Managing Diverse Assets for Financial Independence: 5 Essential Strategies for Professionals

Are you ready to take control of your financial future by effectively managing diverse assets for independence, including your salary, bonuses, stocks, and property investments?

As a life coach specializing in asset allocation strategies, I’ve helped many professionals like you navigate the complexities of diverse asset management. Together, we can craft a plan for long-term wealth accumulation that works for your unique situation.

In this blog, you’ll discover actionable strategies for:

- Diversifying investments for a robust, diversified investment portfolio

- Maximizing tax advantages through tax-efficient investing strategies

- Setting specific financial goals for retirement planning and financial independence

Let’s dive into managing diverse assets for independence.

Understanding the Challenges of Managing Diverse Assets

Navigating the complexities of managing diverse assets for independence can be daunting. You’re balancing salary, bonuses, and investments, each with its own set of rules and potential pitfalls in your journey towards long-term wealth accumulation.

Many professionals find optimizing tax-advantaged accounts challenging. You must stay informed about the best strategies for tax efficiency while also planning for short-term and long-term goals, including retirement planning for professionals.

Moreover, asset allocation strategies and diversification can feel overwhelming. It’s about finding the right mix that aligns with your risk tolerance and financial objectives when building a diversified investment portfolio.

In my experience, clients often struggle with prioritizing these tasks in managing diverse assets for independence. The pressure to make the right decisions can be intense, especially when considering passive income generation and alternative investments for professionals.

Managing diverse assets requires thoughtful planning and consistent review. It’s not easy, but it is achievable, whether you’re aiming for financial independence retire early (FIRE) or focusing on sustainable withdrawal strategies.

Overcoming the challenge of managing diverse assets for independence requires a few key steps. Here are the main areas to focus on to make progress in your asset allocation strategies and long-term wealth accumulation.

- Diversify Investments Across Asset Classes: Spread your investments across different asset classes to manage risk and maximize returns, creating a diversified investment portfolio.

- Maximize Tax-Advantaged Accounts: Take full advantage of accounts like 401(k)s, Roth IRAs, and HSAs for tax-efficient investing strategies.

- Create Dedicated Funds for Specific Goals: Open separate savings accounts for major life goals like buying a home or retirement planning for professionals.

- Implement a Systematic Investment Plan (SIP): Set up monthly contributions to mutual funds or ETFs to benefit from dollar-cost averaging and passive income generation.

- Regularly Review and Rebalance Portfolio: Schedule quarterly reviews to adjust your investments and maintain your desired asset allocation, focusing on risk management in asset management.

Let’s dive into these strategies for managing diverse assets for independence!

1: Diversify investments across asset classes

Diversifying your investments is crucial for managing diverse assets for independence and enhancing returns.

Actionable Steps:

- Review your current portfolio: Identify all asset classes you are invested in, such as equities, bonds, and real estate, to create a diversified investment portfolio.

- Set diversification goals: Aim for a balanced mix of growth and stability by setting specific targets for different asset classes, focusing on asset allocation strategies.

- Invest in mutual funds and ETFs: Choose funds that provide exposure to various sectors and regions to minimize risk and support long-term wealth accumulation.

Explanation: Diversifying your portfolio helps spread risk across different asset classes and sectors, reducing the impact of any single investment’s poor performance and supporting retirement planning for professionals.

By doing so, you increase the potential for stable long-term returns and enhance your financial independence retire early (FIRE) prospects.

According to Investopedia, asset allocation is a key element of portfolio management and is crucial for achieving a preferred risk-return profile.

Taking these steps sets a strong foundation for managing diverse assets for independence and your financial future.

2: Maximize tax-advantaged accounts like 401(k)s

Maximizing tax-advantaged accounts like 401(k)s is crucial for efficient long-term savings and tax benefits when managing diverse assets for independence.

Actionable Steps:

- Contribute to 401(k) Up to Employer Match: Ensure you contribute enough to take full advantage of any employer matching contributions, a key aspect of retirement planning for professionals.

