5 Essential Strategies for Entrepreneurs to Determine When to Hire a Financial Planner

Are you struggling to manage your growing portfolio while juggling your side hustle? Wondering when to hire a financial planner for your small business?

As a life coach, I’ve seen many entrepreneurs face this challenge. Balancing multiple financial accounts and business strategies can be overwhelming, especially when it comes to entrepreneur financial management.

In this article, you’ll discover strategies to determine when it’s time to hire a financial planner. We’ll cover assessing your financial complexity, evaluating your expertise, and calculating the cost-benefit of professional help. These insights will help you understand when to seek professional financial advice for your growing business.

Let’s dive into the world of small business financial planning and explore the financial milestones for startups that signal it’s time for expert guidance.

Understanding the Struggles of Managing Business Finances

Managing your business finances can be a daunting task. Many entrepreneurs like you face the challenge of balancing time between handling finances and growing the business, often wondering when to hire a financial planner.

This often leads to overlooked tax planning for small business owners, missed investment strategies for entrepreneurs, and inefficient cash flow management for entrepreneurs.

These issues can cause significant financial losses. In my experience, several clients report feeling overwhelmed by their financial responsibilities, unsure about when to seek professional financial advice.

This stress can stunt your business growth and hinder your personal financial goals, including self-employed retirement planning.

It’s clear that managing finances without professional help can be a major hurdle, especially when it comes to small business financial planning and financial risk assessment for startups.

How can you strike a balance and ensure financial stability while considering the financial milestones for startups?

Key Steps to Determine When to Hire a Financial Planner

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in small business financial planning.

- Assess Complexity of Your Financial Situation: Make an inventory of your financial accounts and investments to evaluate when to hire a financial planner.

- Evaluate Time Constraints and Financial Expertise: Track how much time you spend on financial management weekly, considering entrepreneur financial management needs.

- Calculate Cost-Benefit of Hiring a Planner: Research average costs and fee structures of financial planners to determine when to seek professional financial advice.

- Review Business Growth and Financial Goals: Define short-term and long-term business growth goals, aligning them with financial milestones for startups.

- Determine Need for Specialized Tax Strategies: Identify potential tax savings with advanced strategies, focusing on tax planning for small business owners.

Let’s dive in!

1: Assess complexity of your financial situation

Understanding the complexity of your financial situation is crucial for determining when to hire a financial planner. This assessment is especially important for small business financial planning and entrepreneur financial management.

Actionable Steps:

- Inventory All Accounts: List every financial account and investment you have. Categorize them by type and management needs, which can help identify when to seek professional financial advice.

- Regular Financial Reviews: Schedule periodic reviews of your financial statements. Identify areas that require professional oversight, particularly for cash flow management for entrepreneurs.

- Risk Management Analysis: Evaluate your insurance coverage and risk mitigation strategies. Address any gaps that increase your financial exposure, which is crucial for financial risk assessment for startups.

Explanation: These steps help you gain a clear picture of your financial status and identify areas needing professional help, including when to hire a financial planner for business growth and financial planning.

By regularly reviewing your finances and assessing risks, you can better manage your portfolio and align with your growth goals. This process is essential for self-employed retirement planning and investment strategies for entrepreneurs.

For more insights, check out this article on small business financial advisors.

Start by taking these steps to assess your financial complexity, setting a solid foundation for the next stages of your financial planning journey. This assessment will help you recognize financial milestones for startups and determine when to hire a financial planner for tax planning for small business owners.

2: Evaluate time constraints and financial expertise

Evaluating your time constraints and financial expertise is crucial for understanding when to hire a financial planner for your small business financial planning needs.

Actionable Steps:

- Conduct a Time Audit: Track how many hours you spend each week on financial management. Compare this to the time you devote to growing your business and consider if it’s time to seek professional financial advice.

- Assess Your Skills: Evaluate your proficiency in areas like tax planning for small business owners and investment strategies for entrepreneurs. Identify gaps where professional assistance could be beneficial.

