6 Powerful Techniques to Master Investment Management for Multi-Income Entrepreneurs

Are you finding it challenging to manage your investments while juggling multiple income streams? Managing multiple income stream investments can be complex for entrepreneurs.

As a life coach, I’ve helped many entrepreneurs navigate these complexities. Balancing a primary career with side business ventures can be overwhelming, especially when it comes to entrepreneurial portfolio management and investment diversification strategies.

In this article, you’ll discover strategies to diversify investments, maximize tax advantages for multiple income streams, and develop effective financial tracking systems for cash flow management. We’ll explore risk assessment for diverse investments and discuss long-term wealth building for entrepreneurs.

Let’s dive in to explore asset allocation for entrepreneurs and passive income optimization techniques.

Understanding the Struggles of Investment Management for Entrepreneurs

Balancing investment management with a primary career and side business ventures is no easy task. Many clients initially struggle with managing multiple income stream investments and keeping track of their various income streams.

This can lead to financial instability without proper planning and investment diversification strategies.

The complexities of handling multiple income sources can be overwhelming. Without a clear entrepreneurial portfolio management strategy, you risk missing opportunities for growth and security.

Strategic financial planning is crucial for side hustlers. It ensures you maximize returns and maintain stability across all your ventures through effective asset allocation for entrepreneurs.

In my experience, people often find that juggling so many responsibilities can be stressful. However, with the right approach to managing multiple income stream investments, you can achieve financial success and peace of mind.

Key Steps to Effective Investment Management for Entrepreneurs

Managing multiple income stream investments is a crucial challenge for entrepreneurs. Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress in entrepreneurial portfolio management.

- Diversify investments across multiple asset classes: Implement investment diversification strategies by investing in stocks, bonds, real estate, and peer-to-peer lending platforms.

- Create a comprehensive financial tracking system: Track all income, expenses, and investments using a spreadsheet or financial software for effective cash flow management for multiple revenue sources.

- Allocate profits strategically between ventures: Assess profitability and allocate profits to promising opportunities, balancing business and personal investments.

- Maximize tax-advantaged retirement accounts: Contribute to Solo 401(k)s or SEP IRAs for tax benefits and savings growth, considering tax implications for multiple income streams.

- Develop a risk management strategy: Identify potential risks and maintain an emergency fund as part of risk assessment for diverse investments.

- Set up automated investing for consistent growth: Use robo-advisors or automated platforms for regular contributions, aiding in passive income optimization and long-term wealth building for entrepreneurs.

Let’s dive into these strategies for managing multiple income stream investments!

1: Diversify investments across multiple asset classes

Diversifying investments across multiple asset classes is crucial for managing multiple income stream investments and minimizing risk while ensuring stable income.

Actionable Steps:

- Research and invest in a mix of stocks, bonds, real estate, and peer-to-peer lending platforms for effective investment diversification strategies.

- Attend investment seminars or webinars to stay updated on new asset classes and investment opportunities for entrepreneurial portfolio management.

- Use diversification to mitigate risks and ensure stable income across different economic cycles, focusing on passive income optimization.

Explanation: Diversifying your investments helps spread risk and provides a buffer against economic fluctuations. By investing in various asset classes, you can achieve a more balanced and resilient portfolio, which is essential for managing multiple income stream investments.

For more insights on diversification, you can check this source. This strategy is essential for achieving consistent financial growth and security, particularly in financial planning for business owners.

Key benefits of diversification include:

- Reduced overall portfolio risk through asset allocation for entrepreneurs

- Potential for higher long-term returns and long-term wealth building for entrepreneurs

- Protection against market volatility, crucial for balancing business and personal investments

Next, let’s explore how to create a comprehensive financial tracking system for cash flow management for multiple revenue sources.

2: Create a comprehensive financial tracking system

Creating a comprehensive financial tracking system is vital for managing multiple income stream investments and keeping your finances organized to achieve your goals.