- Utilize Roth IRAs: If eligible, contribute to a Roth IRA to benefit from tax-free growth and withdrawals, supporting long-term wealth accumulation.

- Explore HSAs: Use Health Savings Accounts for their triple tax advantage if you have a high-deductible health plan, enhancing your tax-efficient investing strategies.

Key benefits of tax-advantaged accounts include:

- Reduced current taxable income

- Tax-deferred or tax-free growth

- Potential employer contributions

Explanation: These steps are essential for leveraging tax-advantaged accounts, which can significantly boost your retirement savings and support your journey towards financial independence retire early (FIRE).

For instance, contributing to a Roth IRA can offer tax-free growth, as highlighted by Investopedia.

By maximizing contributions to these accounts, you can reduce your taxable income and grow your investments more efficiently, supporting your diversified investment portfolio.

Taking these steps will help you build a strong foundation for your financial independence through managing diverse assets for independence.

3: Create dedicated funds for specific goals

Creating dedicated funds for specific goals helps you stay focused and organized on your financial journey, which is crucial for managing diverse assets for independence.

Actionable Steps:

- Set Clear Financial Goals: Define specific, measurable goals for significant life events, such as purchasing a home, education, or retirement planning for professionals.

- Open Separate Savings Accounts: Create individual accounts for each goal to keep funds organized and track progress easily, supporting long-term wealth accumulation.

- Automate Contributions: Set up automatic transfers to these accounts to ensure consistent savings without manual intervention, facilitating passive income generation.

Explanation: These steps are crucial for effective financial planning. By setting clear goals and organizing your savings, you can stay on track and avoid financial stress while managing diverse assets for independence.

According to NCUA, managing funds in a structured way reduces concentration risk, ensuring financial stability and growth, which aligns with risk management in asset management principles.

This approach simplifies your financial management, making your goals more achievable and supporting your journey towards financial independence retire early (FIRE).

4: Implement a systematic investment plan (SIP)

Implementing a systematic investment plan (SIP) is essential for managing diverse assets for independence and ensuring consistent growth and disciplined investing.

Actionable Steps:

- Select SIP-Friendly Investments: Choose mutual funds or ETFs that support systematic investment plans, aligning with your diversified investment portfolio goals.

- Set Up Monthly Contributions: Allocate a fixed amount to invest each month, leveraging dollar-cost averaging for long-term wealth accumulation.

- Monitor Performance Regularly: Keep an eye on your SIP’s performance and adjust contributions as needed, incorporating risk management in asset management principles.

Benefits of a systematic investment plan:

- Consistent investing habit

- Reduced impact of market volatility

- Potential for long-term wealth accumulation and financial independence retire early (FIRE)

Explanation: These steps help you invest methodically, reducing the risk of market timing. Regular investments can smooth market fluctuations and build wealth over time, supporting retirement planning for professionals.

According to NCUA, systematic investment plans ensure financial stability and growth by spreading out investments.

By following these steps, you lay the groundwork for a reliable and disciplined investment approach in managing diverse assets for independence.

5: Regularly review and rebalance portfolio

Regularly reviewing and rebalancing your portfolio is essential to ensure it aligns with your financial goals and risk tolerance when managing diverse assets for independence.

Actionable Steps:

- Schedule Quarterly Reviews: Set reminders to review your portfolio at least every three months to assess performance and alignment with goals, including retirement planning for professionals.

- Rebalance Based on Targets: Adjust your investments to maintain your desired asset allocation strategies, buying or selling assets as necessary.

- Consult a Financial Advisor: Periodically seek professional advice to ensure your strategy remains optimal amid changing market conditions and supports long-term wealth accumulation.

Key aspects to consider during portfolio review:

- Performance of individual investments in your diversified investment portfolio

- Overall asset allocation for managing diverse assets for independence

- Changes in personal financial situation affecting risk management in asset management

Explanation: These steps are crucial for maintaining a balanced and effective portfolio. Regular reviews help you stay on track to meet your financial goals, including financial independence retire early (FIRE).