- Engage in Education: Attend financial workshops or webinars to boost your knowledge and determine if you can manage your finances independently or when to hire a financial planner.

Explanation: These steps help you gauge whether managing your finances independently is feasible. A time audit can reveal how much effort you spend on financial tasks versus business growth and financial planning.

Assessing your skills highlights areas where you might need expert help. Engaging in continuous learning ensures you stay informed about financial management best practices for entrepreneurs.

For more insights, read this article on transitioning from bookkeeper to CFO.

Taking these steps to evaluate your time and expertise ensures you make informed decisions about when to hire a financial planner for your entrepreneur financial management needs.

3: Calculate cost-benefit of hiring a planner

Understanding the cost-benefit of hiring a financial planner is crucial for entrepreneurs managing complex portfolios and determining when to hire a financial planner for their small business financial planning needs.

Actionable Steps:

- Research Planner Fees: Investigate average costs and fee structures of financial planners. Compare these expenses to the potential financial benefits for your business growth and financial planning.

- Estimate ROI: Calculate the return on investment from improved financial management. Consider how a planner can enhance your financial efficiency and assist with self-employed retirement planning.

- Scenario Analysis: Create best and worst-case financial scenarios with and without a planner. Use these projections to make informed decisions about when to seek professional financial advice.

Explanation: These steps help you weigh the financial benefits of hiring a planner against the costs, considering factors like cash flow management for entrepreneurs and tax planning for small business owners.

Estimating ROI and analyzing different scenarios can reveal the value a planner can add, especially for investment strategies for entrepreneurs. For more insights, check out this article on creating a successful financial plan.

Taking these steps ensures you make an informed decision about investing in a financial planner and identifying the financial milestones for startups that may indicate when to hire a financial planner.

4: Review business growth and financial goals

Reviewing your business growth and financial goals is essential to ensure you’re on the right track and to align your finances with your ambitions. This process can also help determine when to hire a financial planner for your small business.

Actionable Steps:

- Set Clear Growth Objectives: Define short-term and long-term business growth goals. Ensure they align with your small business financial planning needs.

- Track Milestones: Establish financial milestones for startups and entrepreneurs. Regularly review these milestones to track progress toward your goals and determine when to seek professional financial advice.

- Schedule Periodic Reviews: Hold regular reviews of your financial goals and progress. Adjust your entrepreneur financial management strategies as needed.

Key factors to consider when setting financial goals:

- Market trends and economic conditions

- Industry-specific growth patterns

- Your business’s historical performance and cash flow management for entrepreneurs

Explanation: These steps help you maintain a clear focus on your business growth and financial objectives. By setting clear goals and tracking your progress, you can identify when to hire a financial planner or seek professional guidance for tax planning for small business owners and investment strategies for entrepreneurs.

Regular reviews ensure you stay aligned with your ambitions and adapt to changing circumstances. For more insights, read this article on creating a successful financial plan.

This proactive approach will help you stay on course and make informed decisions about when to hire a financial planner or seek professional financial planning assistance for your self-employed retirement planning and financial risk assessment for startups.

5: Determine need for specialized tax strategies

Identifying the need for specialized tax strategies is crucial for optimizing your financial situation and knowing when to hire a financial planner for your small business financial planning.

Actionable Steps:

- Consult a Tax Advisor: Schedule a meeting with a tax advisor to explore advanced tax-saving strategies tailored to your business, which is essential for entrepreneur financial management.

- Analyze Investment Tax Implications: Review how different investment strategies for entrepreneurs affect your tax liabilities. Consider the benefits of tax-advantaged accounts like SEP IRAs for self-employed retirement planning.

- Stay Compliant: Ensure all business transactions comply with current tax laws to avoid penalties and fines, a key aspect of tax planning for small business owners.

Benefits of specialized tax strategies:

- Reduced overall tax burden

- Improved cash flow management for entrepreneurs

- Enhanced long-term financial stability

Explanation: These steps help you maximize tax savings and ensure compliance with tax regulations, which is essential for financial health and determining when to seek professional financial advice.