Actionable Steps:

- Develop a detailed spreadsheet or use financial software: Track all your income, expenses, and investments in one place, focusing on entrepreneurial portfolio management.

- Schedule regular financial reviews: Set aside time each month to analyze your financial data, assess risk for diverse investments, and make necessary adjustments.

- Set clear financial goals and monitor progress: Establish specific targets for investment diversification strategies and use your tracking system to measure how well you’re achieving them.

Explanation: Having a financial tracking system allows you to see the big picture and make informed decisions for long-term wealth building as an entrepreneur.

It helps identify trends and areas for improvement in passive income optimization. This is crucial for maintaining financial stability and balancing business and personal investments.

For more on effective financial tracking, you can check this source.

Staying organized and proactive with your finances is key to long-term success in managing multiple income stream investments.

Next, we’ll discuss how to allocate profits strategically between your ventures.

3: Allocate profits strategically between ventures

Allocating profits strategically between ventures is essential for maximizing the growth potential of your investments when managing multiple income stream investments.

Actionable Steps:

- Evaluate the profitability of each venture: Regularly assess the financial performance of your ventures to identify the most lucrative opportunities, supporting effective entrepreneurial portfolio management.

- Reinvest in profitable ventures: Allocate a portion of your profits to scaling the most successful ventures for higher returns, focusing on passive income optimization.

- Consult with a financial advisor: Seek professional advice to ensure optimal profit allocation and tax efficiency, addressing tax implications for multiple income streams.

Explanation: These steps help ensure your profits are used to maximize growth and minimize risks in managing multiple income stream investments.

By reinvesting in the most profitable ventures, you can achieve higher returns and financial stability. For more insights on strategic profit allocation, you can check this source.

This approach supports sustained growth and helps you reach your financial goals through effective investment diversification strategies.

Next, let’s explore how to maximize tax-advantaged retirement accounts as part of your long-term wealth building for entrepreneurs.

4: Maximize tax-advantaged retirement accounts

Maximizing tax-advantaged retirement accounts is essential for growing your savings while minimizing tax liabilities when managing multiple income stream investments.

Actionable Steps:

- Contribute to a Solo 401(k) or SEP IRA: Make regular contributions to these accounts to benefit from tax deductions and compound growth, supporting your investment diversification strategies.

- Research and utilize HSAs: Use Health Savings Accounts to save on taxes while covering healthcare costs, boosting your overall savings and optimizing passive income.

Explanation: These steps help ensure your retirement savings grow efficiently while taking full advantage of tax benefits. For more insights on maximizing tax-advantaged accounts, see this source.

This strategy supports long-term financial stability and helps you reach your retirement goals, crucial for entrepreneurial portfolio management.

Key considerations for retirement planning:

- Start early to leverage compound interest

- Diversify retirement investments as part of managing multiple income stream investments

- Regularly review and adjust your strategy for balancing business and personal investments

Next, let’s discuss developing a risk management strategy.

5: Develop a risk management strategy

Developing a risk management strategy is crucial for safeguarding your investments and ensuring long-term financial stability when managing multiple income stream investments.

Actionable Steps:

- Identify and assess potential risks: Evaluate each investment and income stream for possible financial threats, focusing on risk assessment for diverse investments.

- Create a contingency plan: Prepare for financial downturns or unexpected expenses by setting aside funds, essential for entrepreneurial portfolio management.

- Diversify income sources: Maintain an emergency fund and invest in various assets to buffer against risks, implementing investment diversification strategies.

Explanation: These steps help protect your financial health by preparing for uncertainties in managing multiple income stream investments.

Diversifying your investments and maintaining an emergency fund can mitigate risks and contribute to long-term wealth building for entrepreneurs. For more insights, consider reading this source.

This approach keeps you secure and steady in the face of financial challenges, essential for balancing business and personal investments.

Next, let’s discuss setting up automated investing for consistent growth.

6: Set up automated investing for consistent growth

Setting up automated investing ensures consistent growth and helps you stay on track with your financial goals when managing multiple income stream investments.

