5 Powerful Ways Single Earners Can Save Money While Enjoying Life

Are you struggling to find the best ways to save money as a single earner without sacrificing your quality of life? Balancing savings and enjoyment on a single salary can be challenging, but it’s not impossible.

As a life coach, I’ve helped many single women navigate the challenges of financial independence while maintaining a fulfilling lifestyle. In my experience, finding a balance between saving and enjoying life is crucial for those practicing frugal living strategies for singles.

In this article, you’ll discover actionable strategies to automate savings, budget effectively, prioritize experiences, and increase your income. These smart spending habits for individual earners will help you maximize your savings potential as a single earner.

Let’s dive in to explore economical living without sacrificing comfort and thrifty lifestyle choices for solo breadwinners.

The Challenge of Balancing Savings and Quality of Life

Many single women face significant hurdles when saving money as a single earner. The pressure to save for the future while enjoying life can be overwhelming, especially when it comes to budgeting tips for solo income households.

Several clients often feel torn between financial stability and living fully in the present. This struggle can lead to stress and feelings of inadequacy, particularly when trying to implement frugal living strategies for singles.

In my experience, people often find it challenging to balance these conflicting priorities. Financial independence can seem like an unattainable goal, especially when considering cost-cutting measures without lifestyle compromise.

Does this sound familiar to you?

If so, you’re not alone in the challenge of saving money as a single earner.

Effective Strategies to Balance Savings and Quality of Life

Overcoming this challenge requires a few key steps for saving money as a single earner. Here are the main areas to focus on to make progress in balancing savings and enjoyment on a single salary.

- Automate savings with direct deposit splits: Set up automatic transfers to a high-yield savings account, a smart spending habit for individual earners.

- Create a realistic budget using the 50/30/20 rule: Allocate your income to needs, wants, and savings, an essential budgeting tip for solo income households.

- Prioritize experiences over material possessions: Spend on experiences that bring joy and fulfillment, a key aspect of financial planning for one-income lifestyles.

- Explore frugal alternatives for self-care: Find affordable ways to maintain your well-being, embracing frugal living strategies for singles.

- Increase income through side hustles or upskilling: Monetize skills or invest in further education, maximizing savings potential as a single earner.

Let’s dive into these money-saving hacks for single professionals!

1: Automate savings with direct deposit splits

Automating savings with direct deposit splits is a smart way for a single earner to consistently save without extra effort, making it an essential strategy for saving money as a single earner.

Actionable Steps:

- Set up direct deposit to automatically allocate a percentage of income to a high-yield savings account, a key budgeting tip for solo income households.

- Use bank features or apps to automate regular transfers to an emergency fund, supporting frugal living strategies for singles.

- Allocate a portion of each paycheck to specific savings goals like vacations or home purchases, balancing savings and enjoyment on a single salary.

Explanation:

By automating your savings, you make sure a portion of your income is saved before you have a chance to spend it. This approach aligns with the increasing use of technology for financial management and is particularly beneficial for maximizing savings potential as a single earner.

According to USA.gov, using budgeting tools can help you stay focused on your financial goals.

This method ensures that saving becomes a seamless part of your routine, helping you build a safety net and work toward larger financial goals, which is crucial for financial planning for one-income lifestyles.

2: Create a realistic budget using the 50/30/20 rule

Creating a realistic budget using the 50/30/20 rule is crucial for balancing savings and maintaining a fulfilling lifestyle, especially when saving money as a single earner.

Actionable Steps:

- Calculate your after-tax income and allocate it: 50% to needs, 30% to wants, and 20% to savings, a key budgeting tip for solo income households.

- Use budgeting tools and apps like YNAB or Mint to track and adjust spending, enhancing smart spending habits for individual earners.

- Regularly review your budget to reflect changes in income or expenses, setting monthly or quarterly reminders as part of your financial planning for one-income lifestyles.

Explanation:

Following the 50/30/20 rule helps ensure your money is allocated effectively, balancing needs, wants, and savings. Utilizing budgeting tools can help you stay on track with your financial goals and maximize savings potential as a single earner.

According to USA.gov, these tools make managing your finances easier and more organized.

Key benefits of the 50/30/20 rule include:

- Simplified financial planning for frugal living strategies for singles

- Clear allocation of resources for cost-cutting measures without lifestyle compromise

- Flexibility to adjust based on personal circumstances, allowing for balancing savings and enjoyment on a single salary

This approach makes budgeting less overwhelming and more manageable, helping you achieve financial stability while enjoying life, promoting economical living without sacrificing comfort for solo breadwinners.

3: Prioritize experiences over material possessions

Prioritizing experiences over material possessions can enhance your quality of life without derailing your savings goals, especially when saving money as a single earner.

Actionable Steps:

- Identify and list experiences that bring joy and fulfillment. Reflect on past enjoyable experiences and identify what truly makes you happy while balancing savings and enjoyment on a single salary.

- Allocate a portion of the budget to experiences like travel, hobbies, and social activities. Plan and budget for these activities to ensure they fit within your financial plan, focusing on smart spending habits for individual earners.