Consulting with a tax advisor and understanding tax impacts can prevent costly mistakes and support business growth and financial planning. For more insights, visit this article on creating a successful financial plan.

Taking these steps will help you determine if specialized tax strategies are necessary for your business and when to hire a financial planner to assist with financial risk assessment for startups.

Partner with Alleo for Financial Planning Success

We’ve explored how to determine when to hire a financial planner and the benefits it can bring. But did you know you can work directly with Alleo to make this journey easier and faster for entrepreneurs and small business owners?

Alleo provides affordable, tailored coaching support for your financial planning needs, including self-employed retirement planning and cash flow management for entrepreneurs. With our AI coach, you get full coaching sessions like any human coach, plus a free 14-day trial with no credit card required.

Setting Up with Alleo:

- Create an Account: Sign up easily on our platform for small business financial planning.

- Personalized Plan: Our AI coach helps you set up a personalized financial plan, addressing when to seek professional financial advice.

- Follow-Up: The AI coach follows up on your progress and handles changes, supporting your business growth and financial planning.

- Accountability: Stay on track with text and push notifications, crucial for managing financial milestones for startups.

Alleo ensures you stay accountable and make informed financial decisions, including investment strategies for entrepreneurs and tax planning for small business owners.

Ready to get started for free and learn when to hire a financial planner?

Let me show you how!

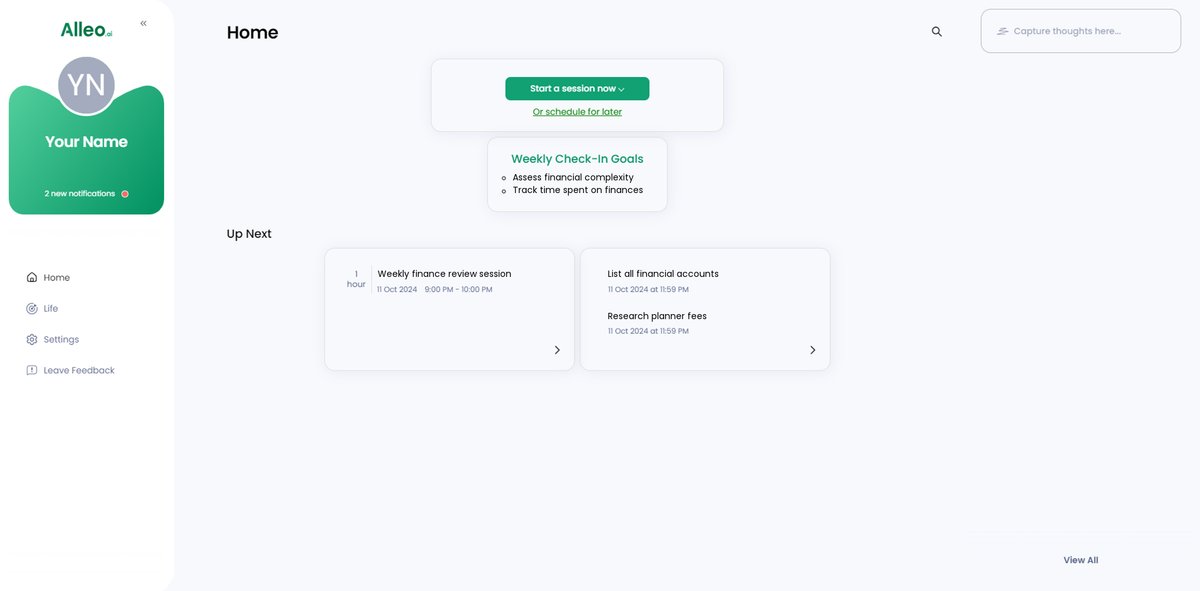

Step 1: Log In or Create Your Account

To start your financial planning journey with Alleo, log in to your existing account or create a new one to access our AI coach and personalized guidance.

