How to Balance Retirement and Taxable Accounts: 6 Fundamental Principles for Financial Planners

Are you struggling with balancing retirement and taxable accounts while juggling a side hustle?

As a life coach, I’ve helped many side hustlers navigate these financial challenges. In my experience, managing both account types strategically is crucial for long-term financial success and effective asset location optimization.

In this guide, you’ll discover how to assess your goals, maximize contributions, and implement tax-efficient investing techniques for a balanced financial plan. We’ll explore retirement account allocation strategies and diversification between retirement and taxable accounts.

Let’s dive in to explore how balancing retirement and taxable accounts can set you up for a secure financial future.

Understanding the Challenges of Balancing Retirement and Taxable Accounts

Navigating the financial landscape as a side hustler can be tricky. Many clients initially struggle with balancing retirement and taxable accounts, which is crucial for tax-efficient investing techniques and asset location optimization.

Without a balanced approach to diversification between retirement and taxable accounts, you risk tax inefficiencies and missed growth opportunities. This imbalance can result in higher tax liabilities and reduced long-term returns, affecting your capital gains tax management.

In my experience, people often find it overwhelming to manage multiple account types, including Roth IRA vs. traditional IRA comparisons. The lack of a strategic plan for balancing retirement and taxable accounts can lead to significant financial stress.

But don’t worry—there are actionable strategies to help you overcome these challenges, including retirement account allocation strategies and withdrawal strategies in retirement. Let’s explore them together.

A Roadmap to Balancing Retirement and Taxable Accounts

Overcoming this challenge of balancing retirement and taxable accounts requires a few key steps. Here are the main areas to focus on to make progress.

- Assess client’s retirement goals and risk tolerance: Conduct a comprehensive financial evaluation and set specific retirement account allocation strategies.

- Maximize contributions to tax-advantaged accounts: Prioritize employer-sponsored plans and IRAs, considering Roth IRA vs. traditional IRA comparisons.

- Implement tax-efficient investment strategies: Diversify investments between retirement and taxable accounts and utilize tax-loss harvesting for capital gains tax management.

- Create a strategic withdrawal plan for retirement: Determine optimal withdrawal strategies in retirement and consider healthcare costs and Required Minimum Distributions (RMDs) planning.

- Utilize Roth conversions for tax diversification: Assess the benefits and implement a phased conversion strategy for balancing retirement and taxable accounts.

- Balance asset location across account types: Use asset location optimization strategies and regularly rebalance portfolios across multiple account types.

Let’s dive in!

1: Assess client’s retirement goals and risk tolerance

Understanding your client’s retirement goals and risk tolerance is crucial for creating a tailored financial plan, including balancing retirement and taxable accounts.

Actionable Steps:

- Conduct a comprehensive financial evaluation.

- Use a detailed questionnaire to understand the client’s current financial situation, goals, and risk tolerance for retirement account allocation strategies.

- Analyze existing assets, liabilities, income, and expenses across both retirement and taxable accounts.

- Set specific retirement goals.

- Define clear, measurable retirement objectives, such as target retirement age and desired retirement income, considering tax-efficient investing techniques.

- Use retirement planning software to project future needs and scenarios, including Roth IRA vs. traditional IRA comparisons.

- Regularly review and adjust goals.

- Schedule periodic reviews, such as annually, to reassess goals and make necessary adjustments based on life changes or financial market conditions, including rebalancing across multiple account types.

Explanation: Assessing retirement goals and risk tolerance helps you create a personalized plan that aligns with your client’s needs. This approach ensures they stay on track for long-term financial success, including optimizing asset location and diversification between retirement and taxable accounts.

For example, using retirement planning tools can help visualize future scenarios and adjust strategies accordingly, including planning for Required Minimum Distributions (RMDs).

Key factors to consider when assessing retirement goals:

- Desired lifestyle in retirement

- Anticipated healthcare needs

- Potential legacy plans and estate planning for retirement accounts

By regularly reviewing and adjusting goals, you can adapt to changes and maximize growth opportunities while managing capital gains tax.

This proactive approach is essential for achieving financial stability and peace of mind, including developing effective withdrawal strategies in retirement.

2: Maximize contributions to tax-advantaged accounts

Maximizing contributions to tax-advantaged accounts is vital for balancing retirement and taxable accounts, reducing your tax burden and growing your retirement savings.

Actionable Steps:

- Max out contributions to employer-sponsored retirement plans.

- Prioritize 401(k) or similar plans, especially if your employer offers a match.

- Set up automatic contributions to ensure consistency and avoid missing out on employer matches.

- Contribute to Individual Retirement Accounts (IRAs).

