How Young Professionals Can Master the Balance of Travel and Financial Independence

Are you struggling to balance your passion for travel with the need to build financial independence? Many young professionals find themselves grappling with the challenge of balancing wanderlust and career goals.

As a life coach, I’ve helped many professionals navigate these exact challenges. I’ve seen firsthand how difficult it can be to balance immediate desires with long-term security, especially when it comes to balancing travel and financial independence.

In this article, you’ll discover actionable steps to achieve both goals. From creating a travel savings fund to embracing minimalism, we’ll cover practical strategies to help you save money and enjoy life’s adventures. We’ll explore budget travel tips, work-life balance for travelers, and saving strategies for young professionals that can support your journey towards financial independence.

Let’s dive in and explore how you can master the art of balancing travel and financial independence.

Navigating the Financial Challenges of Travel and Independence

Balancing travel and financial independence is no easy feat. Many single women face this dilemma, struggling to prioritize between immediate adventures and long-term security.

In my experience, several clients initially struggle with setting financial goals while yearning to explore the world. The pain of missing out on travel experiences can feel intense, yet the anxiety of not saving enough for the future is equally daunting. Balancing wanderlust and career goals is a common challenge for young professionals.

Financial independence is crucial for your long-term goals, but it often feels at odds with your immediate desires. The challenge is finding a balance that doesn’t compromise your future security or your present happiness. Work-life balance for travelers is essential when considering a digital nomad lifestyle or remote work opportunities.

Achieving this balance requires a clear strategy and determination. By breaking down goals and taking actionable steps, you can create a path that aligns both your travel dreams and financial aspirations. This may involve exploring budget travel tips, saving strategies for young professionals, and financial planning for frequent travelers.

Strategies to Balance Travel and Financial Independence

Overcoming this challenge of balancing travel and financial independence requires a few key steps. Here are the main areas to focus on to make progress:

- Create a travel savings fund separate from other goals: Set specific travel savings goals and automate contributions to support your financial planning for frequent travelers.

- Pursue remote work or digital nomad opportunities: Identify and secure remote work roles that align with your career growth while traveling.

- Optimize travel costs with budget-friendly destinations: Research and plan trips to affordable adventure destinations during off-peak seasons, utilizing budget travel tips.

- Develop skills that combine work and travel interests: Enroll in courses and seek mentorship in relevant fields to enhance your work-life balance for travelers.

- Use credit card rewards for travel expense savings: Choose and strategically use travel rewards credit cards, implementing travel hacking techniques.

- Practice minimalism to reduce costs and increase savings: Adopt a minimalist lifestyle and focus on experiences, aligning with saving strategies for young professionals.

Let’s dive in to explore these strategies for balancing travel and financial independence!

1: Create a travel savings fund separate from other goals

Creating a dedicated travel savings fund is crucial for balancing travel and financial independence. This approach helps maintain a clear focus on both immediate and long-term objectives.

Actionable Steps:

- Automate your savings: Set up automatic monthly transfers to a high-yield savings account dedicated to travel, supporting your saving strategies for young professionals.

- Set specific goals: Define a clear savings target for your trips and track your progress regularly, essential for financial planning for frequent travelers.

- Adjust contributions: Assess your budget periodically and increase savings when possible without affecting other goals, crucial for maintaining work-life balance for travelers.

Explanation:

By segregating your travel fund, you ensure that your travel plans do not interfere with other financial goals. This method helps maintain a clear focus on both immediate and long-term objectives while balancing travel and financial independence.

According to Investopedia, creating specific savings goals is essential for financial planning.

This approach allows you to enjoy travel experiences without compromising financial security, effectively balancing wanderlust and career goals.

2: Pursue remote work or digital nomad opportunities

Working remotely can offer the flexibility needed to travel while maintaining financial independence, making it an essential strategy for balancing travel and financial independence.

Actionable Steps:

- Identify remote-friendly roles: Focus on job roles in industries like tech, marketing, or customer service that support remote work and enable a digital nomad lifestyle.

- Build a strong portfolio: Showcase your skills and experience to attract remote work opportunities through platforms like LinkedIn, supporting your career growth while traveling.

