4 Proven Steps to Transition from Business Consulting to Wealth Management for Entrepreneurs

Are you an entrepreneur struggling to transition from business consulting to wealth management? This career change from consulting to wealth management can be challenging, but rewarding.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, the right plan can transform your career, especially when transitioning from business consultant to financial advisor.

In this article, you’ll discover how to earn key certifications, master exit strategies, and build a network of successful entrepreneurs. You’ll also learn how to offer specialized wealth management strategies for business owners and leverage your business expertise in wealth management.

Let’s dive into the world of entrepreneurial wealth optimization and financial services for entrepreneurs.

Understanding the Challenges of Transitioning from Business Consulting to Wealth Management

Shifting from business consulting to wealth management can be daunting. Many entrepreneurs struggle with understanding the nuances of financial planning and investment strategies for business owners.

Without a structured approach, you risk missing out on critical opportunities. In my experience, people often underestimate the complexity of this transition from consulting to wealth management.

Side hustlers, especially, face unique struggles. They juggle multiple roles and need a solid business plan to succeed in entrepreneurial wealth optimization.

It’s crucial to recognize these challenges in the career change from consulting to wealth management. By doing so, you can better prepare and avoid common pitfalls in financial services for entrepreneurs.

Essential Steps to Transition from Business Consulting to Wealth Management

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in your career change from consulting to wealth management:

- Obtain Relevant Certifications (e.g., CFP, CIMA): Enhance your credentials to build credibility and expertise in wealth management strategies for business owners.

- Develop Expertise in Business Exit Strategies: Learn how to guide business owners through successful transitions, leveraging your business consulting skills in financial advisory.

- Network with Successful Entrepreneurs: Build connections that can provide valuable insights and opportunities for entrepreneurial wealth optimization.

- Offer Specialized Services for Business Owners: Tailor your services to meet the unique needs of business owners, applying your business expertise in wealth management.

Let’s dive into these essential steps for transitioning from business consulting to wealth management!

1: Obtain relevant certifications (e.g., CFP, CIMA)

Obtaining certifications like CFP and CIMA is crucial for building credibility and expertise when transitioning from business consulting to wealth management.

Actionable Steps:

- Enroll in a top certification program: Identify and register for programs like CFP and CIMA. Set a clear timeline for completion, focusing on wealth management strategies for business owners.

- Prepare diligently: Create a study schedule using online resources, practice tests, and study groups to enhance your knowledge of entrepreneurial wealth optimization.

- Apply practical experience: Seek internships or part-time roles in wealth management firms. Offer pro bono financial planning services to small business owners to gain hands-on experience in consulting skills for financial advisory.

Explanation:

These steps help you gain the necessary knowledge and credentials to bridge the gap between business consulting and wealth management. Certifications like CFP not only enhance your expertise but also make you more attractive to potential clients seeking financial services for entrepreneurs.

This structured approach ensures that you are well-prepared to meet the challenges of this transition from business consultant to financial advisor. According to the College for Financial Planning, their faculty has more than 150 years of combined industry experience, underscoring the value of these certifications for those pursuing a career change from consulting to wealth management.

Key benefits of obtaining relevant certifications for the transition from business consulting to wealth management:

- Enhanced credibility with clients and peers in entrepreneur financial planning

- In-depth knowledge of financial planning principles and business acumen in wealth management

- Increased earning potential in the wealth management field, leveraging your business expertise

Investing in certifications sets a strong foundation for your career transition from business consulting to wealth management, equipping you with the skills needed for success in financial advisory for entrepreneurs.

2: Develop expertise in business exit strategies

Developing expertise in business exit strategies is crucial for guiding business owners through successful transitions, especially when transitioning from business consulting to wealth management.

Actionable Steps:

- Attend workshops and seminars: Participate in events focused on business exit strategies and wealth management strategies for business owners to learn from industry experts and network with peers.