- Opt for traditional or Roth IRAs based on your eligibility and tax benefits, considering Roth IRA vs. traditional IRA comparison.

- If applicable, utilize spousal IRAs to maximize contributions for both partners.

- Explore Health Savings Accounts (HSAs).

- If eligible, contribute to an HSA for its triple tax benefits (tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses).

Explanation: Maximizing contributions to tax-advantaged accounts helps lower your taxable income and fosters long-term growth, supporting tax-efficient investing techniques.

Utilizing strategies like automatic contributions to employer-sponsored plans ensures you don’t miss out on valuable employer matches, contributing to effective retirement account allocation strategies.

For instance, according to NBER, many plans now include automatic enrollment to aid in consistent saving. This proactive approach is essential for securing a stable financial future and balancing retirement and taxable accounts.

Taking these steps can significantly enhance your financial stability and set you on the right path for retirement, while optimizing asset location and preparing for future withdrawal strategies in retirement.

3: Implement tax-efficient investment strategies

Implementing tax-efficient investment strategies is essential for balancing retirement and taxable accounts, minimizing tax liability, and maximizing growth.

Actionable Steps:

- Diversify investments across account types.

- Allocate assets based on their tax efficiency, focusing on retirement account allocation strategies.

- Use low-cost index funds and ETFs to minimize expenses and optimize asset location.

- Utilize tax-loss harvesting.

- Regularly review taxable accounts to identify opportunities for capital gains tax management.

- Offset gains with losses to reduce taxable income and enhance tax-efficient investing techniques.

- Implement tax-efficient fund placement.

- Place tax-efficient investments in taxable accounts, considering diversification between retirement and taxable accounts.

- Avoid high-turnover funds in taxable accounts to minimize capital gains taxes and optimize withdrawal strategies in retirement.

Explanation: These steps help you minimize taxes and maximize returns. Diversifying investments and utilizing tax-loss harvesting can significantly enhance your financial health when balancing retirement and taxable accounts.

According to Money with Katie, using low-cost index funds and ETFs is a cost-effective way to achieve long-term growth. This proactive approach ensures your investments work harder for you, especially when considering Roth IRA vs. traditional IRA comparison.

Benefits of tax-efficient investment strategies:

- Reduced tax liability

- Improved after-tax returns

- Enhanced long-term wealth accumulation

These strategies set you up for long-term success and financial stability, including effective Required Minimum Distributions (RMDs) planning and estate planning for retirement accounts.

4: Create a strategic withdrawal plan for retirement

Creating a strategic withdrawal plan for retirement is essential for balancing retirement and taxable accounts while managing your finances and minimizing tax liabilities.

Actionable Steps:

- Prioritize withdrawals from taxable accounts first.

- This allows tax-advantaged accounts to keep growing, supporting tax-efficient investing techniques.

- Consider Required Minimum Distributions (RMDs).

- Factor in RMDs to avoid penalties and manage your taxable income, a crucial aspect of RMDs planning.

- Plan for healthcare costs in retirement.

- Use Health Savings Account (HSA) funds for medical expenses to leverage tax-free withdrawals, optimizing asset location.

Explanation: These steps are crucial for optimizing your retirement income and reducing tax burdens through effective withdrawal strategies in retirement.

By withdrawing from taxable accounts first, you can maximize the growth of your tax-advantaged accounts, enhancing your retirement account allocation strategies.

According to Edelman Financial Engines, managing RMDs effectively can help keep you in a lower tax bracket, which is key to balancing retirement and taxable accounts.

This strategic approach ensures you maintain financial stability throughout your retirement years, incorporating diversification between retirement and taxable accounts.

Taking these steps can lead to a more financially secure and stress-free retirement, effectively balancing retirement and taxable accounts.

5: Utilize Roth conversions for tax diversification

Utilizing Roth conversions for tax diversification can significantly enhance your long-term financial strategy by offering tax-free growth and withdrawals, contributing to balancing retirement and taxable accounts.

Actionable Steps:

- Assess the benefits of Roth conversions. Calculate potential tax savings and long-term benefits of converting traditional IRA funds to Roth IRAs. Evaluate current and future tax brackets to determine the optimal timing for conversions, considering retirement account allocation strategies.

- Implement a phased conversion strategy. Spread conversions over several years to avoid pushing into higher tax brackets. Monitor tax law changes that could impact conversion benefits and tax-efficient investing techniques.

- Reassess conversion strategy periodically. Regularly review the conversion strategy to ensure it aligns with financial goals and tax planning needs. Adjust the strategy based on changes in income, tax laws, or financial goals, focusing on asset location optimization.