- Create a vision board or journal to visualize and plan for future experiences. Use these tools for motivation and to keep track of your goals, incorporating frugal living strategies for singles.

Explanation:

Focusing on experiences rather than material possessions can lead to greater happiness and satisfaction. According to Investopedia, quality of life is a subjective measure impacting many financial decisions.

This approach ensures that your spending aligns with what truly brings you joy, making it easier to stick to your budget and implement cost-cutting measures without lifestyle compromise.

Prioritizing experiences over material items creates lasting memories and fulfillment, helping you achieve a balanced and enjoyable life while maximizing savings potential as a single earner.

4: Explore frugal alternatives for self-care

Exploring frugal alternatives for self-care is crucial for saving money as a single earner while maintaining well-being without breaking the bank.

Actionable Steps:

- Identify high-cost self-care expenses and find affordable alternatives. Consider DIY beauty treatments, home workouts, and budget-friendly wellness practices as part of your frugal living strategies for singles.

- Utilize community resources like free fitness classes, libraries, and community centers. Many communities offer these services at no cost, supporting cost-cutting measures without lifestyle compromise.

- Exchange services with friends or join local swap groups. This can help you access services without spending money, maximizing savings potential as a single earner.

Explanation:

Adopting frugal self-care alternatives allows you to maintain your well-being while keeping expenses in check. According to USA.gov, budgeting tools can help you prioritize and manage these costs effectively, which is essential for financial planning for one-income lifestyles.

By leveraging community resources and swapping services, you can enjoy self-care without a hefty price tag, supporting smart spending habits for individual earners.

Frugal self-care ideas to consider:

- At-home spa treatments using natural ingredients

- Free meditation apps or YouTube guided meditations

- Nature walks or hikes in local parks

Focusing on affordable self-care ensures you stay healthy and happy while still saving money as a single earner for other important goals, balancing savings and enjoyment on a single salary.

5: Increase income through side hustles or upskilling

Increasing income through side hustles or upskilling is crucial for saving money as a single earner and maintaining a fulfilling lifestyle. This approach aligns with smart spending habits for individual earners.

Actionable Steps:

- Identify skills or hobbies that can be monetized. Consider options like freelance writing, tutoring, or selling handmade crafts as part of frugal living strategies for singles.

- Invest in upskilling through online courses or workshops. Use platforms like Coursera, Udemy, or LinkedIn Learning for additional learning, supporting financial planning for one-income lifestyles.

- Network and seek mentorship opportunities to advance your career. Attend networking events or approach potential mentors for guidance, enhancing your potential for saving money as a single earner.

Explanation:

These steps are essential for boosting your income and achieving financial goals. By monetizing skills and investing in education, you can increase your earning potential and implement cost-cutting measures without lifestyle compromise.

According to LFCU, using fintech tools and apps can also help manage and optimize these efforts. Embracing these approaches ensures you have multiple income streams and greater financial security, supporting economical living without sacrificing comfort.

Popular side hustle options include:

- Freelance writing or graphic design

- Virtual assistance or social media management

- Online tutoring or course creation

Increasing your income through side hustles or upskilling can enhance your financial stability and create opportunities for personal growth, allowing you to balance savings and enjoyment on a single salary.

Partner with Alleo for Financial Freedom

We’ve explored balancing savings and quality of life, and how to achieve it as a single earner. But did you know that you can work directly with Alleo to make this journey easier and faster for saving money as single earner?

Setting up an account with Alleo is simple. Create a personalized plan tailored to your financial goals, including budgeting tips for solo income households.

Alleo’s AI coach will guide you every step of the way, offering frugal living strategies for singles.

Alleo follows up on your progress, handles changes, and keeps you accountable via text and push notifications. This ensures you stay on track with smart spending habits for individual earners.

Ready to get started for free and maximize your savings potential as a single earner?

Let me show you how to balance savings and enjoyment on a single salary!

