How Young Professionals Can Stay Consistent with Financial Independence Goals: A Revolutionary Approach

Imagine if you could achieve financial independence without constantly worrying about every penny. Staying consistent with financial independence is key to long-term success.

As a life coach, I’ve helped many professionals navigate these challenges. In my experience, staying consistent with financial independence goals is a common struggle, especially for millennials and young adults seeking to build wealth in their 20s and 30s.

In this post, you’ll discover actionable steps to maintain consistency and trust the financial independence process over time. We’ll explore budgeting tips, investing for beginners, and long-term savings strategies to help you on your journey.

Let’s dive in and explore how you can balance work-life and financial goals while working towards financial independence.

Understanding the Challenges of Staying Consistent

Young professionals often find it tough to stick to their financial independence goals. Staying consistent with financial independence can be challenging due to emotional and psychological barriers, like fluctuating motivation and financial setbacks, which can be overwhelming for those focused on building wealth in their 20s and 30s.

In my experience, people often face periods where their financial progress seems to stagnate or even regress. This can be particularly frustrating when you’ve been working diligently towards your long-term savings strategies and financial planning for millennials.

Several clients report feeling disheartened by unexpected expenses or life changes. These setbacks can make it challenging to maintain consistency with budgeting tips for young adults and debt management for young professionals.

Such challenges in staying consistent with financial independence are common but surmountable. Let’s explore actionable steps to navigate them, including effective money management apps and tools.

Strategic Steps to Stay Consistent with Financial Independence

Overcoming this challenge requires a few key steps. Here are the main areas to focus on to make progress towards staying consistent with financial independence:

- Set clear, measurable financial milestones: Define specific goals to stay motivated in your journey to financial independence.

- Track progress with a budgeting app or spreadsheet: Use money management apps and tools to monitor your finances and maintain consistency.

- Automate savings and investments monthly: Ensure consistency with automated transactions, a crucial aspect of long-term savings strategies.

- Join a financial accountability group or community: Gain support from like-minded peers, especially beneficial for investing for beginners and those focusing on retirement planning for young adults.

Let’s dive in to explore these strategies for staying consistent with financial independence!

1: Set clear, measurable financial milestones

Setting clear, measurable financial milestones is crucial for staying consistent with financial independence and maintaining motivation on your journey.

Actionable Steps:

- Define specific goals: Break down long-term financial goals into smaller, manageable milestones, like saving $5,000 in six months. This approach is essential for financial planning for millennials.

- Use the SMART criteria: Ensure each milestone is Specific, Measurable, Achievable, Relevant, and Time-bound for clarity and direction. This method aligns with effective budgeting tips for young adults.

- Regularly review and adjust: Regularly review and adjust milestones based on your progress and any changes in your financial situation. This practice is key to building wealth in your 20s and 30s.

Explanation: Setting clear, measurable goals keeps you focused and motivated. It transforms vague aspirations into actionable steps, which is crucial for long-term savings strategies.

By breaking down larger goals, you make them more attainable. According to Financial Samurai, having precise milestones helps maintain consistency and progress in staying consistent with financial independence.

This structured approach ensures you stay on track and adapt to any changes in your financial landscape, supporting your journey towards financial independence.

2: Track progress with a budgeting app or spreadsheet

Using a budgeting app or spreadsheet is crucial for staying consistent with financial independence goals and maintaining long-term savings strategies.

Actionable Steps:

- Choose a reliable tool: Pick a budgeting app or create a detailed spreadsheet to track income, expenses, and savings, essential for financial planning for millennials.

- Update weekly: Set aside time each week to update your budget and review your progress, a key aspect of staying consistent with financial independence.

- Use visual aids: Utilize charts and graphs to understand financial trends and make informed decisions, beneficial for investing for beginners.

Explanation: Tracking your finances helps you maintain consistency and accountability in your financial journey. This practice allows you to see where your money is going and make adjustments as needed, which is crucial for building wealth in your 20s and 30s.

For instance, using a tool from Peach State Federal Credit Union can streamline this process and provide valuable insights.

Key benefits of tracking your finances include:

- Increased awareness of spending habits

- Easier identification of areas for improvement

- Better alignment of spending with financial goals

These steps ensure you’re always aware of your financial health, helping you stay on track with your journey towards financial independence.

3: Automate savings and investments monthly

Automating your savings and investments is crucial for staying consistent with financial independence and reducing the mental load associated with financial management.

Actionable Steps:

- Set up automatic transfers: Arrange for a fixed amount to be transferred to your savings account or investment portfolio as soon as you receive your paycheck, a key budgeting tip for young adults.