Explanation: These steps are crucial for maximizing the benefits of Roth conversions and minimizing tax liabilities. By spreading conversions over several years, you can avoid higher tax brackets and ensure a more efficient tax strategy, supporting diversification between retirement and taxable accounts.

According to Thrivent, Roth conversions can offer significant long-term tax benefits when done strategically. This approach helps secure a more stable and tax-efficient retirement plan, addressing Roth IRA vs. traditional IRA comparison considerations.

Key considerations for Roth conversions:

- Current vs. expected future tax rates

- Time horizon until retirement

- Overall financial goals, including Required Minimum Distributions (RMDs) planning

Taking these steps can lead to a more diversified and tax-efficient retirement portfolio, effectively balancing retirement and taxable accounts while considering capital gains tax management and withdrawal strategies in retirement.

6: Balance asset location across account types

Balancing asset location across account types, including retirement and taxable accounts, is vital for tax efficiency and long-term growth.

Actionable Steps:

- Place tax-inefficient investments in tax-advantaged accounts. Allocate bonds and REITs to accounts like 401(k)s or IRAs to shield them from taxes, optimizing retirement account allocation strategies.

- Place tax-efficient investments in taxable accounts. Use stocks and ETFs in taxable accounts to take advantage of lower capital gains taxes, implementing tax-efficient investing techniques.

- Rebalance portfolios regularly. Review and adjust your asset allocation periodically to maintain your desired risk level and maximize tax efficiency, focusing on diversification between retirement and taxable accounts.

Explanation: These steps help optimize your portfolio’s tax efficiency and growth potential. By placing tax-inefficient investments in tax-advantaged accounts, you can minimize your tax burden while balancing retirement and taxable accounts.

Meanwhile, placing tax-efficient investments in taxable accounts leverages favorable tax treatments. According to NerdWallet, regular rebalancing can help maintain your portfolio’s desired risk and return profile.

This strategic approach ensures your investments work harder for you through asset location optimization.

Balancing asset location effectively across retirement and taxable accounts sets you up for a more secure financial future.

Partner with Alleo to Balance Your Retirement and Taxable Accounts

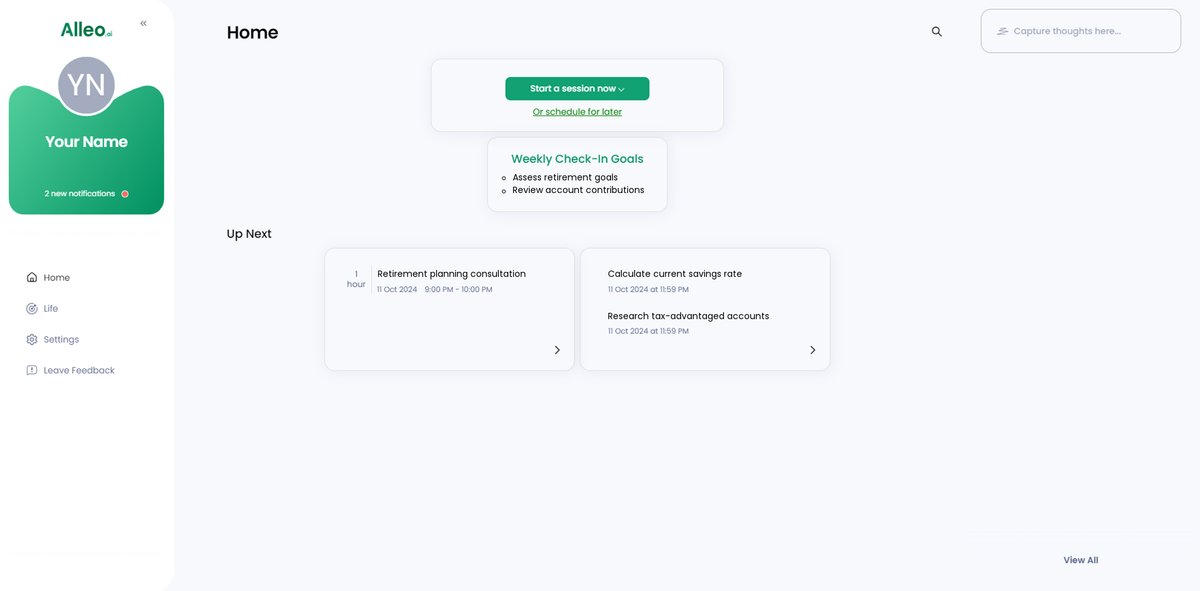

We’ve explored the challenges of balancing retirement and taxable accounts, and the steps to achieve it. But did you know you can work directly with Alleo to make this journey of balancing retirement and taxable accounts easier and faster?