Actionable Steps:

- Use robo-advisors for automated contributions: Set up regular investments through robo-advisors to maintain consistency and leverage automated portfolio management for entrepreneurial portfolio management.

- Automate transfers to high-yield savings accounts: Schedule automatic transfers to high-yield accounts to grow your savings effortlessly, aiding in cash flow management for multiple revenue sources.

Explanation: These steps ensure regular contributions to your investments without requiring constant oversight. Automated investing helps you build wealth steadily and reliably, supporting long-term wealth building for entrepreneurs.

For more insights on effective automated investing, consider reviewing this source. This strategy frees up your time while ensuring your financial goals are met through passive income optimization.

Benefits of automated investing:

- Consistent contributions regardless of market conditions, supporting investment diversification strategies

- Reduced emotional decision-making in balancing business and personal investments

- Time-saving and convenient for financial planning for business owners

By implementing automated investing, you can focus on other important aspects of your business and personal life while managing multiple income stream investments effectively.

Partner with Alleo on Your Investment Journey

We’ve explored managing investments for entrepreneurs with multiple income streams. But did you know Alleo can make this journey easier for those focused on managing multiple income stream investments?

Set up your account and create a personalized plan for investment diversification strategies. Alleo’s AI coach provides full coaching sessions on entrepreneurial portfolio management, just like a human coach.

The coach will follow up on progress and handle changes in your passive income optimization. Stay accountable via text and push notifications for effective cash flow management for multiple revenue sources.

Ready to get started for free on your long-term wealth building as an entrepreneur? Let me show you how!