Adjusting your investments ensures that your portfolio remains diversified and aligned with your risk tolerance. According to Investopedia, portfolio management involves building and overseeing a selection of assets to meet long-term financial goals and risk tolerance.

Taking these actions ensures your portfolio is well-managed and aligned with your financial objectives, including tax-efficient investing strategies and passive income generation.

Partner with Alleo on Your Financial Independence Journey

We’ve explored the complexities of managing diverse assets for independence and achieving financial independence. Did you know Alleo can help make this journey easier and faster, supporting your long-term wealth accumulation goals?

Setting up an account with Alleo is simple. Create a personalized financial plan tailored to your unique needs, including asset allocation strategies and retirement planning for professionals.

Alleo’s AI coach will provide affordable, tailored coaching support, just like a human coach, guiding you through diversified investment portfolio management and risk management in asset management.

Benefit from full coaching sessions and a free 14-day trial with no credit card required. Alleo will follow up on your progress, handle changes, and keep you accountable via text and push notifications, supporting your journey towards financial independence retire early (FIRE).

Ready to get started for free? Let me show you how to begin managing diverse assets for independence!

Step 1: Log In or Create Your Alleo Account

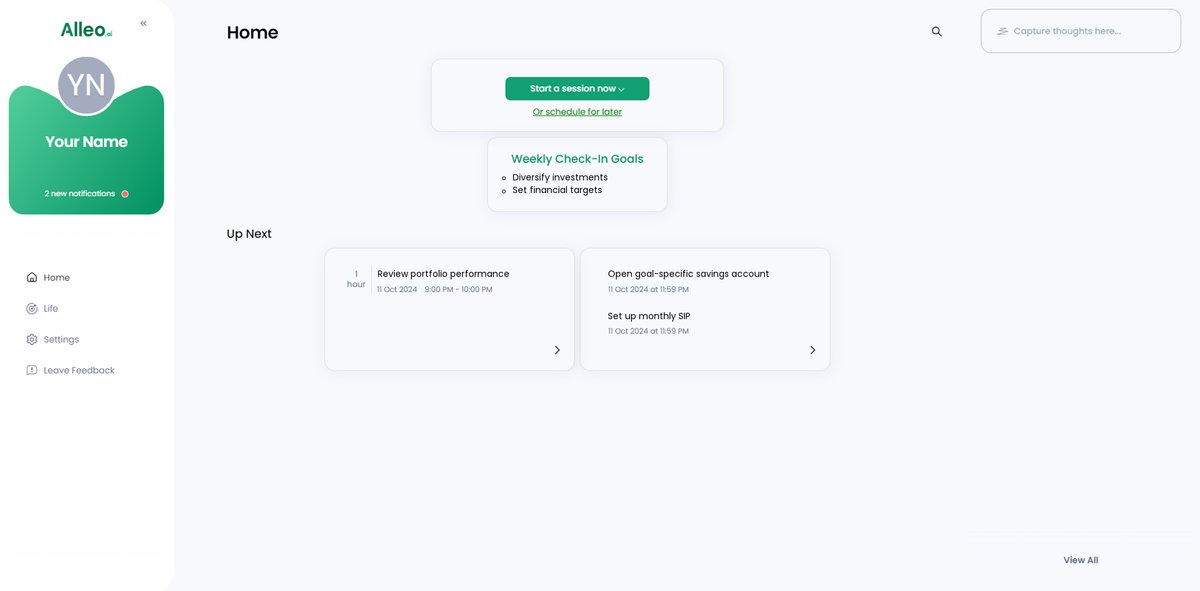

To begin your journey towards financial independence with Alleo, simply log in to your existing account or create a new one to access personalized AI coaching and start building your tailored financial plan.

Step 2: Choose “Building better habits and routines”

Select “Building better habits and routines” to establish a solid foundation for managing your diverse assets effectively, aligning with your goals for financial independence and creating a systematic approach to your investments and savings.