With Alleo AI coach, you get affordable, tailored coaching support for your financial planning needs, including retirement account allocation strategies and tax-efficient investing techniques. Set up an account and create a personalized plan for balancing retirement and taxable accounts in minutes.

Alleo’s coach will help you assess your goals, maximize contributions, and implement tax-efficient strategies for asset location optimization. The coach follows up on your progress, handles changes in diversification between retirement and taxable accounts, and keeps you accountable via text and push notifications.

Ready to get started for free? Let me show you how to begin balancing your retirement and taxable accounts!

Step 1: Log In or Create Your Account

To start balancing your retirement and taxable accounts with Alleo’s AI coach, log in to your existing account or create a new one in just a few clicks.

Step 2: Choose “Building better habits and routines”

Click on “Building better habits and routines” to focus on developing consistent financial practices that will help you effectively balance your retirement and taxable accounts, aligning with your long-term financial goals.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your life area to focus on, enabling Alleo’s AI coach to provide tailored guidance on balancing your retirement and taxable accounts, maximizing tax efficiency, and achieving your long-term financial goals.

Step 4: Starting a coaching session

Begin your journey with Alleo by scheduling an intake session to create a personalized financial plan that balances your retirement and taxable accounts, setting the stage for your future coaching sessions.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, allowing you to track your progress in balancing retirement and taxable accounts.

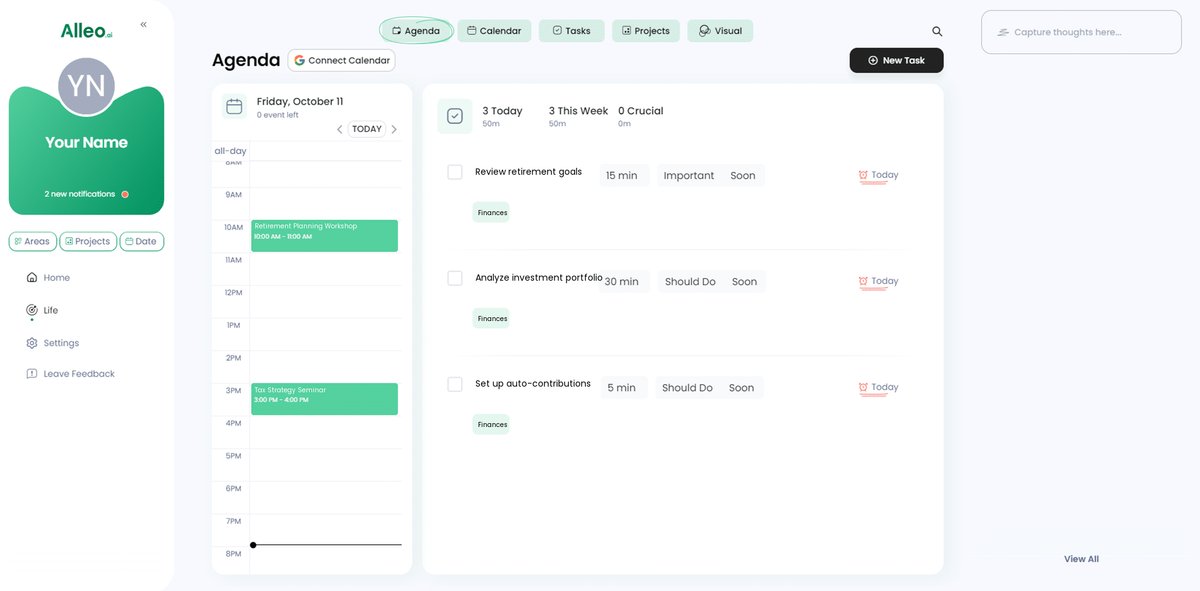

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to schedule and track important financial milestones, such as contribution deadlines, portfolio rebalancing dates, and regular check-ins on your retirement and taxable account balances, helping you stay on top of your financial goals and progress.

Taking Control of Your Financial Future

Balancing retirement and taxable accounts can feel overwhelming. But with the right strategies, you can achieve financial stability and growth through effective retirement account allocation strategies.

Remember, understanding your goals and risk tolerance is the first step. Maximize contributions to tax-advantaged accounts to reduce your tax burden and implement tax-efficient investing techniques.

Implement tax-efficient investment strategies and create a strategic withdrawal plan for retirement. Utilize Roth conversions for tax diversification and balance asset location optimization. Consider comparing Roth IRA vs. traditional IRA options for your situation.

You can do this. Take control of your financial future by balancing retirement and taxable accounts effectively.

Partnering with Alleo can make this journey easier. Their AI coach provides tailored support and keeps you on track with diversification between retirement and taxable accounts.

Start planning today for free!