- Leverage job boards: Use sites such as Remote.co or We Work Remotely to find remote positions that match your expertise and allow for work-life balance for travelers.

Explanation:

These steps help you secure remote work opportunities, allowing you to travel without sacrificing income. According to Spend Life Traveling, balancing work and travel is vital for maintaining financial stability.

Embracing remote work can provide the best of both worlds, ensuring you stay on track with your financial goals while exploring new places and balancing wanderlust and career goals.

Key benefits of remote work for travelers include:

- Flexible schedule to explore new destinations and affordable adventure destinations

- Ability to earn income while traveling, supporting financial planning for frequent travelers

- Opportunity to immerse in local cultures for extended periods while pursuing budget travel tips

![]()

3: Optimize travel costs with budget-friendly destinations

Optimizing travel costs is essential for balancing travel and financial independence. By implementing budget travel tips, you can maintain your wanderlust while securing your financial future.

Actionable Steps:

- Research budget-friendly destinations: Identify destinations with lower living costs and affordable accommodations, perfect for the digital nomad lifestyle.

- Plan trips during off-peak seasons: Travel during off-peak times to save on flights and lodging, a key travel hacking technique.

- Use travel apps and websites: Leverage apps like Hopper and sites like Skyscanner to find the best deals on travel expenses, supporting your saving strategies as young professionals.

Explanation:

These steps help you maximize travel experiences without overspending. By choosing budget-friendly destinations and traveling during off-peak seasons, you can stretch your travel budget further while balancing wanderlust and career goals.

According to Spend Life Traveling, planning strategically is crucial for maintaining financial stability while exploring new places.

This approach ensures that your travel adventures do not compromise your financial goals, allowing you to achieve work-life balance for travelers.

![]()

4: Develop skills that combine work and travel interests

Developing skills that combine work and travel interests is essential for balancing travel and financial independence while exploring the world.

Actionable Steps:

- Enroll in relevant online courses: Focus on skills like digital marketing, writing, or programming that support remote work opportunities and the digital nomad lifestyle.

- Attend webinars and workshops: Participate in events that offer insights into balancing work-life balance for travelers and career growth while traveling.

- Seek mentorship: Connect with professionals who successfully balance wanderlust and career goals to gain valuable insights and advice on financial planning for frequent travelers.

Explanation:

These steps help you build marketable skills that enable remote work, aligning with your travel goals and budget travel tips.

By investing in education and networking, you can create opportunities that support your travel lifestyle and saving strategies for young professionals.

According to Learn Tourism, networking and skill development are key for young professionals aiming to balance career and travel.

This approach ensures that you stay competitive in the job market while enjoying your adventures and exploring affordable adventure destinations.

5: Use credit card rewards for travel expense savings

Utilizing credit card rewards can be a game-changer for saving on travel expenses while balancing travel and financial independence.

Actionable Steps:

- Choose a travel rewards credit card: Select a card that offers travel rewards with low fees and favorable terms, ideal for budget travel tips.

- Maximize everyday spending: Use your credit card for everyday purchases to accumulate points, supporting your digital nomad lifestyle.

- Redeem points strategically: Convert your points for flights, hotel stays, and other travel-related expenses to minimize costs and maintain work-life balance for travelers.

Explanation:

These steps help you leverage credit card rewards to reduce travel expenses, allowing you to travel more without breaking the bank while balancing travel and financial independence.

According to Investopedia, using credit card rewards strategically can significantly cut down your travel costs.

This approach enables you to enjoy travel experiences while maintaining financial security and saving strategies for young professionals.

This strategy helps you get the most out of your everyday spending for travel savings, supporting your goal of balancing wanderlust and career goals.

Top ways to maximize credit card rewards for travel:

- Sign up for cards with substantial welcome bonuses

- Use category-specific cards for bonus points on certain purchases

- Take advantage of card issuer shopping portals for extra points, enhancing your travel hacking techniques

6: Practice minimalism to reduce costs and increase savings

Practicing minimalism is crucial to reducing costs and increasing savings in the context of balancing travel experiences with financial independence. This approach aligns with the digital nomad lifestyle and work-life balance for travelers.