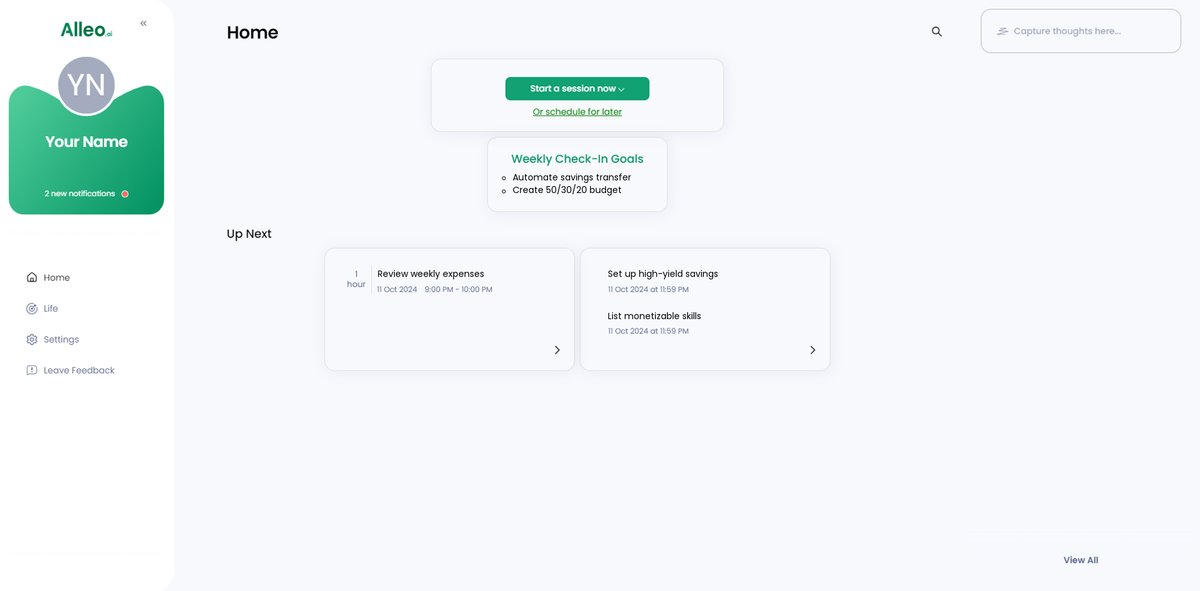

Step 1: Get Started with Alleo

Log in to your existing Alleo account or create a new one to begin your journey towards financial balance and independence.

Step 2: Choose Your Focus Area

Select “Improving overall well-being and life satisfaction” to address the challenge of balancing savings with quality of life, aligning your financial goals with personal fulfillment and happiness.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary focus area in Alleo to align with your goal of balancing savings and quality of life, allowing the AI coach to provide tailored strategies for budgeting, saving, and increasing income while maintaining a fulfilling lifestyle.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to set up a personalized plan that aligns with your financial goals and lifestyle aspirations.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, check the Alleo app’s home page to view and manage the financial goals you discussed, helping you stay on track with balancing savings and quality of life.

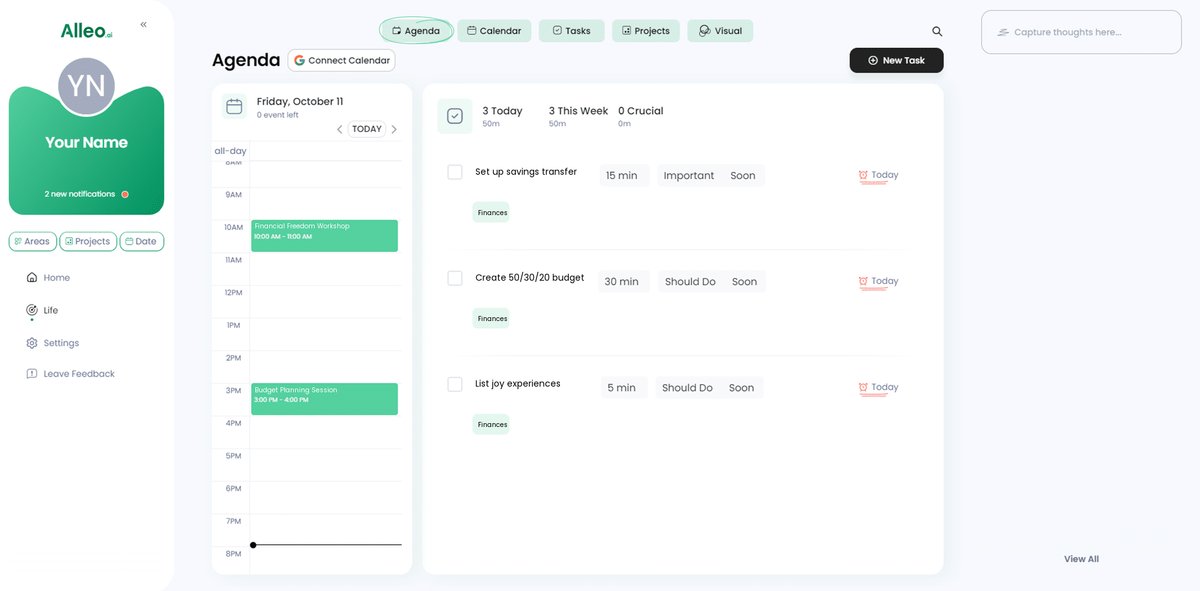

Step 6: Adding events to your calendar or app

Use Alleo’s calendar and task features to track your progress in achieving financial balance by adding key events like budget reviews, savings milestones, and planned experiences to stay motivated and accountable on your journey to financial freedom.

Your Path to Financial Balance and Fulfillment

As we wrap up, remember that achieving financial independence while enjoying life is possible, even when saving money as a single earner.

Balancing savings and quality of life is challenging, but you can do it with the right strategies for budgeting on a solo income.

Automating savings, budgeting wisely, prioritizing experiences, exploring frugal self-care, and increasing income can transform your financial journey as a single professional.

I understand the hurdles you face in maximizing savings potential as a single earner. I’ve helped many others navigate this path successfully.

You can take actionable steps to improve your financial situation and still enjoy life, implementing smart spending habits for individual earners.

For personalized support in financial planning for one-income lifestyles, try Alleo, your AI life coach.

Take control of your finances today. Start your journey with Alleo for free and achieve financial freedom while balancing savings and enjoyment on a single salary.