Step 2: Choose Your Financial Focus

Select “Setting and achieving personal or professional goals” to align your financial planning with your business growth objectives, helping you determine when professional assistance may be necessary to manage your complex portfolio and optimize your financial strategies.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in the AI coach to address the challenges of managing your business finances and determining when to hire a financial planner, aligning perfectly with your entrepreneurial needs.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where our AI coach will help you set up a personalized financial plan tailored to your business needs and goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, easily access and manage the financial goals you discussed by checking the home page of the Alleo app, where they’ll be prominently displayed for your ongoing review and adjustment.

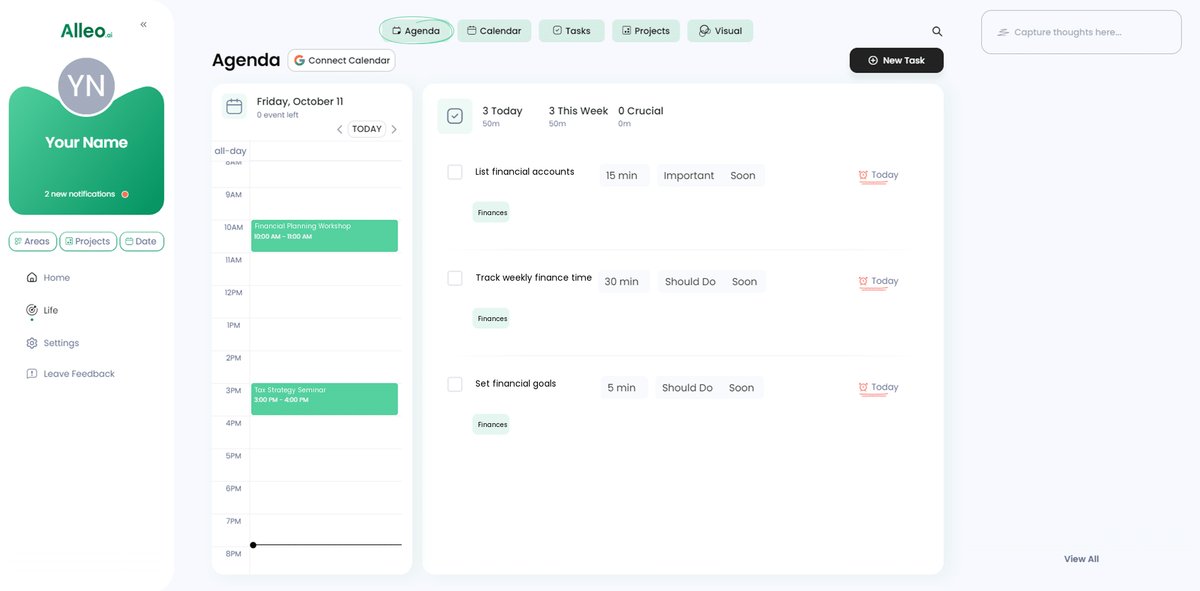

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your financial planning activities, helping you stay accountable and monitor your progress towards achieving your business growth and financial goals.

Take the Next Step Towards Financial Clarity

Having explored the steps to determine when to hire a financial planner, you now have a solid foundation for small business financial planning.

Balancing your financial responsibilities while growing your business can be challenging, especially when considering self-employed retirement planning and cash flow management for entrepreneurs.

Consider the benefits of professional guidance and how it might unlock new growth opportunities for you, particularly in areas like tax planning for small business owners and investment strategies for entrepreneurs.

Remember, you don’t have to navigate this journey alone, especially when it comes to financial risk assessment for startups.

Alleo is here to support you every step of the way in your entrepreneur financial management journey.

Give our AI coach a try with a free 14-day trial to help you decide when to seek professional financial advice.

Empower your financial planning and focus on what you do best—growing your business and reaching financial milestones for startups.

Take action today and set yourself on the path to financial success with Alleo, your partner in business growth and financial planning.