- Allocate a percentage of your income: Dedicate specific percentages of your income to different financial goals, like 20% to savings and 10% to investments, supporting long-term savings strategies.

- Use roundup tools: Utilize money management apps and tools that round up your purchases and save the difference, boosting your savings effortlessly and aiding in building wealth in your 20s and 30s.

Explanation: Automating your finances ensures that you’re consistently saving and investing without having to think about it, which is essential for financial planning for millennials.

This method reduces the risk of spending money impulsively and helps you stay on track with your financial goals, supporting your journey towards financial independence.

According to Can I Retire Yet, automating finances is a proven strategy to maintain financial discipline and reach your milestones.

This approach simplifies your financial management, making it easier to achieve long-term goals and balance work-life and financial goals.

4: Join a financial accountability group or community

Joining a financial accountability group or community is crucial for staying consistent with financial independence and maintaining motivation throughout your journey.

Actionable Steps:

- Find a like-minded group: Search for or create a group with individuals who share similar financial goals, including long-term savings strategies.

- Schedule regular check-ins: Plan regular meetings to discuss progress, challenges, and strategies for building wealth in your 20s and 30s.

- Engage in online forums: Participate in online communities focused on financial independence and investing for beginners for additional support.

Explanation: Engaging with a financial accountability group helps you stay on track by providing support and encouragement from others with similar goals. These groups can offer valuable insights and motivation for financial planning for millennials.

According to Financial Samurai, social support is essential for maintaining consistency in financial goals.

The power of community in financial independence:

- Shared knowledge and experiences in budgeting tips for young adults

- Motivation through peer accountability for debt management for young professionals

- Access to diverse strategies and perspectives on work-life balance and financial goals

Connecting with others can make your journey towards staying consistent with financial independence more manageable and enjoyable, while also providing insights on career development and financial independence.

Partner with Alleo on Your Financial Independence Journey

We’ve explored the challenges of staying consistent with financial independence goals and how to overcome them. But did you know you can work directly with Alleo to make this journey easier and faster for young professionals focused on building wealth in their 20s and 30s?

Setting up an account with Alleo is simple. Start by creating a personalized plan tailored to your financial goals, including long-term savings strategies and retirement planning for young adults.

Alleo’s AI coach will help you set SMART milestones and track your progress. It will send automated reminders and updates, ensuring you stay consistent with financial independence objectives.

Alleo offers tailored advice based on your financial data, helping you adapt to changes in your career development and financial independence journey.

The coach keeps you accountable with regular check-ins via text and push notifications, aiding in budgeting and money management for millennials.

Ready to get started for free? Let me show you how to begin investing for beginners and manage your finances effectively!

Step 1: Log In or Create Your Account

To begin your journey towards financial independence with Alleo’s AI coach, Log in to your account or create a new one if you’re a first-time user.

Step 2: Choose Your Financial Independence Focus

Select “Setting and achieving personal or professional goals” to align your financial independence journey with clear, actionable targets that address your specific challenges and keep you motivated throughout the process.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your primary life area in Alleo to align with your financial independence goals and receive tailored guidance on budgeting, saving, and investing strategies that will help you stay consistent on your path to financial freedom.

Step 4: Starting a Coaching Session

Begin your financial independence journey with Alleo by scheduling an initial intake session, where you’ll work with the AI coach to set up a personalized plan tailored to your goals and milestones.

