stress for financial advisors, visit this resource.

Benefits of a supportive network:

- Reduces feelings of isolation

- Provides opportunities for problem-solving and developing coping mechanisms for workplace anxiety

- Enhances professional growth and burnout prevention for high-achievers

Creating a supportive network can be a game-changer in your stress management strategy for financial advisors.

5: Prioritize tasks and break them into manageable chunks

Prioritizing tasks and breaking them into manageable chunks is crucial for managing stress for financial advisors and enhancing productivity.

Actionable Steps:

- Utilize a task management system: Use tools like the Eisenhower Matrix to categorize tasks by urgency and importance, improving time management skills for professionals.

- Break down large tasks into smaller steps: Divide a quarterly financial report into weekly sections to avoid last-minute stress, a key strategy for burnout prevention for high-achievers.

- Set clear deadlines for each step: Assign specific deadlines to each smaller task to ensure steady progress and maintain work-life balance techniques.

Explanation: These steps help financial advisors stay organized and reduce the feeling of being overwhelmed, serving as effective stress reduction strategies for executives.

They also improve your ability to manage stress effectively, incorporating mindfulness practices in the workplace.

According to a study, effective task prioritization can significantly lower stress levels and enhance job satisfaction. For more tips on managing stress for financial advisors, visit this resource.

Mastering task prioritization will make your workload more manageable and less stressful, contributing to overall stress management for financial advisors.

6: Implement regular self-care routines

Implementing regular self-care routines is essential for managing stress for financial advisors and maintaining work-life balance.

Actionable Steps:

- Incorporate physical activity daily: Take a 30-minute walk during lunch breaks to clear your mind and boost energy, a key stress reduction strategy for executives.

- Schedule regular downtime for relaxation: Dedicate evenings to activities you enjoy, such as reading or painting, to unwind and practice mindfulness in the workplace.

- Practice healthy eating habits: Prepare nutritious meals in advance to ensure a balanced diet and sustained energy throughout the day, supporting burnout prevention for high-achievers.

Explanation: These steps help maintain physical and mental well-being by encouraging regular relaxation and healthy habits, crucial for managing stress for financial advisors.

According to a study, self-care practices like physical activity and healthy eating can significantly reduce stress and improve overall health. For more details, visit this resource.

Essential components of a self-care routine:

- Regular exercise or movement

- Adequate sleep and rest

- Balanced nutrition

Taking care of yourself is crucial for sustaining long-term productivity and well-being, especially when managing stress for financial advisors in high-pressure jobs.

Partner with Alleo on Your Stress Management Journey

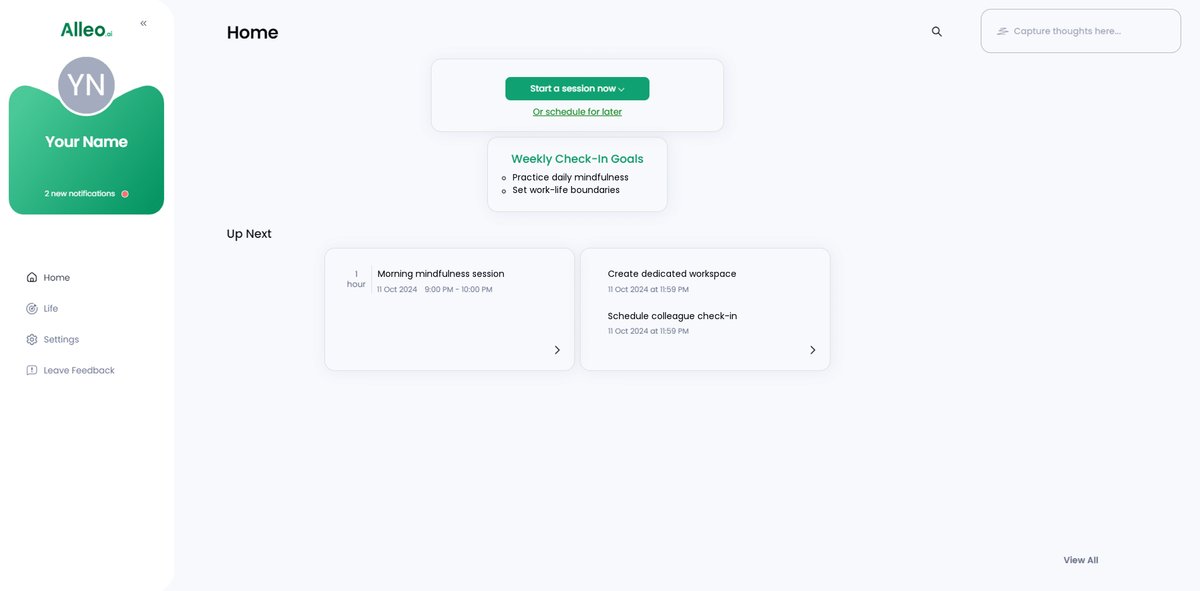

We’ve discussed managing stress for financial advisors in high-pressure jobs. But did you know you can work directly with Alleo to make this journey easier and improve your work-life balance?