Step 1: Log in or Create Your Account

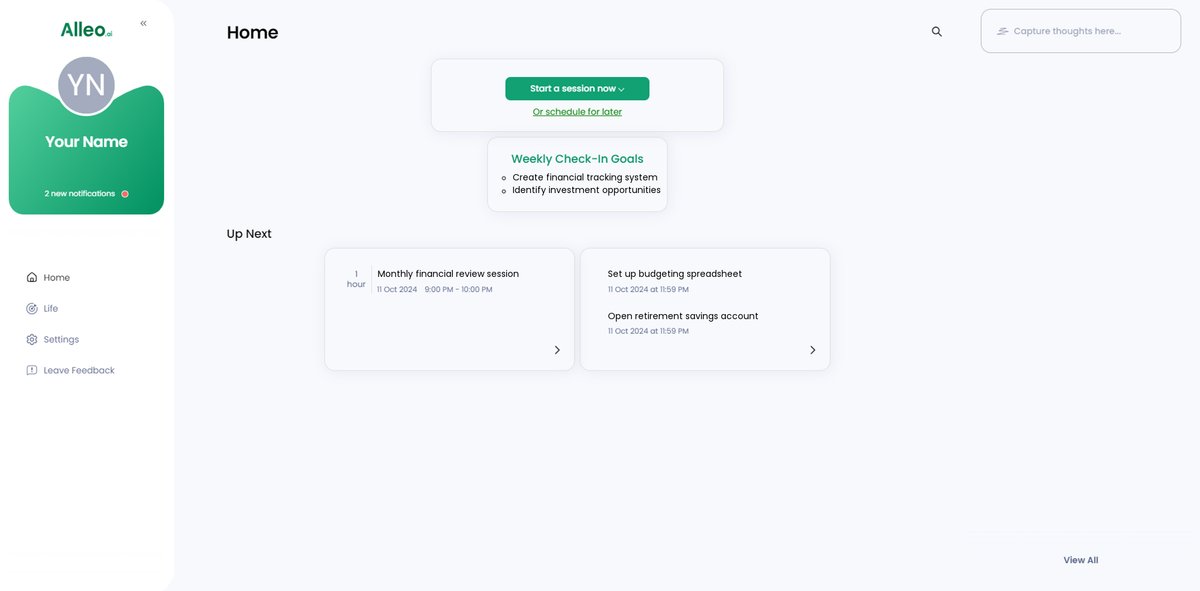

To start your investment management journey with Alleo, simply Log in to your account or create a new one to access personalized AI coaching tailored to your financial goals and multiple income streams.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to develop a structured approach for managing your diverse investments and income streams effectively, aligning with your financial goals and reducing overwhelm.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to receive tailored guidance on managing investments across multiple income streams, aligning perfectly with your entrepreneurial challenges and goals for financial growth and stability.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by initiating an intake session, where you’ll work with the AI coach to establish your personalized investment management plan and set clear financial goals aligned with your multiple income streams.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to view and manage the investment goals you discussed, allowing you to track your progress and stay aligned with your financial strategies.

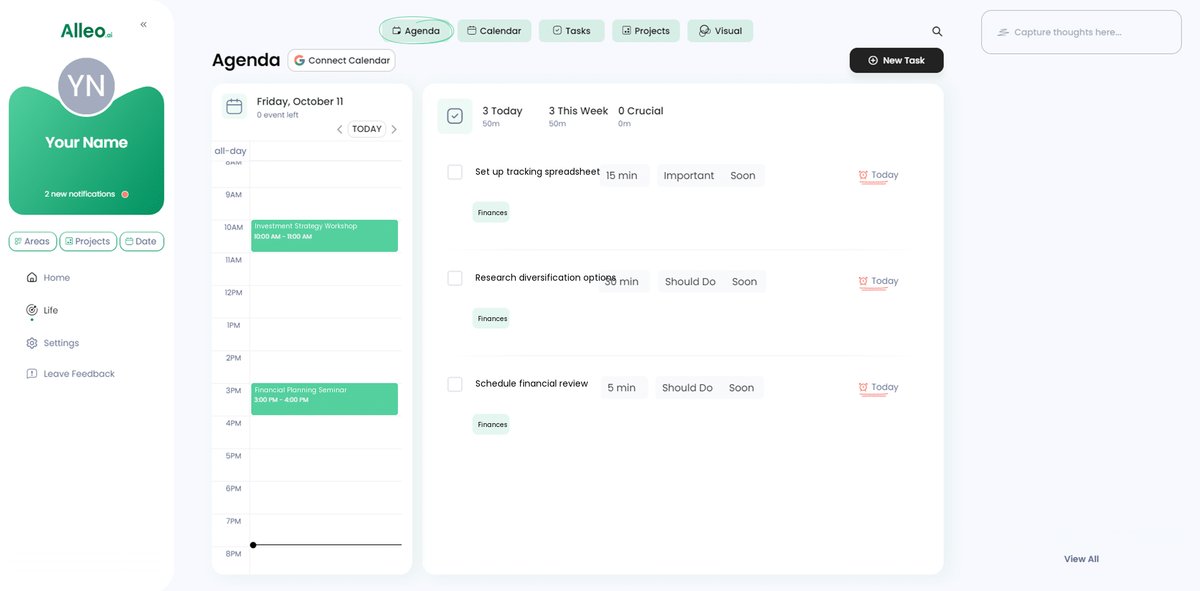

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track your investment management activities, ensuring you stay on top of your financial goals and making it easier to manage multiple income streams effectively.

Bringing It All Together for Financial Success

Managing multiple income stream investments can feel overwhelming. Yet, with careful planning, it becomes manageable.

By implementing investment diversification strategies, you spread risk and ensure stable income. Creating a comprehensive financial tracking system helps you stay organized and on track with entrepreneurial portfolio management.

Strategically allocating profits ensures your resources are used effectively. Maximizing tax-advantaged accounts grows your savings efficiently, considering tax implications for multiple income streams.

Developing a risk assessment strategy for diverse investments safeguards your assets against uncertainties.

Automated investing ensures consistent growth without constant oversight, aiding in passive income optimization. Remember, Alleo is here to help with financial planning for business owners.

Start implementing these strategies today. Achieve financial stability and growth through effective asset allocation for entrepreneurs.

Sign up for Alleo for personalized support on this journey of managing multiple income stream investments and balancing business and personal investments.