Step 3: Select “Finances” as Your Focus Area

Choose “Finances” as your focus area in Alleo to receive tailored guidance on managing your diverse assets, optimizing tax strategies, and achieving your financial independence goals effectively.

Step 4: Starting a Coaching Session

Begin your journey with Alleo by scheduling an intake session, where you’ll work with the AI coach to create a personalized financial plan tailored to your diverse assets and goals.

Step 5: Viewing and Managing Goals After the Session

After your coaching session, you’ll find the financial goals you discussed displayed on the home page of the Alleo app, allowing you to easily track and manage your progress towards financial independence.

6: Adding events to your calendar or app

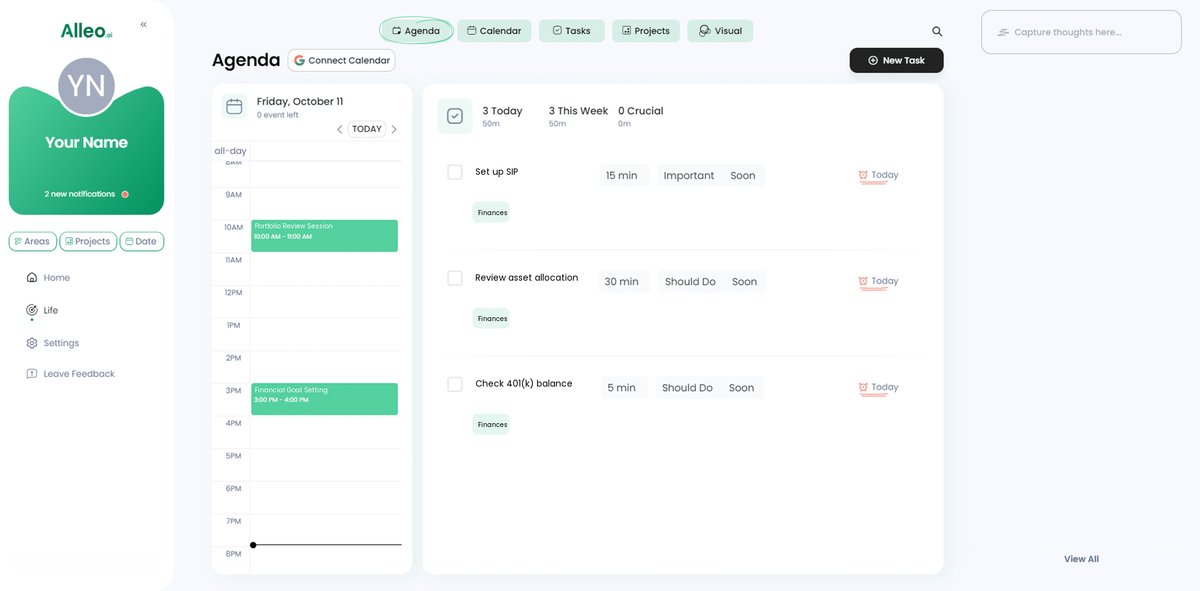

Use Alleo’s calendar and task features to schedule your portfolio reviews, investment contributions, and goal-setting sessions, allowing you to easily track your progress towards financial independence and stay accountable to your plan.

Embrace Your Financial Future with Confidence

As we wrap up, remember that managing diverse assets for independence is an attainable goal with the right asset allocation strategies.

You’ve learned how to diversify investments, maximize tax-efficient investing strategies, and create dedicated funds for your long-term wealth accumulation goals.

Implementing a systematic investment plan and regularly reviewing your diversified investment portfolio are crucial steps in retirement planning for professionals.

I understand it can feel overwhelming at times. But don’t forget, you have the tools and knowledge to succeed in risk management in asset management.

With Alleo, your journey to financial independence retire early (FIRE) can be even smoother. Our AI coach is here to support you in managing diverse assets for independence every step of the way.

Try Alleo for free today and take the first step towards a secure financial future with sustainable withdrawal strategies.