- Study case studies and white papers: Research successful business exits and entrepreneur financial planning by reading case studies and industry reports. Subscribe to relevant journals for ongoing learning in financial services for entrepreneurs.

- Create a portfolio of exit strategies: Document various exit strategies tailored to different business scenarios, incorporating business expertise in wealth management. Test these strategies with mentors or in hypothetical scenarios to enhance your consulting skills in financial advisory.

Explanation:

These steps matter because they equip you with the knowledge to guide business owners through complex transitions, from business consulting to wealth management.

By attending events and studying real-world cases, you gain practical insights and strategies for entrepreneurial wealth optimization. Creating a portfolio of exit strategies helps you apply this knowledge effectively, supporting your career change from consulting to wealth management.

For additional guidance, you can refer to resources available on Indiana SBDC’s transition services, which provide valuable information on exit planning and business valuation.

Mastering these strategies positions you as a trusted advisor, ready to assist business owners in achieving successful transitions and leveraging your business acumen in wealth management.

3: Network with successful entrepreneurs

Building a strong network of successful entrepreneurs is essential for transitioning from business consulting to wealth management. This network can provide valuable insights into entrepreneurial wealth optimization and financial services for entrepreneurs.

Actionable Steps:

- Join professional associations and groups: Become a member of relevant professional associations, such as local business chambers. Attend networking events and actively participate in discussions focused on business consulting to wealth management.

- Seek mentorship: Identify and approach successful entrepreneurs for mentorship. Schedule regular meetings to discuss wealth management strategies for business owners and gain insights into the transition to financial planning career.

- Leverage social media: Use LinkedIn and other platforms to connect with industry leaders. Share valuable content on business expertise in wealth management and engage with posts to build relationships.

Explanation:

These steps matter because they help you gain valuable insights and opportunities from experienced entrepreneurs. By joining associations and seeking mentorship, you can learn from those who have successfully transitioned from business consultant to financial advisor.

Leveraging social media allows you to expand your network and establish your presence in the realm of entrepreneurial wealth optimization. According to Elite Consulting Partners, networking with industry insiders is crucial for career advancement, especially when considering a career change from consulting to wealth management.

Effective networking strategies for wealth management:

- Attend industry-specific conferences and seminars on business consulting to wealth management

- Participate in online forums and discussion groups focused on entrepreneur financial planning

- Offer value through knowledge-sharing and collaboration, showcasing your consulting skills in financial advisory

Connecting with successful entrepreneurs positions you for success in wealth management, allowing you to leverage your business acumen in wealth management services.

4: Offer specialized services for business owners

Offering specialized services for business owners is vital for standing out in wealth management and business consulting to wealth management.

Actionable Steps:

- Conduct market research: Identify the specific needs of business owners in your target market. Tailor your wealth management strategies for business owners to meet these needs effectively.

- Develop targeted marketing materials: Create brochures, websites, and social media content highlighting your specialized services for entrepreneurs. Use case studies and testimonials to demonstrate success in entrepreneurial wealth optimization.

- Pilot your services: Offer your specialized financial services for entrepreneurs to a select group of clients for feedback. Refine your business consulting to wealth management approach based on their input and experiences.

Explanation:

These steps matter because they help you tailor your offerings to meet the unique needs of business owners. By conducting market research, you can identify gaps and opportunities in entrepreneur financial planning.

Developing targeted marketing materials ensures that your services are effectively communicated. Piloting your services allows you to refine and perfect them, leveraging your business expertise in wealth management.

For more insights, you can refer to the Certified Employee Ownership Advisor program, which offers valuable guidance on specialized services in business transitions.

Key specialized services for business owners:

- Succession planning and exit strategy development

- Business valuation and financial modeling

- Tax-efficient wealth transfer strategies

This approach positions you as a trusted advisor, ready to support business owners through their unique challenges, combining consulting skills in financial advisory with business acumen in wealth management.