Step 5: Viewing and managing goals after the session

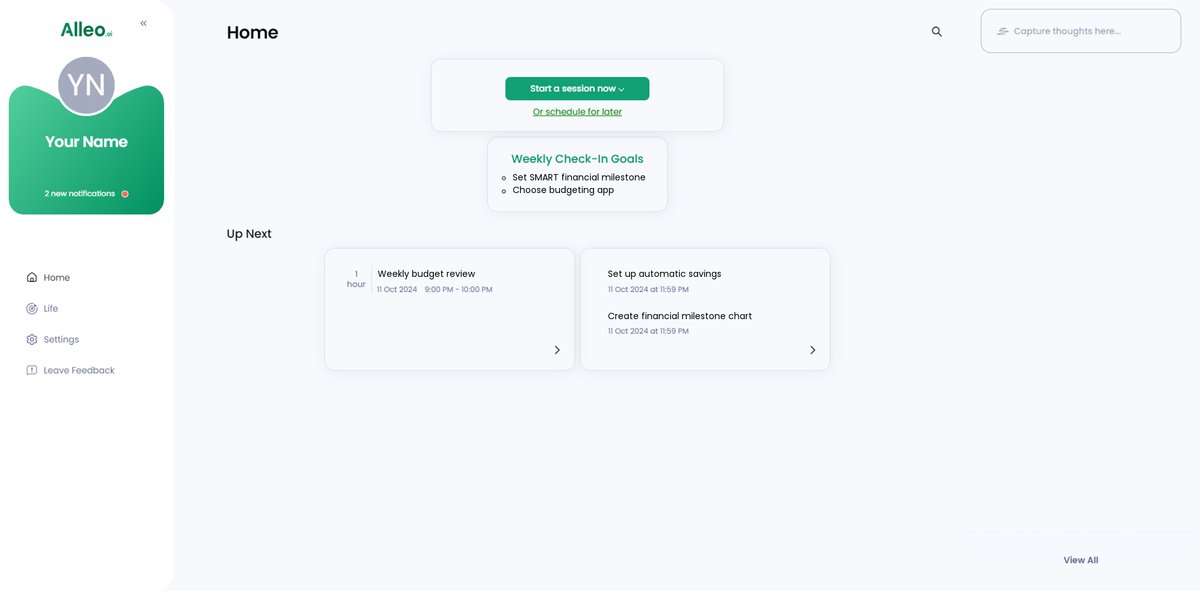

After your coaching session, check the Alleo app’s home page to view and manage the financial independence goals you discussed, allowing you to track your progress and stay consistent with your plan.

Step 6: Adding events to your calendar or app

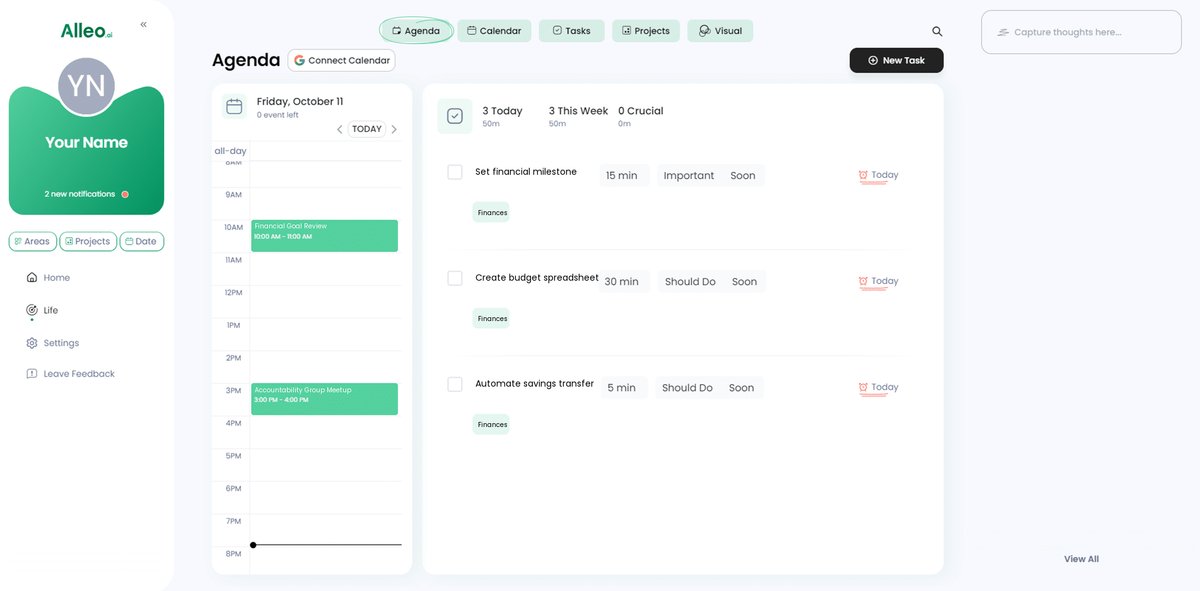

Use Alleo’s calendar and task features to add important financial milestones and check-ins, helping you track your progress and stay accountable on your journey to financial independence.

Final Thoughts: Stay Consistent and Achieve Financial Independence

Let’s wrap up our journey. Remember, staying consistent with financial independence goals is challenging but entirely possible.

Setting clear, measurable milestones keeps you motivated and focused. Tracking your progress with a budgeting app or spreadsheet provides essential accountability, especially for millennials focused on financial planning.

Automating your savings and investments reduces the mental burden, and joining a financial accountability group ensures you stay motivated. This approach is particularly effective for young adults building wealth in their 20s and 30s.

I understand the struggles you face in maintaining consistency with financial independence. You’re not alone on this journey.

Take the first step today. Consider using Alleo to simplify your path to financial independence and enhance your long-term savings strategies.

You can do this! Start now and transform your financial future through consistent efforts towards financial independence.