Actionable Steps:

- Declutter your space: Sell or donate unused items to boost your travel fund, supporting your budget travel tips.

- Adopt a minimalist lifestyle: Cut down on non-essential living expenses, enhancing your saving strategies for young professionals.

- Focus on experiences, not possessions: Prioritize spending on experiences that bring joy over material goods, aligning with balancing wanderlust and career goals.

Explanation:

These steps help streamline your lifestyle, making it easier to save for travel. By decluttering and focusing on experiences, you align with industry trends of minimalism and sustainability, supporting your journey in balancing travel and financial independence.

According to Duffel Bag Spouse, minimalism can significantly reduce living costs, enhancing your ability to save for travel adventures and explore affordable adventure destinations.

Benefits of minimalism for travelers:

- Increased financial flexibility for travel experiences

- Less stress from managing fewer possessions

- Greater appreciation for experiences over material things

This approach ensures your travel dreams don’t compromise your financial security, supporting your goals of balancing travel and financial independence.

Work with Alleo to Achieve Your Travel and Financial Goals

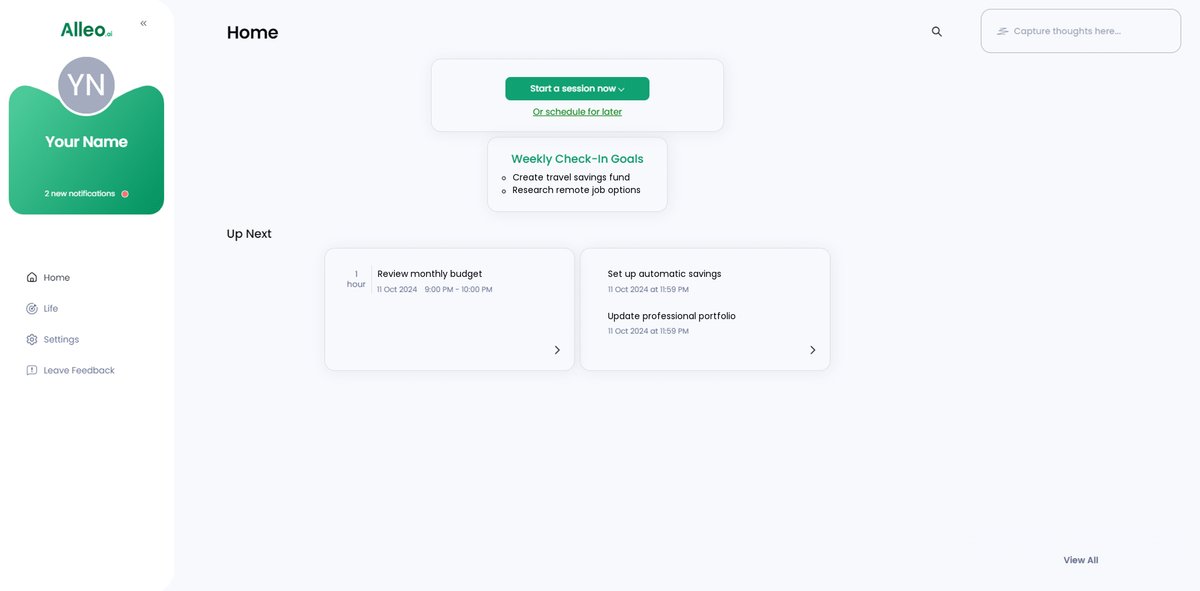

We’ve explored the challenges of balancing travel and financial independence. But did you know you can work with Alleo to make this journey easier and faster?

Setting up an account with Alleo is simple. Create a personalized plan to address your travel and financial goals, including budget travel tips and saving strategies for young professionals.

Alleo’s AI coach provides tailored coaching support, just like a human coach, helping you navigate the digital nomad lifestyle and maintain work-life balance for travelers.

Track your progress with regular follow-ups via text and push notifications. The coach helps you stay accountable and handle any changes, supporting your career growth while traveling.

Alleo offers a free 14-day trial with no credit card required, perfect for those exploring remote work opportunities and financial planning for frequent travelers.

Ready to get started for free? Let me show you how to balance wanderlust and career goals!