Partner with Alleo on Your Transition Journey

We’ve explored the challenges of transitioning from business consulting to wealth management, the benefits, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey from business consultant to financial advisor easier and faster?

Step 1: Goal Setting

Use Alleo to set and track your certification goals for your career change: consulting to wealth management. Utilize reminders and progress tracking to stay on course in your transition to financial planning career.

Step 2: Schedule Management

Plan study sessions, workshops, and networking events with Alleo’s scheduling features. Balance work, study, and personal time effectively as you develop wealth management strategies for business owners.

Step 3: Decision Making

Use Alleo’s AI coaching to evaluate different exit strategies in your business consulting to wealth management transition. Get personalized advice on networking and offering specialized financial services for entrepreneurs.

Step 4: Building Healthy Habits

Develop routines that support continuous learning and professional growth in entrepreneurial wealth optimization. Use Alleo’s habit-building tools to ensure consistent progress in applying your business expertise in wealth management.

Ready to get started for free? Let me show you how!

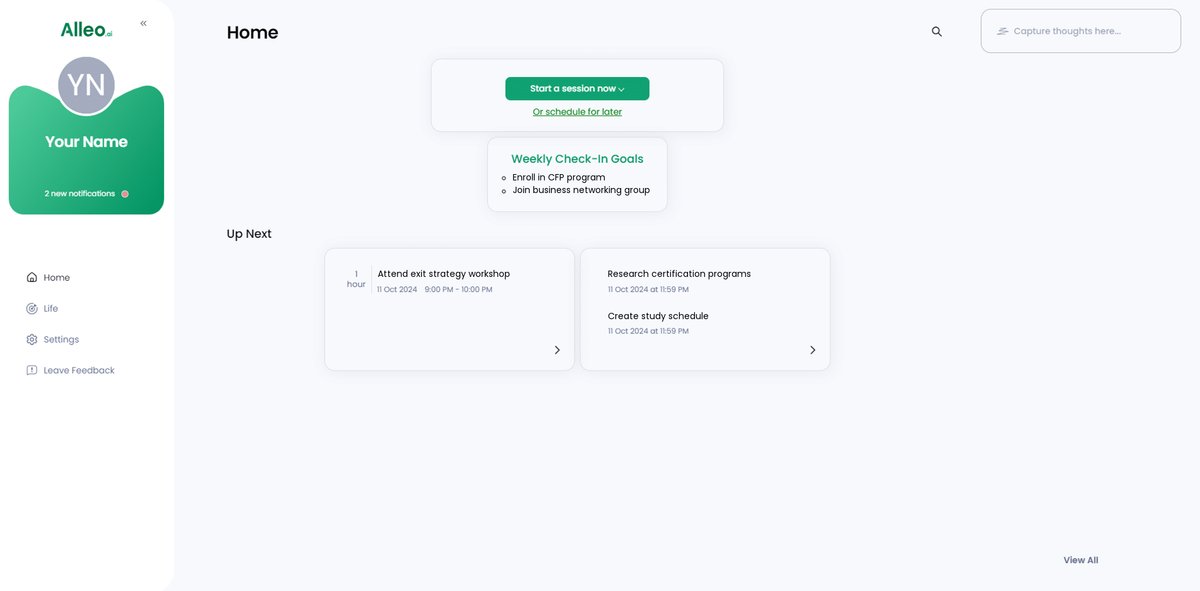

Step 1: Log In or Create Your Alleo Account

To start your transition from business consulting to wealth management, log in to your Alleo account or create a new one to access personalized goal-setting and progress-tracking tools.

Step 2: Choose Your Focus – Setting and Achieving Goals

Click on “Setting and achieving personal or professional goals” to align your efforts with your transition from business consulting to wealth management, helping you stay focused on key milestones like obtaining certifications and developing expertise in exit strategies.

Step 3: Select “Career” as Your Focus Area

Choose “Career” as your primary life area in Alleo to receive tailored guidance on transitioning from business consulting to wealth management, helping you navigate certification processes, develop exit strategies, and build a network of successful entrepreneurs.