Alleo offers affordable, tailored coaching support for stress management and burnout prevention, just like a human coach. Start with a free 14-day trial, no credit card required.

First, set up your account. Then, create a personalized stress management plan incorporating effective time management skills for professionals.

Alleo’s AI coach will help overcome specific challenges, introducing mindfulness practices in the workplace. The coach follows up on progress, handles changes, and keeps you accountable via text and push notifications, acting as one of your essential productivity tools for busy professionals.

Ready to get started for free and learn coping mechanisms for workplace anxiety?

Let me show you how to begin your stress reduction journey!

Step 1: Log In or Create Your Account

To begin your stress management journey with Alleo, simply Log in to your account or create a new one to access personalized AI coaching tailored for financial advisors.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to start developing consistent practices that will help you manage work-related stress effectively, aligning with the strategies discussed in the article for maintaining a healthy work-life balance as a financial advisor.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your focus area in Alleo to directly address the work-related stress you face as a financial advisor, allowing the AI coach to provide tailored strategies for managing professional pressures and achieving a better work-life balance.

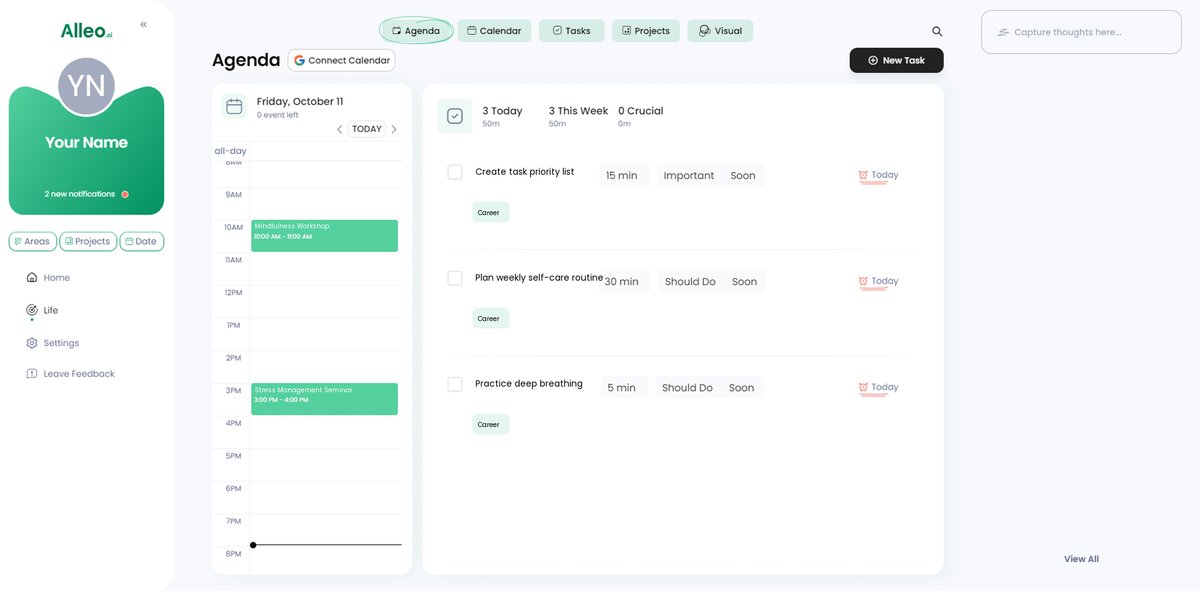

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an initial intake session, where you’ll discuss your stress management goals and create a personalized plan to tackle the challenges you face as a financial advisor.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the app’s home page to review and manage the stress management goals you discussed, allowing you to track your progress and make adjustments as needed.

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your stress management activities, such as mindfulness sessions, exercise, and self-care routines, helping you stay accountable and monitor your progress in reducing work-related stress.

Wrapping Up: Your Path to Stress-Free Success

We’ve covered a lot of ground today. Understanding and managing stress for financial advisors is crucial for your well-being.

Remember, simple changes can make a big difference. Practice mindfulness practices in the workplace, set boundaries, develop a growth mindset, build your support network, prioritize tasks with time management skills for professionals, and indulge in self-care routines for corporate leaders.

You have the power to transform your stress management. Implement these stress reduction strategies for executives and watch your stress levels decrease.

Partner with Alleo for tailored support. With personalized coaching, Alleo can help you stay on track and maintain work-life balance techniques.

Don’t let stress control your life. Start your journey to a balanced, fulfilling career today by managing stress for financial advisors effectively.

Try Alleo now, for free.