Step 1: Access Your Alleo Account

Log in to your existing Alleo account or create a new one to start balancing your travel dreams with financial independence.

Step 2: Choose Your Focus Area

Select “Setting and achieving personal or professional goals” to align your travel aspirations with your financial independence objectives, allowing Alleo to provide tailored guidance for balancing these key aspects of your life.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area to align Alleo’s AI coaching with your goal of balancing travel experiences and financial independence, enabling you to receive tailored guidance on budgeting, saving strategies, and optimizing your resources for both travel and long-term financial security.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session to create a personalized plan that balances your travel aspirations and financial independence goals.

Step 5: Viewing and managing goals after the session

After your coaching session, check the Alleo app’s home page to review and manage the travel and financial goals you discussed, allowing you to track your progress and stay accountable to your balanced lifestyle plan.

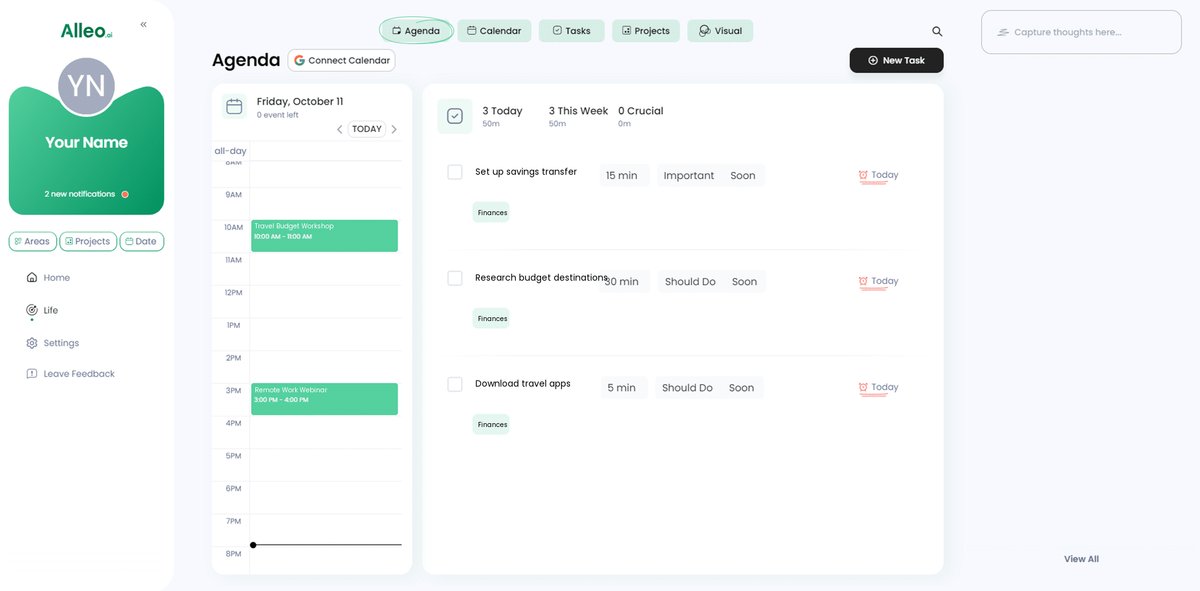

Step 6: Adding events to your calendar or app

Track your progress towards balancing travel and financial independence by adding key milestones and savings goals to your calendar or task management app, allowing you to visualize your journey and stay motivated as you work towards your objectives.

Embrace Your Journey with Confidence

Balancing travel and financial independence is a challenging but rewarding endeavor. By implementing these strategies, you can achieve both goals without sacrificing your dreams of becoming a digital nomad or exploring affordable adventure destinations.

Remember, it’s all about creating a plan that works for you. Small, consistent steps lead to big results in your financial planning for frequent travel and career growth while traveling.

Your journey to financial independence and travel adventures begins now. You’ve got this! With the right work-life balance for travelers, you can achieve your wanderlust and career goals.

For personalized support in balancing travel and financial independence, Alleo can guide you every step of the way. Try it free for 14 days and see the difference it makes in your saving strategies and remote work opportunities.

Start today, and watch your dreams come to life through budget travel tips and travel hacking techniques.