Step 4: Starting a coaching session

Begin your wealth management transition journey with an intake session in Alleo, where you’ll outline your goals and create a personalized plan to guide your shift from business consulting.

Step 5: Viewing and Managing Goals After the Session

After your coaching session on transitioning to wealth management, check the Alleo app’s home page to review and manage the goals you discussed, ensuring you stay on track with your career transition plan.

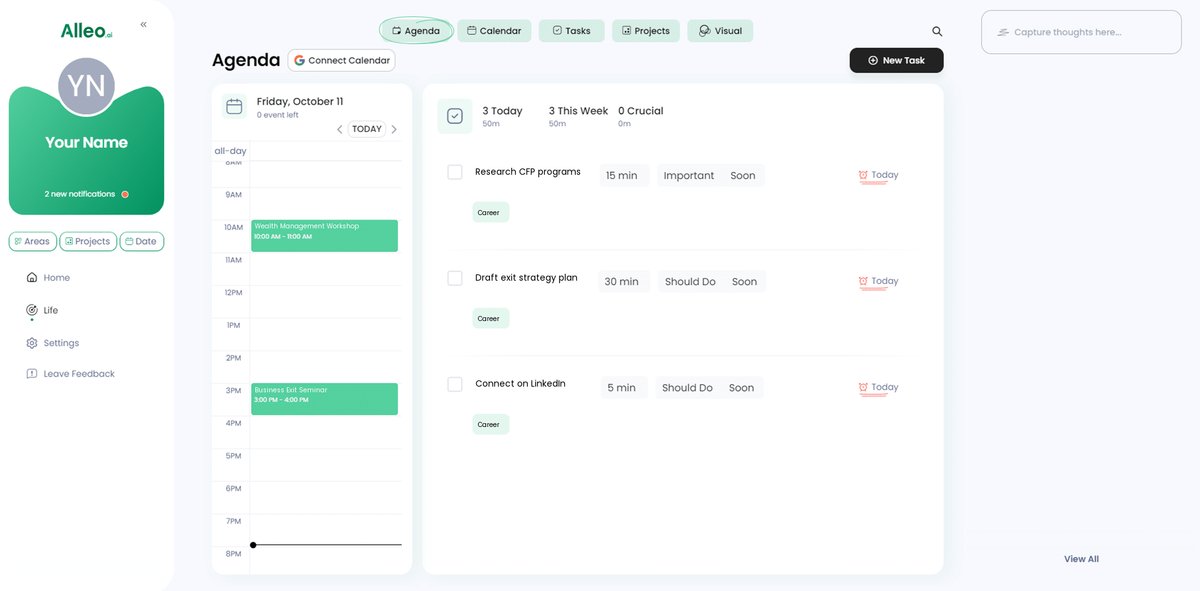

Step 6: Adding events to your calendar or app

Use Alleo’s calendar integration to add key events like certification exam dates, networking meetings, and workshops, allowing you to track your progress in transitioning from business consulting to wealth management and stay on top of important deadlines.

Embark on Your Wealth Management Journey

Transitioning from business consulting to wealth management can feel overwhelming. However, with the right plan and wealth management strategies for business owners, it’s entirely attainable.

By obtaining certifications, mastering exit strategies, networking, and offering specialized financial services for entrepreneurs, you can successfully make this shift from business consultant to financial advisor.

Remember, you’re not alone in this career change: consulting to wealth management. Many have navigated this path before you, and you can too, leveraging your business expertise in wealth management.

Using Alleo can ease this journey from business consulting to wealth management. It helps you set goals, manage your schedule, make decisions, and build healthy habits for entrepreneurial wealth optimization.

You have the tools and support to succeed in entrepreneur financial planning. Start your transition to a financial planning career today with Alleo and transform your career.

Your journey to wealth management begins now, applying your consulting skills in financial advisory.